Marine Sensors Market Size (2024 – 2030)

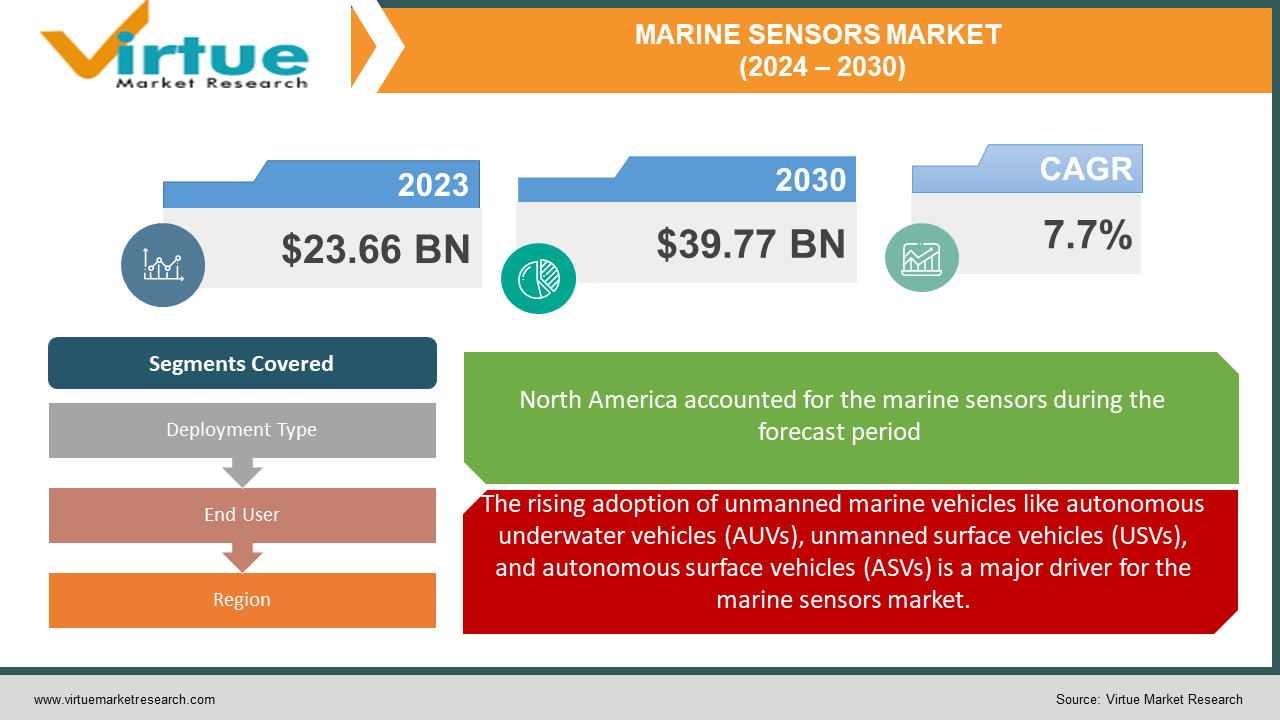

The Global Marine Sensors Market was valued at USD 23.66 Billion in 2023 and is projected to reach a market size of USD 39.77 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 7.7%.

The global marine sensors market is expected to experience steady growth in the coming years driven by increasing demand from the marine industry. Marine sensors are used to monitor a range of parameters such as temperature, depth, speed, navigation, fluid flow, corrosion, and vessel monitoring. Key applications include oceanographic research, defense, commercial boats and ships, underwater drones, and offshore oil and gas platforms. Several factors are contributing to the rising adoption of marine sensors. Growth in maritime trade and passenger traffic has increased the need for safety and efficiency. Advanced marine sensors enable features like collision avoidance, predictive maintenance, fuel monitoring, and autonomous navigation. Regulatory bodies across the world are also mandating the use of marine sensors for environment protection and crew safety. Marine sensors reduce human errors and improve decision-making through real-time data. Growing concerns over marine pollution and the push for decarbonization have led to stringent regulations. Marine sensors are essential for monitoring emissions, fuel efficiency, and compliance-vital functions for modern vessels. Research into climate patterns, marine biodiversity, and ocean exploration necessitates sophisticated sensors for collecting underwater data, fueling further innovation in the market.

Key Market Insights:

Maritime trade has increased the need for marine sensors to ensure navigation safety, avoid collisions, monitor engine performance, and comply with regulatory policies. Advanced sensors enable smart shipping for greater operational efficiency. Unmanned marine vehicles like autonomous underwater vehicles (AUVs), unmanned surface vehicles (USVs), and autonomous surface vehicles (ASVs) are seeing rising adoption for ocean research, oil & gas exploration, hydrographic surveys, and navy applications. These vehicles and vessels rely extensively on compact and high-performance marine sensors for navigation, object detection, and mission-critical decision-making in remote locations. Growth in marine threats has boosted spending on marine domain awareness systems. Integrated systems with networked sensors are being deployed extensively for coastal surveillance, illegal fishing monitoring, border security, anti-piracy operations, and vessel tracking. This will stimulate demand for advanced marine sensors. Traditional marine sensors are being replaced by modern sensors with enhanced capabilities. Advanced acoustic sensors support seabed imaging, underwater communication, and navigation. Optical sensors facilitate atmospheric and oceanographic research. RFID sensors enable asset tracking and inventory management. Such technological advancements expand the capabilities of marine sensors.

Global Marine Sensors Market Drivers:

The rising adoption of unmanned marine vehicles like autonomous underwater vehicles (AUVs), unmanned surface vehicles (USVs), and autonomous surface vehicles (ASVs) is a major driver for the marine sensors market.

The rising adoption of unmanned marine vehicles like autonomous underwater vehicles (AUVs), unmanned surface vehicles (USVs), and autonomous surface vehicles (ASVs) is a major driver for the growth of the global marine sensors market. These vehicles rely extensively on compact yet advanced sensors for navigation, object detection, optimal decision-making, and mission-critical operations in remote underwater or surface locations. AUVs equipped with depth sensors, cameras, sonars, and other instruments are used for tasks like seabed mapping, water sampling, marine habitat monitoring, pipeline/wreck inspections, and bathymetric surveys. They generate high-resolution maps and data for oceanographers. Sensors in underwater drones help detect pipeline or rig leaks, conduct subsea equipment inspections, monitor underwater structures, and acquire seismic data. This aids offshore oil & gas companies and offshore wind farm developers. Navy forces employ AUVs/USVs for ISR, anti-submarine warfare, mine countermeasures, electronic warfare, and other risky missions. Onboard sensors enable autonomous functionalities. Naval spending on marine drones is increasing tremendously. The global unmanned marine vehicles market is expected to exhibit a CAGR of over 22% from 2022 to 2030.

Maritime domain awareness (MDA) systems integrated with advanced sensors are being deployed extensively for coastal surveillance, illegal fishing monitoring, border security, anti-piracy operations, and vessel tracking.

The global marine sensors market is expanding due in large part to the growing use of advanced sensors in integrated maritime domain awareness (MDA) systems. The ability to effectively comprehend activities, events, and trends in the maritime environment that may influence the environment, economics, safety, or security is known as maritime domain awareness. MDA helps marine agencies make better decisions and identify dangers early. Radar systems, electro-optic sensors, and AIS receiver networks are utilized to keep an eye on illicit activities in coastal seas, including piracy, sabotage, and illegal fishing. Via real-time alerts, suspicious vessels can be intercepted. To enforce exclusion zones, curb illegal immigration, and prevent hostile intrusions, sensors are used to identify and track vessels along maritime borders. Data integration benefits intelligence organizations. The water and weather can be continuously monitored thanks to sensor arrays placed along coasts, atop anchored buoys, and on seabed cables. This offers vital information about alterations in the environment. Comprehensive visibility over port operations, cargo transportation, fishing fleets, passenger ferries, etc. is made possible by the integration of coastal AIS receivers with interior vessel monitoring infrastructure. Governments throughout the world are investing a lot of money in these integrated MDA networks, which are encouraging the use of maritime sensors.

Global Marine Sensors Market Restraints and Challenges:

Marine sensors based on advanced technologies such as ultrasonic, hydroacoustic, and oceanographic sensors have high upfront costs. The costs further increase for sensors specially designed to withstand harsh marine environments.

The high upfront costs of advanced marine sensors are a major restraint for the global marine sensors market. The costs further increase for specialized sensors designed to withstand harsh saline environments and extreme pressures in underwater conditions. Many research institutes, academic organizations, and smaller marine companies have limited budgets allocated for sensing equipment procurement. The high price point makes the adoption of certain advanced sensor technologies challenging for such end-users. Such high capital expenditure requirements mean that only large well-funded research institutions, offshore companies, and naval agencies can afford them. Smaller research labs and boats/underwater drone operators find the costs prohibitive. This is especially true in developing countries where oceanographic research is limited by budget constraints. India has just begun making investments in ocean research but has a long way to go to match developed countries in sensor adoption. The limited funding for marine research and development in many Southeast Asian countries too hinders uptake. Sensor manufacturers can lease out their equipment to smaller research institutes for temporary projects to recover costs. Cloud computing solutions where sensors are provided as a subscription-based service could also help in improving adoption by reducing upfront capital expenditure. Marine sensors for civilian use based on commercial off-the-shelf (COTS) technologies are an emerging trend. Avoiding specialized components brings down costs considerably making sensors affordable for wider adoption. Partnerships with academia during R&D to better understand budget constraints can further help in developing economic solutions. The high purchasing cost of advanced marine sensors coupled with limited funding allocation for ocean research makes adoption challenging for smaller organizations and institutes.

Global Marine Sensors Market Opportunities:

Unmanned underwater vehicles (UUVs) including remotely operated underwater vehicles (ROVs) and autonomous underwater vehicles (AUVs) rely extensively on high-performance sensors for navigation, positioning, obstacle avoidance, object identification, and gathering ocean data. UUVs are seeing surging adoption across military, commercial, scientific, and recreational applications thereby driving the uptake of sensors tailored for marine drones. Traditional sensors are being replaced by modern sensors based on emerging technologies to enhance capabilities. For instance, lidar bathymetry employs laser sensors for shallow water mapping. Biosensors allow real-time observation of marine habitats and organisms. Such technological developments are creating revenue opportunities for sensor manufacturers. Government initiatives worldwide to set up ocean observation platforms such as high-frequency coastal radar systems, tsunami warning buoys, tidal monitoring networks, and seafloor observatories are stimulating sensor adoption. Advancements in sensor connectivity and IoT integration will further aid large-scale deployments. The growing trend towards combining different sensors into intelligent integrated systems for tasks ranging from seabed surveys to vessel performance monitoring is driving demand for specialized marine sensors to be incorporated into such systems. Developing rugged sensors that can operate reliably in deep seas and withstand extreme pressures, temperatures and salinity levels presents an innovation opportunity. The market potential exists for miniaturized sensors designed specifically for deepwater monitoring.

MARINE SENSORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.7% |

|

Segments Covered |

By Deployment Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell, Kongsberg, Wärtsilä, Garmin, Xylem Teledyne Technologies, Raymarine, Atlas Elektronik, Vale port |

Marine Sensors Market Segmentation: By Deployment Type

-

Physical Sensors

-

Chemical Sensors

-

Biological Sensors

-

Acoustic Sensors

-

Optical Sensors

-

Gas Sensors

-

Others

Physical Sensors include sensors for measuring temperature, pressure, mass, flow, level, motion, humidity, force, and other physical parameters. Physical sensors account for the largest share of over 40% of the total marine sensors market. Pressure and temperature sensors are the most widely used. Chemical Sensors measure pH, oil content, dissolved gas, and other chemical parameters in marine environments. They comprise around 15% share of the marine sensors market. Increasing adoption of water quality monitoring systems is driving the growth of chemical sensors. Biological Sensors allow real-time monitoring of marine microbial and cellular activity. They have about 10% market share. Growth is driven by expanding ocean biology research programs. Acoustic Sensors include hydrophones, sonar systems, and acoustic emission sensors used for underwater communication, imaging, navigation, and surveillance. Acoustic sensors account for a 15% share owing to naval and offshore applications. Optical Sensors include brightness, light, and image sensors based on technologies like laser, infrared, fiber optics, and CMOS. Used extensively in underwater imaging and communication. Account for 10% share. Acoustic sensors are the second largest due to their use in defense, commercial vessels, and ocean research institutes. Chemical sensors are projected to experience the fastest growth at 9% CAGR driven by rising water quality monitoring activities. Gas sensors will also exhibit high growth due to increasing oceanography studies.

Marine Sensors Market Segmentation: By End User

-

Defense

-

Commercial

-

Scientific Research

-

Offshore

-

Coastal Infrastructure

-

Others

Defense includes the Navy, coast guards, and other maritime security organizations. The defense sector accounts for the largest share of around 35% of the marine sensors market. Extensive use in naval vessels and maritime surveillance propels adoption. Commercial includes commercial ships, passenger cruises, cargo transporters, fishing vessels, recreational boats, etc. Comprise over 25% market share owing to safety regulations mandating sensor use. Scientific Research includes research institutes, universities, and environmental agencies involved in oceanography studies. Accounts for 15% share. Rising ocean monitoring projects are driving growth. The offshore sector includes offshore oil & gas companies, offshore renewable energy farms, subsea mining, etc.

Others include tourism, marine archaeology, etc. Among these segments, the defense sector will continue to dominate market share by a significant margin during the forecast period owing to the large-scale use of specialized marine sensors for naval applications. The commercial segment is likely to exhibit the fastest growth at around 9% CAGR. Stringent policies for onboard performance monitoring systems in commercial vessels will drive the adoption of sensors to aid navigation safety and prevent accidents.

Marine Sensors Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America wields substantial influence, holding a market share exceeding 30%. This dominance stems from the vast maritime infrastructure and the presence of industry-leading sensor manufacturers. The US Navy is a crucial demand driver. Their focus on technological superiority continuously pushes innovation and adoption of advanced marine sensor solutions. Europe holds a strong position with roughly 25% of the world market. Strict maritime regulations focused on surveillance and a deep commitment to oceanographic research drive a significant portion of sensor usage here. Boasting a share of 20%, Asia Pacific is a significant player. Growth is fueled by factors like surging maritime trade, booming offshore oil and gas sectors, and the expansion of naval forces in countries like China, Japan, South Korea, and India. Latin America currently represents approximately 10% of the market. Investments in ocean research and upgrading port infrastructure are promising sectors with the potential for expanded sensor adoption in the future. The Middle East and Africa's contribution is around 8%, primarily linked to its oil and gas industry and its focus on offshore exploration and production activities. However, limited investment in oceanographic research may hinder broader market growth here. The rest of the world collectively accounts for the remaining 7% of the market. North America and Europe maintain leadership positions thanks to well-established maritime sectors, emphasis on compliance, and pioneering research. On the other hand, Asia Pacific stands out as the region to watch; its anticipated CAGR of over 9% signals remarkable growth potential in the years to come.

COVID-19 Impact Analysis on the Global Marine Sensors Market:

The COVID-19 pandemic has had a significant impact on the global marine sensors market, causing disruptions in supply chains, changes in demand, and new challenges for manufacturers and suppliers. One of the biggest impacts has been on supply chains and production. With lockdowns and restrictions imposed in many countries, manufacturing operations faced labor shortages, delays in raw material deliveries, and logistics challenges. This led to reduced production volumes and capacity constraints for marine sensor manufacturers. Key suppliers based in China, Europe, and the US faced months-long factory shutdowns and output reductions. The limited availability of components and inputs increased costs as well. On the demand side, the slowdown in seaborne trade and marine operations during lockdowns led to deferred orders and reduced demand for marine sensors from commercial shipping companies and navies. The sharp fall in oil prices also led oil and gas companies to cut down on offshore exploration spending, further hitting demand. However, some segments such as oceanography institutes and marine research organizations saw sustained demand.

Latest Trends/ Developments:

The global marine sensors market has been experiencing several key trends and developments driven by factors such as technological advances, new applications, and changing environmental regulations. One of the major trends is the increasing adoption of multi-parameter sensors that can track various oceanographic parameters in one device. Companies like Vale Port are offering integrated sensors that can measure parameters like water temperature, depth, salinity, dissolved oxygen, and turbidity. The data from such digital multi-parameter probes are being integrated with analytics and cloud platforms. Another noticeable trend is the growing use of marine sensors for offshore oil and gas exploration and production activities. With higher offshore upstream investment after the pandemic, demand for underwater acoustic sensors, vibration monitoring sensors, pressure sensors, and others is increasing from oil majors. Firms like Sonardyne, Kongsberg, and Teledyne are providing customized marine sensor packages for seismic surveys, platform monitoring, and production optimization. The emergence of unmanned and autonomous vessels has also expanded the application of marine sensors for navigation, situational awareness, collision avoidance, and performance monitoring. Leading players such as Yost Labs and RBR are developing specialized sensors for USVs and ROVs tailored to their dynamics and control needs. This will further grow with maturing autonomous ship technology.

Key Players:

-

Honeywell

-

Kongsberg

-

Wärtsilä

-

Garmin

-

Xylem

-

Teledyne Technologies

-

Raymarine

-

Atlas Elektronik

-

Vale port

Chapter 1. Marine Sensors Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Marine Sensors Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Marine Sensors Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Marine Sensors Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Marine Sensors Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Marine Sensors Market – By Deployment Type

6.1 Introduction/Key Findings

6.2 Physical Sensors

6.3 Chemical Sensors

6.4 Biological Sensors

6.5 Acoustic Sensors

6.6 Optical Sensors

6.7 Gas Sensors

6.8 Others

6.9 Y-O-Y Growth trend Analysis By Deployment Type

6.10 Absolute $ Opportunity Analysis By Deployment Type, 2024-2030

Chapter 7. Marine Sensors Market – By End User

7.1 Introduction/Key Findings

7.2 Defense

7.3 Commercial

7.4 Scientific Research

7.5 Offshore

7.6 Coastal Infrastructure

7.7 Others

7.8 Y-O-Y Growth trend Analysis By End User

7.9 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Marine Sensors Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Deployment Type

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Deployment Type

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Deployment Type

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Deployment Type

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Deployment Type

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Marine Sensors Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Honeywell

9.2 Kongsberg

9.3 Wärtsilä

9.4 Garmin

9.5 Xylem

9.6 Teledyne Technologies

9.7 Raymarine

9.8 Atlas Elektronik

9.9 Vale port

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Growing awareness of marine pollution and climate change drives demand for sensors that monitor water quality, biodiversity, and changing ocean patterns.

Specialized sensors for deep-sea exploration, naval applications, or sophisticated data analysis can be extremely expensive. This can limit adoption, particularly for smaller organizations or research projects.

Honeywell, Kongsberg, Wärtsilä, Garmin, Xylem, Teledyne Technologies, Raymarine.

North America currently holds the largest market share, estimated at around 30%.

Asia Pacific exhibits the fastest growth, driven by its increasing population, and expanding economy.