Marine Gas Oil Market Size (2024 – 2030)

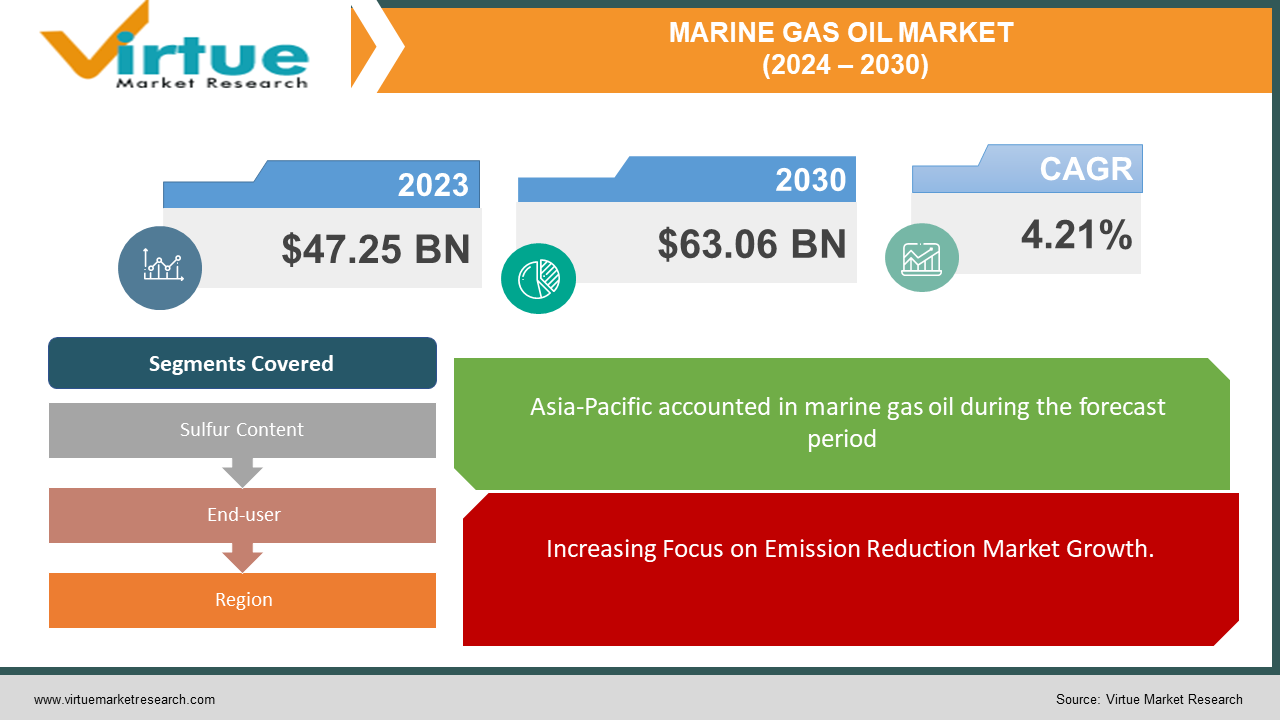

The Global Marine Gas Oil Market was valued at USD 47.25 billion in 2023 and is projected to reach a market size of USD 63.06 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.21%.

Marine Gas Oil (MGO) is an important fuel in the maritime market, renowned for its efficiency and environmental friendliness. Derived from the distillation of crude oil, MGO has a lower sulfur content compared to traditional marine fuels, making it compliant with stringent emissions regulations such as the International Maritime Organization's (IMO) sulfur bar. Its cleaner combustion reduces harmful pollutants, which in turn contributes to the preservation of marine ecosystems and mitigating global air pollution. With its stable and predictable properties, MGO ensures smooth engine performance, improving vessel reliability and performance. Its versatility allows for use in a variety of marine applications, from large cargo vessels to smaller fishing boats, catering to diverse maritime needs. As the industry continues to prioritize sustainability, MGO stands as a prominent choice, aligning with the objectives of reducing greenhouse gas emissions and promoting cleaner energy alternatives. In an era of heightened environmental consciousness, Marine Gas Oil emerges as a crucial component in fostering a greener and more sustainable maritime future.

Key Market Insights:

Asia-Pacific region has the largest and had almost USD 19.50 billion of total market share in 2023 and is expected to show a CAGR of 5.31%.

According to the 2023 Review of Maritime Transport published by the United Nations Conference on Trade and Development, in 2022, container port throughput volumes in Asia stood at 590.8 million TEU, accounting for nearly 60% of the global container port throughout volume.

The MGO market is characterized by the presence of major oil and gas companies, trading firms, and independent suppliers, with ongoing consolidation and strategic partnerships shaping the competitive landscape.

Marine Gas Oil Market Drivers:

Increasing Focus on Emission Reduction Market Growth.

Increasing concern about air pollution and its environmental impacts has led to a focus on reducing emissions across all sectors, including the maritime sector. MGO's clean energy products reduce emissions of sulfur oxide (SOx), nitrogen oxide (NOx), and other pollutants compared to other fuels. Demand for MGO as a clean fuel option continues to grow as participants in the shipping industry seek to reduce their environmental footprint.

Rise in Offshore Exploration and Production Activities accelerates the market growth.

The offshore oil and gas industry relies on ocean liners for exploration, production, and transportation. Increasing global energy demand has led to exploration and production in areas such as the North Sea, the Gulf of Mexico, and West Africa. Ships involved in these projects must comply with strict regulations and provide high-performance and reliable fuel; This makes MGO the first choice for these applications.

Stringent Environmental Regulations will drive the Marine Gas Oil market forward.

One of the biggest drivers of the MGO market is the implementation of strict environmental regulations by international organizations such as the International Maritime Organization (IMO). Regulations such as the International Maritime Organization's sulfur cap require reducing sulfur emissions from ships. The lower content of MGO compared to marine fuels such as heavy fuel oil (HFO) has made it the first choice of mariners wishing to comply with these regulations. This factor is forcing shipping companies to invest in MGO-compatible ships and increasing the global demand for MGO.

Marine Gas Oil Market Restraints and Challenges:

Volatility in Crude Oil Prices restrain the market growth.

Since MGO is derived from refined Crude oil, the Marine Gas Oil industry is closely linked to Crude oil prices. Changes in crude oil prices can affect the price of MGO, affect the income of ship operators, and affect purchasing decisions. High and volatile gasoline prices can increase the operating costs of ships using MGO, thereby reducing demand and consumption. Additionally, price volatility can make it difficult for market participants to plan good investments and manage financial risks.

Infrastructure Limitations for MGO Supply prove to be a challenge in the Marine Gas Oil Market.

Despite the growing demand for MGO, restrictions on its production, storage, and distribution pose some challenges to the market. Infrastructure for refining and storing MGO may be insufficient or inadequate in some regions, causing shippers to face supply shortages and logistical problems. Limited MGO refueling facilities in ports place additional pressure on the use of MGO as a marine fuel, especially in high-traffic areas. These infrastructure constraints may hinder the growth of the MGO market and limit its penetration in certain regions.

Technological Advancements in Alternative Fuels hinder market growth.

Advances in alternative fuels such as liquefied natural gas (LNG), hydrogen fuel cells, and biofuels pose significant challenges to MGO's control over the marine fuel industry. These alternative fuels provide environmental benefits such as lower sulfur oxide (SOx) and greenhouse gas (GHG) emissions and are considered more environmentally friendly. As regulations evolve to encourage the use of cleaner fuels, ship operators will face difficulties transitioning from MGO to these options, making it difficult to grow and sustain their business.

Marine Gas Oil Market Opportunities:

The rise in Demand for Scrubber-Fitted Vessels provides an opportunity for market players to establish their presence.

The installation of exhaust gas cleaning systems, or scrubbers, on vessels, presents an opportunity for the MGO market. Scrubbers allow vessels to continue using high-sulfur fuels like Heavy Fuel Oil (HFO) while meeting emissions regulations by removing pollutants from exhaust gases. However, scrubber-fitted vessels require compliant fuels like MGO when operating in emission control areas (ECAs) or areas with strict sulfur limits. As more shipowners invest in scrubber technology to comply with regulations while maintaining fuel flexibility, there is an opportunity for MGO suppliers to cater to the increased demand for compliant fuels.

Focus on Fuel Efficiency and Performance – an opportunity to be more profitable in the market.

The shipping industry is increasingly looking for ways to improve fuel efficiency and ship performance to reduce operating costs and environmental impact. MGO's stable combustion characteristics and high power density allow ship operators to increase fuel efficiency and improve engine performance. Suppliers can use this opportunity to develop MGO models to suit specific engine types and operations, providing additional solutions that increase the efficiency of ships and reduce oil consumption. Additionally, advances in MGO additives and lubricants can increase fuel efficiency and engine reliability, creating opportunities for innovation and diversification in business.

Emerging Markets and Growing Maritime Trade provide limitless opportunities.

The expansion of the maritime industry and the emergence of new routes provide an opportunity for the growth of the MGO market. Rapid economic growth and urbanization in regions such as Asia Pacific and Africa have increased the demand for raw materials and manufactured goods, leading to an increase in maritime transportation. As the industry grows and new routes are opened, the demand for marine oils such as MGO increases accordingly. Vendors can use this opportunity to expand their presence in emerging markets, establish partnerships with supply chains, and invest in infrastructure to meet the growing demand for MGO in these areas.

MARINE GAS OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.21% |

|

Segments Covered |

By Sulfur Content, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Shell PLC, ExxonMobil Corporation , BP PLC, Chevron Corporation, TotalEnergies SE, Engen Petroleum, Gazprom Neft PJSC, Lubrizol (Berkshire Hathaway), Bomin Bunker Fuel Holding GMBH & Co. KG, Neste OYJ |

Marine Gas Oil Market Segmentation - by Sulfur Content

-

Low Sulfur MGO (LSMGO)

-

Regular MGO

In 2023, based on the Sulfur Content, LSMGO hold the largest market share with over 60% of the market. With its low sulfur content, typically below 0.1%, LSMGO has become the first choice for mariners wishing to comply with regulations. Ships operating in emissions control areas and areas with strict restrictions must use fuel with a sulfur content well below normal. This makes LSMGO the fuel of choice to meet these stringent regulations. LSMGO's important position in the market is strengthened by raising environmental awareness in the maritime sector. Many seafarers have voluntarily chosen cleaner fuels to reduce their impact on the environment and comply with international efforts to combat climate change and air pollution.

Marine Gas Oil Market Segmentation - by End-user

-

Tanker Fleet

-

Container Fleet

-

Bulk and General Cargo Fleet

-

Ferries

-

Offshore Support Vessel (OSV)

-

Other End-user Types

In 2023, based on the end user, the Container Fleet holds the largest portion of the market share, whereas OSV is expected to grow at a 6.25% CAGR during the forecast period.

Container vessels play a crucial role in facilitating global trade by transporting a significant portion of goods in standardized containers. As a result, the container fleet segment accounts for a substantial share of the maritime transportation market. The container shipping industry maintains a consistent demand for fuel due to the continuous flow of goods across major trade routes. This demand ensures a steady consumption of Marine Gas Oil (MGO) by container vessels throughout the year, contributing to its dominance in the market. Container shipping is vital for the global economy, facilitating the movement of manufactured goods, raw materials, and consumer products between regions. The economic significance of container shipping underscores the importance of the container fleet segment in the MGO market.

The reason for OSV to be the fastest-growing during the forecasting period is that Offshore support vessels (OSV) play an important role in supporting offshore oil and gas exploration, production, and drilling activities. They transport personnel, devices, and supplies to offshore platforms, rigs, and installations, enabling offshore operations to function effectively. Offshore oil and gas activities mostly require 24/7 support, leading to prolonged operations of OSVs. This results in a rigorous demand for fuel, including Marine Gas Oil, to power these vessels throughout the year. OSVs have unique operational requirements, including stability, performance, and safety measurements. MGO's suitability for these diversified applications further tends to dominate in the OSV segment of the MGO market.

Marine Gas Oil Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023 based on Region, Asia-Pacific has the largest market share, with over 40% market share. The Asia-Pacific region dominates the marine oil (MGO) market due to its important role in the global market and rapid growth. The region hosts the world's busiest ports, including Singapore, Shanghai, and Hong Kong, and is an important hub for international transportation. The Asia-Pacific region, with its vast coastline, archipelago, and constituency of big businessmen, supports a large portion of the world's economic activity, driving substantial demand for MGOs to power shipping vessels. Additionally, rapid economic growth in countries such as China, Japan, and South Korea has increased the demand for MGO by increasing the number of enterprises and industries. Strict environmental regulations, such as the International Maritime Organization's sulfur limit, have also led to a decline in the use of sulfur magnesium oxide in the region. Asia-Pacific's dominance is driven by large cargo, emerging markets, technological advancements, and regulatory compliance, making it a key player in creating opportunities in the global MGO market.

In North America, stringent environmental regulations such as those imposed by the Environmental Protection Agency (EPA) have increased the demand for low-sulfur MGO in the fuel industry and oil, particularly in the Gulf of Mexico. Europe's focus on environmental sustainability has led to increased use of low-sulfur MGO to meet stringent regulations such as IMO sulfur caps. The growth of maritime and port industries in South America has increased the demand for MGO. Meanwhile, in the Middle East and Africa region, there are major oil-producing countries such as the United Arab Emirates and South Africa, which are increasing the demand for MGO in the offshore support operations and maritime industries.

While Asia-Pacific leads the Global Marine Gas Oil market, other regions such as North America and Europe are experiencing rapid growth and present huge opportunities for Marine Gas Oil market vendors.

COVID-19 Impact Analysis on the Global Marine Gas Oil Market:

The COVID-19 pandemic has had a major impact on the global marine oil (MGO) market, with many segments affected. Severe disruptions to international trade and transportation led to a decline in MGO demand, especially at the onset of lockdowns and travel restrictions. The economic crisis, factory closures, and production interruptions led to a decrease in cargo and fleet usage, resulting in a decrease in fuel consumption. Additionally, falling oil prices and a weak economy have placed additional pressure on MGO suppliers and stakeholders. However, as the economy gradually reopens and the global trade resumes, the MGO market is also expected to gradually recover. Recovery efforts, government stimulus packages, and ongoing vaccination campaigns are anticipated to revive economic activity and bolster demand for MGO, albeit with continued uncertainty surrounding the trajectory of the pandemic and its potential impact on global trade dynamics.

Latest Trends/ Developments:

Recent trends in the marine oil (MGO) market include a shift to low-sulfur fuels due to stringent environmental regulations such as the International Maritime Organization's sulfur limit. There is also a growing demand for liquefied natural gas (LNG) as a clean marine fuel. Advances in fuel economy technology, such as new engine designs and hybrid drive systems, optimize fuel consumption. In addition, incentive efforts to reduce carbon emissions focus on renewable fuels and biofuels. Finally, digitization and data analysis have improved fuel management and fleet performance monitoring. These standards ensure the business remains committed to security, compliance, and innovation.

Key Players:

-

Shell PLC

-

ExxonMobil Corporation

-

BP PLC

-

Chevron Corporation

-

TotalEnergies SE

-

Engen Petroleum

-

Gazprom Neft PJSC

-

Lubrizol (Berkshire Hathaway)

-

Bomin Bunker Fuel Holding GMBH & Co. KG

-

Neste OYJ

-

In May 2022, Neste OYJ, in collaboration with its partner Nordic Marine Oil, started manufacturing a new Neste Marine 0.1 Co-processed marine fuel in Scandinavia to reduce greenhouse emissions. The fuel is based on Neste Marine 0.1 low-sulfur marine fuel, which is a range of low-sulfur marine fuels (Neste MGO DMA and Neste MDO DMB) with a sulfur content of less than 0.1%

Chapter 1. MARINE GAS OIL MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. MARINE GAS OIL MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. MARINE GAS OIL MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. MARINE GAS OIL MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. MARINE GAS OIL MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. MARINE GAS OIL MARKET – By Sulfur Content

6.1 Introduction/Key Findings

6.2 Low Sulfur MGO (LSMGO)

6.3 Regular MGO

6.4 Y-O-Y Growth trend Analysis By Sulfur Content

6.5 Absolute $ Opportunity Analysis By Sulfur Content, 2024-2030

Chapter 7. MARINE GAS OIL MARKET – By End-user

7.1 Introduction/Key Findings

7.2 Tanker Fleet

7.3 Container Fleet

7.4 Bulk and General Cargo Fleet

7.5 Ferries

7.6 Offshore Support Vessel (OSV)

7.7 Other End-user Types

7.8 Y-O-Y Growth trend Analysis By End-user

7.9 Absolute $ Opportunity Analysis By End-user, 2024-2030

Chapter 8. MARINE GAS OIL MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Sulfur Content

8.1.3 By End-user

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Sulfur Content

8.2.3 By End-user

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Sulfur Content

8.3.3 By End-user

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Sulfur Content

8.4.3 By End-user

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Sulfur Content

8.5.3 By End-user

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. MARINE GAS OIL MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Shell PLC

9.2 ExxonMobil Corporation

9.3 BP PLC

9.4 Chevron Corporation

9.5 TotalEnergies SE

9.6 Engen Petroleum

9.7 Gazprom Neft PJSC

9.8 Lubrizol (Berkshire Hathaway)

9.9 Bomin Bunker Fuel Holding GMBH & Co. KG

9.10 Neste OYJ

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Marine Gas Oil Market was valued at USD 47.25 billion in 2023 and is projected to reach a market size of USD 63.06 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.21%.

The segments under the Global Marine Gas Oil Market by Sulfur Content are Low Sulfur MGO and Regular MGO.

Asia-Pacific is the dominant region in the Global Marine Gas Oil Market.

Shell PLC, ExxonMobil Corporation, BP PLC, Bomin Bunker Fuel Holding GMBH & Co. KG, Neste OYJ, etc.

The COVID-19 pandemic has had a major impact on the global marine oil (MGO) market, with many segments affected. Severe disruptions to international trade and transportation led to a decline in MGO demand, especially at the onset of lockdowns and travel restrictions. The economic crisis, factory closures, and production interruptions led to a decrease in cargo and fleet usage, resulting in a decrease in fuel consumption.