Marine Engine Market Size (2024 – 2030)

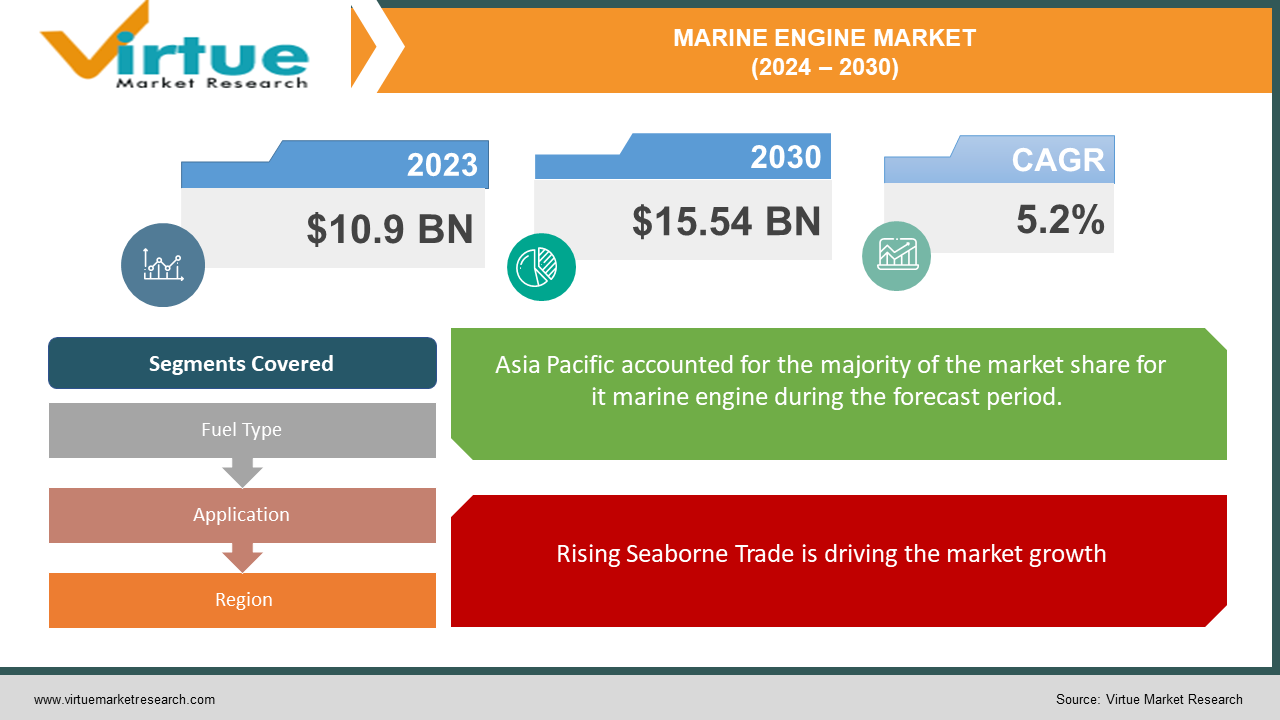

The Global Marine Engine Market was valued at USD 10.9 billion in 2023 and will grow at a CAGR of 5.2% from 2024 to 2030. The market is expected to reach USD 15.54 billion by 2030.

The global marine engine market powers the vast network of cargo ships that keep international trade humming. Fueled by rising seaborne trade and government support for shipbuilding, the market is expected to chug along at a steady pace. Stricter environmental regulations are pushing innovation, with cleaner technologies like dual-fuel and hybrid engines gaining traction. Niche markets beyond traditional cargo ships are also emerging, with specialized engines being developed for the booming offshore wind industry and the needs of fishing and leisure boat operators. Though high upfront costs can be a hurdle, advancements in efficiency and digitalization are creating a promising future for this dynamic market.

Key Market Insights:

Growing focus on environmental regulations is leading to a rise in demand for cleaner burning and more fuel-efficient engines. Creating demand for eco-friendly solutions in the marine engine industry.

Increasing demand for larger and more efficient vessels in the commercial shipping segment is driving the market.

Expansion of the global maritime industry with growing international trade is another key driver.

The Asia-Pacific region reigns supreme in the marine engine market, boasting the largest market share (38.5 %) and significant projected growth.

Global Marine Engine Market Drivers:

Rising Seaborne Trade is driving the market growth

Rising seaborne trade is the lifeblood of the global marine engine market. Since international maritime transport continues to be the most cost-effective way to move vast quantities of goods across continents, its growth directly translates to a surge in demand for marine engines. Factors like globalization and economic development in emerging markets are fueling this trade boom. Imagine a world where countries like China and India continue to see significant industrial growth. This translates to a constant flow of imported raw materials and manufactured products, all heavily reliant on cargo ships. To keep pace with this ever-increasing seaborne trade, a larger and more powerful fleet is needed. This translates directly to a demand for more marine engines, both for entirely new ships and potentially for upgrades on existing vessels to ensure they remain competitive in this growing market. The need for efficient and reliable engines becomes paramount, as they directly impact operational costs and a ship's ability to meet tight deadlines.

Government Initiatives for Shipbuilding are driving market growth

Government support for shipbuilding is acting as a tailwind for the marine engine market. Many countries recognize the strategic and economic importance of a robust shipbuilding industry and are actively investing through subsidies, financial aid programs, and shipyard modernization initiatives. These efforts create a domino effect that ultimately benefits marine engine manufacturers. Imagine a government offering substantial subsidies to local shipyards for building new vessels. This incentivizes shipyards to increase their output, directly translating to a demand for new marine engines to power these ships. Additionally, government funding might be directed towards modernizing shipyards, allowing them to construct more complex vessels requiring powerful and advanced engines. Furthermore, these initiatives often prioritize the use of domestic components, creating a favorable environment for local marine engine manufacturers to secure lucrative contracts. This government support for shipbuilding acts as a springboard, propelling the growth of the global marine engine market.

Growth of Niche Markets is driving the market growth

The global marine engine market is setting sail beyond traditional cargo ships, venturing into exciting niche markets. The burgeoning offshore wind industry demands specialized engines for service vessels. Imagine powerful yet environmentally friendly engines that can navigate challenging sea conditions while efficiently powering these crucial support ships. This presents a significant opportunity for manufacturers to develop innovative solutions catering to this growing green energy sector. Beyond commercial applications, advancements in engine technology are catering to the recreational boating and fishing industries as well. Here, the focus shifts towards a trifecta of needs: fuel efficiency, performance, and reliability. Imagine weekend anglers seeking an engine that delivers exceptional fuel economy without sacrificing power for a thrilling catch. Similarly, leisure boaters might prioritize quiet operation and smooth cruising for a relaxing day on the water. By developing engines that cater to these diverse needs, marine engine manufacturers can tap into a passionate and loyal customer base in the niche markets of fishing and leisure boating

Global Marine Engine Market challenges and restraints:

Strict Environmental Regulations are restricting the market growth

Strict environmental regulations are a double-edged sword for the marine engine market. While they present a significant challenge, they also unlock exciting opportunities. Stringent emission reduction and decarbonization goals set by organizations like the International Maritime Organization (IMO) are forcing manufacturers to develop cleaner technologies. This translates to increased investment in research and development of hybrid and dual-fuel engines. These cleaner technologies come with a heftier price tag, and existing vessels may even require costly upgrades to comply with new regulations. This can squeeze profit margins for both manufacturers and ship owners in the short term. However, these challenges are countered by the potential for long-term gains. Cleaner engines reduce operational costs through improved fuel efficiency and compliance with stricter fuel sulfur limits. Additionally, they position manufacturers and ship owners as environmentally conscious leaders, potentially attracting new businesses and investors in the sustainability-focused future of maritime transport.

High Initial Investment Costs are restricting the market growth

The high upfront cost of marine engines acts as a roadblock, especially for smaller players in the industry. Imagine a small fishing boat operator needing a new engine. The initial investment for a cutting-edge, fuel-efficient engine might be several times higher than a conventional option. While the more efficient engine offers significant fuel cost savings over its lifespan, the initial burden can be insurmountable. This financial hurdle discourages investment in these newer technologies, which can be more environmentally friendly or offer better performance. Manufacturers are aware of this challenge and are exploring solutions like offering financing options or leasing models to make these advanced engines more accessible. Additionally, government incentives or subsidies could help bridge the cost gap for smaller businesses, encouraging the wider adoption of cleaner and more efficient technologies throughout the marine engine market.

Market Opportunities:

The global marine engine market presents a compelling landscape of opportunities for innovation and growth. Surging demand for cleaner and more sustainable solutions is driving the rise of dual-fuel and hybrid engines. These engines offer adaptability, allowing vessels to operate on cleaner fuels like Liquefied Natural Gas (LNG) or biofuels while maintaining compatibility with traditional options. This caters to stricter environmental regulations and fluctuates fuel prices. Furthermore, the growing focus on efficiency creates a market for advanced engine designs that optimize fuel consumption and reduce emissions. Technological advancements like digitalization and the Internet of Things (IoT) are also creating opportunities. By integrating sensors and data analytics, engine performance can be monitored and optimized remotely, leading to improved fuel efficiency and predictive maintenance. Additionally, the expansion of the offshore wind industry is fostering demand for specialized engines suited to powering wind farm service vessels. By catering to these evolving needs, marine engine manufacturers can unlock significant growth potential in the years to come.

MARINE ENGINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Fuel Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Wärtsilä, Rolls-Royce plc, MAN Energy Solutions, Caterpillar Inc., Cummins Inc., Hyundai Heavy Industries, Mitsubishi Heavy Industries, GE Transportation (formerly GE Marine), DEUTZ AG, Yanmar Holdings Co., Ltd. |

Marine Engine Market Segmentation - By Fuel Type

-

Diesel Engines

-

Electric and Hybrid Engines

diesel engines reign supreme in the marine engine market, holding the majority share. Their dominance stems from their established reliability, power, and affordability. However, stricter emission regulations are putting pressure on this dominance. This is creating an opportunity for electric and hybrid engines, an emerging segment with significant growth potential

Marine Engine Market Segmentation - By Application

-

Commercial Shipping

-

Recreational Boating

commercial shipping segment holds the dominant position in the marine engine market, accounting for over 60% of the market share. While recreational boating is a significant segment, its growth is more closely tied to disposable income and leisure activities. This can lead to fluctuations in demand based on economic conditions

Marine Engine Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region reigns supreme in the marine engine market, boasting the largest market share and significant projected growth. This dominance can be attributed to several factors: a booming shipbuilding industry in countries like China, South Korea, and Japan; a rising demand for commercial vessels due to increasing international trade; and government support for the shipbuilding industry

COVID-19 Impact Analysis on the Global Marine Engine Market

The COVID-19 pandemic delivered a heavy blow to the global marine engine market. Disruptions in international trade led to a sharp decline in demand for new ships, causing a ripple effect that impacted engine sales. Strict lockdowns and travel restrictions hampered shipyard operations, stalling new builds and engine installations. Additionally, supply chain disruptions caused shortages of critical components, further hindering engine production. However, the impact wasn't uniform across all segments. The commercial shipping sector, particularly those reliant on passenger transport (cruises, ferries), witnessed a steeper decline due to travel restrictions. On the other hand, the recreational boating segment experienced a slight uptick in some regions as people sought out individual leisure activities. As the global economy recovers, the marine engine market is showing signs of rebound. Pent-up demand for new vessels, coupled with continued growth in international trade, is propelling engine sales. Looking ahead, the market is expected to witness a shift towards cleaner technologies as stricter environmental regulations come into play. This will likely favor the growth of electric and hybrid engine segments, shaping a more sustainable future for the global marine engine market

Latest trends/Developments

The global marine engine market is undergoing a wave of innovation driven by sustainability concerns and technological advancements. A key trend is the rise of cleaner burning engines, with stricter emission regulations pushing manufacturers towards technologies like Liquefied Natural Gas (LNG) and dual-fuel engines that offer a significant reduction in harmful pollutants. Furthermore, electric and hybrid propulsion systems are gaining significant traction, particularly for smaller vessels and inland waterways. Advancements in battery technology and the development of efficient hybrid designs are making these options increasingly viable, promising a future with quieter and cleaner marine operations. Looking beyond fuels, digitalization is transforming the industry. Engine manufacturers are integrating sensor technology and remote monitoring systems to enable real-time performance analysis, predictive maintenance, and improved fuel efficiency. Additionally, the concept of autonomous vessels is being explored, with the potential for significant operational cost reductions and improved safety. The future of the marine engine market is shaping up to be a confluence of cleaner technologies, digital intelligence, and a focus on operational efficiency. This will require collaboration between engine manufacturers, shipbuilders, and regulatory bodies to ensure a sustainable and prosperous future for the maritime industry.

Key Players:

-

Wärtsilä

-

Rolls-Royce plc

-

MAN Energy Solutions

-

Caterpillar Inc.

-

Cummins Inc.

-

Hyundai Heavy Industries

-

Mitsubishi Heavy Industries

-

GE Transportation (formerly GE Marine)

-

DEUTZ AG

-

Yanmar Holdings Co., Ltd.

Chapter 1. Marine Engine Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Marine Engine Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Marine Engine Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Marine Engine Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Marine Engine Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Marine Engine Market – By Fuel Type

6.1 Introduction/Key Findings

6.2 Diesel Engines

6.3 Electric and Hybrid Engines

6.4 Y-O-Y Growth trend Analysis By Fuel Type

6.5 Absolute $ Opportunity Analysis By Fuel Type, 2024-2030

Chapter 7. Marine Engine Market – By Application

7.1 Introduction/Key Findings

7.2 Commercial Shipping

7.3 Recreational Boating

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Marine Engine Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Fuel Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Fuel Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Fuel Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Fuel Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Fuel Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Marine Engine Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Wärtsilä

9.2 Rolls-Royce plc

9.3 MAN Energy Solutions

9.4 Caterpillar Inc.

9.5 Cummins Inc.

9.6 Hyundai Heavy Industries

9.7 Mitsubishi Heavy Industries

9.8 GE Transportation (formerly GE Marine)

9.9 DEUTZ AG

9.10 Yanmar Holdings Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Marine Engine Market was valued at USD 10.9 billion in 2023 and will grow at a CAGR of 5.2% from 2024 to 2030. The market is expected to reach USD 15.54 billion by 2030.

Growth of Niche Markets and government Initiatives for Shipbuilding are the reasons that drive the market.

Based on engine type it is divided into two segments – Diesel Engines, Electric, and Hybrid Engines

Asia Pacific is the most dominant region for the Marine Engine Market.

Mitsubishi Heavy Industries, GE Transportation (formerly GE Marine), DEUTZ AG, Yanmar Holdings Co., Ltd.