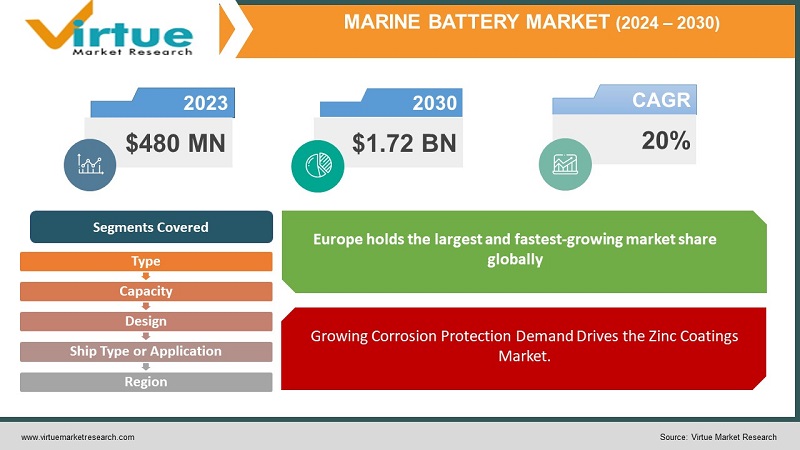

Marine Battery Market Size (2024-2030)

The Global Marine Battery Market is valued at USD 480 million in 2023, and is projected to reach USD 1.72 billion by 2030, growing at a CAGR of 20% from 2024 to 2030.

The marine battery serves as the primary or auxiliary power source for vessels, harnessing chemical energy to facilitate various functions, including start-stop mechanisms, windlasses, lighting, depth finders, and fish locators. These batteries are engineered with robust materials and heavier plates, specifically designed to endure the vibrations and impact inherent in marine environments. The escalating demand for marine freight transportation vessels, the advantages of lithium-ion batteries compared to lead-acid counterparts, and the increasing popularity of water sports and leisure activities are anticipated to propel the growth of the marine battery market.

The global marine battery market presents promising growth prospects for market participants, driven by the growing automation in marine transportation and the adoption of hybrid and electric vessels. Manufacturers and key players stand to benefit from harnessing the potential of renewable energy for charging marine batteries. Additionally, advancements in hybrid propulsion technologies are poised to broaden the scope of the marine battery market. However, impediments to market growth include the restricted range and capacity of fully electric ships, as well as challenges related to battery maintenance and protection.

Key Market Insights:

The regulatory measure responds to heightened environmental and health concerns globally, prompting ship operators to install exhaust cleaning systems or scrubbers on vessels to purify emissions before release. Adherence to the regulation necessitates a shift from high-sulfur fuel oil (HSFO) to very low-sulfur fuel oil (VLSFO) or the adoption of LNG-based fuel. The rule has spurred ship manufacturers to embrace battery-driven hybrid or electric propulsion systems.

Major players in the market are making substantial investments in research and development to diversify their product portfolios, contributing to the further expansion of the Marine Battery Market. Strategic initiatives, such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaborations with other organizations, are being undertaken by market participants to enhance their market presence. To thrive in an increasingly competitive market environment, the Marine Battery industry must deliver cost-effective solutions.

Global Marine Battery Market Drivers:

The Growth of Global Marine Battery Market is driven by rising maritime tourism and the need for better marine infrastructure

A heightened demand for maritime tourism, coupled with the necessity for improved marine infrastructure and connectivity, stands as pivotal catalysts for the expansion of marine industries. This trend is poised to yield substantial economic benefits for both developing and developed nations, particularly those heavily reliant on marine and coastal tourism. The optimization of seaborne economy policies by governments worldwide, focusing on eco-friendly marine tourism and enhanced port connectivity, is integral for fostering market growth within the forecast period of 2024-2030.

Another Factor Driving the Marker is the implementation of IMO (International Maritime Organization) 2020 sulfur regulation

Since January 2020, the International Maritime Organization (IMO) has implemented regulations aimed at mitigating the escalating emissions of sulfur dioxide from marine vessels. Stringent regulations are in effect within four Emission Control Areas (ECAS): the Baltic Sea area, the North Sea area, the North American area, and the U.S. Caribbean Sea area. These designated areas are anticipated to witness a surge in demand for alternative marine power technologies, leading to a notable adoption rate of marine batteries and associated technologies. These developments are expected to drive the growth of the marine battery market.

Global Marine Battery Market Constraints and Challenges:

The Global Marine Battery Market may be impacted by lack of proper charging infrastructure.

A significant challenge for the marine battery market is the insufficient charging infrastructure at ports, particularly problematic for large vessels powering their systems or storing energy. The complexity intensifies for larger ships, requiring multiple cables to receive a consistent power supply. Connecting numerous heavy cables, especially for short berthing periods, proves neither time-efficient nor practical. Adequate infrastructure, both onshore (port side) and onboard ships, is imperative. However, the electrical power available from onshore grids often fails to meet the specific voltage, frequency, and earthing requirements of vessels.

Moreover, the deployment of electric vessels necessitates high-voltage superchargers to ensure swift turn-around times. However, such superchargers strain local power grids, often incapable of delivering the required power promptly. Consequently, initial deployments of fully electric ferries require sufficient storage capacity for a rapid turn-around.

Market expansion may be harmed by high cost and limited range of marine batteries.

Electric propulsion systems entail higher initial costs compared to conventional systems, attributed to the installation of relevant storage capacity and battery size, which consequently restricts the range of electric-propelled vessels. The maturity of battery technology in the marine sector is still evolving, confronting challenges due to the superior range and capacity of conventional marine fuels and propulsion systems. Additionally, electronic components are susceptible to corrosion, demanding specialized coatings and treatments, along with highly skilled human resources for operation. The cost factor acts as a deterrent to the widespread adoption of electric propulsion technology.

Global Marine Battery Market Opportunities:

The growing demand for hybrid ships is a great market opportunity to grab for Marine Battery Market.

Presently, hybrid propulsion technology finds applicability in smaller vessels, including ferries and cruise ships. The ongoing advancements in marine electric-propulsion technology and the emergence of alternative fuels, such as fuel cells, present manufacturers with a significant avenue for developing electric propulsion systems tailored for larger ships. Notably, the United Kingdom witnessed the construction of the USD 14 million diesel-electric hybrid ferry, the Catriona, by shipbuilder Ferguson Marine (UK) for deployment on CalMac's Clyde and Hebridean routes. The Catriona's hybrid system seamlessly integrates diesel power with electric battery power. Strengthening the case for hybrid technology, a report titled "A Smarter Journey," jointly published by Siemens and Bellona (Norway) in June 2018, suggested that approximately 70% of Norway's 180-strong ferry fleet could undergo conversion to battery or hybrid propulsion, 84% to all-electric, and 43% to some variant of hybrid technology. In June 2019, Leclanché SA forged a partnership with Comau (Italy), a prominent player in advanced industrial automation products and solutions, to establish the world's first automated manufacturing lines for this innovative technology.

MARINE BATTERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20% |

|

Segments Covered |

By Type, Capacity, Design, Ship Type or Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Corvus Energy (Norway), Leclanché S.A. (Switzerland), Siemens AG (Germany), Saft SA (France), Shift Clean Energy (Canada), Echandia Marine AB (Sweden), EST Floattech (Netherlands), Sensata Technolgies Inc. (US), Powertech Systems (France), Lifeline Batteries (US) |

Global Marine Battery Market Segmentation:

Global Marine Battery Market Segmentation: By Type

- Lithium-ion

- Fuel Cell

- Lead-Acid Battery

- Nickel-Cadmium

- Sodium-based

The marine battery segmentation by type includes lithium-ion, fuel cell, lead-acid battery, nickel-cadmium, and sodium-based. Notably, the lead-acid battery segment is poised to be a significant market driver, holding the largest market share in 2023. This growth is attributed to the heightened demand for electric propulsion in various commercial vessels by key market players and operators of commercial marine fleets. The surge in demand for electric propulsion, coupled with the increasing popularity of maritime tourism, propels market growth. The lithium-ion segment is expected to experience substantial growth, fueled by the rising demand for commercial vessels with electric propulsion globally, particularly in the four Emission Control Areas (ECAS) outlined by IMO 2022. The demand for lithium-ion battery-powered vessels across industries provides an environmentally friendly, efficient, and reliable solution for maritime operations.

Global Marine Battery Market Segmentation: By Capacity

- Less than 100Ah

- 100-250Ah

- Greater than 250 Ah

Capacity-wise, the market is categorized into less than 100 Ah, 100-250 Ah, and greater than 250 Ah. The segment exceeding 250 Ah claimed the highest market share in 2023 due to the escalating demand for large-capacity batteries in electrically propelled commercial vessels. The adoption of electric propulsion in marine vessels, passenger ships, and ferries is increasing in response to stringent governmental and international environmental policies targeting carbon and hazardous gaseous emissions. The less than 100Ah segment is anticipated to be the second largest during the forecast period, primarily driven by the high demand for these batteries in leisure boats and the increased adoption of marine batteries as vessels shift from conventional marine fuel-based propulsion. The 100-250Ah segment is expected to witness significant growth, driven by the need for improved maritime connectivity and the rising demand for maritime passenger ships and ferries worldwide.

Global Marine Battery Market Segmentation: By Design

- Solid-state Battery

- Flow Battery

In terms of design, the market is segmented into solid-state batteries and flow batteries. The flow battery segment is projected to dominate the market during the forecast period due to the increased utility of electric propulsion across various applications, a rise in the number of commercial vessels, and the growing global interest in maritime tourism. Despite the higher initial cost associated with electric propulsion, operators of commercial marine vessel fleets recognize its utility. The solid-state battery segment exhibits a notable growth rate, being the fastest growing during the forecast period. This growth is driven by the high demand for marine applications, providing an extended range and lower risk compared to flow batteries.

Global Marine Battery Market Segmentation: By Ship Type or Application

- Commercial

- Defense

The commercial segment is anticipated to experience the highest growth rate during the forecast period. This growth is attributed to the increasing maritime tourism, adjustments in governmental policies to optimize the seaborne economy, the conversion of existing fleets to electric propulsion within IMO 2020's ECAS, a surge in demand for marine services across commercial industries (deep-sea mining, energy, infrastructure, oil, and gas), and the substantial growth in the utility of battery technology in the commercial sector. The defense segment is expected to grow significantly, driven by the increasing number of defense shipbuilding programs, the growing use of marine batteries in naval vessels by government and commercial naval shipyards, and the rise in defense budgets globally.

Global Marine Battery Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Europe holds the largest and fastest-growing market share globally. This growth is attributed to the high number of commercial marine vessel operators and market players, along with a vast supply chain network in Europe. The increase in maritime tourism and the widespread adoption of electric propulsion in various marine applications contribute to market expansion. North America is poised for remarkable growth, driven by the increasing adoption of electric propulsion by government agencies like NOAA, the rising use of battery-powered marine vessels for commercial and governmental purposes, and the high demand for these batteries in North America for leisure boats and recreational applications.

COVID-19 Impact Analysis on the Global Marine Battery Market:

The marine industry experienced substantial repercussions from the COVID-19 pandemic. Despite facing challenges, the market exhibited measured growth throughout the pandemic and is poised for further expansion in the forecast period. The dwindling number of new marine vessel orders between 2018 and 2019, compounded by the outbreak of the COVID-19 pandemic, disrupted the global supply chain, leading to an eventual economic slowdown that affected the availability of commercial vessels and created disruptions in the supply chain. Nevertheless, there is an anticipated upswing in the demand for marine battery technology in the upcoming forecast period.

The pandemic witnessed a notable contraction in global market growth and a decline in revenue growth for market players, primarily due to production and delivery delays. Manufacturing shutdowns, a consequence of worldwide lockdown implementations or limited manufacturing capacity, further impacted the industry. The budgets allocated by governmental and commercial market players for the development of the shipping and shipbuilding industry diminished due to the widespread impact of the ongoing pandemic and associated reductions in infrastructure spending.

Latest Trends/ Developments:

A collaborative venture was established between Bijlsma Wartena (Netherlands) and EST-Floattech through a signed contract. This collaboration aims to provide 1,050 Green Orca batteries featuring over 2.5 MWh of Lithium-ion Polymer N.M.C. battery energy storage capacity.

ABS (American Bureau of Shipping) entered into a collaborative agreement with Contemporary Amperex Technology Co., Limited (CATL) to jointly conduct research on lithium battery propulsion for next-generation vessels. The collaboration focuses on exploring technical standards for battery-powered vessels, encompassing critical safety-related technologies such as the charging system, power battery compartment layout, propulsion system, and fire control.

Key Players:

- Corvus Energy (Norway)

- Leclanché S.A. (Switzerland)

- Siemens AG (Germany)

- Saft SA (France)

- Shift Clean Energy (Canada)

- Echandia Marine AB (Sweden)

- EST Floattech (Netherlands)

- Sensata Technolgies Inc. (US)

- Powertech Systems (France)

- Lifeline Batteries (US)

Chapter 1. Global Marine Battery Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Marine Battery Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Marine Battery Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Marine Battery Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitute

Chapter 5. Global Marine Battery Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Marine Battery Market– By Type

6.1. Introduction/Key Findings

6.2. Lithium-ion

6.3. Fuel Cell

6.4. Lead-Acid Battery

6.5. Nickel-Cadmium

6.6. Sodium-based

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Global Marine Battery Market– By Capacity

7.1. Introduction/Key Findings

7.2. Less than 100Ah

7.3. 100-250Ah

7.4. Greater than 250 Ah

7.5. Y-O-Y Growth trend Analysis By Capacity

7.6. Absolute $ Opportunity Analysis By Capacity , 2024-2030

Chapter 8. Global Marine Battery Market– By Design

8.1. Introduction/Key Findings

8.2. Direct Plan-based/Goal-based

8.3. Comprehensive Wealth Advisory

8.4. Y-O-Y Growth trend Analysis Design

8.5. Absolute $ Opportunity Analysis Design , 2024-2030

Chapter 9. Global Marine Battery Market– By Ship Type or Application

9.1. Introduction/Key Findings

9.2. Commercial

9.3. Defense

9.4. Y-O-Y Growth trend Analysis Ship Type or Application

9.5. Absolute $ Opportunity Analysis Ship Type or Application , 2024-2030

Chapter 10. Global Marine Battery Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Type

10.1.3. By Capacity

10.1.4. By Ship Type or Application

10.1.5. Design

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By Capacity

10.2.4. By Ship Type or Application

10.2.5. Design

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Type

10.3.3. By Capacity

10.3.4. By Ship Type or Application

10.3.5. Design

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Type

10.4.3. By Capacity

10.4.4. By Ship Type or Application

10.4.5. Design

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Type

10.5.3. By Capacity

10.5.4. By Ship Type or Application

10.5.5. Design

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Marine Battery Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Corvus Energy (Norway)

11.2. Leclanché S.A. (Switzerland)

11.3. Siemens AG (Germany)

11.4. Saft SA (France)

11.5. Shift Clean Energy (Canada)

11.6. Echandia Marine AB (Sweden)

11.7. EST Floattech (Netherlands)

11.8. Sensata Technolgies Inc. (US)

11.9. Powertech Systems (France)

11.10. Lifeline Batteries (US)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Marine Battery Market is valued at USD 480 million in 2023.

The worldwide Global Marine Battery Market growth is estimated to be 20% from 2024 to 2030.

The Global Marine Battery Market is segmented by Type (Lithium-ion, Fuel Cell, Lead-Acid Battery, Nickel-Cadmium, and Sodium-based), By Capacity (Less than 100Ah, 100-250Ah, and Greater than 250 Ah), By Design (Solid-state Battery and Flow Battery), By Ship Type or Application (Commercial and Defense).

The outlook for the global Marine Battery Market is promising, driven by the rising marine tourism, implementation of 2020 Sulphur regulation.

The marine battery market experienced substantial repercussions from the COVID-19 pandemic. Despite facing challenges, the market exhibited measured growth throughout the pandemic and is poised for further expansion in the forecast period