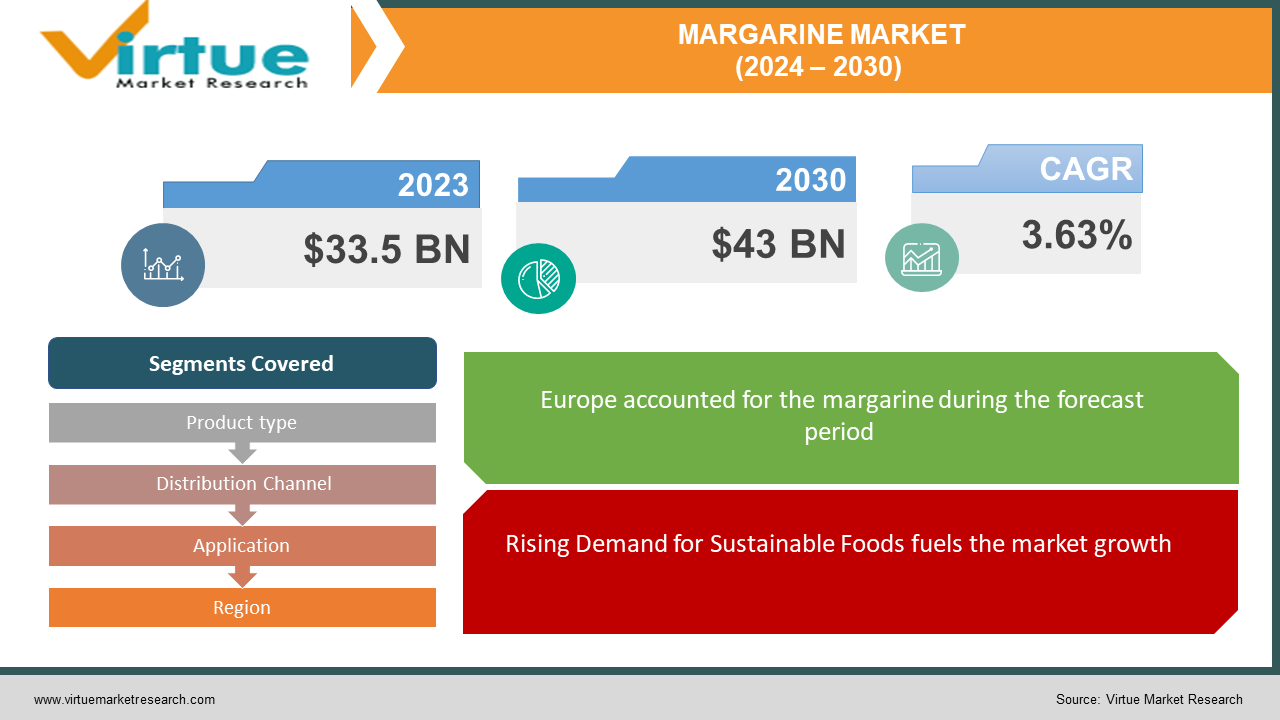

Margarine Market Size (2024 – 2030)

The Global Margarine Market was valued at USD 33.5 billion in 2023 and is projected to reach a market size of USD 43 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.63%.

Margarine is a healthy alternative to buttermilk or cream made from milk. Low-fat margarine is made from vegetable oils such as canola oil, peanut oil, and soybean oil. The fact that butter contains saturated fat, which can be harmful to health, has increased margarine sales in recent years. In the long term, consumers are turning to plant-based sugar alternatives over health, which will create a new margarine industry.

Unsalted margarine has a neutral or mild taste that does not interfere with the main product and has all the ingredients that will add the necessary texture, volume, and flavor to the food. As consumers become more aware of healthy eating, products are using it as a low-fat substitute for healthy fats, thus driving the growth of commercial margarine.

Key Market Insights:

The cost-effectiveness of the product drives the margarine market as it is increasingly used as a cheaper alternative to butter and other fat-soluble products. The use of margarine products reduces the cost of the final product. It is widely used in the bakery industry in products such as pastries, buns, and cookies. Therefore, the bakery industry plays an important role in the use of margarine.

Today's consumers, who are busy with business and private life, prefer products that are easy to make and do not take much time. Margarine or low-fat bread can be eaten directly by adding it to other foods. The demand for margarine is expected to increase in the coming days due to its ease of cooking and flavor. These factors, which exist in today's economic conditions, are expected to increase the demand for the margarine sector during the evaluation period.

Margarine Market Drivers:

Rising Demand for Sustainable Foods fuels the market growth.

Margarine has long been overlooked as people turn to butter in search of a healthy alternative. The effect is more pronounced in the upper classes because high-income people do not use margarine, which is cheaper than butter regardless of its fat content. However, as the search for more nutritious foods continues, manufacturers are responding to changing needs. Innovation will soon be commercialized. According to the World Economic Forum's January 2023 report, 30% of consumers prefer healthy foods.

Many government health departments have worked with the agricultural sector to remove harmful ingredients, including trans fats, from food products. This is expected to strengthen the growth of the margarine market. For example, in Argentina, the issue of high risk of heart disease has been addressed by government officials, leading to the implementation of programs that can help promote healthy food by eliminating products containing trans fats. Additionally, many margarine companies in the Netherlands are aware of the importance of being non-GMO. Trying to respond to changing needs, they came up with the idea of creating the best materials for the market. Governments around the world also support sustainable food production, including meat, dairy, and other protein-rich foods.

Growing varieties in the bakery products fuels the market growth.

Margarine is widely used in the preparation of cakes and biscuits as it gives a flaky texture to baked goods. It also helps extend the shelf life of baked goods. Therefore, increasing demand for bakery products is expected to help the business grow. Margarine is rich in unsaturated fats but sometimes also contains trans fats.

Margarine Market Restraints and Challenges:

Health issues related to trans-fats expected to restrain the market growth.

Trans fat is a type of fat linked to the risk of chronic disease. As a result, the Food and Drug Administration now bans the use of trans fats in processed foods. According to the World Health Organization, some laws will protect 3.5 billion people in 58 countries from dangerous obesity by the end of 2023. It is estimated that commercial trans-fat consumption causes approximately 500,000 deaths from heart disease each year. Nearly two-thirds of deaths linked to trans-fat consumption occurred in 15 countries.

The volatility in Margarine's price brings a challenge to market growth.

Global Margarine prices fluctuate significantly due to factors like currency fluctuations, and speculation. This uncertainty can discourage investment and harm smaller players.

Butter is an alternative to provide challenges to the Margarine market.

Since butter is a healthy alternative to margarine, it inhibits market growth. However, the emergence of sustainable and plant-based margarine will create new opportunities in the market.

Margarine Market Opportunities:

As there is a growing need for perfectionism in the food industry, the increasing demand for specialty products should increase the market potential. To this end, major manufacturers have adopted the solution of creating a variety of specialized margarine products to suit various applications in the food industry. For example, East Asia Palm Products produces a range of vegetable laminated margarine specifically designed to meet the needs of laminated products such as croissants, danishes, and puff pastry. Rising demand for pure margarine is noted to provide significant growth opportunities.

MARGARINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.63% |

|

Segments Covered |

By Product type, Distribution Channel, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bunge Limited, Conagra Brands Inc., EFKO Group, NMGK Group, PURATOS, Richardson International Limited, Vandemoortele, Wilmar International Ltd., Upfield BV, BRF SA |

Margarine Market Segmentation by Product Type

-

Hard

-

Soft

-

Liquid

In 2023, based on the Product Type, the Soft segment is projected to grow at a CAGR of 3.86% and is currently leading the charts followed by the Hard and Liquid segments. Soft Margarine content is less trans-fat. On the other hand, they are made from vegetable oils such as sunflower, soybean, rapeseed, olive oil, and rapeseed oil.

The Hard segment is expected to witness a higher CAGR during the forecasting period because of the increasing demand for bakery products. It could see a CAGR of around 4.2%.

Margarine Market Segmentation by Distribution Channel

-

Retail

-

HoReCa

-

Industrial

-

Online

In 2023, based on Distribution Channel, the Retail segment accounted for the largest revenue share with approximately 45% of the market and registered a CAGR of 2.43%. This could be because of the expansion of supermarkets and hypermarkets. But as the market thrives online sector is gaining popularity because of premium quality Margarines which have higher nutritional value than local ones and registered a CAGR of 4.56%.

HoReCa segment seems to be growing faster because of expansion in the Travel and Tourism sector.

Margarine Market Segmentation by Application

-

Household

-

Food Industry

-

Catering

In 2023, based on Application, the Food Industry segment accounted for the largest revenue share with approximately 45% of the market and is expected to show a CAGR of 3.7% during the forecasting period.

The Household segment is expected to progress at a higher CAGR of 4.1% during the forecasting period.

Margarine Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The global margarine market is dominated by Europe with approximately 45% of the market share. This is mainly due to its high consumption in food processing. Additionally, Germany and France are Europe's largest consumers. As supply in the baking and food markets continues to increase, market demand for margarine in Europe is also increasing. That's why companies in the margarine market have expanded their products in the last few years, focusing on marketing to younger consumers. According to the European Commission's 2022 report, the food processing industry in Europe has developed significantly, with a total of 300,000 companies, accounting for 16.4% of Europe's total economy. Trans fatty acids have been eliminated from margarine stores in Western Europe. As a result, the Vegetable Oil and Oil Industry is working to refine and improve the quality of margarine, influencing dietary recommendations and medical advice, and raising concerns about increasing rates of heart disease worldwide. This contributes to the spread of the margarine industry in the region.

Asia-Pacific is expected to be the fastest-growing region in the margarine market. Consumption increased as more end users established operations in the region. Additionally, increasing disposable income and increasing demand for processed foods are also likely to increase the demand for margarine in the region.

North America is the second runner-up in the list whereas South America and Middle East & Africa have a relatively lower portion in the market.

COVID-19 Impact Analysis on the Global Margarine Market:

The COVID-19 pandemic has affected the availability of margarine products in the market due to trade restrictions. Many margarine factories are closing due to a lack of raw materials and skilled workers. While many stores were forced to close, sales in margarine stores dropped rapidly.

Trade restrictions continue to hinder business growth due to restrictions on the import and export of goods and high transportation costs. As the situation returns to normal, the demand for margarine should increase due to the health benefits of its consumption.

Latest Trends/ Developments:

Smart Balance margarine is widely used in baked goods because it is cheap and effective. With the increase in the consumption of snacks such as biscuits, muffins, plum cakes, and bread, the demand for margarine will also increase. The rise of small regional stores and high-end operators selling various products is expected to generate revenue from the sale of margarine products.

As the population is expanding, the demand for food and beverages is also increasing, causing many people to adopt vegan and plant-based foods, including vegan margarine, to stay healthy. As the population ages rapidly, they are changing their eating habits to organic products that do not contain any additives. This will increase the market share of heart-healthy margarine.

Consumers care about the balance of the environment as well as human health and consume foods with a lower carbon footprint than animal products. Therefore, margarine brands that follow sustainable practices are expected to stand out from the competition and earn more capital.

Key Players:

-

Bunge Limited

-

Conagra Brands Inc.

-

EFKO Group

-

NMGK Group

-

PURATOS

-

Richardson International Limited

-

Vandemoortele

-

Wilmar International Ltd.

-

Upfield BV

-

BRF SA

-

In February 2023, FGV Holdings Berhad made a strategic move to expand its business in the Middle East and North Africa region. The company achieved this by launching its new product in the FMCG category, ADELA Margarine. The new product was introduced at Gulffood 2023, the world's largest food fair, held at the famous Dubai World Trade Centre.

-

In February 2023, Food and beverage giant Unilever launched a new range of margarine-based water products. These products are a healthy alternative to standard margarine because they are low in fat and calories.

-

In March 2023, The U.S. Food and Drug Administration (FDA) allowed liquid margarine to be used as a fat in foods. This decision is expected to increase the number of margarine-based products in the US market.

Chapter 1. Margarine Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Margarine Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Margarine Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Margarine Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Margarine Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Margarine Market– By Product Type

6.1 Introduction/Key Findings

6.2 Hard

6.3 Soft

6.4 Liquid

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Margarine Market– By Distribution Channel

7.1 Introduction/Key Findings

7.2 Retail

7.3 HoReCa

7.4 Industrial

7.5 Online

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Margarine Market– By Application

8.1 Introduction/Key Findings

8.2 Household

8.3 Food Industry

8.4 Catering

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Margarine Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Distribution Channel

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Distribution Channel

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Distribution Channel

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Distribution Channel

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Distribution Channel

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Margarine Market– Company Profiles – (Overview, By Product Type Portfolio, Financials, Strategies & Developments)

10.1 Bunge Limited

10.2 Conagra Brands Inc.

10.3 EFKO Group

10.4 NMGK Group

10.5 PURATOS

10.6 Richardson International Limited

10.7 Vandemoortele

10.8 Wilmar International Ltd.

10.9 Upfield BV

10.10 BRF SA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Margarine Market was valued at USD 33.5 billion in 2023 and is projected to reach a market size of USD 43 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.63%.

The segments under the Global Margarine Market by Product Type are Hard, Soft, and Liquid.

The European region is the dominant Global Margarine Market.

Bunge Limited, Conagra Brands Inc., EFKO Group, NMGK Group, PURATOS, Richardson International Limited, Vandemoortele, Wilmar International Ltd., Upfield BV, BRF SA, etc.

The COVID-19 pandemic has affected the availability of margarine products in the market due to trade restrictions. Many margarine factories are closing due to a lack of raw materials and skilled workers. While many stores were forced to close, sales in margarine stores dropped rapidly.