Mango Pickle Market size (2025-2030)

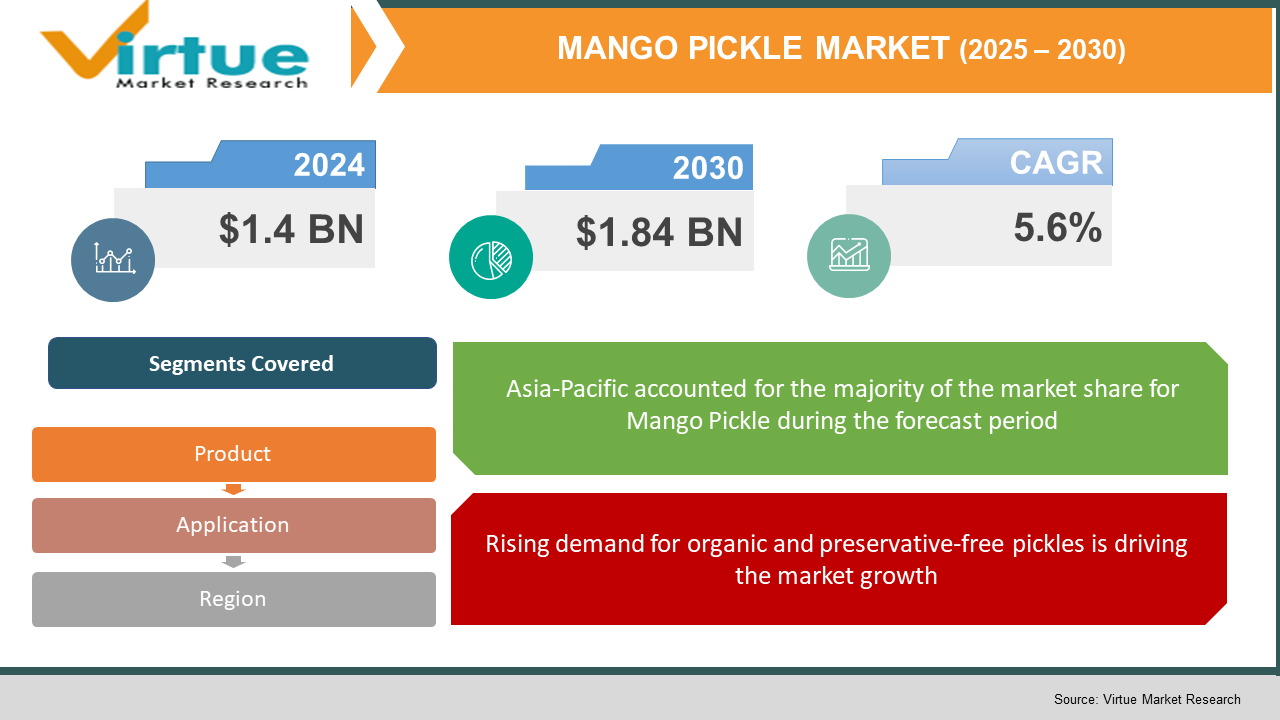

The Global Mango Pickle Market was valued at USD 1.4 billion in 2025 and will grow at a CAGR of 5.6% from 2025 to 2030. The market is expected to reach USD 1.84 billion by 2030.

The Mango Pickle Market encompasses the production, distribution, and consumption of mango-based pickles, a popular condiment especially in Asian cuisines. Mango pickles are known for their tangy and spicy flavor profiles, made using raw mangoes, oil, salt, and various spices. This market is driven by both traditional consumer bases in countries like India and growing demand in Western nations due to the popularity of ethnic foods and culinary globalization. Consumers are increasingly drawn to artisanal and organic varieties, while manufacturers are diversifying offerings with different regional recipes and convenient packaging formats. The market’s growth is further supported by rising exports and increased shelf visibility in retail outlets globally.

Key market insights:

India remains the largest producer and consumer of mango pickles, contributing to over 60% of global consumption in 2024.

Organic mango pickles are gaining traction, with demand growing by 12% annually, especially in North America and Europe.

E-commerce is a major growth channel, with online mango pickle sales accounting for 18% of total global sales in 2024.

Export value from India alone crossed USD 320 million in 2024, a 9% increase over the previous year.

Consumers are seeking preservative-free and low-oil pickle options, with that segment seeing a 15% year-on-year rise in global demand.

Global Mango Pickle Market Drivers

Growing popularity of ethnic and regional cuisine is driving the market growth

The global food culture is increasingly embracing diversity, with ethnic and regional cuisines gaining substantial popularity. Mango pickles, a traditional condiment from South Asia, have found acceptance in many Western households and restaurant menus, particularly among adventurous eaters and health-conscious consumers seeking natural flavors and fermented products. The rising appreciation for global tastes and authenticity has created strong demand for traditional foods, including mango pickles. As more people travel and migrate, the global palate expands, and nostalgic and cultural foods like mango pickles gain market share. Furthermore, culinary tourism, social media influencers, and food shows have amplified awareness and desirability for Indian cuisine, which commonly features mango pickles. As a result, manufacturers are increasing their distribution efforts across regions like North America, Europe, and the Middle East. The growing consumption of ethnic meals in the ready-to-eat and quick-service segments also enhances mango pickle usage in new food applications. This expansion of culinary interest and cross-cultural gastronomy is a long-term driver of the mango pickle market.

Rising demand for organic and preservative-free pickles is driving the market growth

Consumers are increasingly health-conscious and ingredient-aware, leading to a higher preference for organic, preservative-free food options. This demand is significantly reshaping the mango pickle market. Traditional pickles are often perceived as unhealthy due to their high salt, oil, and preservative content. However, recent innovations have enabled producers to create healthier versions using natural preservatives like vinegar and organic spices while reducing oil and sodium content. The availability of organic mangoes and sustainable sourcing practices has encouraged numerous brands to enter the organic mango pickle segment. With certifications like USDA Organic or EU Organic adding credibility, these products attract premium pricing and a loyal customer base. Clean-label trends are also encouraging transparent packaging and marketing. Consumer education through content marketing and influencer partnerships has accelerated the shift towards these healthier alternatives. As major supermarket chains allocate shelf space to organic condiments, the availability and visibility of these pickles have increased, further strengthening their demand across health-centric demographic segments worldwide.

Increasing export opportunities and global retail presence is driving the market growth

The rising global diaspora, along with the growing international interest in Indian cuisine, is boosting the export of mango pickles to regions like North America, Europe, the Middle East, and Africa. Indian food, once a niche offering, is now entering mainstream retail through both traditional grocery chains and modern formats such as specialty food stores and online marketplaces. Large FMCG companies have begun international distribution agreements to place their mango pickle products in global retail chains. Export-friendly packaging, compliance with international food safety standards, and introduction of fusion flavors tailored for Western tastes have expanded market potential. Furthermore, increasing bilateral trade agreements and favorable export policies in India and other producing countries have facilitated easier and cost-effective international shipping of packaged food products. Companies are also leveraging regional distribution networks and online B2B platforms to target restaurants and ethnic food vendors overseas. The net effect is a steady increase in mango pickle exports, supported by consumer curiosity, better logistics, and favorable pricing.

Global Mango Pickle Market Challenges and Restraints

Short shelf life and storage challenges is restricting the market growth

One of the significant challenges faced by the mango pickle market is the product's relatively short shelf life, particularly in the case of artisanal or preservative-free variants. Traditional mango pickles rely heavily on salt and oil as natural preservatives, but with rising demand for low-sodium and low-oil options, shelf stability becomes a pressing concern. Without the use of artificial preservatives, pickles are vulnerable to spoilage, microbial contamination, and changes in texture or flavor over time. The transportation and storage conditions significantly impact product longevity. In tropical and humid climates, maintaining the quality of mango pickles during storage and transit becomes particularly difficult. Small-scale producers, who often lack access to advanced cold chain logistics and vacuum-sealing technology, find it harder to ensure consistent product quality. This limits their ability to expand to global markets or scale up production. Moreover, consumer skepticism regarding pickle safety and hygiene, especially for loosely packaged or bulk products, further impacts the market. To remain competitive, manufacturers must invest in food preservation R&D, better packaging solutions, and cold chain infrastructure, all of which increase production costs and create barriers for new entrants.

Fluctuating raw material prices and seasonality is restricting the market growth

The production of mango pickles is highly dependent on the availability and pricing of raw mangoes, which are seasonal and prone to climate variability. A bad harvest due to weather conditions, pests, or disease outbreaks can severely affect mango supply, leading to increased prices and limited production capacity. Since mangoes are the core ingredient, fluctuations in their cost directly impact profit margins, especially for small to medium enterprises. Additionally, other essential ingredients like mustard oil, spices, and packaging materials also experience price volatility. Most manufacturers procure raw mangoes in bulk during the harvest season, but improper storage can lead to spoilage, increasing operational losses. This seasonal dependency creates inconsistency in supply, pricing, and delivery schedules, making it harder to meet continuous demand in international markets. Producers are often compelled to raise prices or reduce quantities during off-seasons, which can impact brand loyalty and long-term customer satisfaction. While cold storage and contract farming offer some solutions, they require significant capital investments that many small players cannot afford. This unpredictability in input costs and supply can restrain growth and expansion plans across both domestic and export markets.

Market opportunities

The mango pickle market stands to benefit from a growing range of opportunities, particularly in premium product innovation, regional variety diversification, and global digital commerce. As health trends evolve, brands are introducing mango pickles with added health benefits, such as low-sodium, probiotic-enriched, or sugar-free variants, catering to consumers with dietary restrictions or preferences. Regional pickle variants like Gujarati sweet mango pickle or Andhra avakaya offer scope for differentiation and consumer engagement. Product localization and regional storytelling help brands build authenticity and loyalty. Furthermore, private label and co-branding opportunities with large retail chains present scalable growth avenues. The rise of vegan and vegetarian diets worldwide creates a favorable backdrop for plant-based condiments like mango pickles. Online marketplaces and direct-to-consumer models are empowering small and mid-sized manufacturers to reach global audiences without the need for expensive distribution channels. E-commerce also facilitates customization, subscription-based deliveries, and limited edition packaging, which enhance consumer experience and brand perception. With the expansion of cold chain infrastructure and packaging technology, the logistical barriers to international shipping are reducing. Additionally, consumer interest in fermentation, gut health, and clean eating trends aligns well with the natural, traditional appeal of mango pickles. Marketing strategies that tap into cultural heritage, sustainability, and artisanal craftsmanship further enhance product storytelling and premium positioning. Educational campaigns and social media promotions are helping overcome hesitations around pickles by highlighting their culinary value and health potential. Overall, the convergence of health consciousness, global flavor exploration, and e-commerce presents a fertile ground for sustained market expansion and innovation.

MANGO PICKLE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mother's Recipe, Priya Foods, Aachi Foods, Patak’s, and Double Horse. |

Mango Pickle Market segmentation

Mango Pickle Market segmentation By Product:

• Spicy Mango Pickle

• Sweet Mango Pickle

• Sour Mango Pickle

• Organic Mango Pickle

• Low-oil Mango Pickle

Spicy mango pickle holds the dominant position in the global mango pickle market due to its deep-rooted popularity in traditional cuisines across South Asia and growing preference in international markets. Known for its rich flavor and long shelf life, spicy variants appeal to both ethnic and global consumers who seek bold, authentic taste experiences. It is a staple accompaniment in Indian meals and enjoys year-round demand. Spicy mango pickles also show better export viability due to their longer preservation and wider acceptance among fusion chefs and diaspora populations.

Mango Pickle Market segmentation By Application:

• Household Consumption

• HoReCa (Hotels, Restaurants, Caterers)

• Online Subscription Services

• Ready-to-Eat Meal Kits

• Institutional Use (e.g., schools, hospitals)

Household consumption remains the most dominant application segment for mango pickles. Despite innovations in commercial foodservice and ready-to-eat meals, traditional home dining remains the primary consumption channel. Mango pickles are a staple in daily meals across Indian households and increasingly adopted in international homes due to the rising availability of ethnic foods. The emotional connection, cultural familiarity, and versatility of mango pickles make them indispensable in home kitchens, contributing to their continued dominance in this segment.

Mango Pickle Market Regional segmentation

• North America

• Europe

• Asia-Pacific

• South America

• Middle East and Africa

Asia-Pacific is the dominant region in the global mango pickle market, primarily due to the cultural, culinary, and agricultural significance of mangoes and pickles in countries like India, Bangladesh, Pakistan, and Sri Lanka. India alone accounts for the majority of global production and consumption, supported by deep-rooted culinary traditions where pickles are an essential component of daily meals. The availability of diverse mango varieties and traditional recipes fuels regional and international demand. Additionally, established local brands, artisanal producers, and cooperative manufacturing networks contribute to a vibrant and competitive market landscape. The region also benefits from favorable climatic conditions for mango cultivation, ensuring consistent and affordable supply of raw materials. With strong domestic consumption and a growing export base, Asia-Pacific also leads in innovation, ranging from organic variants to advanced packaging technologies. Countries like India and Bangladesh are also increasingly targeting diaspora populations through dedicated export strategies. The rising influence of South Asian cuisine globally has further enhanced the visibility of mango pickles from this region. Asia-Pacific's established infrastructure, cultural affinity, and abundant resources make it the cornerstone of the global mango pickle market.

COVID-19 Impact Analysis on the Mango Pickle Market

The COVID-19 pandemic had a mixed impact on the global mango pickle market. During the initial phases of the lockdowns, there was a disruption in supply chains due to movement restrictions, labor shortages, and halted production facilities, particularly affecting small-scale pickle manufacturers in South Asia. The seasonal nature of mango harvesting compounded the issue, with limited access to fresh produce delaying the manufacturing cycle. However, on the demand side, there was a noticeable surge in consumption as consumers turned to comfort foods and traditional items with longer shelf lives during periods of uncertainty. Mango pickles, seen as familiar and versatile, became a staple pantry item in many households. With increased cooking at home, demand for ethnic condiments rose sharply. E-commerce channels saw a significant uptick, with many traditional producers transitioning to online platforms to maintain revenue streams. Additionally, health-conscious variants gained attention as consumers began seeking preservative-free, organic, or low-oil options. Restaurants and hotels experienced a temporary dip in demand due to closures, but recovery began in late 2021 as dining out resumed. The overall market demonstrated resilience, with digital transformation, localized sourcing, and logistical adaptation allowing businesses to bounce back. Post-COVID, the market is more digitized, health-aware, and globally accessible than before.

Latest trends/Developments

The mango pickle market is witnessing a range of emerging trends and developments that reflect evolving consumer preferences and technological advancements. One major trend is the rise of functional mango pickles, which incorporate ingredients like probiotics or superfoods to offer additional health benefits. Another growing trend is sustainable packaging; many brands are moving away from plastic jars toward biodegradable, glass, or reusable containers. Product differentiation through regional and artisanal recipes is also prominent, with brands promoting hyper-local varieties such as Punjabi aam ka achaar, Tamil-style maavadu, or Maharashtrian mango thokku to attract culturally connected consumers. The growing emphasis on clean-label products has driven transparency in ingredient sourcing and manufacturing processes, while QR codes on packaging now offer consumers traceability and preparation stories. Subscription-based pickle delivery services and customization options—like spice-level selection—are gaining traction, particularly in urban areas. Startups and D2C brands are leveraging influencer marketing and Instagram reels to tap into younger audiences, showcasing mango pickles as gourmet, trendy, and globally relevant. Global retail giants are increasingly stocking ethnic condiments, giving mango pickles better visibility and acceptance. Some producers are experimenting with fusion flavors, like mango pickle with jalapeño or mango kimchi hybrids, targeting global palates. Additionally, freeze-drying and vacuum-packing technologies are being adopted to increase shelf life and make products travel-friendly for exports. These innovations are redefining the traditional image of mango pickles and aligning the market with future culinary trends.

Key Players:

- Mother's Recipe

- Priya Foods

- Aachi Foods

- Patak’s

- Double Horse

- Nilon’s

- Everest Pickles

- Tasty Nibbles

- Urban Platter

- Eastern Condiments

Chapter 1. Mango Pickle Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MANGO PICKLE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. MANGO PICKLE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. MANGO PICKLE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. MANGO PICKLE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MANGO PICKLE MARKET – By Product

6.1 Introduction/Key Findings

6.2 Spicy Mango Pickle

6.3 Sweet Mango Pickle

6.4 Sour Mango Pickle

6.5 Organic Mango Pickle

6.6 Low-oil Mango Pickle

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. MANGO PICKLE MARKET – By Application

7.1 Introduction/Key Findings

7.2 Household Consumption

7.3 HoReCa (Hotels, Restaurants, Caterers)

7.4 Online Subscription Services

7.5 Ready-to-Eat Meal Kits

7.6 Institutional Use (e.g., schools, hospitals)

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. MANGO PICKLE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. MANGO PICKLE MARKET – Company Profiles – (Overview, Product , Portfolio, Financials, Strategies & Developments)

9.1 Mother's Recipe

9.2 Priya Foods

9.3 Aachi Foods

9.4 Patak’s

9.5 Double Horse

9.6 Nilon’s

9.7 Everest Pickles

9.8 Tasty Nibbles

9.9 Urban Platter

9.10 Eastern Condiments

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Mango Pickle Market was valued at USD 1.4 billion in 2025 and will grow at a CAGR of 5.6% from 2025 to 2030. The market is expected to reach USD 1.84 billion by 2030

Key drivers include rising popularity of ethnic cuisine, growing demand for organic and preservative-free pickles, and increasing global exports.

Segments include product types like spicy, sweet, sour, and organic mango pickles, and applications like household, HoReCa, and meal kits

Asia-Pacific is the dominant region due to high domestic consumption, diverse production, and strong export infrastructure

Leading players include Mother's Recipe, Priya Foods, Aachi Foods, Patak’s, and Double Horse.