Malt Extract Market Size (2025-2030)

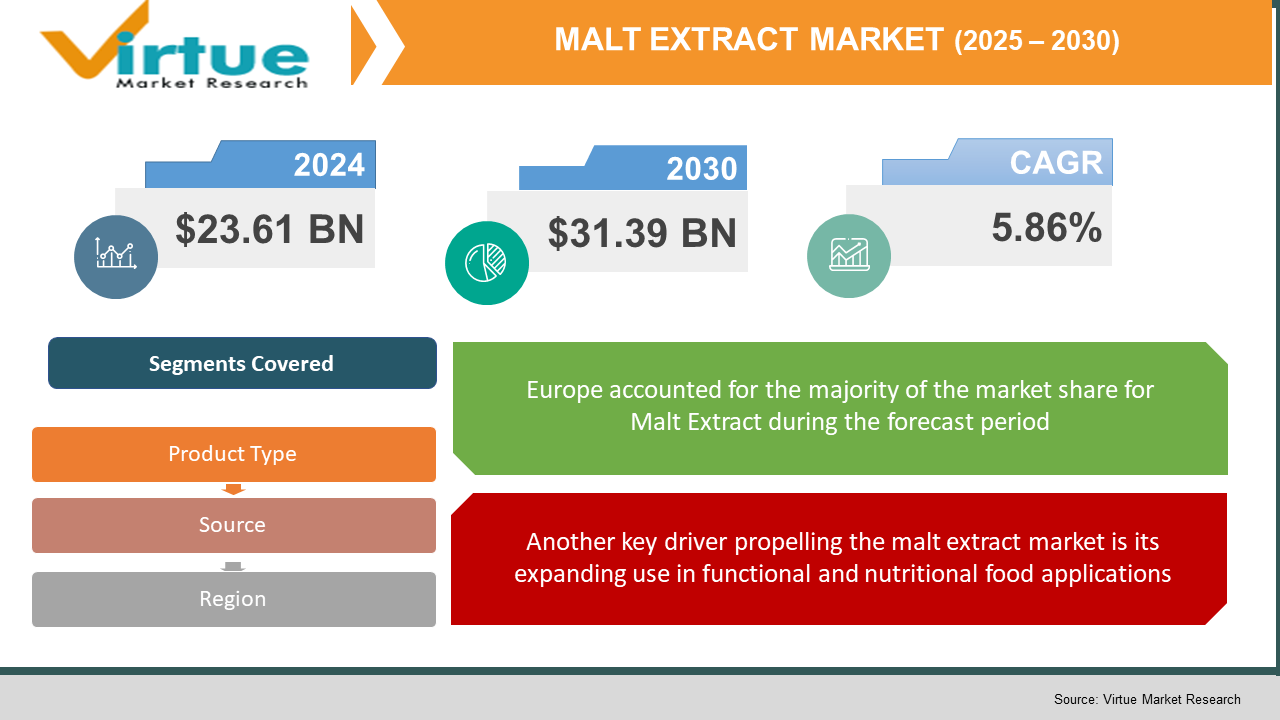

The Malt Extract Market was valued at USD 23.61 billion in 2024 and is projected to reach a market size of USD 31.39 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.86%.

With a rise in demand for natural and nutritious ingredients across the food, beverage, and health markets, the Malt Extract Market has experienced substantial growth. Malt extract is known for its rich flavour, natural sweetness, and high nutritional content; it is derived from malted barley and other grains. The increase in the use of malt extract in functional foods and sports nutrition, particularly in craft beverages such as beer and non-alcoholic malt drinks, has made it a favourite on a truly global scale. Meanwhile, the growing trend toward clean-label and plant-based products is even further encouraging manufacturers to use malt extract in a variety of applications, making it a key ingredient in the ever-evolving food landscape.

Key Market Insights:

Over 60% of malt extract is used by the food and beverage industry, especially in baking and brewing. The growth of craft beer and artisanal bakery products has significantly boosted their demand in North America and Europe.

The use of malt extract in nutritional supplements and sports drinks has grown by over 30% in the last 5 years. Its high vitamin B content and natural energy-boosting properties make it popular in clean-label formulations.

Malt Extract Market Drivers:

Consumers worldwide are increasingly turning towards food and beverage products that are free from artificial additives, preservatives, and synthetic sweeteners.

Globally, consumers are increasingly moving towards food and beverage products devoid of artificial additives or preservatives and, more importantly, synthetic sweeteners. Those post-pandemic, heightened health consciousness largely explain the development of the importance of ingredient transparency and label literacy; Enter malt extract; it is the natural derivative of barley and other grains and becomes, therefore, a clean-label that provides natural sweetness, rich flavour, and highly valued nutrition. Its usage eliminates the whole argument for synthetic colouring and flavour agents, in line with current dietary demands. The functional properties of malt extract-such as being a natural binder, sweetener, and colourant, further boost its desirability among manufacturers seeking multi-functional, label-friendly ingredients. From cereals, breakfast bars, down to bakery items and plant-based drinks, malt extract has been perhaps the ingredient of choice. The other thing is that consumer trust in these "natural origin" claims increases the sellability of a product containing malt extract. And top food companies have been very active in reformulating their products to get rid of refined sugar and less sugar with the use of malt extract, which brings nutritional benefits without compromising taste. Yet, this clean-label momentum is not a fad or trend; it is a transformation over many years that will seal malt extract as a true staple in the health-forward food industry. The growing uptake of malt extract at the global level continues to rise because major economies in the world are maturing as far as clean-label awareness is concerned, such as North America and Europe.

Another key driver propelling the malt extract market is its expanding use in functional and nutritional food applications.

As malt extract is widely used in functional and nutritional foods, it will add to the potential drivers in this market. The ingredient serves as a supplement to the regular diets with vitamins A, B2, B6, and folate, as well as minerals that include magnesium and phosphorus. This makes it an important component of diet supplements, sports nutrition products, and health drinks. The ability of malt extract to provide energy release over a long duration makes it highly attractive to sportspeople and fitness enthusiasts; hence, it is increasingly used in energy bars, protein shakes, and recovery beverages. In addition, malt extract has mild prebiotic properties that might additionally support gut health; so it's an important ingredient for wellness foods. The more taste and tangible health benefits consumers expect in the foods they buy, the more manufacturers are using malt extract to fortify their brands. This trend is more evident in regions like Asia-Pacific and Latin America, where the functional food market is driven by increasing disposable incomes and health awareness. Innovations in the areas of vegan-friendly, non-GMO, and gluten-free applications of malt extracts have expanded the scope of applicability. Thus, companies are investing in R&D efforts to customise malt-based solutions for certain health claims. This intersection of nutrition and innovation continues to propel the malt extract market in the global arena.

Malt Extract Market Restraints and Challenges:

A main constraint that restrains the malt extract market is the volatility in prices of raw materials, particularly with barley and other cereal grains utilised for malt production. Weather conditions, agricultural practices, and geopolitical tensions can lead to disturbances to the supply and pricing of these raw materials. Also, global supply chain disruptions such as transportation delays, export restrictions, and rising freight rates tend to create more complications in consistently procuring quality barley. These fluctuations affect not just the cost of production for manufacturers but also lead to ever-increasing pricing uncertainty for end users. Smaller producers in developing markets, with limited access to high-quality commodity sources, often struggle to achieve their profit margin. Furthermore, with price sensitivity, they may consider switching to cheaper, artificial alternatives if there exists a significant escalation in the price of products based on malt extract. This constraint could see a slowdown in market growth, especially in co-dependent nations that are agricultural import land-restricted.

Malt Extract Market Opportunities:

Over a global trend shifting towards plant-based lifestyles and alcohol-free consumption, the malt extract market is expected to have promising growth opportunities. Consumers are looking healthier and natter alternatives for the conventional sodas and alcoholic drinks; thus, it has found pretty extensive application into the realm of transforming nonalcoholic beverages into flavorful and functional drinks in which it constitutes the major ingredient in a lot of vegan drinks, malt-based smoothies, and fermented health beverages because malt extract enhances taste, color, and nutritional addition without using artificial additives. Apart from that, malt extract contains a lot of vitamins, minerals, and antioxidants, which fit well within the wellness trend in the beverage industry. Thus, malt extracts are expected to witness rapid growth, with leading beverage companies innovating malt-based drinks to meet expanding markets like Asia-Pacific and the Middle East. It is also majorly done for product diversification and premiumization by allowing the manufacture of specialised products that meet the exclusive taste and health needs of specific consumer segments.

MALT EXTRACT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.86% |

|

Segments Covered |

By Product Type, Source, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Muntons plc, Maltexco S.A., Döhler GmbH, Briess Malt & Ingredients Co., Malteurop Groupe, GrainCorp Limited, United Malt Group, Cargill, Incorporated, PureMalt Products Ltd., and Axéréal Group |

Malt Extract Market Segmentation:

Malt Extract Market Segmentation: By Product Type

- Dry Malt Extract

- Liquid Malt Extract

The Malt Extract Market is divided into Dry Malt Extract (DME) and Liquid Malt Extract (LME), each having its own merits and applications. Dry Malt Extract, generally in powder form, serves the bakery, confectionery, and nutraceutical sectors, given its ease of handling, longer shelf life, and convenience in transport; it dissolves very fast, hence, is the preferred choice for energy bars, dry mixes, and protein powders. Liquid Malt Extract, being more syrupy and viscous, finds application in breweries, dairy, and F&B due to its strong flavour and natural sweetness. LME retains more of its enzymes and aroma due to a lessened processing method; therefore, it is very suitable for craft beers and fermented drinks. The brewing industry continues to be the largest consumer of LME, while DME has been gradually increasing in its use in the health food sector. Manufacturers also provide customised blends of either or both forms, depending on specific industrial requirements. However, demand in favour of both shall increase steadily owing to their product versatility and natural nature, with the assumption that DME will grow at a faster rate, given its suitability for contemporary functional food formats. Research and Development on new drying technologies and formulation innovation will further increase the DME and LME functionality in some traditional as well as some emerging segments.

Malt Extract Market Segmentation: By Source

- Barley

- Wheat

- Rye

- Others

Malt extract is prepared with different cereal grains, but is predominantly made with barley for its high level of enzymes and optimal malting characteristics. Barley-based malt extract is very much used in brewing and food applications, giving rich flavour, good fermentability, and nutritional value. Wheat malt extract is entering the market quickly in baked goods and breakfast cereals, as its light colour and soft flavour allow it to collaborate fine in more refined recipes. Rye malt extract has a spicy signature of its own and has also been an increasingly essential ingredient in special bread and craft beer recipes, aiming to establish a unique, sensuous flavour. Other types include corn and sorghum, besides developing gluten-free malt extracts for gluten-free users. The diversification in source types reflects the growing consumer interest in personalised nutrition and ethnic flavours. Most importantly, non-barley sources have helped producers satisfy particular dietary trends like veganism, low-gluten, or heritage grain-based diets. Indeed, the closer fields are to improving agricultural practices and the need for alternative grains, the better balanced the market is expected to be in each of these sources, a trend critical for some parts of Asia and Africa, where grains other than barley predominate.

Malt Extract Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The regional account of the Malt Extract Market, slated for 2024, shows Europe to be the chief region, supported by the advanced brewing sectors, high demand for bakery goods, and growing interest in the acceptance of natural sweeteners. North America stands a close second, with rising consumption of functional foods and sports nutrition products, along with a feverish craft beer culture, adding to the consistent growth of the market. Asia-Pacific seems to sprout up really fast in the race owing to health consciousness, diversification of dietary patterns, and influence from western food trends in particular countries like India, China, and Japan. In South America, moderate growth is witnessed; this is attributed to fast-growing bakery sectors and the increasing demand for nutritional supplements. Meanwhile, the Middle East and Africa region has recently begun to show a considerable amount of activity, particularly in the non-alcoholic malt beverage sector, which accords with growing cultural acceptance and a rising incidence of urbanisation in such places.

COVID-19 Impact Analysis on the Malt Extract Market:

The malt extract market seems to have been impacted by the COVID-19 pandemic in different ways. On the one hand, the global supply chains were disrupted alongside temporary closures of breweries and food manufacturing units, leading to decreased demand and production delays, particularly during the earlier months of the pandemic. Liquid malt extract sales were particularly affected by the hospitality sector slowdown, including bars, restaurants, and craft breweries. However, the pandemic also had the unforeseen positive impact of increasing health consciousness and home baking trends, propelling demand for malt extract in nutritional supplements, functional food, and DIY baking categories. Now more than ever, consumers are looking for clean-label, immune-supporting ingredients that have shifted malt extract applications from the traditional beverage to wellness and home-use food segments. Producers have even refocused their attention on digital sales channels and product innovation as the market moves towards a post-pandemic world.

Latest Trends/ Developments:

The Malt Extract Market is changing almost constantly according to the needs of consumers and innovative technology. One of the most important trends is the consumer demand for clean-label and plant-based products, which compels manufacturers to formulate organic gluten-free malt extracts that should be non-GMO. There is also a growing interest in functional and speciality malts, fortified with probiotics, or geared towards specific diets such as gut health and sports nutrition. Sustainability is emerging as be of the most important developments as companies are adopting eco-friendly sourcing and recyclable packaging for environmentally conscious consumers. The other change affecting the market, of course, is adopting digital transformation into the production and supply chain system to enhance the efficiency brought about by AI and automation. Expansion of e-commerce and direct-to-consumer channels has further enabled brands to reach millions of customers across geographies that focus on health issues or niche products. This is the shift towards using malt extract more health-driven and innovatively, breaking from the traditional forms of use for food, beverage, and wellness applications.

Key Players:

- Muntons plc

- Maltexco S.A.

- Döhler GmbH

- Briess Malt & Ingredients Co.

- Malteurop Groupe

- GrainCorp Limited

- United Malt Group

- Cargill, Incorporated

- PureMalt Products Ltd.

- Axéréal Group

Chapter 1. Malt Extract Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. MALT EXTRACT MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. MALT EXTRACT MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. MALT EXTRACT MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. MALT EXTRACT MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MALT EXTRACT MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Dry Malt Extract

6.3 Liquid Malt Extract

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. MALT EXTRACT MARKET – By Source

7.1 Introduction/Key Findings

7.2 Barley

7.3 Wheat

7.4 Rye

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Source

7.7 Absolute $ Opportunity Analysis By Source, 2025-2030

Chapter 8. MALT EXTRACT MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Source

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Source

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By Source

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product Type

8.4.3. By Source

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By Source

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. MALT EXTRACT MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Muntons plc

9.2 Maltexco S.A.

9.3 Döhler GmbH

9.4 Briess Malt & Ingredients Co.

9.5 Malteurop Groupe

9.6 GrainCorp Limited

9.7 United Malt Group

9.8 Cargill, Incorporated

9.9 PureMalt Products Ltd.

9.10 Axéréal Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Malt Extract Market was valued at USD 23.61 billion in 2024 and is projected to reach a market size of USD 31.39 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.86%.

The Malt Extract Market is driven by rising consumer demand for natural, clean-label ingredients and the growing popularity of functional and nutritional foods. Additionally, the expansion of the craft brewing industry and increasing health awareness globally are fueling its growth.

Based on Service Provider, the Malt Extract Market is segmented into material manufacturers, Raw Material Suppliers, Lab information management systems, Distributors & Wholesalers, End-to-End Solution Providers.

Europe is the most dominant region for the Malt Extract Market.

Muntons plc, Maltexco S.A., Döhler GmbH, Briess Malt & Ingredients Co., Malteurop Groupe, GrainCorp Limited, United Malt Group, Cargill, Incorporated, PureMalt Products Ltd., and Axéréal Group are the key players in the Malt Extract Market