Magnet Coatings Market Size (2024 – 2030)

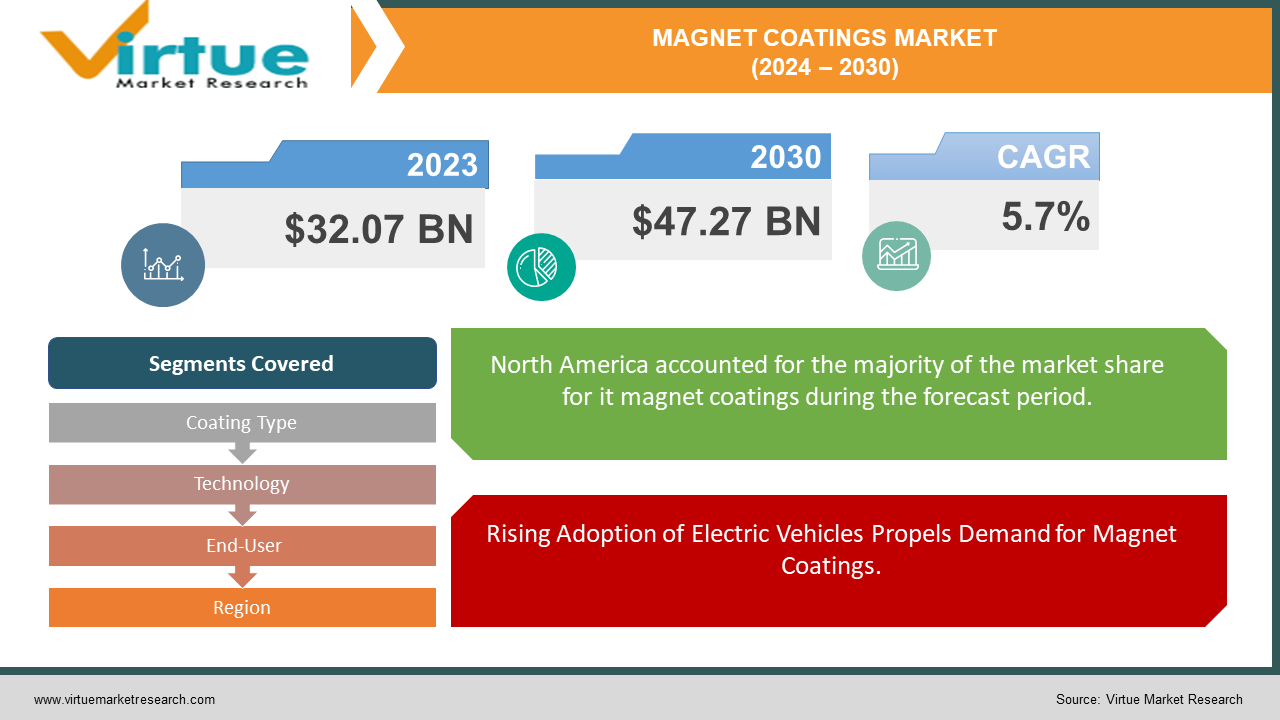

The global magnet coatings market is projected to grow from an estimated USD 32.07 billion in 2023 to USD 47.27 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 5.7% over the forecast period of 2024-2030.

The magnet coatings market is a vital segment within the broader coatings industry, encompassing various types of coatings designed to enhance the performance and longevity of magnets used across diverse applications. These coatings serve crucial functions such as corrosion resistance, insulation, and thermal management, catering to industries ranging from automotive and electronics to renewable energy and healthcare. The market is characterized by a constant drive for innovation, spurred by increasing demand for high-performance magnets in emerging technologies like electric vehicles, renewable energy systems, and advanced electronics. Technological advancements, stringent regulatory requirements, and shifting consumer preferences towards eco-friendly and sustainable coatings are key factors shaping the market landscape. Additionally, the market is influenced by regional variations in demand, supply chain dynamics, and evolving end-user requirements, underscoring the importance of localized strategies and collaborations across the value chain for sustained growth and competitiveness.

Key Insights:

With electric vehicle (EV) adoption rising, the automotive segment is expected to witness significant growth, accounting for over 40% of the magnet coatings market by 2030.

The renewable energy sector is forecasted to register a CAGR of 12% during the forecast period, driven by the expansion of wind and solar power installations, boosting demand for magnet coatings in generators and turbines.

Innovations in coating technologies, such as the development of eco-friendly and high-performance coatings, are anticipated to fuel market growth, with over 70% of manufacturers investing in R&D initiatives by 2025.

Compliance with stringent environmental regulations poses a challenge, with an estimated 20% increase in production costs expected by 2030.

Global Magnet Coatings Market Drivers:

Rising Adoption of Electric Vehicles Propels Demand for Magnet Coatings.

The increasing adoption of electric vehicles (EVs) worldwide is a significant driver for the global magnet coatings market. As the automotive industry shifts towards electrification to reduce emissions and enhance energy efficiency, there is a growing demand for high-performance magnets coated with specialized coatings to ensure optimal performance and longevity in EV drivetrains and components.

Expansion of Renewable Energy Sector Drives Magnet Coatings Market Growth.

The expansion of the renewable energy sector, particularly in wind and solar power generation, is driving the demand for magnet coatings. Coated magnets play a crucial role in generators and turbines, where they require protection against corrosion, insulation, and thermal management to ensure reliable and efficient operation. As governments worldwide prioritize clean energy initiatives, the demand for magnet coatings is expected to surge further.

Technological Advancements Fuel Innovation in Magnet Coatings.

Technological advancements in coating formulations and application techniques are fueling innovation in the magnet coatings market. Manufacturers are increasingly investing in research and development to develop advanced coatings that offer superior performance, durability, and environmental sustainability. From eco-friendly formulations to coatings tailored for specific applications such as aerospace and medical devices, technological advancements are driving the market forward and opening new opportunities for growth and differentiation.

Global Magnet Coatings Market Restraints and Challenges:

Regulatory Compliance and Environmental Concerns Pose Challenges for Magnet Coatings Market.

Stringent regulations regarding environmental protection and volatile organic compound (VOC) emissions present challenges for the magnet coatings market. Compliance with these regulations often requires significant investments in research, development, and manufacturing processes to ensure coatings meet regulatory standards without compromising performance or increasing production costs. Additionally, growing environmental concerns among consumers and stakeholders necessitate the adoption of sustainable practices and eco-friendly formulations, further adding complexity to the regulatory landscape and impacting market dynamics.

Fluctuating Raw Material Prices and Supply Chain Disruptions Impact Magnet Coatings Industry.

The magnet coatings industry faces challenges related to fluctuating raw material prices and supply chain disruptions. Volatility in commodity markets, geopolitical tensions, and unforeseen events such as natural disasters or pandemics can lead to sudden price fluctuations and supply shortages for key raw materials used in coating formulations. As a result, manufacturers must carefully manage their supply chains, diversify sourcing strategies, and implement risk mitigation measures to ensure continuity of operations and minimize the impact of price volatility on production costs and profitability.

Intense Competition and Technological Innovation Drive Market Fragmentation.

Intense competition and rapid technological innovation contribute to market fragmentation and pose challenges for players in the magnet coatings industry. With numerous manufacturers vying for market share, differentiation becomes crucial to stand out in a crowded marketplace. This drives continuous innovation in coating formulations, application techniques, and value-added services to meet evolving customer demands and stay ahead of competitors. However, maintaining a competitive edge requires substantial investments in research and development, infrastructure, and marketing efforts, which may strain resources and profitability for smaller players in the market.

Global Magnet Coatings Market Opportunities:

The surge in Demand for High-Performance Magnets Creates Opportunities for Magnet Coatings Market.

The increasing demand for high-performance magnets across various industries, including automotive, electronics, renewable energy, and healthcare, presents significant opportunities for the magnet coatings market. As technological advancements drive the development of advanced applications such as electric vehicles, wind turbines, and medical imaging devices, there is a growing need for magnet coatings that offer enhanced durability, corrosion resistance, and thermal stability to ensure optimal performance and longevity of magnets in these applications. Manufacturers can capitalize on this trend by developing specialized coatings tailored to meet the specific requirements of each industry and application, thereby expanding their market presence and driving revenue growth.

Shift towards Sustainable Coating Solutions Opens New Avenues for Market Expansion.

The increasing emphasis on sustainability and environmental responsibility is creating opportunities for the magnet coatings market to innovate and develop eco-friendly coating solutions. As governments worldwide implement stricter environmental regulations and consumers become more conscious of their carbon footprint, there is a growing demand for coatings that minimize environmental impact and adhere to sustainability standards. Manufacturers can leverage this trend by investing in research and development to develop bio-based, water-based, and solvent-free coating formulations that offer comparable or superior performance to traditional coatings while reducing VOC emissions, hazardous waste, and energy consumption. By offering sustainable coating solutions, manufacturers can differentiate themselves in the market, attract environmentally-conscious customers, and access new growth opportunities in emerging eco-friendly industries such as electric mobility, renewable energy, and green technology.

Technological Advancements Drive Innovation and Market Expansion in Magnet Coatings.

Technological advancements in coating materials, formulations, and application processes are driving innovation and market expansion in the magnet coatings industry. From nanotechnology and thin-film coatings to advanced surface treatments and multi-functional coatings, manufacturers are continuously developing new and improved coating solutions to meet the evolving needs of customers and industries. These advancements enable coatings to provide enhanced properties such as increased adhesion, durability, corrosion resistance, and thermal stability, making them suitable for a wider range of applications and environments. Manufacturers can capitalize on this trend by investing in research and development, collaborating with technology partners, and adopting cutting-edge manufacturing processes to develop innovative coating solutions that offer superior performance, durability, and value to customers. By staying at the forefront of technological innovation, manufacturers can differentiate themselves in the market, attract new customers, and drive revenue growth.

MAGNET COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.7% |

|

Segments Covered |

By Coating Type, Technology, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ESG Coating GmbH, Bekaert, Anocote, Master Magnetics, Inc., Magnet Applications, Inc., Sumitomo Bakelite Co., Ltd., Ningbo Vastsky Magnet Co., Ltd., Magnequench International Inc., Arnold Magnetic Technologies,Shin-Etsu Chemical Co., Ltd., Hitachi Metals, Ltd., Electron Energy Corporation |

Magnet Coatings Market Segmentation: By Coating Type

-

Epoxy

-

Nickel

-

Zinc

-

Polymer

-

Others

Among the various coating types in the global magnet coatings market, epoxy coatings emerge as one of the most effective options due to their versatile properties and wide-ranging applications. Epoxy coatings offer exceptional adhesion to metal surfaces, including magnets, providing a durable and protective layer that enhances corrosion resistance and mechanical strength. Moreover, epoxy coatings exhibit excellent chemical resistance and thermal stability, making them suitable for demanding environments such as automotive, aerospace, and industrial applications. Their ability to be formulated with additives for specific functionalities, such as abrasion resistance or UV protection, further enhances their effectiveness across diverse industries. Additionally, epoxy coatings can be easily applied using various techniques, including spraying, dipping, and electrocoating, offering flexibility and efficiency in manufacturing processes. Overall, the versatility, durability, and performance of epoxy coatings make them a preferred choice for protecting magnets in critical applications, driving their effectiveness and widespread adoption in the global magnet coatings market.

Magnet Coatings Market Segmentation: By Technology

-

Electroplating

-

Sputtering

-

Physical vapor deposition (PVD)

-

Chemical vapor deposition (CVD)

-

Spray coating

Among the technologies utilized in the global magnet coatings market, physical vapor deposition (PVD) stands out as one of the most effective methods due to its versatility, precision, and efficiency. PVD involves the deposition of thin layers of coating material onto magnet surfaces through a vacuum environment, utilizing techniques such as evaporation and sputtering. This technology offers several advantages, including precise control over coating thickness, uniformity, and composition, resulting in coatings with high purity and excellent adhesion properties. Additionally, PVD coatings exhibit superior wear resistance, corrosion protection, and thermal stability, making them ideal for demanding applications in industries such as automotive, electronics, and aerospace. Furthermore, PVD processes are environmentally friendly, producing minimal waste and emissions compared to traditional coating methods. The ability to coat complex shapes and components with thin, uniform layers makes PVD technology highly effective for enhancing the performance and longevity of magnets in various applications, driving its widespread adoption and prominence in the global magnet coatings market.

Magnet Coatings Market Segmentation: By End-User

-

Automotive

-

Electronics

-

Energy generation

-

Medical devices

-

Consumer goods

Among the diverse end-user segments in the global magnet coatings market, the automotive industry emerges as one of the most impactful and effective segments. Automotive applications drive significant demand for magnet coatings due to the widespread use of magnets in various components, including electric motors, sensors, actuators, and speakers. Coated magnets are essential for ensuring the performance, efficiency, and reliability of these components, particularly in electric vehicles (EVs) where magnets play a critical role in propulsion systems. In addition to EVs, conventional vehicles also utilize magnets coated with specialized coatings for applications such as power steering, braking systems, and transmission systems. The automotive industry's rigorous performance requirements and stringent quality standards necessitate high-performance coatings that offer exceptional durability, corrosion resistance, and thermal stability. As the automotive industry continues to innovate and transition towards electrification and autonomous driving technologies, the demand for magnet coatings is expected to escalate further, driven by the need for advanced materials that can withstand higher temperatures, vibrations, and environmental conditions. Therefore, the automotive segment represents a lucrative and strategically important market for magnet coatings, offering substantial opportunities for manufacturers to innovate, differentiate, and capture market share in this dynamic industry.

Magnet Coatings Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The market share by region in the global vehicle coatings market reflects a diverse landscape with distinct regional dynamics. North America commands the largest share, accounting for 42% of the market, driven by a robust automotive industry and a strong focus on technological innovation and quality standards. Europe follows closely behind with a 27% share, characterized by stringent regulatory requirements and a growing emphasis on sustainability and eco-friendly coatings. The Asia-Pacific region emerges as a significant contender, capturing 20% of the market share, fueled by rapid industrialization, urbanization, and the expanding automotive sector in countries like China, Japan, and India. South America the Middle East and Africa regions contribute 6% and 5% respectively, reflecting evolving automotive landscapes and growing consumer preferences for quality coatings. These regional distributions underscore the importance of localized strategies and tailored approaches to meet the diverse needs and preferences of customers across different markets.

COVID-19 Impact Analysis on the Global Magnet Coatings Market:

The COVID-19 pandemic has had a multifaceted impact on the global magnet coatings market, reshaping demand patterns and supply chains across the industry. The widespread lockdown measures and economic disruptions implemented to contain the virus led to a temporary downturn in market activity, as manufacturing operations were halted, and consumer spending declined. This resulted in supply chain disruptions, raw material shortages, and logistical challenges, impacting the production and distribution of magnet coatings. Additionally, uncertainties surrounding the global economy and fluctuations in end-user industries, such as automotive and electronics, further exacerbated market volatility. However, as economies gradually reopen and vaccination efforts progress, the market is showing signs of recovery, driven by pent-up demand, government stimulus packages, and accelerated digitalization trends. Furthermore, the pandemic has underscored the importance of resilience and agility in supply chain management, prompting companies to reassess their sourcing strategies, inventory management practices, and digitalization efforts to navigate future disruptions effectively. Overall, while the COVID-19 crisis posed challenges for the global magnet coatings market, it has also catalyzed opportunities for innovation, collaboration, and adaptation to emerge stronger in the post-pandemic landscape.

Latest Trends/ Developments:

In the dynamic landscape of the global magnet coatings market, several emerging trends and developments are reshaping industry dynamics and driving innovation. One notable trend is the increasing demand for eco-friendly and sustainable coating solutions, spurred by growing environmental awareness and stringent regulatory requirements. Manufacturers are investing in research and development to develop bio-based, water-based, and solvent-free coatings that offer comparable or superior performance to traditional formulations while minimizing environmental impact. Additionally, advancements in coating technologies, such as nanocoatings and self-healing coatings, are gaining traction for their ability to enhance durability, scratch resistance, and the overall performance of magnets in diverse applications. Furthermore, the rise of electric vehicles, renewable energy systems, and advanced electronics is fueling demand for high-performance magnet coatings tailored to meet the specific requirements of these emerging technologies. Moreover, digitalization and Industry 4.0 initiatives are driving the adoption of smart coatings equipped with functionalities like self-cleaning surfaces and sensor-based coatings for enhanced performance and functionality. As the industry continues to evolve, collaboration between manufacturers, research institutions, and regulatory bodies will be crucial in driving innovation and addressing emerging market needs effectively.

Key Players:

-

ESG Coating GmbH

-

Bekaert

-

Anocote

-

Master Magnetics, Inc.

-

Magnet Applications, Inc.

-

Sumitomo Bakelite Co., Ltd.

-

Ningbo Vastsky Magnet Co., Ltd.

-

Magnequench International Inc.

-

Arnold Magnetic Technologies

-

Shin-Etsu Chemical Co., Ltd.

-

Hitachi Metals, Ltd.

-

Electron Energy Corporation

Chapter 1. Magnet Coatings Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Magnet Coatings Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Magnet Coatings Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Magnet Coatings MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Magnet Coatings Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Magnet Coatings Market– By Coating Type

6.1 Introduction/Key Findings

6.2 Epoxy

6.3 Nickel

6.4 Zinc

6.5 Polymer

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Coating Type

6.8 Absolute $ Opportunity Analysis By Coating Type, 2024-2030

Chapter 7. Magnet Coatings Market– By Technology

7.1 Introduction/Key Findings

7.2 Electroplating

7.3 Sputtering

7.4 Physical vapor deposition (PVD)

7.5 Chemical vapor deposition (CVD)

7.6 Spray coating

7.7 Y-O-Y Growth trend Analysis By Technology

7.8 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Magnet Coatings Market– By End-User

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Electronics

8.4 Energy generation

8.5 Medical devices

8.6 Consumer goods

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Magnet Coatings Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Coating Type

9.1.3 By Technology

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Coating Type

9.2.3 By Technology

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Coating Type

9.3.3 By Technology

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Coating Type

9.4.3 By Technology

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Coating Type

9.5.3 By Technology

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Magnet Coatings Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ESG Coating GmbH

10.2 Bekaert

10.3 Anocote

10.4 Master Magnetics, Inc.

10.5 Magnet Applications, Inc.

10.6 Sumitomo Bakelite Co., Ltd.

10.7 Ningbo Vastsky Magnet Co., Ltd.

10.8 Magnequench International Inc.

10.9 Arnold Magnetic Technologies

10.10 Shin-Etsu Chemical Co., Ltd.

10.11 Hitachi Metals, Ltd.

10.12 Electron Energy Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global magnet coatings market is projected to grow from an estimated USD 32.07 billion in 2023 to USD 47.27 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 5.7% over the forecast period of 2024-2030.

The primary drivers of the global magnet coatings market include the increasing adoption of electric vehicles, expansion of renewable energy infrastructure, and advancements in electronics and medical devices requiring coated magnets.

The key challenges facing the global magnet coatings market include stringent environmental regulations, supply chain disruptions, and fluctuating raw material prices.

In 2023, North America held the largest share of the global magnet coatings market.

ESG Coating GmbH, Bekaert, Anocote, Master Magnetics, Inc., Magnet Applications, Inc., Sumitomo Bakelite Co., Ltd., Ningbo Vastsky Magnet Co., Ltd., Magnequench International Inc., Arnold Magnetic Technologies, Shin-Etsu Chemical Co., Ltd., Hitachi Metals, Ltd., Electron Energy Corporation are the main players.