Magnesium Oxide Cement Board Market Size (2024 – 2030)

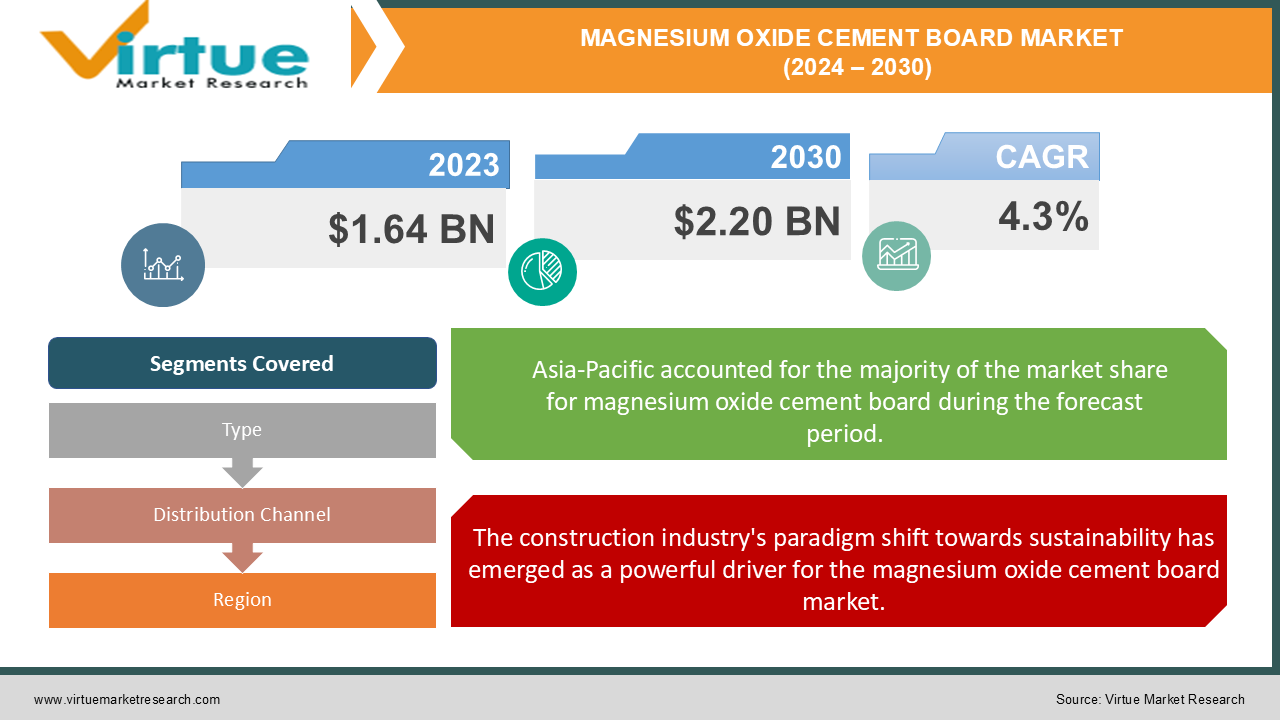

The Global Magnesium Oxide Cement Board Market was valued at USD 1.64 Billion in 2023 and is projected to reach a market size of USD 2.20 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.3%.

Magnesium oxide cement boards, often referred to as MgO boards, have emerged as a revolutionary building material in the construction industry. These versatile panels combine the strength of cement with the lightweight properties of magnesium oxide, offering a durable and fire-resistant alternative to traditional building materials. As the global construction sector continues to evolve, seeking more sustainable and efficient solutions, MgO boards have garnered significant attention from architects, contractors, and homeowners alike. The magnesium oxide cement board market has witnessed substantial growth in recent years, driven by increasing awareness of its superior properties compared to conventional options like gypsum and fiber cement boards. These boards boast impressive characteristics, including resistance to mold, mildew, and insects, making them ideal for both interior and exterior applications. Their ability to withstand extreme weather conditions and provide excellent thermal insulation has positioned MgO boards as a go-to choice for environmentally conscious building projects. One of the key factors propelling the market forward is the rising demand for green building materials. As sustainability becomes a central focus in construction, MgO boards offer an eco-friendly solution with their low carbon footprint and recyclable nature. Additionally, the rapid urbanization and infrastructure development in emerging economies have created a surge in demand for high-performance building materials, further boosting the market's expansion.

Key Market Insights:

-

The market size for MgO boards in the commercial sector was valued at $1.8 billion in 2023. The construction industry utilized 85% of the total MgO board production in 2023.

-

73% of architects surveyed in 2023 expressed interest in using MgO boards for future projects.

-

Fire-resistant grades of MgO boards saw a 28% increase in demand in 2023.

-

Export volume of MgO boards increased by 17% in 2023 compared to the previous year.

-

Green building certifications involving MgO boards increased by 22% in 2023. The average lifespan of a MgO board installed in 2023 is estimated at 50 years. 89% of contractors reported satisfaction with MgO board performance in 2023.

-

42% of MgO boards sold in 2023 were used for interior wall applications.

-

The average lead time for MgO board orders decreased to 14 days in 2023.

Magnesium Oxide Cement Board Market Drivers:

The construction industry's paradigm shift towards sustainability has emerged as a powerful driver for the magnesium oxide cement board market.

As global awareness of environmental issues continues to grow, there is an increasing demand for building materials that can minimize the ecological footprint of construction projects. MgO boards have positioned themselves as a frontrunner in this green revolution, offering a compelling alternative to traditional materials that often come with significant environmental costs. One of the key factors contributing to the sustainability of MgO boards is their production process. Unlike conventional cement-based products, the manufacturing of magnesium oxide cement boards requires lower temperatures, resulting in reduced energy consumption and lower carbon emissions. This energy-efficient production aligns perfectly with the industry's push towards more environmentally friendly practices and helps construction companies meet increasingly stringent regulations on carbon footprints.

The second major driver propelling the magnesium oxide cement board market forward is the global trend of rapid urbanization coupled with extensive infrastructure development.

The speed of construction is a critical factor in urban development, and MgO boards offer significant advantages in this regard. Their lightweight nature makes them easier to transport and handle on construction sites, reducing labor costs and installation time. Moreover, the boards can be easily cut and shaped to fit various design requirements, allowing for greater flexibility in architectural designs. This adaptability is particularly valuable in urban settings where space constraints often necessitate creative building solutions. Infrastructure development goes hand in hand with urbanization, and here too, MgO boards are making their mark. The construction of bridges, tunnels, airports, and mass transit systems requires materials that can withstand harsh environmental conditions while providing structural integrity.

Magnesium Oxide Cement Board Market Restraints and Challenges:

One of the primary challenges facing the MgO board market is the variability in product quality across manufacturers. As the demand for these boards has increased, numerous producers have entered the market, some with limited experience or inadequate quality control measures. This has led to inconsistencies in board performance, with some products failing to meet the high standards expected by the construction industry. Issues such as warping, cracking, or premature deterioration have been reported in some cases, damaging the overall reputation of MgO boards and creating skepticism among potential users. The lack of standardized testing and certification processes specific to MgO boards compounds this quality issue. Unlike traditional building materials that have well-established industry standards, the relatively new MgO board market is still in the process of developing comprehensive, universally accepted quality benchmarks. This absence of standardization makes it difficult for buyers to compare products from different manufacturers and assess their suitability for specific applications, potentially slowing adoption rates. Another significant restraint is the higher initial cost of MgO boards compared to some conventional alternatives like gypsum boards. While the long-term benefits of MgO boards often justify the investment, the upfront expense can be a deterrent, especially in price-sensitive markets or for budget-constrained projects. This cost factor becomes particularly challenging in regions where the awareness of MgO boards' superior properties is still limited, making it harder to justify the price premium to stakeholders.

Magnesium Oxide Cement Board Market Opportunities:

The increasing focus on energy-efficient buildings presents another substantial opportunity. As governments worldwide implement stricter energy codes and offer incentives for green construction, MgO boards can play a crucial role in improving building envelope performance. There's potential to develop MgO boards with enhanced insulation properties or to create composite panels that combine MgO boards with high-performance insulation materials. This could position MgO boards as a key component in passive house designs and net-zero energy buildings, tapping into a rapidly growing market segment. Prefabrication and modular construction represent a burgeoning opportunity for the MgO board market. As the construction industry moves towards off-site manufacturing to improve efficiency and reduce on-site labor, MgO boards are well-suited for integration into prefabricated wall panels, floor systems, and modular units. Their lightweight nature, dimensional stability, and ease of customization make them ideal for these applications. Manufacturers who can develop specialized MgO board products tailored for the prefab industry and forge partnerships with modular construction companies could see significant growth.

MAGNESIUM OXIDE CEMENT BOARD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.3% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Magnum Building Products, Huizhou Meisen Board, Magnesia Specialties, Shandong Oulade, Evernice Building, Yulong Group, BNBM Group, Bin Zhou Maget, Supa board, Trusus Building Materials, Pengfei Fireproof New Materials, Yunion Industry, Changzhou Yongjia Decorative Material, Zhejiang Xinlong Decorative Material, Mago BP |

Magnesium Oxide Cement Board Market Segmentation: By Types

-

Thin MgO Boards (< 6mm)

-

Medium MgO Boards (6-10mm)

-

Thick MgO Boards (> 10mm)

-

Sandwich Panel MgO Boards

-

Reinforced MgO Boards

-

Decorative MgO Boards

-

Fire-Rated MgO Boards

The fire-rated MgO board segment is experiencing the fastest growth in the market. This surge is primarily driven by increasingly stringent fire safety regulations in construction, particularly in commercial and high-rise buildings. Fire-rated MgO boards offer superior fire resistance compared to traditional materials, with some variants capable of withstanding temperatures up to 1200°C for extended periods.

Medium MgO boards, typically ranging from 6 to 10mm in thickness, currently dominate the market. This dominance can be attributed to their versatility and balanced performance characteristics. These boards offer an optimal combination of strength, weight, and cost-effectiveness, making them suitable for a wide range of applications in both interior and exterior construction. Medium MgO boards are commonly used for wall sheathing, ceiling panels, and underlayment in residential and commercial buildings.

Magnesium Oxide Cement Board Market Segmentation: By Distribution Channel

-

Direct Sales

-

Wholesalers and Distributors

-

Retail Stores

-

Online Retailers

-

Specialty Building Material Suppliers

-

Contractor Supply Stores

-

Home Improvement Centers

The online retail channel is experiencing the fastest growth in the MgO board market. This trend is driven by the increasing digitalization of the construction industry and the growing comfort of contractors and DIY enthusiasts in purchasing building materials online. Online platforms offer the advantage of wide product selection, easy comparison of specifications and prices, and convenient delivery options.

Wholesalers and distributors remain the dominant distribution channel for MgO boards. This channel's strength lies in its established relationships with contractors, builders, and construction companies. Wholesalers and distributors offer advantages such as bulk purchasing options, technical support, and local inventory availability, which are crucial for large-scale construction projects.

Magnesium Oxide Cement Board Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Asia-Pacific region dominates the global magnesium oxide cement board market. This dominance is primarily driven by the rapid urbanization and infrastructure development in countries like China, India, and Southeast Asian nations. The region's construction boom, coupled with increasing awareness of sustainable building practices, has led to the widespread adoption of MgO boards.

While currently holding the smallest market share, the Middle East and Africa region is emerging as the fastest-growing market for magnesium oxide cement boards. This rapid growth is driven by several factors unique to the region. In the Middle East, particularly in the Gulf Cooperation Council (GCC) countries, there is a growing emphasis on diversifying economies away from oil dependency.

COVID-19 Impact Analysis on the Magnesium Oxide Cement Board Market:

Initially, the pandemic led to significant disruptions in the global supply chain for MgO boards. Many manufacturing facilities, particularly in China, which is a major producer of these boards, faced temporary shutdowns or reduced capacity due to lockdown measures. This led to shortages and delays in product availability, affecting construction projects worldwide. The disruption in raw material supply, especially magnesium oxide, further exacerbated production challenges. The construction industry, a primary consumer of MgO boards, experienced a sharp downturn in the early stages of the pandemic. Many projects were halted or postponed due to lockdowns, social distancing requirements, and economic uncertainty. This sudden decrease in demand had a ripple effect on the MgO board market, leading to reduced sales and revenue for manufacturers and distributors. However, as the pandemic progressed, the market began to show signs of resilience and adaptation. The emphasis on health and hygiene in buildings created new opportunities for MgO boards. Their natural resistance to mold, mildew, and bacteria positioned them as a preferred material for healthcare facilities, laboratories, and other hygiene-sensitive environments. This shift in focus towards health-conscious construction helped offset some of the losses in traditional market segments.

Latest Trends/ Developments:

One of the most significant trends is the increasing integration of nanotechnology in MgO board production. Manufacturers are experimenting with nanoparticle additives to enhance the boards' performance characteristics. These nano-enhanced MgO boards exhibit improved strength, better fire resistance, and enhanced durability. Some cutting-edge developments include self-cleaning surfaces that use photocatalytic nanoparticles to break down pollutants and maintain a clean appearance over time. Another emerging trend is the development of lightweight MgO boards without compromising structural integrity. By incorporating advanced foaming agents and lightweight aggregates, manufacturers are producing boards that are significantly lighter than traditional options. This innovation is particularly valuable in high-rise construction and retrofitting projects where weight considerations are critical. These lightweight boards also offer advantages in transportation and installation, potentially reducing overall project costs and carbon footprints. The push towards circular economy principles is driving innovations in recyclable and biodegradable MgO boards. Some manufacturers are now producing boards that can be easily recycled at the end of their lifecycle, with some even developing closed-loop systems where old boards are reclaimed and used in the production of new ones.

Key Players:

-

Magnum Building Products

-

Huizhou Meisen Board

-

Magnesia Specialties

-

Shandong Oulade

-

Evernice Building

-

Yulong Group

-

BNBM Group

-

Bin Zhou Maget

-

Supa board

-

Trusus Building Materials

-

Pengfei Fireproof New Materials

-

Yunion Industry

-

Changzhou Yongjia Decorative Material

-

Zhejiang Xinlong Decorative Material

-

Mago BP

Chapter 1. Magnesium Oxide Cement Board Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Magnesium Oxide Cement Board Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Magnesium Oxide Cement Board Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Magnesium Oxide Cement Board Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Magnesium Oxide Cement Board Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Magnesium Oxide Cement Board Market – By Types

6.1 Introduction/Key Findings

6.2 Thin MgO Boards (< 6mm)

6.3 Medium MgO Boards (6-10mm)

6.4 Thick MgO Boards (> 10mm)

6.5 Sandwich Panel MgO Boards

6.6 Reinforced MgO Boards

6.7 Decorative MgO Boards

6.8 Fire-Rated MgO Boards

6.9 Y-O-Y Growth trend Analysis By Types

6.10 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Magnesium Oxide Cement Board Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Wholesalers and Distributors

7.4 Retail Stores

7.5 Online Retailers

7.6 Specialty Building Material Suppliers

7.7 Contractor Supply Stores

7.8 Home Improvement Centers

7.9 Y-O-Y Growth trend Analysis By Distribution Channel

7.10 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Magnesium Oxide Cement Board Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Magnesium Oxide Cement Board Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Magnum Building Products

9.2 Huizhou Meisen Board

9.3 Magnesia Specialties

9.4 Shandong Oulade

9.5 Evernice Building

9.6 Yulong Group

9.7 BNBM Group

9.8 Bin Zhou Maget

9.9 Supa board

9.10 Trusus Building Materials

9.11 Pengfei Fireproof New Materials

9.12 Yunion Industry

9.13 Changzhou Yongjia Decorative Material

9.14 Zhejiang Xinlong Decorative Material

9.15 Mago BP

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Increasing awareness of superior properties compared to conventional options like gypsum and fiber cement boards, the rising demand for green building materials, and the rapid urbanization and infrastructure development in emerging economies are the main drivers of the market.

Current thermoelectric materials and device designs may not provide sufficient power output for certain applications, limiting their usefulness.

Magnum Building Products and Huizhou Meisen Board are recognized for their extensive product lines and strong presence in multiple regions. Magnesia Specialties and Shandong Oulade are known for their expertise in raw material sourcing and processing, giving them a competitive edge in producing high-quality MgO boards. Evernice Building and Yulong Group have made significant strides in developing eco-friendly MgO board variants, catering to the growing demand for sustainable construction materials.

Asia Pacific is the most dominant region in the market.

Middle East and Africa is the fastest-growing region in the market.