Machine Vision System Market Size (2024 – 2030)

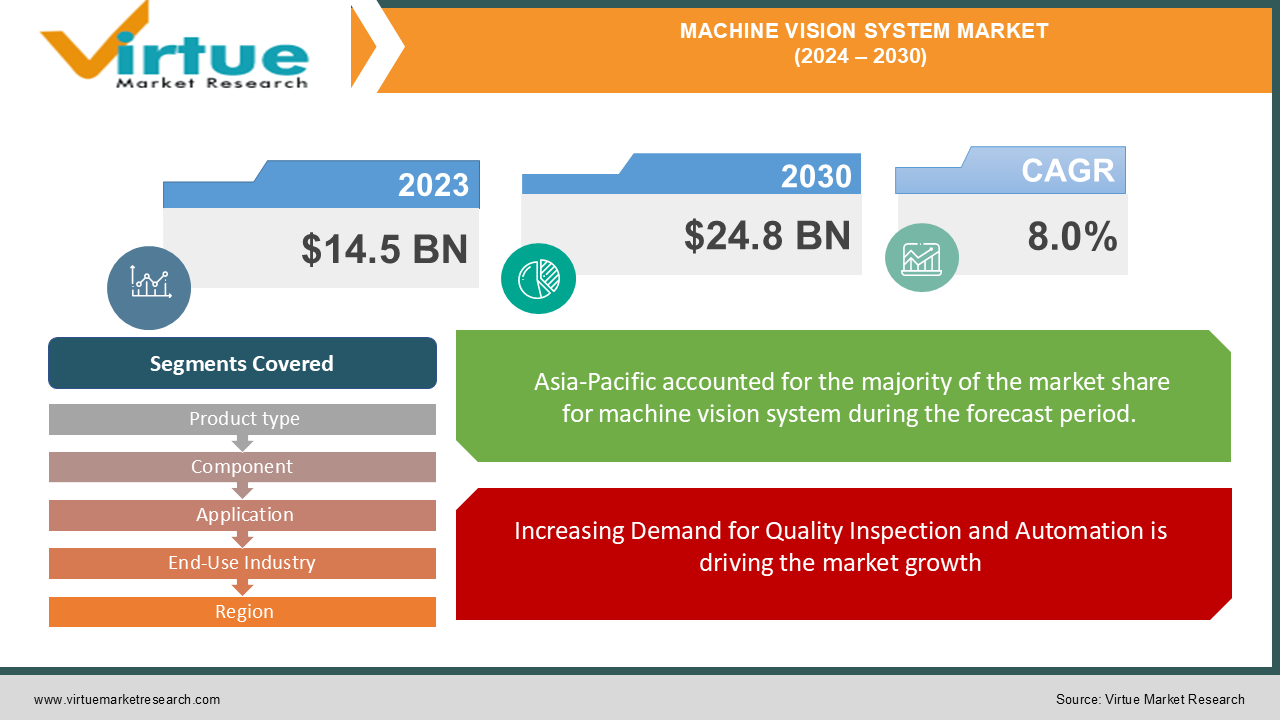

As of 2023, the Machine Vision System Market is valued at approximately USD 14.5 billion, with projections indicating a robust growth trajectory, reaching USD 24.8 billion by 2030, at a compound annual growth rate (CAGR) of 8.0% during the forecast period.

The market's growth is fueled by the rapid adoption of Industry 4.0 and the increasing emphasis on automation to enhance productivity and reduce errors in production lines. Key players in the market are focusing on developing advanced machine vision solutions that leverage AI, deep learning, and edge computing to provide real-time data processing and improved accuracy in quality control. Additionally, the growing demand for automated inspection and the need for efficient handling of complex processes in industries such as automotive, electronics, and pharmaceuticals are expected to further drive market growth.

Key Market Insights

Hardware components, including cameras, processors, and sensors, dominate the market, accounting for over 60% of the global market revenue, driven by the need for high-performance imaging and data processing capabilities in machine vision systems.

Quality assurance & inspection applications hold a significant share, representing over 40% of the market revenue, as machine vision systems are increasingly used to ensure product quality and reduce defects in manufacturing processes.

Asia-Pacific leads the market, contributing to 42% of global revenue, due to rapid industrialization, strong manufacturing capabilities, and the increasing adoption of automation technologies in countries like China, Japan, and South Korea.

The adoption of smart camera-based machine vision systems is expected to grow significantly, with projected adoption rates increasing by 20% by 2028, driven by their compact design, ease of integration, and ability to perform complex inspection tasks.

Global Machine Vision System Market Drivers

Increasing Demand for Quality Inspection and Automation is driving the market growth The rising demand for automated quality inspection and control processes in manufacturing is a primary driver of the Machine Vision System Market. Machine vision systems offer numerous benefits, including high-speed inspection, precise measurement, and the ability to detect defects that are invisible to the human eye. These advantages make machine vision systems ideal for industries that require stringent quality standards, such as automotive, electronics, and pharmaceuticals. The growing focus on enhancing product quality, reducing waste, and improving overall operational efficiency is driving the adoption of machine vision systems across various sectors.

Technological Advancements in Machine Vision Systems is driving the market growth Technological advancements, such as the integration of AI, deep learning, and edge computing, are significantly driving the growth of the Machine Vision System Market. These technologies enable machine vision systems to process large volumes of data quickly, make real-time decisions, and improve the accuracy of inspections. AI-powered machine vision systems can learn from historical data and adapt to new inspection tasks, enhancing their versatility and performance. Additionally, advancements in camera technology, such as the development of high-resolution and 3D cameras, are expanding the capabilities of machine vision systems, allowing them to handle more complex applications with greater precision.

Growth of the Electronics & Semiconductor Industry is driving the market growth The rapid growth of the electronics and semiconductor industry is a significant driver of the Machine Vision System Market. As the demand for consumer electronics, such as smartphones, tablets, and wearable devices, continues to rise, manufacturers are increasingly adopting machine vision systems to ensure the quality and precision of electronic components. Machine vision systems are widely used in the electronics industry for tasks such as wafer inspection, component alignment, and solder joint inspection. The need for high-speed, accurate, and reliable inspection solutions in the electronics industry is driving the adoption of machine vision systems, contributing to the overall growth of the market.

Global Machine Vision System Market Challenges and Restraints

High Initial Costs and Integration Complexity is restricting the market growth Despite the numerous benefits of machine vision systems, the high initial costs associated with their adoption and the complexity of integrating them into existing production lines are significant restraints on the market. The cost of purchasing, installing, and configuring machine vision systems can be prohibitive for small and medium-sized enterprises (SMEs), limiting their ability to invest in automation. Additionally, the integration of machine vision systems with other equipment, such as robotic arms and conveyor systems, requires expertise and can lead to increased implementation time and costs. Ensuring seamless integration and minimizing downtime during the transition to automated inspection processes are critical concerns for manufacturers, and addressing these challenges is essential for the widespread adoption of machine vision systems.

Shortage of Skilled Personnel is restricting the market growth The shortage of skilled personnel with expertise in machine vision technologies is another challenge facing the market. The successful implementation and operation of machine vision systems require specialized knowledge in areas such as image processing, AI algorithms, and system integration. The lack of skilled technicians and engineers who can design, program, and maintain these systems can hinder their adoption, particularly in regions with limited access to technical training and education. Addressing the skills gap and providing adequate training and support to end-users is crucial for the sustained growth of the machine vision system market.

Market Opportunities

The Machine Vision System Market presents several opportunities for growth and innovation. The increasing focus on smart manufacturing and the adoption of Industry 4.0 principles are driving interest in advanced machine vision systems that can enhance productivity and quality. Manufacturers that invest in developing AI-driven, smart vision solutions that offer real-time data analysis and decision-making capabilities are well-positioned to capitalize on the growing demand for intelligent automation. Additionally, the expansion of machine vision applications into new industries, such as healthcare, agriculture, and food & beverage, presents significant growth opportunities. The use of machine vision for tasks such as medical imaging, crop monitoring, and food inspection is creating new avenues for market expansion. Companies that embrace these trends and invest in technology-driven solutions are likely to experience substantial growth in the machine vision system market.

MACHINE VISION SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.0% |

|

Segments Covered |

By Product type, Component, Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cognex Corporation, Basler AG, Keyence Corporation, Omron Corporation, National Instruments Corporation, Teledyne Technologies Incorporated, Sony Corporation, Allied Vision Technologies GmbH, ISRA Vision AG, Intel Corporation |

Machine Vision System Market Segmentation - By Component

-

Hardware

-

Software

Hardware components, including cameras, processors, and sensors, have emerged as the most dominant segment in the machine vision system market, capturing over 60% of the global revenue. This dominance is primarily due to the critical role these components play in the performance and accuracy of machine vision systems. High-resolution cameras, advanced image sensors, and powerful processors are essential for capturing and analyzing images quickly and accurately. The ongoing advancements in hardware technology, such as the development of 3D cameras and hyperspectral imaging sensors, are further enhancing the capabilities of machine vision systems. As the demand for high-performance imaging and data processing continues to grow, the hardware segment is expected to maintain its leading position in the market.

Machine Vision System Market Segmentation - By Product Type

-

Smart Camera-based

-

PC-based

Smart camera-based machine vision systems are increasingly gaining traction in the market, driven by their compact design, ease of integration, and ability to perform complex inspection tasks. These systems integrate imaging, processing, and communication functions into a single device, making them ideal for applications that require flexibility and mobility. Smart camera-based systems are widely used in industries such as electronics, automotive, and food & beverage for tasks such as object recognition, barcode reading, and defect detection. The growing demand for cost-effective and easy-to-deploy vision solutions is driving the adoption of smart camera-based systems, making this segment a key contributor to the overall growth of the machine vision system market.

Machine Vision System Market Segmentation - By Application

-

Quality Assurance & Inspection

-

Positioning & Guidance

-

Measurement

-

Identification

Quality assurance & inspection applications play a crucial role in the machine vision system market, accounting for over 40% of the total revenue. Machine vision systems are extensively used to ensure product quality and consistency by detecting defects, verifying dimensions, and checking for completeness. These systems are particularly valuable in industries such as automotive, electronics, and pharmaceuticals, where high levels of precision and accuracy are required. The ability of machine vision systems to perform inspections at high speeds and with minimal human intervention is driving their adoption in quality assurance applications, making this segment a key driver of market growth.

Machine Vision System Market Segmentation - By End-Use Industry

-

Automotive

-

Electronics & Semiconductor

-

Food & Beverages

-

Pharmaceuticals

-

Others

The automotive industry is the most dominant end-use industry in the machine vision system market, contributing significantly to the overall revenue. The industry's reliance on automation and the need for high precision in manufacturing processes make it a key driver of demand for machine vision systems. Machine vision is widely used in the automotive industry for applications such as assembly verification, surface inspection, and robotic guidance. The ongoing shift towards electric vehicles (EVs) and autonomous driving technologies is also driving the adoption of machine vision systems in the automotive sector. As the automotive industry continues to evolve and expand, the demand for advanced machine vision solutions is expected to grow in tandem.

Machine Vision System Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

Asia-Pacific leads the Machine Vision System Market, contributing to 42% of global revenue. The region's leadership is driven by rapid industrialization, strong manufacturing capabilities, and the increasing adoption of automation technologies in countries like China, Japan, and South Korea. The presence of major electronics and automotive manufacturers, coupled with favorable government policies supporting Industry 4.0 and smart manufacturing, is fueling the demand for machine vision systems in Asia-Pacific. Additionally, the region's large labor market and growing emphasis on reducing operational costs are driving the adoption of automation and machine vision solutions. As Asia-Pacific continues to be a hub for manufacturing and technological innovation, the machine vision system market in the region is expected to witness substantial growth.

COVID-19 Impact Analysis on Machine Vision System Market

The COVID-19 pandemic has had a profound impact on the Machine Vision System Market. The pandemic accelerated the adoption of automation and machine vision technologies as companies sought to minimize human contact and ensure the safety of their workforce. The surge in demand for essential goods, particularly in the food & beverage, pharmaceuticals, and electronics industries, highlighted the need for efficient and reliable quality inspection solutions. As a result, investments in machine vision systems increased, with companies focusing on enhancing their automation capabilities to meet the growing demand. The COVID-19 pandemic also underscored the importance of resilience and flexibility in manufacturing and supply chains, further driving the adoption of machine vision systems. While the pandemic posed challenges, such as supply chain disruptions and economic uncertainties, it ultimately reinforced the critical role of automation in ensuring operational continuity and efficiency.

Latest Trends/Developments

Several trends and developments are shaping the Machine Vision System Market. One notable trend is the increasing adoption of 3D machine vision systems, which provide enhanced accuracy and depth perception compared to traditional 2D systems. 3D vision is particularly valuable in applications such as robotic guidance, bin picking, and surface inspection, where precise measurements and spatial analysis are critical. Another significant trend is the integration of AI and deep learning in machine vision systems, enabling them to perform complex image analysis tasks and improve decision-making capabilities. The growing focus on sustainability is also influencing machine vision systems, with manufacturers developing energy-efficient solutions that reduce operational costs and environmental impact. The rise of smart factories and the increasing demand for real-time data and analytics are further driving innovation in the machine vision system market.

Key Players

-

Cognex Corporation

-

Basler AG

-

Keyence Corporation

-

Omron Corporation

-

National Instruments Corporation

-

Teledyne Technologies Incorporated

-

Sony Corporation

-

Allied Vision Technologies GmbH

-

ISRA Vision AG

-

Intel Corporation

Chapter 1. Machine Vision System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Machine Vision System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Machine Vision System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Machine Vision System Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Machine Vision System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Machine Vision System Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Y-O-Y Growth trend Analysis By Component

6.5 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Machine Vision System Market – By Product Type

7.1 Introduction/Key Findings

7.2 Smart Camera-based

7.3 PC-based

7.4 Y-O-Y Growth trend Analysis By Product Type

7.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 8. Machine Vision System Market – By Application

8.1 Introduction/Key Findings

8.2 Quality Assurance & Inspection

8.3 Positioning & Guidance

8.4 Measurement

8.5 Identification

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Machine Vision System Market – By End-Use Industry

9.1 Introduction/Key Findings

9.2 Automotive

9.3 Electronics & Semiconductor

9.4 Food & Beverages

9.5 Pharmaceuticals

9.6 Others

9.7 Y-O-Y Growth trend Analysis By End-Use Industry

9.8 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 10. Machine Vision System Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Component

10.1.3 By Product Type

10.1.4 By Application

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Component

10.2.3 By Product Type

10.2.4 By Application

10.2.5 By End-Use Industry

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Component

10.3.3 By Application

10.3.4 By End-Use Industry

10.3.5 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Component

10.4.3 By Product Type

10.4.4 By Application

10.4.5 By End-Use Industry

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Component

10.5.3 By Product Type

10.5.4 By Application

10.5.5 By End-Use Industry

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Machine Vision System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Cognex Corporation

11.2 Basler AG

11.3 Keyence Corporation

11.4 Omron Corporation

11.5 National Instruments Corporation

11.6 Teledyne Technologies Incorporated

11.7 Sony Corporation

11.8 Allied Vision Technologies GmbH

11.9 ISRA Vision AG

11.10 Intel Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

As of 2023, the Global Machine Vision System Market is valued at approximately USD 14.5 billion and is projected to reach USD 24.8 billion by 2030, growing at a CAGR of 8.0% during the forecast period.

The key drivers include the increasing demand for quality inspection and automation, technological advancements in machine vision systems, and the growth of the electronics & semiconductor industry.

The Machine Vision System Market is segmented by component (Hardware, Software), product type (Smart Camera-based, PC-based), application (Quality Assurance & Inspection, Positioning & Guidance, Measurement, Identification), and end-use industry (Automotive, Electronics & Semiconductor, Food & Beverages, Pharmaceuticals, Others).

Asia-Pacific is the most dominant region, contributing to 42% of global revenue, driven by rapid industrialization, strong manufacturing capabilities, and the increasing adoption of automation technologies.

The leading players in the market include Cognex Corporation, Basler AG, Keyence Corporation, Omron Corporation, National Instruments Corporation, Teledyne Technologies Incorporated, Sony Corporation, Allied Vision Technologies GmbH, ISRA Vision AG, and Intel Corporation.