Luxury Wines and Spirits Market Size (2024-2030)

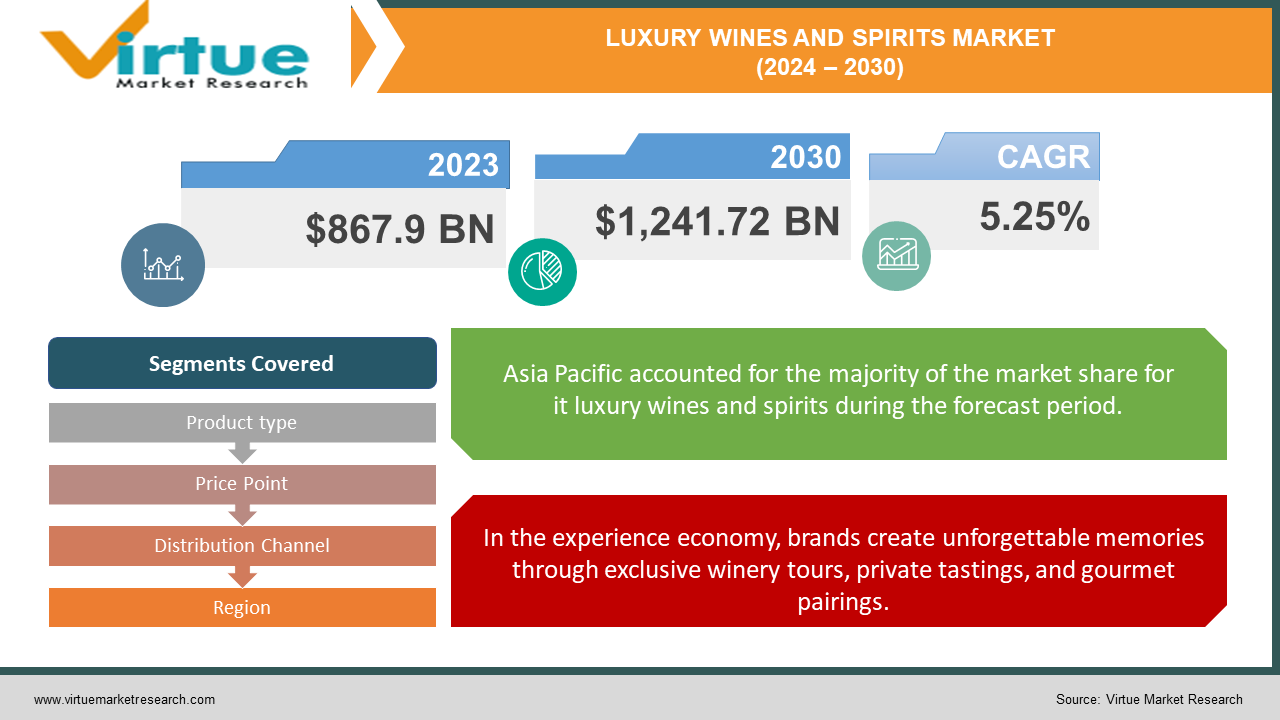

The Luxury Wines and Spirits Market was valued at USD 867.9 billion in 2023 and is projected to reach a market size of USD 1,241.72 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.25%.

The luxury wines and spirits market is a booming industry fueled by a growing appreciation for quality and a desire for unique experiences. As disposable incomes rise globally, consumers are increasingly willing to splurge on premium beverages. This trend is particularly strong in urban areas, where a growing number of high-end bars and restaurants are offering extensive selections.

Key Market Insights:

Firstly, demographics are shifting. Millennials, a generation known for valuing experiences and unique products, account for a significant portion of the market. Furthermore, according to reports, the Asia Pacific region is expected to witness the fastest growth due to rising disposable incomes in countries like China and India, creating a new wave of luxury consumers globally.

Secondly, consumer preferences are evolving. The desire for exclusivity and a deeper connection with the product is on the rise. This is reflected in the growing demand for rare and limited-edition releases – a trend seen in both wines and spirits. For instance, a 2023 report by Knight Frank indicates a surge in the collection of rare Yamazaki whiskies, with some bottles fetching hundreds of thousands of dollars at auction. Consumers are also drawn to the story behind the drink, with craft spirits gaining popularity due to their unique production methods and local provenance.

Luxury Wines and Spirits Market Drivers:

Millennials prioritizing experiences and new products, along with their growing disposable income, fuel the market for premium wines and spirits.

The landscape of luxury wines and spirits is being reshaped by a shift in demographics. Millennials, the generation born between 1981 and 1996, are a major force driving the market. Unlike previous generations, millennials prioritize experiences and unique products. Their rise in disposable income allows them to indulge in luxury beverages, viewing them to elevate everyday moments or celebrate special occasions. Furthermore, economic growth in developing countries like China and India is creating a new generation of luxury consumers.

In the experience economy, brands create unforgettable memories through exclusive winery tours, private tastings, and gourmet pairings.

In today's experience economy, luxury goes far beyond the product itself. Recognizing this shift, brands are creating immersive experiences to connect with consumers on a deeper level. This might involve exclusive winery tours that showcase the winemaking process, private tastings led by experts, or even luxurious events that pair fine wines and spirits with gourmet cuisine. These experiences elevate the brand and create a lasting memory for the consumer.

Online platforms revolutionize access, offering easy browsing and purchase of luxury wines and spirits from anywhere in the world.

The rise of e-commerce platforms is revolutionizing the way consumers access luxury wines and spirits. Online platforms offer unmatched convenience, allowing consumers to browse and purchase these premium products from anywhere in the world. This eliminates geographical limitations and ensures easy access to a wider selection than ever before. A study by Allied Market Research predicts significant growth in the e-commerce segment of the market, highlighting the increasing importance of online channels for reaching a wider audience and catering to the tech-savvy generations.

Luxury Wines and Spirits Market Restraints and Challenges:

The luxury wines and spirits market, while flourishing, faces hurdles that can impede its progress. One key challenge is maintaining a brand image that aligns with evolving consumer values. With a growing focus on health and wellness, particularly among younger demographics, luxury brands need to showcase their commitment to responsible consumption and potentially explore healthier product options. Additionally, counterfeiting remains a significant threat, not only damaging brand reputation but also potentially harming consumers. Here, robust authentication measures and consumer education initiatives become crucial.

Furthermore, navigating the complex web of regulations can be a significant obstacle for market players. Stringent regulations governing production, distribution, and sale can create logistical headaches and inflate costs for producers and distributors. This highlights the need for industry collaboration and advocacy to ensure regulations are balanced, fostering market growth without compromising consumer safety. By adopting sustainable practices throughout the supply chain, luxury brands can not only differentiate themselves but also cater to a growing segment of environmentally conscious consumers.

Luxury Wines and Spirits Market Opportunities:

The luxury wines and spirits market, while facing its share of challenges, also brims with exciting opportunities for continued growth and innovation. One key area of opportunity lies in embracing sustainability throughout the supply chain. As environmental consciousness takes root amongst consumers, particularly younger demographics, luxury brands can differentiate themselves by showcasing a commitment to responsible practices. This could involve sourcing ingredients from sustainable farms, employing eco-friendly packaging solutions, and reducing the carbon footprint of production processes. Highlighting these efforts can resonate with a growing segment of environmentally conscious consumers who are willing to pay a premium for brands that align with their values.

Furthermore, advancements in technology offer exciting possibilities for the luxury wines and spirits market. Blockchain technology, for instance, can be utilized to create tamper-proof authentication systems, ensuring the authenticity of products and combating the threat of counterfeiting. This not only protects brand reputation but also safeguards consumers from potentially harmful imitations.

LUXURY WINES AND SPIRITS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.25% |

|

Segments Covered |

By Product type, Price Point, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Diageo, LVMH, Pernod Ricard, Bacardi, Edrington, Suntory Holdings Limited, Brown-Forman, Thai Beverage Public Limited Company, Hitejinro Co. Ltd, Davide Campari-Milano S.p.A. |

Luxury Wines and Spirits Market Segmentation: By Distribution Channel

-

On-premises

-

Off-premises

-

Duty-free Shops

In the luxury wines and spirits market, the dominant distribution channel is Off-premise (Retail Stores, Online), due to its wide reach and convenience for consumers. This segment is expected to maintain its lead. However, the Online sub-segment is experiencing the fastest growth, driven by the increasing popularity of e-commerce platforms and their ability to offer wider selection and easier access compared to traditional retail stores.

Luxury Wines and Spirits Market Segmentation: By Product Type

-

Fine Wines

-

Aged Spirits

-

Champagne & Sparkling Wines

-

Liqueurs & Cordials

By product type, the luxury wines and spirits market is likely dominated by Fine Wines. These prestigious bottles from established regions hold a strong position due to tradition, quality, and established collector bases. However, the Aged Spirits segment is expected to be the fastest growing. Rising appreciation for craftsmanship and a wider range of flavor profiles due to craft distilleries are driving the demand for premium aged whiskeys, rums, and other spirits.

Luxury Wines and Spirits Market Segmentation: By Price Point

-

Premium Luxury

-

Super Premium Luxury

-

Ultra Luxury

The dominant price point segment in the luxury wines and spirits market is likely Premium Luxury. This segment acts as the entry point, attracting a wider consumer base with its moderate price tags compared to higher tiers. On the other hand, the fastest-growing segment is expected to be Asia Pacific, driven by rising disposable incomes in developing economies within the region. This creates a new generation of luxury consumers seeking these premium beverages as a status symbol.

Luxury Wines and Spirits Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America has a well-established luxury beverage market, with a strong presence of both domestic and international brands. The US, in particular, is a significant consumer of high-end wines and spirits, with a growing appreciation for craft spirits and limited-edition releases. However, high taxes and strict regulations can impact market growth.

Europe is the traditional heartland of luxury wines and spirits, housing iconic wine regions like Bordeaux and Champagne. With a long history of winemaking and a deeply ingrained culture of enjoying premium beverages, Europe remains a dominant force. However, the market faces challenges from rising production costs and competition from emerging regions.

Asia-Pacific is experiencing the fastest growth in the luxury wines and spirits market, fueled by rising disposable incomes in countries like China and India. A growing middle class with a taste for luxury goods is driving demand for premium beverages. However, a lack of established drinking traditions in some parts of the region and the presence of counterfeit products require careful market navigation.

COVID-19 Impact Analysis on the Luxury Wines and Spirits Market:

The COVID-19 pandemic undeniably cast a long shadow over the luxury wines and spirits market, forcing the industry to navigate a wave of unforeseen challenges. A key consequence was a shift in consumer behavior. With a laser focus on essential goods and economic uncertainty looming large, discretionary spending on luxury products like premium wines and spirits dipped. This translated to a decline in sales, particularly noticeable in the on-premise channel. The closure of bars, restaurants, and nightclubs – major hubs for enjoying luxury beverages in a social setting – significantly impacted this segment.

However, amidst the disruption, the market also witnessed some unexpected opportunities emerge. The surge in e-commerce provided a lifeline, offering a convenient alternative for consumers seeking luxury wines and spirits. Restrictions on physical movement due to lockdowns fueled the growth of online platforms, allowing consumers to browse and purchase these premium beverages from the comfort of their homes. Furthermore, a trend towards home consumption took root as people embraced at-home entertaining during lockdowns. This unexpected shift fueled demand for premium beverages enjoyed within the confines of one's own dwelling, presenting a new avenue for market growth. As the market recovers and adapts to this evolving landscape, brands that prioritize a robust online presence and cater to the growing preference for home consumption will be well-positioned for success in the post-pandemic era.

Latest Trends/ Developments:

The luxury wines and spirits market thrive on constant evolution, always buzzing with new ideas and developments to cater to ever-shifting consumer preferences. One of the hottest trends driving the market forward is the rise of personalization and customization. Today's consumers crave a sense of individuality, and luxury brands are responding by offering bespoke options that go beyond simply choosing a bottle off the shelf. This could take the form of curated wine clubs that cater to specific taste profiles, allowing customers to receive a selection of wines tailored to their preferences. Additionally, personalized gift sets with custom labels are gaining traction, offering a unique and thoughtful way to celebrate special occasions. Looking beyond physical products, some forward-thinking brands are exploring the use of augmented reality to create interactive experiences. Imagine virtually exploring a renowned French vineyard or Scottish distillery from the comfort of your living room – augmented reality allows consumers to delve deeper into the brand story and connect with the products on a more personal level. By embracing these innovative approaches, luxury wine and spirit brands can cater to the evolving desires of their clientele, fostering stronger connections and creating a truly memorable experience that goes beyond just the beverage itself.

Key Players:

-

Diageo

-

LVMH

-

Pernod Ricard

-

Bacardi

-

Edrington

-

Suntory Holdings Limited

-

Brown-Forman

-

Thai Beverage Public Limited Company

-

Hitejinro Co. Ltd

-

Davide Campari-Milano S.p.A.

Chapter 1. Luxury Wines and Spirits Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Luxury Wines and Spirits Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Luxury Wines and Spirits Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Luxury Wines and Spirits Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Luxury Wines and Spirits Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Luxury Wines and Spirits Market – By Distribution Channel

6.1 Introduction/Key Findings

6.2 On-premises

6.3 Off-premises

6.4 Duty-free Shops

6.5 Y-O-Y Growth trend Analysis By Distribution Channel

6.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 7. Luxury Wines and Spirits Market – By Product Type

7.1 Introduction/Key Findings

7.2 Fine Wines

7.3 Aged Spirits

7.4 Champagne & Sparkling Wines

7.5 Liqueurs & Cordials

7.6 Y-O-Y Growth trend Analysis By Product Type

7.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 8. Luxury Wines and Spirits Market – By Price Point

8.1 Introduction/Key Findings

8.2 Premium Luxury

8.3 Super Premium Luxury

8.4 Ultra Luxury

8.5 Y-O-Y Growth trend Analysis By Price Point

8.6 Absolute $ Opportunity Analysis By Price Point, 2024-2030

Chapter 9. Luxury Wines and Spirits Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Distribution Channel

9.1.3 By Product Type

9.1.4 By Price Point

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Distribution Channel

9.2.3 By Product Type

9.2.4 By Price Point

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Distribution Channel

9.3.3 By Product Type

9.3.4 By Price Point

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Distribution Channel

9.4.3 By Product Type

9.4.4 By Price Point

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Distribution Channel

9.5.3 By Product Type

9.5.4 By Price Point

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Luxury Wines and Spirits Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Diageo

10.2 LVMH

10.3 Pernod Ricard

10.4 Bacardi

10.5 Edrington

10.6 Suntory Holdings Limited

10.7 Brown-Forman

10.8 Thai Beverage Public Limited Company

10.9 Hitejinro Co. Ltd

10.10 Davide Campari-Milano S.p.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Luxury Wines and Spirits Market was valued at USD 867.9 billion in 2023 and is projected to reach a market size of USD 1,241.72 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.25%.

A New Generation of Luxury Consumers, The Allure of Exclusivity and Craft, The Rise of Immersive Experiences, E-commerce Revolutionizes Access.

Fine Wines, Aged Spirits, Champagne & Sparkling Wines, Liqueurs & Cordials.

While Europe boasts a strong historical presence, the Asia-Pacific region is currently expected to be the most dominant force in the Luxury Wines and Spirits Market due to its rapidly growing economies and rising disposable incomes.

Diageo, LVMH, Pernod Ricard, Bacardi, Edrington, Suntory Holdings Limited, Brown-Forman, Thai Beverage Public Limited Company, Hitejinro Co. Ltd, Davide Campari-Milano S.p.A.