Luxury Vehicle Market Size (2024 – 2030)

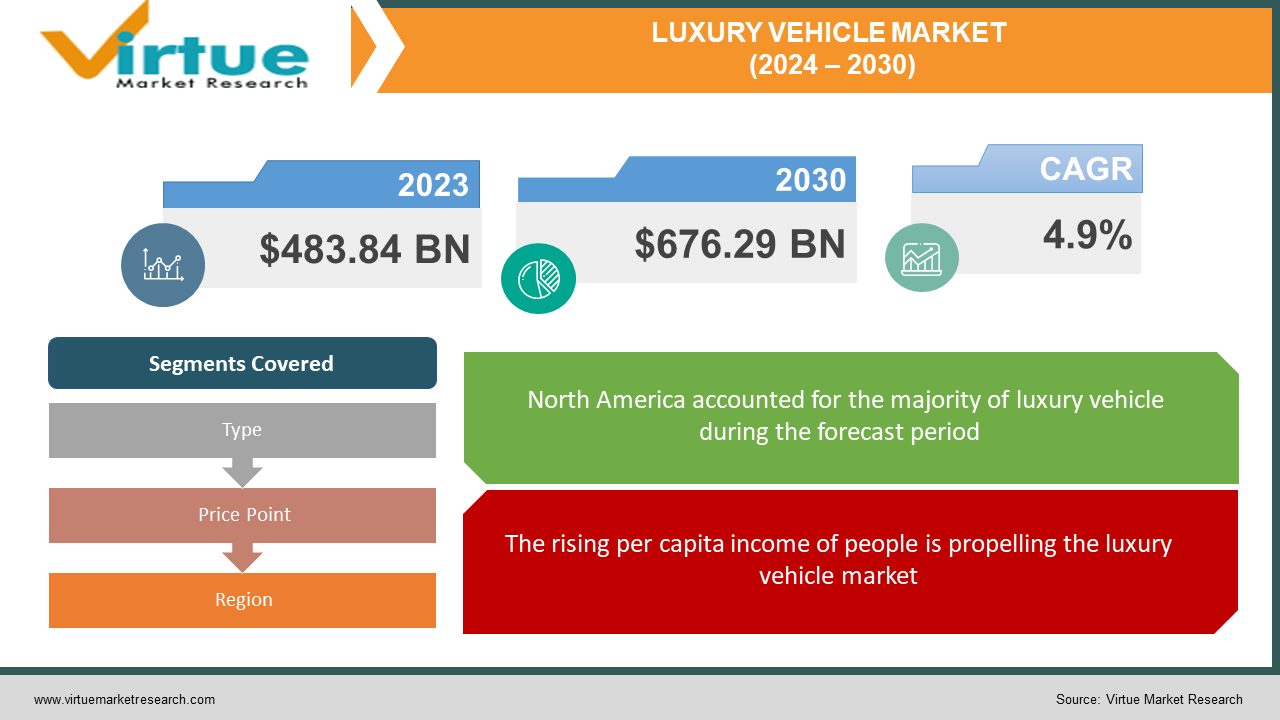

The global luxury vehicle market size was valued at 483.84 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030, reaching USD 676.29 billion by the end of the forecast period.

The luxury vehicle market is a thriving sector of the automotive industry, encompassing high-end cars, SUVs, and other vehicles characterized by premium features, performance, and brand prestige. It caters to a distinct segment of consumers seeking exclusivity, status, and a refined driving experience.

Key Market Insights:

The rise of electric vehicles (EVs) is a defining trend in the luxury car market. Consumers are increasingly drawn to EVs for their environmental benefits, performance capabilities, and cutting-edge technology. Luxury automakers are responding with a surge of new EV models, from high-performance sedans to spacious SUVs, each vying for a piece of the growing market share. This shift towards electrification is not just a fad; it's a fundamental transformation that is reshaping the industry.

The luxury car market is no longer dominated by traditional Western markets. Emerging economies like China and India are experiencing rapid growth in their luxury car segments, fuelled by rising affluence and a growing middle class. These markets present significant opportunities for luxury automakers, but they also require a deep understanding of local preferences and cultural nuances.

The luxury car market is constantly evolving, driven by technological advancements, changing consumer preferences, and global economic trends. Looking ahead, we can expect to see continued innovation in areas like electrification, autonomous driving, and connectivity. Luxury cars will become increasingly personalized, sustainable, and technologically advanced, offering an unparalleled driving experience for discerning buyers.

Luxury Vehicle Market Drivers:

The rising per capita income of people is propelling the luxury vehicle market.

Rising disposable incomes, particularly in emerging giants like China (predicted to account for 40% of global luxury car sales by 2030) and India, are fuelling a new generation of luxury car buyers. The number of high-net-worth individuals (HNWIs) globally is expected to reach 34.6 million by 2025, up from 29.7 million in 2022.

Rising electrification of vehicles shifting the world toward the use of E-vehicles

The rise of electric vehicles (EVs) is a defining trend in the luxury car market. Consumers are increasingly drawn to EVs for their environmental benefits, performance capabilities, and cutting-edge technology. Luxury automakers are responding with a surge of new EV models, from high-performance sedans to spacious SUVs, each vying for a piece of the growing market share. The global luxury electric vehicle market is expected to grow at a staggering 24.5% CAGR between 2023 and 2030, reaching USD 256.7 billion by the end of the forecast period.

The shifting interest of people toward SUVs is driving the market

While traditional luxury sedans still hold a place in the market, SUVs and crossovers are experiencing explosive growth. These versatile vehicles offer a blend of comfort, space, and performance that resonates with modern buyers, particularly families with active lifestyles. Luxury SUVs and crossovers often boast advanced features like all-wheel drive, spacious interiors, and the latest in-car technology, making them a compelling choice for discerning consumers. Discerning buyers are no longer content with cookie-cutter options. Luxury brands are responding with an array of customization options, from bespoke interiors to exclusive paint colors, allowing buyers to create a truly one-of-a-kind vehicle. A 2023 McKinsey & Company report revealed that 70% of luxury car buyers are willing to pay a premium for personalized features and experiences.

Rising climate change concerns are also driving the market

Consumers are increasingly prioritizing eco-friendly choices, and the luxury car market is taking note. Automakers are investing in electric and hybrid models, utilizing sustainable materials, and implementing eco-conscious production processes to reduce their environmental footprint and appeal to environmentally aware buyers. A 2023 survey by Deloitte found that 73% of global consumers are willing to pay a premium for sustainable luxury goods.

Luxury Vehicle Market challenges and restraints:

The luxury car market is particularly susceptible to economic fluctuations

When disposable incomes shrink, consumers tend to tighten their belts, prioritizing essential items over discretionary purchases like luxury vehicles. The recent global economic slowdown and potential future recessions cast a shadow of uncertainty over market growth. During the 2008 financial crisis, the global luxury car market experienced a dramatic 18% decline in sales.

Disruptions in the global supply chain also impacted the market

Shortages of semiconductors and other critical components have led to production delays and increased costs, potentially affecting vehicle availability and pricing. A 2023 study by McKinsey & Company revealed that 80% of automotive executives reported being impacted by supply chain disruptions. Global political instability and trade tensions can disrupt supply chains, hinder economic growth in key markets, and dampen consumer confidence, all of which can negatively impact the luxury car market. The ongoing trade war between the US and China has already disrupted the automotive industry, impacting production and sales in both countries

Evolving regulations on emissions, safety, and data privacy can pose challenges for luxury car manufacturers

Meeting stricter regulations requires investments in new technologies and compliance measures, which can increase costs and impact vehicle design and performance. The European Union's stricter CO2 emission targets for 2030 are expected to put pressure on automakers to accelerate their shift towards electric vehicles.

Market Opportunities:

The surging demand for electric vehicles (EVs) presents a significant opportunity for luxury carmakers. By investing in innovative and high-performance EV models, they can cater to environmentally conscious consumers seeking a luxurious and sustainable driving experience. The global luxury EV market is expected to grow at a staggering 24.5% CAGR from 2023 to 2030, reaching USD 256.7 billion by the end of the forecast period. Discerning luxury car buyers increasingly crave individuality. Automakers can capitalize on this trend by offering extensive customization options, from bespoke interiors and unique paint colors to personalized technology packages. The luxury car market is no longer solely focused on traditional Western markets. Emerging economies like China and India are witnessing a surge in demand for luxury vehicles, presenting significant growth opportunities for automakers willing to adapt their strategies to local preferences.

LUXURY VEHICLE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.9% |

|

Segments Covered |

By Type, Price Point, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mercedes-Benz, BMW, Audi, Lexus, Porsche, Jaguar Land Rover, Tesla, Rolls-Royce, Bentley |

Luxury vehicle market segmentation - by type

-

Sedans

-

SUVs and Crossovers

-

Sports Cars

-

Others

Still a mainstay of the luxury market, offering elegance, comfort, and performance. Subcategories include executive sedans, sports sedans, and entry-level luxury sedans. The global luxury sedan market is expected to grow at a 2.5% CAGR from 2024 to 2030, driven by demand from emerging markets like China and India. Dominating the market with their blend of space, practicality, and performance are Sedans. The global luxury SUV market is expected to grow at a 7.5% CAGR from 2023 to 2030, outpacing all other segments due to their versatility and appeal to families. Cater to driving enthusiasts seeking power, handling, and exclusivity. Subcategories include high-performance coupes, convertibles, and supercars. The global luxury sports car market is expected to grow, fuelled by demand from wealthy collectors and enthusiasts

Luxury vehicle market segmentation - By Price Point

-

Entry-Level Luxury

-

Mid-Level Luxury

-

Ultra-Luxury

More affordable options for first-time luxury car buyers or those seeking value are often targeted at younger demographics. Popular examples Lexus ES, Volvo S60, Audi A3, BMW 2 Series. Mid-Level range vehicles offer a balance of features, performance, and prestige at a premium price point. Popular examples are the Mercedes-Benz C-Class, BMW X3, Audi Q5, and Lexus RX. The pinnacle of luxury is characterized by exclusivity, handcrafted details, and cutting-edge technology. They target high-net-worth individuals and collectors. Popular examples Rolls-Royce Phantom, Bentley Continental GT, Ferrari Roma, and Lamborghini Urus.

Luxury vehicle market segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The global luxury car market is a diverse tapestry, with each region boasting unique preferences and growth trajectories. North America, a mature market dominated by established brands, sees a strong preference for SUVs and trucks alongside rising demand for EVs and technology features. Europe, the traditional powerhouse for luxury, focuses on performance and design, with a growing awareness of sustainability and a preference for sedans and hatchbacks. Asia, the fastest-growing region, driven by China and India, witnesses a surge in demand for SUVs and EVs, with younger demographics entering the market and an increasing appetite for personalization. Latin America, an emerging market with growth potential, sees the entry-level luxury segment gaining traction, with rising interest in SUVs and safety features. Finally, the Middle East & Africa, a diverse region with pockets of luxury car demand, sees a strong preference for SUVs and high-performance vehicles, along with a growing interest in customization options. Understanding these regional nuances is crucial for automakers to tailor their offerings and marketing strategies and unlock the full potential of this dynamic market.

COVID-19 Impact Analysis on the Luxury Vehicle Market

The COVID-19 pandemic dealt a blow to the luxury car market, causing a sharp decline in sales and production in 2020. Consumer confidence took a hit, economic uncertainties rose, and disposable incomes shrunk, leading many to postpone luxury purchases. Supply chain disruptions further hampered production and increased costs. However, as restrictions eased and the global economy recovered, the market showed signs of resilience. Pent-up demand and an influx of new wealthy individuals from the pandemic contributed to a rebound in sales, particularly in SUVs and electric vehicles. The market is expected to continue growing, but challenges remain, including potential economic downturns, geopolitical instability, and the need to adapt to evolving consumer preferences in a post-pandemic world.

Latest trends/Developments

Luxury cars are racing into the future with electric engines, personalized features, and cutting-edge tech. Eco-conscious materials and subscription services are gaining ground, reflecting changing consumer values. Expect thrilling performance, unique experiences, and AI companions as automakers navigate this dynamic and evolving market. Buckle up, the ride ahead is packed with innovation!

Key Players:

-

Mercedes-Benz

-

BMW

-

Audi

-

Lexus

-

Porsche

-

Jaguar Land Rover

-

Tesla

-

Rolls-Royce

-

Bentley

Chapter 1. Luxury Vehicle Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Luxury Vehicle Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Luxury Vehicle Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Luxury Vehicle Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Luxury Vehicle Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Luxury Vehicle Market – By type

6.1 Introduction/Key Findings

6.2 Sedans

6.3 SUVs and Crossovers

6.4 Sports Cars

6.5 Others

6.6 Y-O-Y Growth trend Analysis By type

6.7 Absolute $ Opportunity Analysis By type, 2024-2030

Chapter 7. Luxury Vehicle Market – By Price Point

7.1 Introduction/Key Findings

7.2 Entry-Level Luxury

7.3 Mid-Level Luxury

7.4 Ultra-Luxury

7.5 Y-O-Y Growth trend Analysis By Price Point

7.6 Absolute $ Opportunity Analysis By Price Point, 2024-2030

Chapter 8. Luxury Vehicle Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Price Point

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Price Point

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Price Point

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Price Point

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Price Point

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Luxury Vehicle Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Mercedes-Benz

9.2 BMW

9.3 Audi

9.4 Lexus

9.5 Porsche

9.6 Jaguar Land Rover

9.7 Tesla

9.8 Rolls-Royce

9.9 Bentley

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global luxury vehicle market size was valued at 483.84 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030, reaching USD 676.29 billion by the end of the forecast period.

The luxury vehicle market thrives on a potent blend of economic prosperity, aspirational desires, and technological advancements. Rising disposable incomes, particularly in emerging economies, fuel the demand for high-end automobiles. Consumers, especially younger generations, increasingly seek personalized experiences and exclusivity, driving the trend towards customization and niche offerings.

Based on vehicle type it is divided into three segments - Sedan, SUV, and Sports car.

North America is the most dominant region for the luxury vehicle Market.

Mercedes-Benz, BMW, Audi, Lexus, Porsche, and Jaguar Land Rover are some key players in the market.