GLOBAL LUXURY COSMETICS MARKET (2024 - 2030)

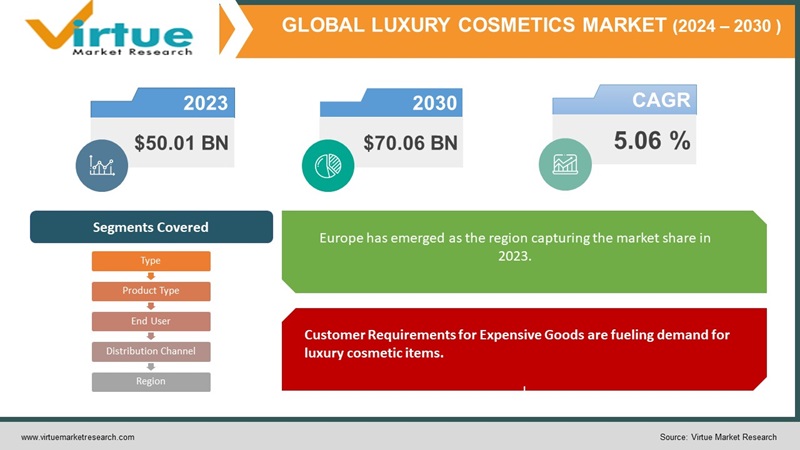

The Global Luxury Cosmetics Market was valued at USD 50.01 billion and is projected to reach a market size of USD 70.6 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.06%.

Cosmetic items have become an aspect of existence serving to cleanse and enhance the visual appeal of our skin. In the world of cosmetics, end or luxury products have taken over the market due, to their selection of natural organic, and chemical-free options. Manufacturers of these cosmetics prioritize the use of premium ingredients that're also organic resulting in superior product formulations. Luxury cosmetics encompass a range of offerings including fragrances, hair care products skincare essentials, and makeup items.

Key Market Insights:

The beauty industry, in the United States is truly impressive with a value of, around 27 billion dollars. Among its sectors luxury hair care stands out as one of the largest having witnessed sales growth of approximately 22 percent in the year 2022.

Between January 2022 and June 2022, there was a rise of 78.5 percent, in the sales of high-end beauty products in physical stores, across Germany compared to the previous year. Interestingly during this time period, Italy stood out as the country where online sales of luxury beauty products saw an increase.

In December 2022 the global sales of perfumes and cosmetics, from the luxury brand Dior reached a value of 7.7 billion euros showing an increase compared to the previous year. From December 2017 to December 2019 the sales revenue of Dior cosmetics and perfumes showed a gradual increase.

Luxury Cosmetics Market Drivers:

Customer Requirements for Expensive Goods are fueling demand for luxury cosmetic items.

Premium products have a way of making people feel exclusive and prestigious. Take luxury cosmetics for example. They appeal to consumers by exuding a sense of prestige and elegance. Those who own and use high end cosmetics often feel pampered and extraordinary which boosts their self-confidence and social standing. These premium goods are known for their performance and top notch quality. In the world of luxury cosmetics, this means using formulations, with ingredients and cutting edge technology. Customers seek out these products because they anticipate results like skin long lasting makeup or a more radiant appearance. The premium market caters to consumer desires, for pleasure and self care. As the importance of self care practices and overall well being continues to rise luxury cosmetics become the complement to this trend. They enhance the experience by offering textures soothing scents and attractive packaging that make it more enjoyable and satisfying.

Increasing the Net Worth of people is fueling market sales.

Increased disposable income plays a role, in influencing industries, including the luxury cosmetics market. This factor is based on the concept that when people and households have money at their disposal after taxes and necessary expenses they tend to allocate a part of it towards non essential and high end purchases such, as upscale cosmetics. When individuals have money to spend they often desire to improve their well being and quality of life. This can involve investing in self care and beauty products. Individuals, with incomes, tend to be drawn towards luxury cosmetics due, to their quality and distinctive allure. Such customers are more inclined and capable of purchasing products that offer premium ingredients and elegant packaging.

Luxury Cosmetics Market Restraints and Challenges:

The luxury cosmetics market is greatly influenced by changing consumer preferences. As cultural norms and beauty ideals evolve so do the wants and expectations of consumers. A key aspect of this shift is the increasing emphasis, on clean beauty. Consumers are now more conscious about the ingredients used in their skincare and beauty products opting for formulas that're cruelty free and free from harmful substances. This change in consumer demand has led to a surge in the popularity of niche beauty brands that offer alternatives to luxury cosmetics.

Furthermore, there is a growing trend towards simplicity and minimalism, in beauty routines. Today many consumers value products that serve purposes and deliver results. This inclination makes them less inclined to invest in a range of luxury cosmetics.

Luxury Cosmetics Market Opportunities:

Eco-Friendly and Sustainable Products.

There is a chance, for businesses in sectors, such as the cosmetics industry to capitalize on the increasing demand, for eco friendly and sustainable products. Luxury cosmetic brands can attract customers who prioritize ethics and ecological sustainability by developing and marketing product lines that's both environmentally friendly and sustainable. Improving customer loyalty and enhancing brand reputation can both be achieved through this approach. Friendly products have the ability to tap into markets and attract various consumer groups. Many individuals have a passion, for sustainability. Luxury cosmetic companies can take advantage of this expanding market by providing options that meet these demands. By implementing practices throughout the supply chain, such as sourcing friendly ingredients reducing packaging waste, and adopting green manufacturing processes we can not only decrease our impact, on the environment but also improve operational efficiency and achieve long term cost savings.

GLOBAL LUXURY COSMETICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Type, Product Type, End User, distribution Channel Chapter 1. Global Luxury Cosmetics Market – Scope & Methodology 1.1. Market Segmentation 1.2. Scope, Assumptions & Limitations 1.3. Research Methodology 1.4. Primary Sources 1.5. Secondary Sources Chapter 2. Global Luxury Cosmetics Market – Executive Summary 2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn) 2.2. Key Trends & Insights 2.2.1. Demand Side 2.2.2. Supply Side 2.4. Attractive Investment Propositions 2.5. COVID-19 Impact Analysis Chapter 3. Global Luxury Cosmetics Market – Competition Scenario 3.1. Market Share Analysis & Company Benchmarking 3.2. Competitive Strategy & Development Scenario 3.3. Competitive Pricing Analysis 3.4. Supplier-Distributor Analysis Chapter 4. Global Luxury Cosmetics Market - Entry Scenario 4.1. Regulatory Scenario 4.2. Case Studies – Key Start-ups 4.3. Customer Analysis 4.5. PESTLE Analysis 4.4. Porters Five Force Model 4.4.1. Bargaining Power of Suppliers 4.4.2. Bargaining Powers of Customers 4.4.3. Threat of New Entrants 4.4.4. Rivalry among Existing Players 4.4.5. Threat of Substitutes Chapter 5. Global Luxury Cosmetics Market - Landscape 5.1. Value Chain Analysis – Key Stakeholders Impact Analysis 5.2. Market Drivers 5.3. Market Restraints/Challenges 5.4. Market Opportunities Chapter 6. Global Luxury Cosmetics Market – By Type

6.1. Coventional 6.2. Organic Chapter 7. Global Luxury Cosmetics Market – By Product Type 7.1. Skincare 7.2. Haircare 7.3. Makeup 7.4. Fragnances Chapter 8. Global Luxury Cosmetics Market – By End User Type 8.1. Male 8.2. Female Chapter 9. Global Luxury Cosmetics Market – By Distribution Channel 9.1. E-commerce 9.2. Supermarket/Hypermarket 9.3. Specialty Stores 9.4. Others Chapter 10. Global Luxury Cosmetics Market, By Geography – Market Size, Forecast, Trends & Insights 10.1. North America 10.1.1. By Country 10.1.1.1. U.S.A. 10.1.1.2. Canada 10.1.1.3. Mexico 10.1.2. By Type 10.1.3. By Product Type 10.1.4. By End-user Type 10.1.5. Distribution Channel 10.1.6. Countries & Segments - Market Attractiveness Analysis 10.2. Europe 10.2.1. By Country 10.2.1.1. U.K. 10.2.1.2. Germany 10.2.1.3. France 10.2.1.4. Italy 10.2.1.5. Spain 10.2.1.6. Rest of Europe 10.2.2. By Type 10.2.3. By Product Type 10.2.4. By End User Type 10.2.5. Distribution Channel 10.2.6. Countries & Segments - Market Attractiveness Analysis 10.3. Asia Pacific 10.3.2. By Country 10.3.2.2. China 10.3.2.2. Japan 10.3.2.3. South Korea 10.3.2.4. India 10.3.2.5. Australia & New Zealand 10.3.2.6. Rest of Asia-Pacific 10.3.2. By Type 10.3.3. By Product Type 10.3.4. By End User Type 10.3.5. Distribution Channel 10.3.6. Countries & Segments - Market Attractiveness Analysis 10.4. South America 10.4.3. By Country 10.4.3.3. Brazil 10.4.3.2. Argentina 10.4.3.3. Colombia 10.4.3.4. Chile 10.4.3.5. Rest of South America 10.4.2. By Type 10.4.3. By Product Type 10.4.4. By End-User Type 10.4.5. Distribution Channel 10.4.6. Countries & Segments - Market Attractiveness Analysis 10.5. Middle East & Africa 10.5.4. By Country 10.5.4.4. United Arab Emirates (UAE) 10.5.4.2. Saudi Arabia 10.5.4.3. Qatar 10.5.4.4. Israel 10.5.4.5. South Africa 10.5.4.6. Nigeria 10.5.4.7. Kenya 10.5.4.10. Egypt 10.5.4.10. Rest of MEA 10.5.2. By Type 10.5.3. By Product Type 10.5.4. By End-user Type 10.6.5. Distribution Channel 10.5.6. Countries & Segments - Market Attractiveness Analysis Chapter 11. Global Luxury Cosmetics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments) 11.1. L'Oréal Group 11.2. LVMH SE 11.3. Shiseido Company Limited 11.4. Puig SL 11.5. Oriflame Cosmetics AG 11.6. Estee Lauder Companies, Inc. 11.7. Coty, Inc. (JAB Cosmetics B.V.) 11.8. Revlon, Inc. (MacAndrews & Forbes) 11.9. Avon Products, Inc. 11.10. Ralph Lauren Corporation and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

L'Oréal Group, LVMH SE, Shiseido Company Limited, Puig SL, Oriflame Cosmetics AG Estee Lauder Companies, Inc., Coty, Inc. (JAB Cosmetics B.V.), Revlon, Inc. (MacAndrews & Forbes), Avon Products, Inc. Ralph Lauren Corporation |

Luxury Cosmetics Market Segmentation:

Market Segmentation: By Type:

- Conventional

- Organic

The luxury cosmetics market worldwide can be categorized into two types; organic. Conventional cosmetics, which make up the dominant portion of the market in terms of revenue, consist of products that blend ingredients. Although these products have been popular, for a time they are currently under scrutiny due to concerns, about harmful substances and their environmental impact. On the other hand, the organic cosmetics segment has seen a growth surge. The increase, in the popularity of cosmetics, can be attributed to consumers becoming more aware of the health and environmental impacts associated with beauty products. Organic beauty products are made from sourced ingredients without the use of synthetic chemicals, parabens, or artificial fragrances. This appeals, to consumers who are seeking alternatives and those who have sensitivities or allergies.

Market Segmentation: By Product Type:

- Skincare

- Haircare

- Makeup

- Fragrances

The luxury cosmetics market worldwide is categorized based on the type of product it offers. These categories encompass skincare, haircare, makeup and fragrances. Among these categories, skincare dominates in terms of revenue share, within the luxury cosmetics industry. Skincare products encompass a range of items that are specially formulated, to cleanse, moisturize and safeguard the skin. This category encompasses products such as cleansers, moisturizers, serums, sunscreens, and anti aging creams that cater to skin concerns like acne or dryness. Haircare products primarily focus on maintaining visually appealing hair. This category includes shampoos, conditioners, hair treatments, styling products, and hair coloring options. The aim of these products is to cleanse the hair while providing nourishment and allowing individuals to achieve their desired look while keeping their hair healthy. Makeup products are created with the intention of enhancing or altering one's appearance. Within this category, you can find foundations, concealers eyeshadows lipsticks mascaras among others that allow people to experiment with looks ranging from natural and subtle to dramatic expressions. Last but not least important are fragrances which encompass perfumes colognes scented lotions among options in a wide variety of scent concentrations, for personalized preferences aiming at enhancing one personal scent and leaving a memorable impact.

Market Segmentation: By End User Type:

- Male

- Female

According to customer preferences the luxury cosmetics market is divided into categories, for both men and women. However, it is the segment that holds a position in this industry. Women tend to have skincare regimens, which involve using cleansers, moisturizers, serums, and specialized products such, as anti aging creams and masks. The section dedicated to makeup, for women offers a range of products like foundations, concealers, eyeshadows, lipsticks, and more. These options cater to occasions and styles. On the other hand, skincare products designed specifically for men focus on simplicity and practicality. They usually include cleansers, moisturizers, and shaving related items. Men's grooming products cover essentials such, as shaving creams, razors, and aftershave that address facial hair care requirements.

Market Segmentation: By Distribution Channel:

- E-commerce

- Supermarket/Hypermarket

- Specialty Stores

- Others

The global luxury cosmetics market is divided into distribution channels, including e commerce supermarkets/hypermarkets, specialty stores, and others. Among these specialty stores hold the market share in terms of revenue. Specialty stores refer to retailers that focus on beauty and cosmetics. They include stores, beauty sections, department stores, and beauty boutiques. These stores offer a curated selection of cosmetics and skincare products often featuring end and luxury brands. One of their advantages is providing a shopping experience with knowledgeable staff who can offer in store beauty consultations. On the other hand, supermarkets and hypermarkets are brick and mortar retailers that sell a wide range of consumer goods, including cosmetics. They are known for their convenience and accessibility when it comes to purchasing beauty products like shampoo, soap, and basic makeup items. In years e commerce or online retail has witnessed growth in the cosmetics industry. Consumers now have the convenience of purchasing beauty products from websites or online marketplaces while enjoying access to a range of products from brands. Additionally, e commerce platforms provide product information along, with customer reviews while offering personalized recommendations based on preferences.

Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Europe has emerged as the region capturing the market share in 2023. Throughout history, European nations such, as France and Italy have been known for their use of cosmetics and involvement in beauty rituals. Prestigious companies like Chanel, L'Oréal, and Estée Lauder have roots in these countries. The field of cosmetics sees innovation and research concentrated in Europe with cutting edge research institutes and laboratories driving the creation of groundbreaking skincare and cosmetic formulas. The diverse needs of the Europes population when it comes to skincare and cosmetics contribute to a business environment. Brands frequently cater to a range of skin types, preferences, and tones found in Europe. Additionally, many high end cosmetics companies with brands are headquartered on the continent. Cities like Paris and Milan are renowned for their fashion and beauty industries which attract customers seeking exclusivity and luxury. Furthermore, the e commerce boom, across Europe has further bolstered the cosmetics sector. There is a range of beauty products that're readily available, to consumers online throughout the continent contributing to the growth of the market. However, the Asia-Pacific region is anticipated to grow faster during the forecast period.

COVID-19 Impact Analysis on the Global Luxury Cosmetics Market:

The regional market faced challenges due, to COVID-19 in 2020. The luxury cosmetics market in the APAC region was negatively affected by the increasing number of COVID-19 cases, which impacted aspects like workforce availability, supply of materials and intermediate food products as well as trade and logistics. This led to fluctuations in demand and supply and uncertain consumer behavior in the luxury cosmetics market. However with the introduction of COVID-19 vaccines, in 2021 and people following measures the market is now recovering as production resumes. As a result, it is expected that the regional luxury cosmetics market will experience growth during the forecast period.

Latest Trends/ Developments:

The market, for luxury cosmetics is experiencing growth due to factors. One of the drivers is the increasing income of individuals particularly in developing regions. People are becoming more aware of the benefits associated with using luxury cosmetics leading to a demand for products. Furthermore, the expansion of e commerce globally has made luxury cosmetics more accessible through both offline channels. Another positive influence on the market is the rising demand for halal cosmetics, which are known for their ingredients and proven vegan formulations. Additionally, consumers are turning to luxury cosmetics to address hair and skin issues like hair fall, dandruff, skin rashes, and acne. This presents opportunities for investors, in the industry. Additionally, major players, in the market are investing significantly in conducting research and development (R&D) initiatives to introduce premium cosmetics, fragrances, and oral care products. This is driving the demand for luxury cosmetics. Moreover, there is a growing interest among fashion professionals, in high quality color cosmetic products, which is contributing to the market expansion.

Key Players:

- L'Oréal Group

- LVMH SE

- Shiseido Company Limited

- Puig SL

- Oriflame Cosmetics AG

- Estee Lauder Companies, Inc.

- Coty, Inc. (JAB Cosmetics B.V.)

- Revlon, Inc. (MacAndrews & Forbes)

- Avon Products, Inc.

- Ralph Lauren Corporation

Chapter 1. Global Luxury Cosmetics Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Luxury Cosmetics Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Global Luxury Cosmetics Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Luxury Cosmetics Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Luxury Cosmetics Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Luxury Cosmetics Market – By Type

6.1. Coventional

6.2. Organic

Chapter 7. Global Luxury Cosmetics Market – By Product Type

7.1. Skincare

7.2. Haircare

7.3. Makeup

7.4. Fragnances

Chapter 8. Global Luxury Cosmetics Market – By End User Type

8.1. Male

8.2. Female

Chapter 9. Global Luxury Cosmetics Market – By Distribution Channel

9.1. E-commerce

9.2. Supermarket/Hypermarket

9.3. Specialty Stores

9.4. Others

Chapter 10. Global Luxury Cosmetics Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Type

10.1.3. By Product Type

10.1.4. By End-user Type

10.1.5. Distribution Channel

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By Product Type

10.2.4. By End User Type

10.2.5. Distribution Channel

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Type

10.3.3. By Product Type

10.3.4. By End User Type

10.3.5. Distribution Channel

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Type

10.4.3. By Product Type

10.4.4. By End-User Type

10.4.5. Distribution Channel

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Type

10.5.3. By Product Type

10.5.4. By End-user Type

10.6.5. Distribution Channel

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Luxury Cosmetics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1. L'Oréal Group

11.2. LVMH SE

11.3. Shiseido Company Limited

11.4. Puig SL

11.5. Oriflame Cosmetics AG

11.6. Estee Lauder Companies, Inc.

11.7. Coty, Inc. (JAB Cosmetics B.V.)

11.8. Revlon, Inc. (MacAndrews & Forbes)

11.9. Avon Products, Inc.

11.10. Ralph Lauren Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Luxury Cosmetics Market was valued at USD 50.01 billion and is projected to reach a market size of USD 70.6 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.06%.

Customer Requirements for Expensive Goods, and Increasing Net Worth are the Global Luxury Cosmetics Market drivers.

Based on Type, the Global Luxury Cosmetics Market is segmented into Organic and Conventional.

Europe is the most dominant region for the Global Luxury Cosmetics Market.

L'Oréal Group, LVMH SE, Shiseido Company Limited, Puig SL, Oriflame Cosmetics AG, and Estee Lauder Companies, Inc. are the key players operating in the Global Luxury Cosmetics Market.