LTE CPE Market Size (2024 – 2030)

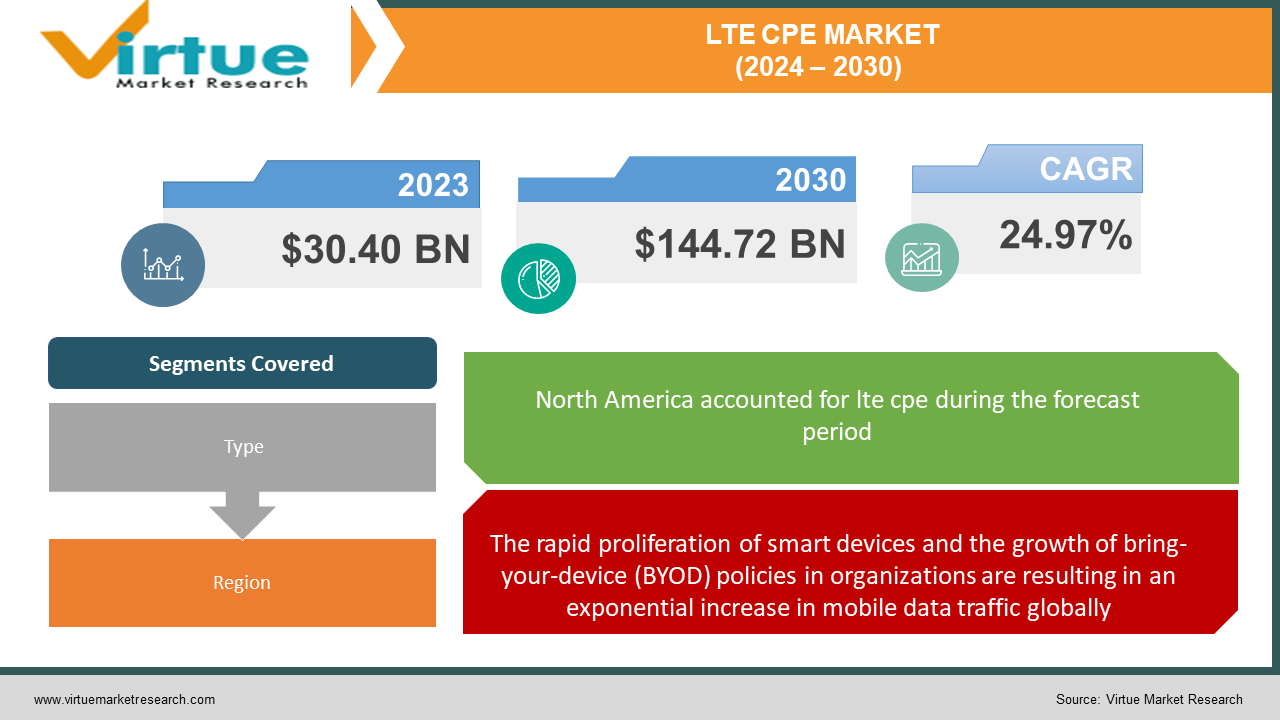

The LTE CPE market was valued at USD 30.40 billion in 2023 and is projected to reach a market size of USD 144.72 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 24.97%.

LTE-CPE devices are a powerful solution for providing internet connectivity in areas where traditional wired broadband lacks feasibility or reaches its limits. Many rural or underserved areas still lack high-speed wired internet infrastructure. LTE CPEs provide a fast and cost-effective way to bridge that divide. Telecommuting and work-from-home policies fuel the demand for reliable home internet solutions in areas where wired broadband may be inconsistent. As 5G networks expand along with 4G LTE, CPE technology benefits from improved speeds and lower latency, boosting its usability as a primary internet connection. For businesses, an LTE CPE provides a powerful backup internet connection. This ensures minimal downtime in the event of outages with wired services. CPEs support growing applications in the Internet of Things (IoT) realm, offering connectivity for smart homes, industrial sensors, and various smart city technologies.

Key Market Insights:

Underserved and rural areas lacking established fiber infrastructure create immense opportunities for LTE CPEs, bridging the gap in reliable internet access for populations traditionally left behind. Compared to laying cable or fiber in sparsely populated regions, wireless infrastructure built around LTE CPEs brings faster ROI for carriers while remaining an appealing option for cost-conscious consumers. Setting up LTE CPE installations is far simpler and less time-consuming, enabling service providers to quickly connect geographically dispersed customers. Companies compete by offering internet service packages combined with LTE CPE devices, increasing accessibility for those without pre-existing hardware. While established providers dominate, local or regional providers utilize LTE CPEs as a tool to break into and service less densely populated areas more nimbly than larger enterprises. LTE CPE will see significant demand across areas yet to have a full 5G infrastructure rollout. Serving as a bridging solution for faster 4G networks in such locations. The introduction of 5G-enabled CPEs is on the horizon, promising future growth for this market segment. Devices with built-in compatibility or upgrade paths are already emerging.

LTE CPE Market Drivers:

The rapid proliferation of smart devices and the growth of bring-your-device (BYOD) policies in organizations are resulting in an exponential increase in mobile data traffic globally.

The proliferation of smart devices and mobility has led to an explosion of data traffic from enterprises, and wireless carriers are struggling to support this surge. As per estimates, global mobile data traffic is expected to expand at a compounded annual rate of around 40% until 2025. While 4G LTE networks still handle the majority of mobile traffic, 5G networks will help with capacity challenges to some extent. Expanding and upgrading LTE infrastructure requires investments in densification through small cells and CPE equipment upgrades. That's where LTE customer premises equipment (CPE), like fixed wireless routers and gateways, plays a crucial role. LTE CPE potentially offers downlink speeds averaging around 100 Mbps and uplink speeds of 50 Mbps on supported frequency bands. This enables enterprises to provision for current and future growth in Wi-Fi data, devices, and connections. The onboarding of new sites or temporary venues also becomes simpler through LTE CPE deployment. Additionally, growing BYOD adoption in workplaces adds a capacity load on networks. Employees connecting personal mobile devices, tablets, and laptops to enterprise networks for work-from-anywhere access or hybrid office environments increase traffic exponentially. Without adequate LTE access points and CPE equipment like Wi-Fi routers, bandwidth bottlenecks can severely impact productivity.

Battery-powered LTE CPE routers provide plug-and-play flexibility to change networks easily with lower cabling costs. Their declining hardware costs, coupled with their energy efficiency, make them attractive for modern workplaces.

For enterprises, expanding wired network connectivity across locations can be an expensive proposition with significant cabling costs and complex installations. Business agility also suffers due to a lack of flexibility in reconfiguring office layouts or adding temporary sites. This is where LTE customer premises equipment (CPE) like routers and gateways provide an edge over traditional Wi-Fi access points. LTE CPE solutions are quick and easy to deploy, requiring only power sockets for setup. The connectivity is provided over the mobile network, eliminating cumbersome LAN cabling. For sites with existing Wi-Fi infrastructure, LTE CPE creates an overlay augmented capacity layer without replacing legacy setups. Such flexibility and convenience provide tangible total cost of ownership benefits in terms of capital and operational expenses. From an energy utilization perspective, LTE CPE solutions are also very efficient for multiple reasons. Firstly, their low transmit power consumption reduces reliance on UPS backups. Secondly, advanced power-saving protocols adjust router transmission energy dynamically based on data traffic load. This leads to major battery power savings—important in case of power outages. Centralized cloud management allows remote diagnosis of network issues, firmware upgrades, and performance monitoring without dispatching IT staff to every location. Overall, when the total cost of networking entire commercial premises is analyzed, LTE CPE not only offers mobility but also noteworthy cost and energy efficiency—crucial drivers spurring adoption globally.

LTE CPE Market Restraints and Challenges:

While LTE networks provide good wide-area coverage, indoor signals often suffer attenuation and weak penetration within buildings.

The radio signals from outdoor LTE macro cell towers often face penetration challenges reaching indoor environments, leading to patchy coverage and weak bandwidth in premises like high-rise offices, factories, warehouses, etc. Attenuation is quite pronounced given floor heights, construction materials, metallic equipment, etc. Outdoor signals can have strengths of -50 to -70 dBm, and indoor signals drop to anywhere between -80 and -100 dBm. Such low signal levels make it difficult for LTE CPE devices like routers and gateways placed deeply inside buildings to maintain reliable and high-speed connectivity. Bandwidth throttling and intermittent connectivity issues then abound, manifested in the form of lag, buffering, and congestion when multiple devices try accessing the network concurrently. This leads to severe impairments in running latency-sensitive enterprise applications. Mitigating such indoor coverage issues requires deploying additional infrastructure like small cells, distributed antenna systems with remote radio heads, or dedicated in-building repeaters. These ancillary installations involve further CAPEX and installation complexity, which can constrain LTE CPE adoption by businesses sensitive to connectivity quality and budgets.

One of the biggest challenges in LTE networked equipment for high-impact enterprises is addressing security concerns and reliability issues.

Many enterprises, especially in sectors like banking and financial services, are wary of the security vulnerabilities that adopting LTE networked equipment can expose networks to. Threat vectors like unauthorized access, data leaks, and malware attacks cause apprehension. Such high-impact firms require assurance of measures like intrusion detection, anomaly identification, active blocking of identified threats, etc. in commercial networking equipment, including routers and gateways. Legacy appliances often come with embedded capabilities to give IT administrators control over securing network integrity. In the case of LTE CPE, the connectivity reliance on external mobile networks makes certain customers uneasy because safeguards may lie outside their purview. Hacking SIM cards or exploiting vulnerabilities in carrier-grade infrastructure puts confidential data flowing through CPE equipment at risk. Additionally, relying on LTE connectivity makes some enterprises doubt service reliability during emergencies when cellular networks face congestion or where priority access privileges are unclear. However, contemporary CPE equipment does come equipped with sophisticated embedded firewalls, intrusion detection abilities, dual SIM or network capability for redundancy, VPN tunnel support, etc. Manufacturers need to pitch the future-proof security merits better to customers. Solutions such as network slicing offer private APN-type provisioning at the operator infrastructure level, enabling prioritized business connections that are resistant to throttling even in circumstances involving crowded public networks. Such innovations can effectively address enterprise concerns around security and emergency reliability that have conventionally hindered the uptake of LTE equipment.

LTE CPE Market Opportunities:

Music festivals, conferences, trade expos and other events held at third-party venues need instant connectivity infrastructure for attendees. LTE-based Wi-Fi routers and point-of-sale systems provide flexible short-term networking without extensive installation overheads for organizers. Police and federal agencies often conduct surveillance and coordinate responses securely across provisional locations where fixed network options are challenging or time-consuming to deploy. Rugged LTE gateways facilitate portability and encrypted data transfers to address such demands. Rural electric utilities that distribute solar and wind projects at remote sites can leverage carrier LTE ubiquity for connecting sensors, monitoring panels, etc. to analyze plant performance metrics. LTE's low-power features suit such perpetually-on-use case needs perfectly. The mining industry is looking to embrace automation and IoT to improve productivity and optimize operations using technologies like autonomous haul trucks, digital twins, and remote mining. This will require upgrading connectivity infrastructure from legacy to LTE before progressing to 5G across vast, hard-to-access sites. LTE routers and gateways thus provide a necessary bridging adoption opportunity.

LTE CPE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

24.97% |

|

Segments Covered |

By Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Huawei, ZTE, Nokia, Netgear, Cradlepoint, Gemtek Inseego, D-Link |

LTE CPE Market Segmentation: By Type

-

Indoor CPE

-

Outdoor CPE

-

Portable/Mobile CPE

Indoor CPE accounts for the largest market share, around 60–70%. This is due to their widespread use in homes and businesses. Indoor CPE is extensively required for stationary, robust broadband solutions within homes and workplaces. This widespread use pattern solidifies its leading market position. With a share of around 20–30%, outdoor CPE is predicted to expand at the fastest rate in the LTE CPE market due to its crucial function in improving network coverage and signal reliability in underdeveloped areas and commercial installations. The portable/mobile CPE segment constitutes a smaller, niche yet continuously growing market share of around 10%.

LTE CPE Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America currently holds the largest share, at around 40%. Demand from underserved regions, growing efforts for fixed wireless connections, and the uptake of IoT technologies are the main drivers of this. Europe is a close contender with an approximately 30% share. Focus on bridging the digital divide in rural zones and interest in advanced CPE for smart homes and industrial use fuel this region. Asia-Pacific is the fastest-developing market, with a share of around 20%. This region's growing focus on fixed wireless and dense city centers supporting IoT growth drives regional interest. The rest of the world, Latin America, the Middle East, and Africa represent a smaller but evolving market segment. There is room for significant growth, particularly in underserved areas where LTE CPE solutions become increasingly critical.

COVID-19 Impact Analysis on the LTE CPE Market.

Pandemic-induced lockdowns illuminated the digital divide more starkly than ever. LTE CPE devices acted as rapid response solutions to keep students, remote workers, and businesses in less connected areas from being left entirely offline. Governments and providers subsidize devices in some regions, stimulating greater adoption. Decentralized businesses were less vulnerable during the pandemic's disruptions. As work-from-home became the norm for many, demand for powerful LTE CPE connections in areas underserved by traditional broadband surged. Even as office work partially returns, hybrid models still support greater demand for flexible and reliable home internet setups. Homebound consumers spend more time and resources improving their environments. IoT-enabled smart home devices have become more sought-after. LTE-CPE provided these systems with high-bandwidth wireless connectivity. Supply chain challenges ignited a fresh focus on local and regional manufacturing solutions for LTE CPE equipment. It promoted research into hardware components less reliant on international transport, making some device production more robust in the long term.

Latest Trends/ Developments:

Devices evolving beyond current LTE-Advanced technologies embrace 5G capabilities for significantly faster speeds, lower latency, and expanded device capacity. This unlocks the potential for near-seamless competition with traditional wired broadband services. While previously focused on underserved areas, the increased range and bandwidth of 5G make it attractive in dense urban cores. Dense cities can gain additional coverage with strategic wireless CPE deployments, increasing their capacity and offering additional flexibility in providing service. Advancements in technology open up additional frequency bands beyond the typical spectrum, increasing potential capacity. Millimeter wave (mmWave) usage shows exciting potential, especially for supporting smart city infrastructure. LTE CPE moves from primarily a connectivity solution to a smart home hub. Devices offer integrated networking capabilities for Wi-Fi, Bluetooth, or Zigbee. These enable the management of a vast array of smart devices for security, appliances, and home management. LTE-CPE devices increasingly feature integrated voice recognition technology and compatibility with various virtual assistants. This further centralizes device control and unlocks voice-activated commands within the smart home environment.

Key Players:

-

Huawei

-

ZTE

-

Nokia

-

Netgear

-

Cradlepoint

-

Gemtek

-

Inseego

-

D-Link

Chapter 1. LTE CPE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. LTE CPE MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. LTE CPE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. LTE CPE MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. LTE CPE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. LTE CPE MARKET – By Type

6.1 Introduction/Key Findings

6.2 Indoor CPE

6.3 Outdoor CPE

6.4 Portable/Mobile CPE

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. LTE CPE MARKET , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By Type

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By Type

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By Type

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By Type

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By Type

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. LTE CPE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Huawei

8.2 ZTE

8.3 Nokia

8.4 Netgear

8.5 Cradlepoint

8.6 Gemtek

8.7 Inseego

8.8 D-Link

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The rapid proliferation of smart devices and growth in bring-your-own-device (BYOD) policies in organizations, along with declining hardware costs coupled with energy efficiency, are the main market drivers.

Attenuation and weak penetration, along with security concerns and reliability issues, are the major barriers that the market is currently facing.

Huawei, ZTE, Nokia, Netgear, Cradlepoint, and Gemtek are the key players.

North America currently holds the largest market share, estimated at around 40%.

Asia-Pacific exhibits the fastest growth, driven by its increasing population and expanding economy.