LOW-SULFUR FUEL OIL MARKET (2024 - 2030)

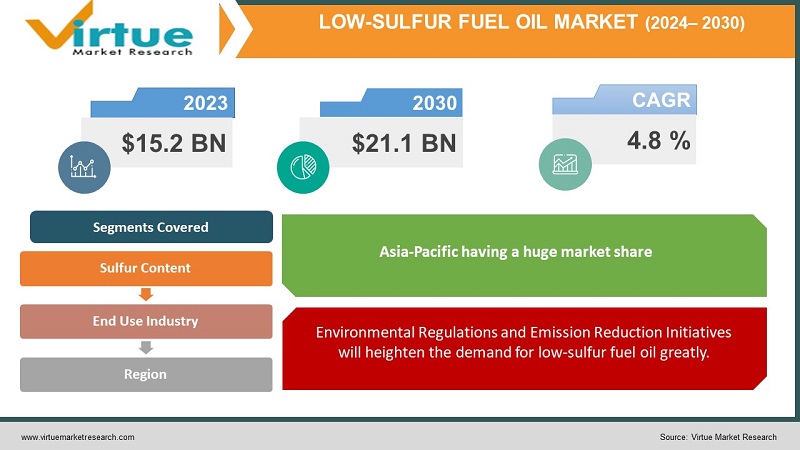

The Global Low-Sulfur Fuel Oil Market was valued at USD 15.2 billion and is projected to reach a market size of USD 21.1 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.8%.

The low-sulfur fuel oil market is a crucial segment of the global energy industry, characterized by the production and consumption of fuel oils with significantly reduced sulfur content. This market has witnessed substantial growth and transformation due to stringent environmental regulations, such as the International Maritime Organization's (IMO) sulfur cap regulations. These regulations require ships to use low-sulfur fuel oils to reduce air pollution, driving demand for cleaner fuels. The low-sulfur fuel oil market has become increasingly important in the context of reducing greenhouse gas emissions and mitigating climate change, with various industries and transportation sectors transitioning towards low-sulfur options, including marine vessels and power generation facilities. This market continues to evolve as technology and innovation play a pivotal role in the development of cleaner and more sustainable fuel oil solutions.

Key Market Insights:

Low-sulfur fuel oil is currently in high demand and is widely traded due to recent International Maritime Organisation regulations limiting sulfur content in fuel oil to just 0.5% S. This byproduct of oil distillation serves as a primary fuel source for maritime vessels and finds applications in electricity generation. The global fuel oil market is robust, with daily demand exceeding 7 million barrels, and approximately half of this demand, around 3.5 million barrels, comes from ship bunkers.

China stands out as a major player in both the production and consumption of low-sulfur fuel oil, thanks to its growing economy. This presents active trading opportunities in the fuel oil market. China, for instance, imports a staggering 12.8 million barrels of oil and oil products daily, with Europe following closely at 12.6 million barrels, and the United States in third place with imports of 7.8 million barrels per day. Notably, China's exports of low-sulfur marine fuels increased by 38% in March compared to the previous year, while monthly fuel oil imports reached a ten-year high.

Low-sulfur Fuel Oil Market Drivers:

Environmental Regulations and Emission Reduction Initiatives will heighten the demand for low-sulfur fuel oil greatly.

Stringent environmental regulations, particularly those related to air quality and greenhouse gas emissions, are a major driver of the low-sulfur fuel oil market. The International Maritime Organization (IMO), for example, has imposed strict limits on sulfur content in marine fuels, requiring ships to use low-sulfur fuel oils to reduce sulfur dioxide emissions. Similarly, many countries and regions have implemented emissions reduction targets and regulations that encourage the use of cleaner fuels with lower sulfur content. These regulations create a strong incentive for industries, transportation, and power generation sectors to adopt low-sulfur fuel oil, driving market demand.

A notable driver in the low-sulfur fuel oil market is the global shift towards sustainable and cleaner energy sources.

The global shift toward cleaner and more sustainable energy sources is another driving force behind the low-sulfur fuel oil market. As the world grapples with the consequences of climate change and the need to reduce carbon emissions, industries and transportation sectors are actively seeking environmentally friendly alternatives. Low-sulfur fuel oil, with its reduced sulfur content and lower emissions of sulfur dioxide, is considered a more eco-friendly choice. This shift towards sustainability is not limited to environmental concerns but also encompasses corporate social responsibility and public demand for cleaner energy options. As a result, industries are increasingly adopting low-sulfur fuel oil to align with these sustainability goals and reduce their environmental footprint, further boosting the market's growth.

Low-sulfur Fuel Oil Market Restraints and Challenges:

Compliance and Quality Assurance pose a significant challenge for Low-sulfur Fuel Oil Market.

The implementation of stringent sulfur emissions regulations, such as the International Maritime Organization's (IMO) sulfur cap, poses a considerable challenge for both fuel producers and consumers. The industry must adapt to produce and supply low-sulfur fuel oils that meet these regulations while ensuring consistent quality. Meeting these compliance standards necessitates rigorous quality control measures throughout the supply chain to prevent sulfur content variations, as non-compliance can result in substantial fines and penalties. Additionally, fuel quality can impact engine performance and emissions, making quality assurance a critical aspect of market operation.

Transition and Infrastructure Costs where low-sulfur fuel oil is used might fluctuate the market growth.

Transitioning to low-sulfur fuel oils often requires significant investments in infrastructure and technology. Refineries and fuel production facilities need to be upgraded or retrofitted to produce lower sulfur fuels. Similarly, transportation and storage infrastructure must be adapted to handle and distribute these cleaner fuels. These investments can be substantial, and the associated costs may be passed on to consumers, potentially affecting the economics of the entire supply chain. The transition to low-sulfur fuel oils can lead to logistical challenges in ensuring a continuous and reliable supply, particularly in regions where infrastructure updates are slower to materialize, posing operational and economic challenges for the industry.

Low-sulfur Fuel Oil Market Opportunities:

The low-sulfur fuel oil market presents promising opportunities, driven by the global commitment to reducing sulfur emissions and mitigating climate change. As more stringent environmental regulations come into effect, such as the IMO's sulfur cap for maritime fuels, there is a growing demand for low-sulfur alternatives. This demand is fostering innovation in cleaner fuel production technologies, as well as the development of alternative fuels like hydrogen and biofuels. The shift towards sustainable energy sources and the increasing adoption of low-sulfur fuels in various sectors, including transportation and power generation, offer avenues for market expansion. As the world focuses on reducing its carbon footprint, the low-sulfur fuel oil market is poised for continued growth and diversification.

LOW-SULFUR FUEL OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.8 % |

|

Segments Covered |

By Sulfur Content, End Use Industry and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Exxon Mobil, Royal Dutch Shell, BP Plc Marathon Petroleum Company, Chevron Corporation, Saudi Arabian Oil Co. (Saudi Aramco), China Petroleum & Chemical Corporation (Sinopec), LUKOIL, Valero Energy Corporation, Neste Oil |

Low-sulfur Fuel Oil Market Segmentation:

Low-sulfur Fuel Oil Market Segmentation: By Sulfur Content:

-

Ultra-Low-sulfur Fuel Oil (ULSFO)

-

Low-sulfur Fuel Oil (LSFO)

-

Very Low-sulfur Fuel Oil (VLSFO)

-

Marine Gas Oil (MGO)

The largest segment by sulfur content in the low-sulfur fuel oil market is the Very Low-sulfur Fuel Oil holding a market share of 41.8%. This is due to strict regulations, such as the International Maritime Organization's (IMO) sulfur cap, which mandates significantly reduced sulfur content in maritime fuels. VLSFO, with sulfur content below 0.5%, has become the preferred choice for the shipping industry to comply with these regulations. This transition to very low-sulfur fuel oil has driven substantial demand, as it offers a balance between compliance and cost-effectiveness, meeting environmental requirements while minimizing the operational impact on vessels and associated infrastructure, making it the dominant segment in the market. The fastest-growing segment by sulfur content is the Ultra-Low-sulfur Fuel Oil expected to grow at a CAGR of 25.6%, due to increasingly stringent environmental regulations. ULSFO, with its minimal sulfur content, not only helps vessels comply with these regulations but also offers reduced emissions, including sulfur dioxide and particulate matter, contributing to improved air quality and reduced environmental impact. As environmental concerns and regulations continue to drive the need for cleaner energy sources, ULSFO is poised for substantial growth, especially in the maritime sector.

Low-sulfur Fuel Oil Market Segmentation: By End Use Industry:

-

Marine

-

Power Generation

-

Industrial

-

Transportation

-

Residential and Commercial

The largest segment in the low-sulfur fuel oil market by end-use industry is the maritime sector, particularly shipping having a significant share of 68.5%. This dominance is driven by the International Maritime Organization's (IMO) sulfur regulations that mandate the use of low-sulfur fuels in the shipping industry to reduce harmful emissions and air pollution. As the maritime sector relies heavily on heavy fuel oil, the transition to low-sulfur alternatives like Very Low-sulfur Fuel Oil (VLSFO) and Ultra-Low-sulfur Fuel Oil (ULSFO) has been essential for regulatory compliance. With a vast number of vessels worldwide, including container ships, tankers, and cruise liners, the shipping industry's substantial demand for low-sulfur fuel oil significantly outweighs other end-use sectors in the market. The fastest-growing segment is also the marine sector growing at a fast rate of 28.7%. This growth is due to the International Maritime Organization's (IMO) stringent sulfur emissions regulations, which have mandated the use of low-sulfur fuels in the shipping industry to reduce air pollution and mitigate environmental impact. The demand for compliant fuels, such as Very Low-sulfur Fuel Oil and Marine Gas Oil, has surged as ship operators seek to meet these regulations. The maritime sector's increasing focus on sustainability and environmental responsibility further fuels the adoption of low-sulfur fuels, making it the fastest-growing end-use industry segment in the market.

Low-sulfur Fuel Oil Market Segmentation: Regional Analysis:

-

North America

-

Asia- Pacific

-

Europe

-

South America

-

Middle East and Africa

The largest region in the low-sulfur fuel oil market is Asia-Pacific having a huge market share of 41%. This dominance can be attributed to several factors, including the region's robust industrial and economic growth, a significant share of the global shipping industry, and the implementation of stringent environmental regulations, such as the IMO's sulfur cap, which have driven the adoption of low-sulfur fuels. The region's expanding population and increasing energy demand have further bolstered the demand for cleaner fuels in various sectors, making Asia-Pacific a pivotal hub for the low-sulfur fuel oil market. The Asia-Pacific region is also experiencing the fastest growth in the low-sulfur fuel oil market poised to grow at a CAGR of 26.3%, attributed to several factors, including the rapid industrialization, expanding shipping industry, and increasing adoption of low-sulfur fuels in countries like China and India. Stringent emissions regulations and a growing environmental awareness are driving demand for cleaner fuels in the region. As a result, the Asia-Pacific region is witnessing significant market expansion as it strives to reduce sulfur emissions and promote sustainable energy sources, particularly in the maritime and transportation sectors.

COVID-19 Impact Analysis on the Global Low-sulfur Fuel Oil Market:

The global Low-sulfur Fuel Oil market experienced a notable impact due to the COVID-19 pandemic. The lockdowns, travel restrictions, and economic slowdown significantly reduced demand for transportation fuels, leading to an initial oversupply of low-sulfur fuel oil in early 2020. However, as international shipping and industrial activities gradually resumed, the implementation of stringent sulfur emissions regulations like the International Maritime Organization's sulfur cap continued to drive the demand for low-sulfur fuels. The market's resilience stems from its critical role in emissions reduction efforts, and the long-term outlook remains positive as industries prioritize cleaner fuels to comply with environmental regulations and reduce their carbon footprint.

Latest Trends/ Developments:

A prominent trend in the low-sulfur fuel oil market is the integration of green hydrogen as a fuel additive. Green hydrogen, produced through renewable energy-driven electrolysis, is gaining attention as a means to reduce the carbon footprint of fuel consumption. When blended with low-sulfur fuel oils, green hydrogen can significantly lower emissions, making it an attractive option for the maritime and power generation sectors. The trend reflects the growing emphasis on decarbonization and achieving net-zero emissions, leading to partnerships and investments in green hydrogen production and its integration into low-sulfur fuel oil formulations.

One significant development in the low-sulfur fuel oil market is the continuous advancement of emission control technologies. To meet stringent environmental regulations and reduce sulfur oxide and nitrogen oxide emissions, the industry is investing in innovative solutions such as exhaust gas cleaning systems and selective catalytic reduction systems. These technologies are being refined and optimized to enhance their effectiveness and efficiency in removing pollutants, ensuring compliance with emissions limits while minimizing operational disruptions and environmental impact. This development underscores the industry's commitment to cleaner fuel combustion and emissions reduction.

Key Players:

-

Exxon Mobil

-

Royal Dutch Shell

-

BP Plc

-

Marathon Petroleum Company

-

Chevron Corporation

-

Saudi Arabian Oil Co. (Saudi Aramco)

-

China Petroleum & Chemical Corporation (Sinopec)

-

LUKOIL

-

Valero Energy Corporation

-

Neste Oil

Chapter 1. GLOBAL LOW-SULFUR FUEL OIL MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL LOW-SULFUR FUEL OIL MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL LOW-SULFUR FUEL OIL MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL LOW-SULFUR FUEL OIL MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL LOW-SULFUR FUEL OIL MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL LOW-SULFUR FUEL OIL MARKET – By Sulfur Content

6.1. Ultra-Low-sulfur Fuel Oil (ULSFO)

6.2. Low-sulfur Fuel Oil (LSFO)

6.3. Very Low-sulfur Fuel Oil (VLSFO)

6.4. Marine Gas Oil (MGO)

Chapter 7. GLOBAL LOW-SULFUR FUEL OIL MARKET – By End Use Industry

7.1. Marine

7.2. Power Generation

7.3. Industrial

7.4. Transportation

7.5. Residential and Commercial

Chapter 8. GLOBAL LOW-SULFUR FUEL OIL MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End User

8.1.3. By Distribution Channel

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Sulfur Content

8.2.3. By End Use Industry

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Sulfur Content

8.3.3. By End Use Industry

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1st of South America

8.4.2. By Sulfur Content

8.4.3. By End Use Industry

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Sulfur Content

8.5.3. By End Use Industry

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL LOW-SULFUR FUEL OIL MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Exxon Mobil

9.2. Royal Dutch Shell

9.3. BP Plc

9.4. Marathon Petroleum Company

9.5. Chevron Corporation

9.6. Saudi Arabian Oil Co. (Saudi Aramco)

9.7. China Petroleum & Chemical Corporation (Sinopec)

9.8. LUKOIL

9.9. Valero Energy Corporation

9.10. Neste Oil

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Low-Sulfur Fuel Oil Market was valued at USD 15.2 billion and is projected to reach a market size of USD 21.1 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.8%.

Environmental Regulations and Emission Reduction Initiatives and the global shift towards sustainable and cleaner energy sources are drivers of the Low-sulfur Fuel Oil market.

Based on the end-use industry, the Global Low-sulfur Fuel Oil Market is segmented into Marine, Power Generation, Industrial, Transportation, Residential, and Commercial.

Asia Pacific is the most dominant region for the Global Low-sulfur Fuel Oil Market.

Exxon Mobil, Royal Dutch Shell, BP Plc, Marathon Petroleum Company, and Chevron Corporation are a few of the key players operating in the Global Low-sulfur Fuel Oil Market.