Low Friction Coatings Market Size (2024 – 2030)

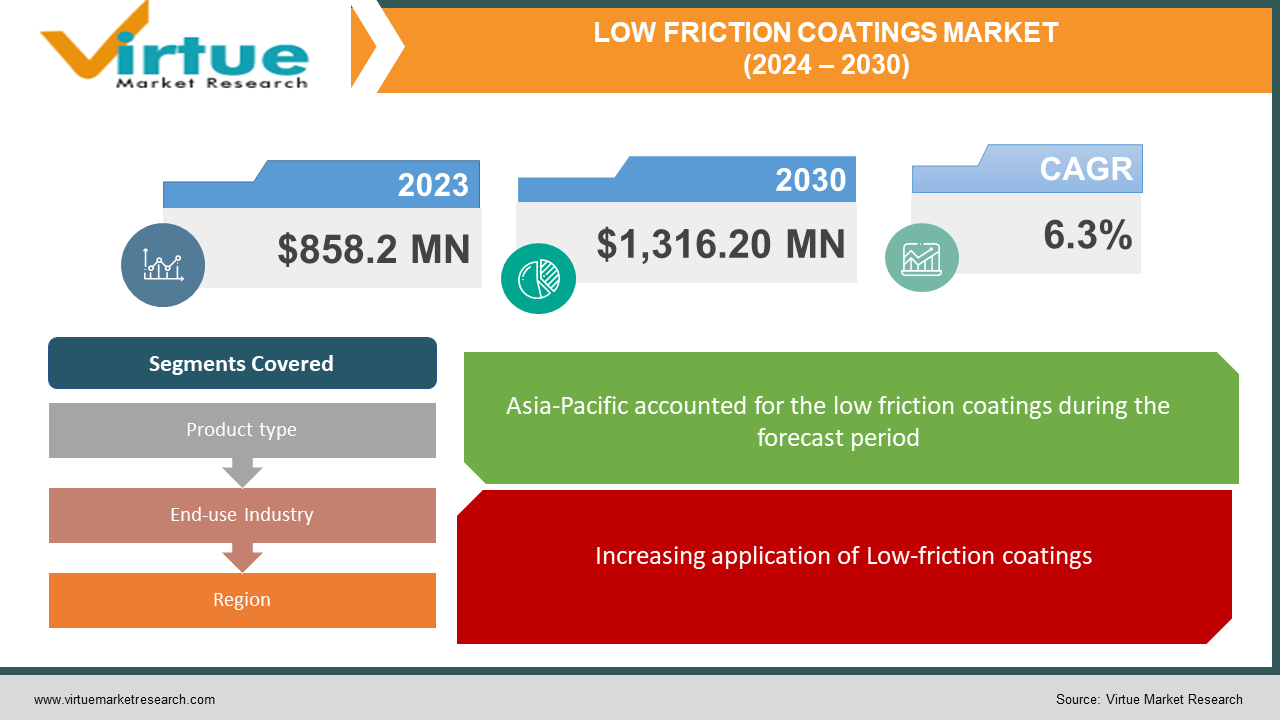

The Low Friction Coatings Market was valued at USD 858.2 million in 2023 and is projected to reach a market size of USD 1,316.20 million by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 6.3%.

Low friction coatings, which are produced from tungsten disulfide, polytetrafluoroethylene, molybdenum disulfide, and others, are utilized to lessen friction between two surfaces. The low friction coatings majorly cut down on material pick-up from the counter surface and the ability to stick, which lowers the amount of downtime needed for cleaning. The low-friction coatings are applied in several end-use industries, involving building & construction, food & beverages, and more. The bolstering transport industry is a significant factor in the development of the low-friction coatings market. Moreover, the booming medical and healthcare sector would propel the demand for low-friction coatings. Resultantly, the low friction coatings market size will widen in the upcoming years.

Key Market Insights:

-

Low friction coatings give bettered performance and service life while dispensing with the necessity for wet lubricants in a working environment that expects safeguarding from heat, synthetic substances, or cleanroom scenarios.

-

Employing low-friction and super-hard coatings in the automotive industry offers a low-friction surface, enhanced fuel economy, durability, and environmental compatibility of modern engine systems. As per the IEA 2021 Outlook, worldwide electric car sales doubled in 2021 and hit 6.6 million. The sales grew strongly in 2022, with 2 million electric cars sold across the world in the first quarter of 2022.

-

The Automotive industry is estimated to grow majorly over the future years. Evolving digital technology, modifications in customer sentiment, and economic health have played a pivotal role in non-commercial business practices of manufacturing vehicles. Hence, due to the elements specified above, the utilization of low-friction coating in the automotive industry is probably to lead in the upcoming years.

Market Drivers:

Increasing application of Low-friction coatings

Low-friction coatings have been increasingly famous in recent years as an impact of their ability to enhance surface features like wettability, corrosion resistance, adhesion, and wear resistance. The growing applications of low-friction coatings in numerous industries are estimated to influence market growth soon. Additionally, low-friction coatings manufacturers are emerging with new products to meet the growing demand for application-specific products. Low-friction thin film coatings, which permit surfaces to rub against one another with less friction and wear, are becoming more known as environmental restrictions on the use of lubricants tighten and disposal costs grow. Resultantly, a low coefficient of friction coating is utilized to develop the tribological qualities of metal cutting and shaping tools, as well as machine fragments such as sliding bearings, seals, and valves, which are constantly strengthening.

Low Friction Coatings Market Restraints and Challenges:

Instability in the Raw Materials Prices

A Low Friction Coatings can be made from multiple basic ingredients, such as acetone, tetrahydrofuran, methanol, trichloroethylene, or a mixture thereof. Reduction and lack of approachability of rarest raw materials, along with considerable price growth, are wreaking havoc in the low friction coatings market. For example, as per the BCF's monthly raw material prices research, the cost of solvent grew the most in January 2021 compared to the older years. Acetone prices upscaled by 123%, n-butyl acetate prices enhanced by 91%, IPA prices increased by 41% and n-butanol prices escalated by 54%. Therefore, the fluctuation in the costs of Low-Friction Coating raw materials is restricting the market growth.

Low Friction Coatings Market Opportunities:

Growing demand for Medical Devices

Low Friction Coatings are utilised on a variety of medical devices, constituting dental, surgical, and others, to push the devices' ability to manoeuvre through tough anatomical paths, develop device control, reduce tissue damage, and improve patient comfort. Critical elements such as product modernizations, new manufacturing facilities, and others are accelerating the development of the medical device industry. For instance, as per the International Trade Administration, the Mexican medical device market exhibited a growth of 10% from the previous year. Furthermore, Canada is the world's eighth-biggest medical device market, valued at roughly USD$8.6 billion. Furthermore, as per Invest India, it is predicted that India’s medical equipment segment will achieve US$50 billion by 2025. Thus, the development of the medical device industry is pushing the demand for Low-Friction Coatings. This, in turn, creates an opportunity to innovate the market.

High Demand in the Automobile and Transportation Industry

Friction Coatings offer better service performance and shelf life. They also ensure the protection of surfaces from synthetic products and heat. Implementation of very hard and low-friction coatings in the automotive sector provides enhanced durability, increased fuel economy, and sustainable compatibility. Economic stability, alterations in consumer sentiment, and evolving digital technology are expected to play a key role in the non-commercial business practices to produce vehicles, which exhibits a direct impact on the demand for Low-Friction Coatings.

LOW FRICTION COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By Product type, End-use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Dow Corning Corporation, The Chemours Company, Whitford Corporation, BECHEM, Endura Coatings, Poeton Industries, Whitmore Manufacturing, LLC, VITRACOAT, AGC Inc ,Everlube |

Low Friction Coatings Market Segmentation: By Product Type

-

Molybdenum Disulphide (MoS2)

-

Tungsten Disulphide (WS2)

-

Polytetrafluoroethylene (PTFE)

-

Perfluoroalkoxy Alkanes (PFA)

-

Fluorinated Ethylene Propylene (FEP)

-

Xylan

-

Graphite

-

Others

The Molybdenum Disulfide (MoS2) product held the biggest Low Friction Coatings Market share and is anticipated to develop at a faster rate during the future period. Molybdenum disulfide (MoS2) low friction coatings generate a protective layer that is dry, clean, and resistant to moisture, oils, greases, dust or other inflames. As an impact of this, molybdenum disulfide (MoS2) low-friction coatings are not prone to aging, evaporation, or oxidation. MoS2 has higher corrosion resistance over Tungsten disulfide. These coatings offer superior rust prevention without the requirement for any surface preparation. Furthermore, molybdenum disulfide coatings offer metals and plastics with a non-flammable, non-staining layer of security. They can achieve precise load-bearing capabilities because a controlled film thickness exists in these low-friction coatings. Due to these advantages of molybdenum disulfide (MoS2), its adoption is growing. This factor is further pushing the Low Friction Coatings market development.

Low Friction Coatings Market Segmentation: By End-use Industry

-

Building & Construction

-

Transport

-

Electrical and Electronics

-

Food & Beverages

-

Medical and Healthcare

-

Chemical

-

Others

The Transport segment dominates the Low Friction Coatings Market share and is estimated to grow at a faster CAGR rate during the upcoming period. Low friction coatings such as tungsten disulfide, polytetrafluoroethylene, molybdenum disulfide, and others are applied in usual transport vehicles such as passenger cars, aircraft, vessels, etc. to majorly prolong the service life of such vehicles by securing their parts from wear and tear. The rising adoption of passenger cars, the widening transport production, and other forces are accelerating the growth of the automotive industry. Hence, the growth of the transport industry is propelling the demand for low-friction coatings. As a result, the Low Friction Coatings market is strengthening.

Low Friction Coatings Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the dominating region in the market owing to its largest Low Friction Coatings Market share (up to 44.4%) in 2023. The economic growth of the Asia-Pacific countries is influenced by the growth of industries such as Automotive, Aerospace, and more. The rising commercial industry, growing disposable income of people, and other such variables are strengthening the automotive and aerospace sector's development in the region. Furthermore, in recent years, the manufacturing of passenger vehicles in the Asia-Pacific region was 35,822,949 units and in the next year, it reached 38,152,172, a growth of 7%. Therefore, the development of the transport industry in Asia-Pacific is required for low-friction coatings. This factor is escalating the growth of the Low Friction Coatings market size.

COVID-19 Impact Analysis on the Low-Friction Coatings Market:

COVID-19 has had a major influence on the global economy in many ways, directly affecting production and demand, resulting in supply chain and market disruption, and having a financial impact on enterprises and financial markets. Because of the pandemic situation, several governments around the world went into lockdown to curb the virus from spreading. Supply and demand chain disturbances caused by lockdowns have a major impact on multiple end-user businesses, including transportation and packaging. However, the scenario improved in 2021, benefiting the market over the estimated period. On the other hand, growing worries about plastic waste and the harmful effects of the COVID-19 epidemic are estimated to stymie the market's development.

Latest Trends and Developments:

Modern facilities coming up in the Food and Manufacturing sector

In the Food & Beverages industry, cleanliness and food compatibility are maintained by utilizing low-friction coatings. They are manufactured to keep sorting, packing, filling, molding, and printing machines & devices for the food industry functioning as efficiently as possible around the clock. The widening of new manufacturing options associated with the food & beverages industry is pushing the food & beverage industry growth. Furthermore, in July 2021, The Interroll food processing and logistics complex in Baal, Germany, began to expand its production capacity and is expected to add approximately 13,000 square meters to the area. By the end of 2022, the plant is estimated to be fully functional. Thus, the new facility development associated with the food & beverages facilities is propelling the demand for machines and components, resulting in the Low Friction Coatings market growth.

Key Players:

-

Dow Corning Corporation

-

The Chemours Company

-

Whitford Corporation

-

BECHEM

-

Endura Coatings

-

Poeton Industries

-

Whitmore Manufacturing, LLC

-

VITRACOAT

-

AGC Inc

-

Everlube

Recent Developments

-

Apticote 480A, a revolutionary Low Friction Coating, was launched by Poeton Industries, a Gloucester-based business. The product integrates the qualities of nickel and fluoropolymer materials to solve various concerns. This product introduction emphasized the widening of Low Friction Coatings.

-

Nippon Paint Marine (NPM), in reaction to the emerging demand for its low-friction hydrogel-containing hull layers, has now combined cutting-edge technology into its usual range of anti-fouling to offer a practical method of reducing fuel usage.

-

PPG purchased Whitford Worldwide Company ("Whitford"), a multinational company with expert skills in low-friction and nonstick coatings for commercial and consumer goods. Financial details weren't made publicly official. This purchase widened the status of PPG in the Low Friction Coatings industry.

Chapter 1. Low Friction Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Low Friction Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Low Friction Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Low Friction Coatings Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Low Friction Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Low Friction Coatings Market – By End-use Industry

6.1 Introduction/Key Findings

6.2 Building & Construction

6.3 Transport

6.4 Electrical and Electronics

6.5 Food & Beverages

6.6 Medical and Healthcare

6.7 Chemical

6.8 Others

6.9 Y-O-Y Growth trend Analysis By End-use Industry

6.10 Absolute $ Opportunity Analysis By End-use Industry , 2024-2030

Chapter 7. Low Friction Coatings Market – By Product Type

7.1 Introduction/Key Findings

7.2 Molybdenum Disulphide (MoS2)

7.3 Tungsten Disulphide (WS2)

7.4 Polytetrafluoroethylene (PTFE)

7.5 Perfluoroalkoxy Alkanes (PFA)

7.6 Fluorinated Ethylene Propylene (FEP)

7.7 Xylan

7.8 Graphite

7.9 Others

7.10 Y-O-Y Growth trend Analysis By Product Type

7.11 Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 8. Low Friction Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-use Industry

8.1.3 By Product Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-use Industry

8.2.3 By Product Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-use Industry

8.3.3 By Product Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-use Industry

8.4.3 By Product Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-use Industry

8.5.3 By Product Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Low Friction Coatings Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Dow Corning Corporation

9.2 The Chemours Company

9.3 Whitford Corporation

9.4 BECHEM

9.5 Endura Coatings

9.6 Poeton Industries

9.7 Whitmore Manufacturing, LLC

9.8 VITRACOAT

9.9 AGC Inc

9.10 Everlube

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Low Friction Coatings Market was valued at USD 858.2 million in 2023 and is projected to reach a market size of USD 1,316.20 million by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 6.3%.

The rising applications of Low Friction Coatings are propelling the Low Friction Coatings Market.

Low Friction Coatings Market is segmented based on Product type, End User Industry, and Region.

Asia-Pacific is the most dominant region for the Low Friction Coatings Market.

Dow Corning Corporation, The Chemours Company, Whitford Corporation, BECHEM, Endura Coatings, and Poeton Industries are a few of the key players operating in the Low Friction Coatings Market.