Low carbon ferromanganese Market Size (2024 – 2030)

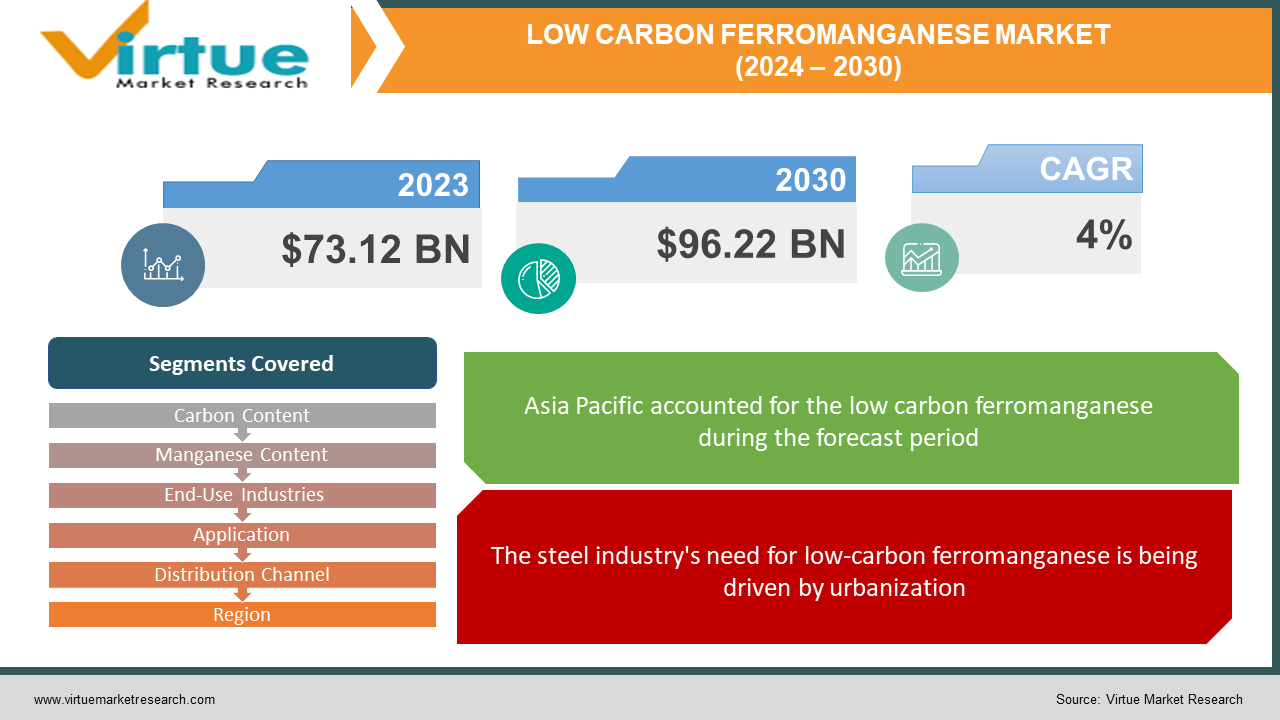

The low-carbon ferromanganese Market was valued at USD 73.12 billion and is projected to reach a market size of USD 96.22 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4%.

A ferromanganese alloy known as low-carbon ferromanganese has a lowered carbon content, usually below a predetermined threshold. This alloy, which consists of iron and manganese, is essential to the creation of alloys and steel. Low-carbon ferromanganese increases the strength and hardness of steel, primarily due to its manganese content. It is effectively utilized as a deoxidizing and desulfurizing chemical in the steelmaking process to eliminate impurities. Notably, its regulated carbon levels mitigate the problems associated with excessive carbon, like brittleness, and make it perfect for applications needing precise manipulation of carbon content. Low-carbon ferromanganese, which is widely employed in alloying operations, improves mechanical and metallurgical qualities and is essential to the manufacturing of high-quality steel and welding applications.

Key Market Insights:

Several factors impact the low-carbon Ferromanganese market, one of which is its crucial function in the steel sector. The need for this alloy is highly dependent on the production of steel worldwide, and changes in the steel market influence its demand. As enterprises look for sustainable steelmaking methods, interest in Low Carbon Ferromanganese may increase due to environmental concerns, particularly those about carbon emissions. Technological developments in the methods used to produce steel can also influence the market environment. A few economic factors, including the expansion of industry and the building of infrastructure, are important in determining demand. The worldwide supply chain, pricing, and availability can all be impacted by changes in trade laws and tariffs, which further complicates the dynamics of the Low Carbon Ferromanganese market.

Low Carbon Ferromanganese Market Drivers:

The steel industry's need for low-carbon ferromanganese is being driven by urbanization.

The Impact of Urbanization on the Need for Low-Carbon Ferromanganese. The global trend towards increased industrialization and urbanization is the primary driver of the requirement for Low Carbon Ferromanganese. The construction of buildings, infrastructure, and manufacturing facilities is growing in step with the industrialization and urbanization of new areas. Steel is a basic material that is highly sought after in various industries to suit structural and production demands. This increased demand for steel helps low-carbon ferromanganese, an essential alloying element in the steel-making process. The potential of the alloy to enhance the properties of steel is consistent with the increasing need for long-lasting and ecologically friendly materials in construction and manufacturing processes linked to worldwide trends in urbanization and industrialization.

Essential Function of Low Carbon Ferromanganese in High-Performance Steel

The Need for High-Performance Steel and the Critical Role of Low-Carbon Ferromanganese The growing need for high-performance steel emphasizes how vital low-carbon ferromanganese is to meet the stringent requirements of significant industries including renewable energy, automotive, and aerospace. The car industry's growing emphasis on safety and fuel efficiency has resulted in a surge in demand for strong but lightweight steel components. The same is true for aerospace applications, where steel that is very strong and long-lasting is required to meet stringent performance standards. Low Carbon Ferromanganese is a crucial alloying element as a result. Furthermore, for the renewable energy sector which includes wind turbines, solar power plants, and electric vehicles to endure hostile environmental conditions, high-performance steel is required.

Adaptable Effect of Ferromanganese with Low Carbon on Steel Quality.

Not only is low-carbon ferromanganese a component of steel, but it also plays a major role in improving the material's toughness, strength, and weldability. This controlled-carbon alloy is essential to the production of the appropriate steel grades and is used in the infrastructure, manufacturing, and construction sectors. The market for low-carbon ferromanganese is still rather strong due to the constant need for steel.

Low Carbon Ferromanganese Market Restraints and Challenges

The market dynamics of Low Carbon Ferromanganese are influenced by many obstacles and limitations. Price fluctuations for raw materials, particularly for manganese and iron ore, cause volatility in production costs, which affects the stability of the market. Recessions and other global economic uncertainty may reduce the steel demand, which in turn may have an impact on the market for low-carbon ferromanganese. Tight environmental rules are driving demand for cleaner alloys, but they also present additional investment requirements and compliance issues. Complicating the market includes rivalry from other alloys and replacements and the possible effects of taxes and trade barriers. The industry also needs to deal with technological developments and disruptions that could change conventional manufacturing methods, which highlights the necessity of innovation and adaptability in the Low Carbon Ferromanganese market.

Low Carbon Ferromanganese Market Opportunities

Expanded usage of low-carbon ferromanganese to improve steel characteristics is made possible by the growing demand for high-performance steel in sectors including aerospace, automotive, and construction. Investments in infrastructure, especially in emerging nations, have enormous development potential since they increase steel demand and, by extension, low-carbon Ferromanganese. Another opportunity for market expansion is provided by the renewable energy sector's reliance on high-strength steel components for electric vehicles and wind energy. This alloy's low carbon content makes it an excellent option for ecologically aware steelmaking, which is in line with the industry's commitment to sustainability. Further driving up steel demand is the continued trends of urbanization around the world, which present excellent prospects for the use of Low Carbon Ferromanganese in infrastructure and building projects.

LOW CARBON FERROMANGANESE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Carbon Content, Manganese Content, End-Use Industries, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ERAMET, Guangxi Xin-Manganese Group, Gulf Ferro Alloys, Mizushima Ferroalloy, OM Materials (Qinzhou), Sichuan chuantou Emei Ferroalloy, Sinai Manganese, Tata Steel's Ferro Alloys & Minerals, Yunan Wenshan Dounan Menganese Industry, Yunnan Jianshui Manganese |

Low Carbon Ferromanganese Market Segmentation: By Carbon Content

-

Ultra-Low Carbon Ferromanganese

-

Low Carbon Ferromanganese

-

Standard Carbon Ferromanganese

The world of steel production is changing dramatically, and low-carbon ferromanganese (LC FeMn) is becoming a key component of the biggest and fastest-growing industries. In the largest category, LC FeMn is essential to the manufacturing of steel, especially low-alloy and high-strength steels used in shipbuilding, automobile, and construction. Environmental rules that emphasize cleaner steelmaking methods, which contribute to its smaller carbon footprint, are driving demand for it. Furthermore, improvements in production processes are making LC FeMn more cost-competitive. The need for low-carbon alternatives in steelmaking is being driven by growing environmental concerns and the global focus on sustainability in the fastest-growing industry. Government incentives along with ongoing technological developments have further fuelled LC FeMn's rapid growth, positioning it as a key player in the changing steel market.

Low Carbon Ferromanganese Market Segmentation: By Manganese Content

-

High Manganese Ferromanganese

-

Medium Manganese Ferromanganese

-

Low Manganese Ferromanganese

Due to its affordability and adaptability, Medium Manganese Ferromanganese holds a substantial market share and is the largest category. In comparison to High Manganese Ferromanganese, this variation maintains lower manufacturing costs while effectively balancing manganese content for deoxidation and alloying in a variety of steel grades, including carbon steel, low-alloy steel, and stainless steel. Due to its increased use in the manufacturing of stainless steel and high-strength low-alloy (HSLA) steels, the High Manganese Ferromanganese segment is expanding at the highest rate. Because it can match these steel grades' manganese requirements for increased strength, toughness, corrosion resistance, and work-hardening qualities, High-Mn FeMn is in high demand.

Low Carbon Ferromanganese Market Segmentation: By End-Use Industries

-

Steel Industry

-

Automotive

-

Aerospace

-

Construction

-

Renewable Energy

-

Others

The largest segment is the steel industry, which is at the top. Because LC FeMn is an essential deoxidizer and alloying element in the production of steel, the demand for it closely corresponds with the expansion of the steel industry. In the meantime, the variety of the fastest-growing segments highlights LC FeMn's versatility. The automotive industry is experiencing significant expansion because of a spike in demand for strong yet lightweight materials, particularly high-strength low-alloy (HSLA) steels. LC FeMn is essential for achieving these material needs. Another sector that is growing quickly is the construction industry, which emphasizes strength and corrosion resistance in particular steel grades for infrastructure projects.

Low Carbon Ferromanganese Market Segmentation: By Application

-

Alloying Element

-

Deoxidizing Agent

-

Desulfurizing Agent

-

Welding Applications

-

Others

The use of LC FeMn as a Deoxidizing Agent makes up the largest portion. This dominance is explained by the crucial role that LC FeMn plays as a major deoxidizer in the manufacturing of steel. Its primary use for LC FeMn is in the prevention of faults and improvement of overall steel quality by the effective removal of oxygen from molten steel. The Alloying Element application market is expanding at the quickest rate. Deoxidization is still crucial, although there are a few reasons for this market's rapid rise. The manufacturing of high-strength low-alloy (HSLA) steels, where alloying elements like manganese are essential for imparting greater strength and toughness, is driving up demand for LC FeMn. In the manufacture of stainless steel, LC FeMn is also becoming more popular, particularly in grades that profit from manganese's characteristics.

Low Carbon Ferromanganese Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors

-

Online Retailers

Because steelmakers buy in bulk from producers and depend on them for specific alloy compositions and technical know-how, direct sales hold a dominant market share in the Low Carbon Ferromanganese (LC FeMn) industry. Stable supply-demand dynamics are ensured through long-term contracts. Distributors, who make use of a wider reach to connect manufacturers with smaller steelmakers and a variety of end-users, are the category that is expanding at the quickest rate concurrently. Distributors provide a larger customer base by enabling flexible order quantities and quicker delivery through inventory management. Their knowledge of particular areas or sectors of the economy helps producers reach new markets. Because of this, the relationships between distributors and direct sales play crucial roles in the changing LC FeMn transaction ecosystem.

Low Carbon Ferromanganese Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The ferromanganese market size is dominated by Asia-Pacific; the primary driver of this growth is the rise in demand from end-user industries including automotive, building & construction, and others. Steel use in the automotive sector is anticipated to propel market expansion in Europe. The steel produced can be used in the automotive industry's widely used forging and pressing procedures. The growing demand for electric vehicles is driving up steel demand in the automotive industry, which is driving up growth in the FeMn market. North America's growth rate is expected to be favorable due to the use of its products in the steel and stainless steel industries. Because of rising purchasing power and quick industrialization, steel is used in both residential and commercial buildings.

COVID-19 Impact Analysis of the Global Game Streaming Market:

The market for low-carbon ferromanganese has been greatly influenced by the COVID-19 outbreak worldwide. Production temporarily slowed because of labor shortages, supply chain disruptions, and restrictions on industrial operations during lockdowns. The market's difficulties were exacerbated by a decline in the demand for steel in industries like building and the automobile. Reassessing global manufacturing strategy considering the epidemic highlighted the significance of robust supply chains. Government stimulus packages and sector modifications were crucial to the market's recovery as lockdown measures eased and industrial operations eventually restarted.

Latest Trends/ Developments:

Ferro Alloys and Impex Metals were purchased by Maithan Alloys for a total of Rs 74.22 crore. With this acquisition, Maithan Alloys will be able to produce 70,355 TPA more ferromanganese and 49,500 TPA more silicon manganese. In Hapur, Uttar Pradesh, Salasar Techno Engineering opened a new facility for the manufacturing of structural steel. The factory will have a 15,000-ton annual installed capacity. After being bought by Tata Steel, Bhushan Energy Ltd. became Tata Steel BSL Ltd. This acquisition is anticipated to boost TATA Steel's position in Odhisa, India.

Key Players:

-

ERAMET

-

Guangxi Xin-Manganese Group

-

Gulf Ferro Alloys

-

Mizushima Ferroalloy

-

OM Materials (Qinzhou)

-

Sichuan chuantou Emei Ferroalloy

-

Sinai Manganese

-

Tata Steel's Ferro Alloys & Minerals

-

Yunan Wenshan Dounan Menganese Industry

-

Yunnan Jianshui Manganese

Chapter 1. Low Carbon Ferromanganese Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Low Carbon Ferromanganese Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Low Carbon Ferromanganese Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Low Carbon Ferromanganese Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Low Carbon Ferromanganese Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Low Carbon Ferromanganese Market – By Carbon Content

6.1 Introduction/Key Findings

6.2 Ultra-Low Carbon Ferromanganese

6.3 Low Carbon Ferromanganese

6.4 Standard Carbon Ferromanganese

6.5 Y-O-Y Growth trend Analysis By Carbon Content

6.6 Absolute $ Opportunity Analysis By Carbon Content, 2024-2030

Chapter 7. Low Carbon Ferromanganese Market – By Manganese Content

7.1 Introduction/Key Findings

7.2 High Manganese Ferromanganese

7.3 Medium Manganese Ferromanganese

7.4 Low Manganese Ferromanganese

7.5 Y-O-Y Growth trend Analysis By Manganese Content

7.6 Absolute $ Opportunity Analysis By Manganese Content, 2024-2030

Chapter 8. Low Carbon Ferromanganese Market – By End-Use Industries

8.1 Introduction/Key Findings

8.2 Steel Industry

8.3 Automotive

8.4 Aerospace

8.5 Construction

8.6 Renewable Energy

8.7 Others

8.8 Y-O-Y Growth trend Analysis By End-Use Industries

8.9 Absolute $ Opportunity Analysis By End-Use Industries, 2024-2030

Chapter 9. Low Carbon Ferromanganese Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Direct Sales

9.3 Distributors

9.4 Online Retailers

9.5 Y-O-Y Growth trend Analysis By Distribution Channel

9.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 10. Low Carbon Ferromanganese Market – By Application

10.1 Introduction/Key Findings

10.2 Alloying Element

10.3 Deoxidizing Agent

10.4 Desulfurizing Agent

10.5 Welding Applications

10.6 Others

10.7 Y-O-Y Growth trend Analysis By Application

10.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 11. Low Carbon Ferromanganese Market , By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Carbon Content

11.1.2.1 By Manganese Content

11.1.3 By End-Use Industries

11.1.4 By Texture

11.1.5 By Application

11.1.6 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Carbon Content

11.2.3 By Manganese Content

11.2.4 By End-Use Industries

11.2.5 By Distribution Channel

11.2.6 By Texture

11.2.7 By Application

11.2.8 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Carbon Content

11.3.3 By Manganese Content

11.3.4 By End-Use Industries

11.3.5 By Distribution Channel

11.3.6 By Texture

11.3.7 By Application

11.3.8 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Carbon Content

11.4.3 By Manganese Content

11.4.4 By End-Use Industries

11.4.5 By Distribution Channel

11.4.6 By Texture

11.4.7 By Application

11.4.8 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Carbon Content

11.5.3 By Manganese Content

11.5.4 By End-Use Industries

11.5.5 By Distribution Channel

11.5.6 By Texture

11.5.7 By Application

11.5.8 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Low Carbon Ferromanganese Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 ERAMET

12.2 Guangxi Xin-Manganese Group

12.3 Gulf Ferro Alloys

12.4 Mizushima Ferroalloy

12.5 OM Materials (Qinzhou)

12.6 Sichuan chuantou Emei Ferroalloy

12.7 Sinai Manganese

12.8 Tata Steel's Ferro Alloys & Minerals

12.9 Yunan Wenshan Dounan Menganese Industry

12.10 Yunnan Jianshui Manganese

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The low-carbon ferromanganese Market was valued at USD 73.12 billion and is projected to reach a market size of USD 96.22 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4%.

Urbanization and Industrialization Trends, Infrastructure Development, Environmental Regulations, High-Performance Steel Requirements, and Steel Industry demands are the market drivers of the Global Low Carbon Ferromanganese Market.

Carbon Content (Ultra-Low Carbon Ferromanganese, Low Carbon Ferromanganese, and Standard Carbon Ferromanganese) are the segments under the Global Low Carbon Ferromanganese Market by carbon content.

Asia Pacific is the most dominant region for the Global Low Carbon Ferromanganese Market.

ERAMET, Guangxi Xin-Manganese Group, Gulf Ferro Alloys, Mizushima Ferroalloy, OM Materials (Qinzhou), Sichuan Chuan Tou Emei Ferroalloy, Sinai Manganese, Tata Steel's Ferro Alloys & Minerals, Yunan Wenshan Dounan Manganese Industry, and Yunnan Jianshui Manganese are the key players in the Global Low Carbon Ferromanganese Market.