Locomotive Market Size (2024 – 2030)

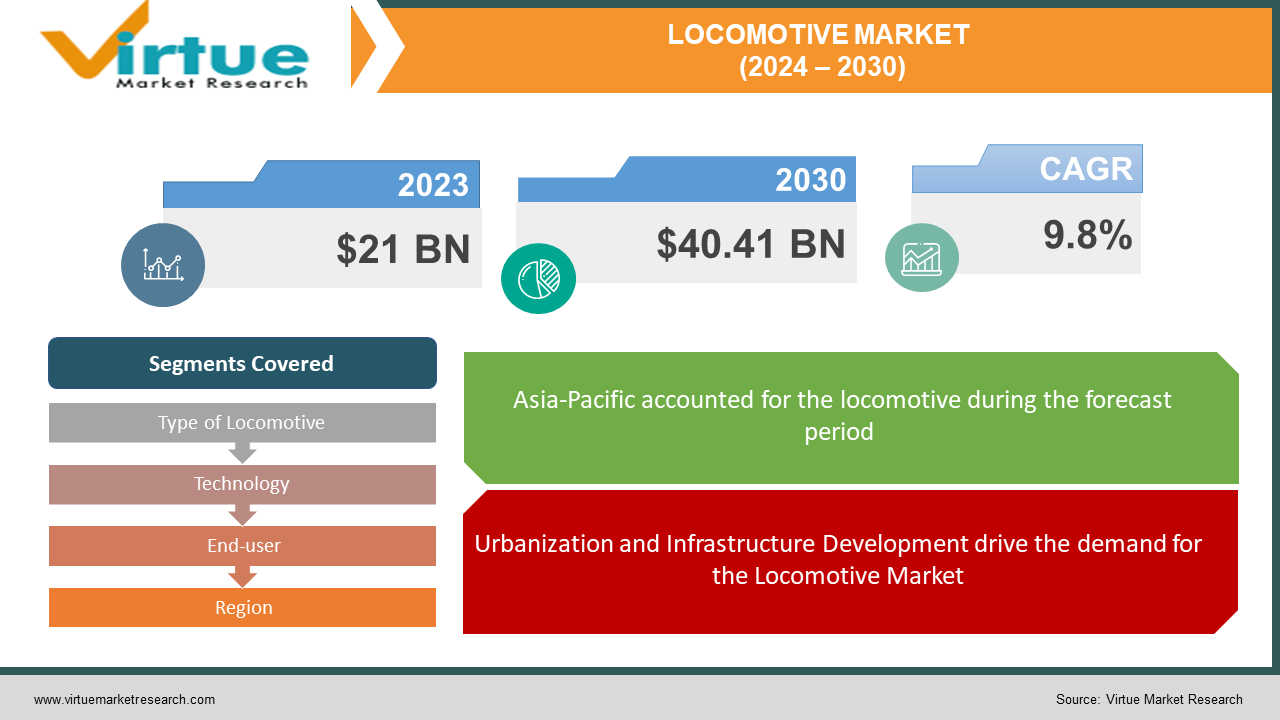

The Global Locomotive Market was valued at USD 21 billion and is projected to reach a market size of USD 40.41 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.8%.

A locomotive is a railway vehicle that provides the motive power for a train. It contains an engine. This engine is usually powered by diesel fuel, electricity, or in some cases, steam. This generates the necessary force to pull or push railway cars along tracks. Locomotives are used for both freight and passenger transportation. Locomotives help in the efficient movement of goods and people across long distances and various terrains. There are diesel locomotives, electric locomotives, and hybrid locomotives. The Locomotive Market is expected to grow significantly in the coming years due to urbanization, population growth, increasing freight and passenger transportation demands, and government initiatives. The major well-established key players in the Locomotive Market are General Electric (GE) Transportation/Wabtec Corporation, Siemens Mobility, Alstom, CRRC Corporation Limited, and Bombardier Transportation/Alstom

Key Market Insights:

Urbanization, economic growth, environmental regulations, technological advancements, and global trade are propelling the Locomotive Market. The restraints on the Locomotive Market include economic volatility, high initial costs, regulatory compliance, and competition from other transport modes, infrastructure limitations, technological challenges, environmental concerns, and global trade dynamics. Ongoing advancements in technology have led to the development of improving fuel efficiency, reducing emissions, enhancing reliability, and incorporating digital solutions for predictive maintenance and monitoring. Asia-Pacific occupies the highest share of the Locomotive Market. Asia-Pacific is also the fastest-growing segment during the forecast period. In Europe and Asia, there's a strong emphasis on electrification and high-speed rail. In North America, diesel locomotives dominate freight transportation.

Locomotive Market Drivers:

Urbanization and Infrastructure Development drive the demand for the Locomotive Market

Urban populations are continuously growing globally. The demand for efficient transportation systems in cities is increasing at a very rapid pace. Transportation systems facilitate the movement of people and goods within and between places. This drives the locomotive industry and investments in railway infrastructure, including new rail lines, station upgrades, and electrification projects. This further creates opportunities for locomotive manufacturers. Urbanization results in the expansion of commuter rail networks and the development of urban transit systems, which require locomotives for passenger transportation. Infrastructure projects such as high-speed rail lines and urban transit expansions increase demand for locomotives.

Environmental Regulations and Sustainability Initiatives are propelling the Locomotive Market

Stringent environmental regulations on carbon emissions and mitigating climate change are increasing. The adoption of cleaner and more fuel-efficient locomotives is increasing. Governments and regulatory bodies worldwide are implementing emission standards and sustainability initiatives. This promotes the use of environmentally friendly transportation solutions. Locomotive manufacturers are responding by developing electric and hybrid locomotives. The latest advancements include emission-reducing technologies. Sustainability initiatives by governments, corporations, and international organizations promote the rail industry to invest in eco-friendly locomotives and technologies. Thus, environmental sustainability is a key driver of the Locomotive Market.

Locomotive Market Restraints and Challenges

The major challenge faced by the Locomotive Market is the high capital cost. The investment in research and development, production facilities, and specialized equipment is high. The high upfront costs associated with locomotive manufacturing create challenges for new players and existing manufacturers. Another challenge in the Locomotive Market is the regulatory requirements and safety standards imposed by government agencies and industry organizations. Obtaining regulatory approval and certification for new locomotive designs is often time-consuming and costly. The other restraints to the Locomotive Market include economic volatility, competition from other transport modes, infrastructure limitations, technological challenges, environmental concerns, and global trade dynamics.

Locomotive Market Opportunities:

The Locomotive Market has various opportunities in the market. With the integration of rail with other modes of transportation, such as ports, terminals, and logistics hubs, the Locomotive Market is anticipated to witness significant growth in the coming years. Increasing focus on sustainability and environmental regulations presents an opportunity for the market. Manufacturers invest in electric and hybrid locomotives for cleaner transportation solutions. Other Opportunities in the Locomotive Market include electrification, modernization of rail infrastructure, expansion of high-speed rail networks, technological advancements, intermodal connectivity, emerging markets, aftermarket services, partnerships, rail freight growth, and infrastructure investment.

LOCOMOTIVE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.8% |

|

Segments Covered |

By Type of Locomotive, Technology, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

General Electric (GE) Transportation/Wabtec Corporation, Siemens Mobility, Bombardier Transportation/Alstom, CRRC Corporation Limited, Electro-Motive Diesel (EMD)/Progress Rail, Alstom, Stadler Rail, Kawasaki Heavy Industries, Hyundai Rotem, Talgo |

Locomotive Market Segmentation: By Type of Locomotive

-

Diesel Locomotives

-

Electric Locomotives

-

Hybrid Locomotives

In 2023, based on market segmentation by Type of Locomotive, Diesel Locomotives occupy the highest share of the Locomotive Market. This is mainly due to their widespread use across various regions and applications.

However, Electric Locomotives is the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 11%. This is due to their lower environmental impact, reduced operating costs over the long term, and increasing emphasis on the electrification of railway networks. Governments and railway operators are focusing on sustainability and emissions reduction. So, the demand for electric locomotives is expected to continue growing rapidly. Advancements in electric propulsion technology and the availability of renewable energy sources further fuel electric locomotives.

Locomotive Market Segmentation: By Technology

-

-

Conventional Locomotives

-

High-Speed Locomotives

-

Maglev Locomotives

-

In 2023, based on market segmentation by technology, the conventional locomotives segment occupies the highest share of the Locomotive Market. This is mainly due to its various applications including freight and passenger transportation. Traditional diesel and electric locomotives are widely used conventional locomotives. However, the high-speed locomotives are the fastest-growing segment during the forecast period. This is mainly due to the increasing demand for rapid transit solutions, urbanization, and the expansion of high-speed rail networks globally. Maglev (magnetic levitation) locomotives have significant potential for growth, especially in markets seeking cutting-edge transportation solutions with reduced friction and higher speeds.

Locomotive Market Segmentation: By End-user

-

Rail Transportation Companies

-

Industrial Companies (for internal transportation)

-

Governments (for public transportation)

In 2023, based on market segmentation by the end-user, the rail transportation companies segment occupies the highest share of the Locomotive Market. This is because they are the primary purchasers and operators of locomotives for both freight and passenger transportation services.

However, Industrial companies utilizing locomotives for internal transportation is the fastest-growing segment during the forecast period. This growth is particularly in sectors such as mining, manufacturing, and logistics, where railroads are used to move raw materials and finished goods within industrial complexes.

The Government (for public transportation infrastructure) sector is also growing significantly. The growth is fueled by the demand for locomotives tailored for passenger services and urban transit operations.

Locomotive Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, Asia-Pacific occupies the highest share of the Locomotive Market. It has a market share of 45%. This growth is due to extensive railway infrastructure development, urbanization, and economic growth driving demand for locomotives. Countries like China, India, Japan, and Australia, have significant market share due to substantial infrastructure investments. Asia-Pacific is also the fastest-growing segment during the forecast period.

North America is a technologically advanced region with another significant Locomotive market. This is mainly due to the mature rail industry and ongoing investments in freight and passenger rail infrastructure. Europe also has a mature Locomotive market with a well-established rail network and stringent environmental regulations favoring electrification and sustainable transportation solutions. South America is showing moderate growth potential. Countries like Brazil and Argentina are investing in railway modernization projects. The Middle East and Africa region present emerging opportunities with investing in rail infrastructure to support economic development and trade.

COVID-19 Impact Analysis on the Global Locomotive Market:

The COVID-19 pandemic had a significant impact on the Locomotive Market. There were economic slowdowns, travel restrictions, work-from-home policies, and lockdown measures. This led to disrupted global supply chains and delays in the delivery of locomotive components and equipment. The pandemic resulted in reduced demand for rail transportation services. Passenger rail segments saw a huge decline. The pandemic accelerated the adoption of digital technologies. Remote monitoring solutions in the locomotive industry improve efficiency, optimize maintenance processes, and enhance safety. Integration of IoT, AI, and predictive analytics solutions is also increasingly adopted. Thus, the pandemic accelerated certain trends in the Locomotive Market.

Latest Trends/ Developments:

One of the developments, in the Locomotive Market is the rise in integrating digital technologies such as the Internet of Things (IoT), artificial intelligence (AI), and predictive analytics. This integration helps in condition monitoring, predictive maintenance, asset optimization, and enhancing operational efficiency. Hybrid locomotives, which combine diesel engines with electric propulsion systems or energy storage systems, are gaining popularity nowadays. Hybrid locomotives offer fuel savings, reduced emissions, and increased flexibility.

There is a growing trend in electrification in the locomotive industry. This reduces carbon emissions and reliance on fossil fuels. The development of battery-electric and hydrogen fuel cell locomotives is on the rise. There is increased investment in electrified railway infrastructure.

Key Players:

-

General Electric (GE) Transportation/Wabtec Corporation

-

Siemens Mobility

-

Bombardier Transportation/Alstom

-

CRRC Corporation Limited

-

Electro-Motive Diesel (EMD)/Progress Rail

-

Alstom

-

Stadler Rail

-

Kawasaki Heavy Industries

-

Hyundai Rotem

-

Talgo

Market News:

-

In February 2024, the Mid Hants Railway in Ropley received a donation from CBRE to aid in restoring the historic P Class No. 178 locomotive, built in 1924 and used for suburban passenger services in London and the South East.

-

In February 2024, Tripura's tourism gem, Unakoti, gained visibility as its name was prominently displayed on the locomotive engine of the Agartala-Anand Vihar Rajdhani Express. This initiative by the Northeast Frontier Railway aims to boost awareness of the state's rich culture and heritage among travelers.

-

In January 2023, Wilmar Sugar introduced a groundbreaking addition to its fleet: the Brisbane locomotive, weighing in at 26 tonnes. This unveiling marks a notable achievement for the company, representing its first new locomotive model since 1991. Of particular significance, the Brisbane stands as Queensland's initial cane rail locomotive to be both designed and manufactured by a milling company, reflecting Wilmar Sugar's dedication to pioneering advancements within the sugar industry.

Chapter 1. Locomotive Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Locomotive Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Locomotive Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Locomotive MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Locomotive Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Locomotive Market– By Type of Locomotive

6.1 Introduction/Key Findings

6.2 Diesel Locomotives

6.3 Electric Locomotives

6.4 Hybrid Locomotives

6.5 Y-O-Y Growth trend Analysis By Type of Locomotive

6.6 Absolute $ Opportunity Analysis By Type of Locomotive, 2024-2030

Chapter 7. Locomotive Market– By Technology

7.1 Introduction/Key Findings

7.2 Conventional Locomotives

7.3 High-Speed Locomotives

7.4 Maglev Locomotives

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Locomotive Market– By End-use Industry

8.1 Introduction/Key Findings

8.2 Rail Transportation Companies

8.3 Industrial Companies (for internal transportation)

8.4 Governments (for public transportation)

8.5 Y-O-Y Growth trend Analysis By End-use Industry

8.6 Absolute $ Opportunity Analysis By End-use Industry, 2024-2030

Chapter 9. Locomotive Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type of Locomotive

9.1.3 By Technology

9.1.4 By By End-use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type of Locomotive

9.2.3 By Technology

9.2.4 By End-use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type of Locomotive

9.3.3 By Technology

9.3.4 By End-use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type of Locomotive

9.4.3 By Technology

9.4.4 By End-use Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type of Locomotive

9.5.3 By Technology

9.5.4 By End-use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Locomotive Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 General Electric (GE) Transportation/Wabtec Corporation

10.2 Siemens Mobility

10.3 Bombardier Transportation/Alstom

10.4 CRRC Corporation Limited

10.5 Electro-Motive Diesel (EMD)/Progress Rail

10.6 Alstom

10.7 Stadler Rail

10.8 Kawasaki Heavy Industries

10.9 Hyundai Rotem

10.10 Talgo

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Locomotive Market was valued at USD 21 billion and is projected to reach a market size of USD 40.41 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.8%.

Urbanization, economic growth, environmental regulations, technological advancements, and global trade are the market drivers of the Global Locomotive Market.

Conventional Locomotives, High-Speed Locomotives, and Maglev Locomotives are the segments of the Global Locomotive Market by Technology.

Asia-Pacific is the most dominant region for the Global Locomotive Market.

General Electric (GE) Transportation/Wabtec Corporation, Siemens Mobility, Alstom, CRRC Corporation Limited, and Bombardier Transportation/Alstom are the key players in the Global Locomotive Market.