Locker Market Size (2024 – 2030)

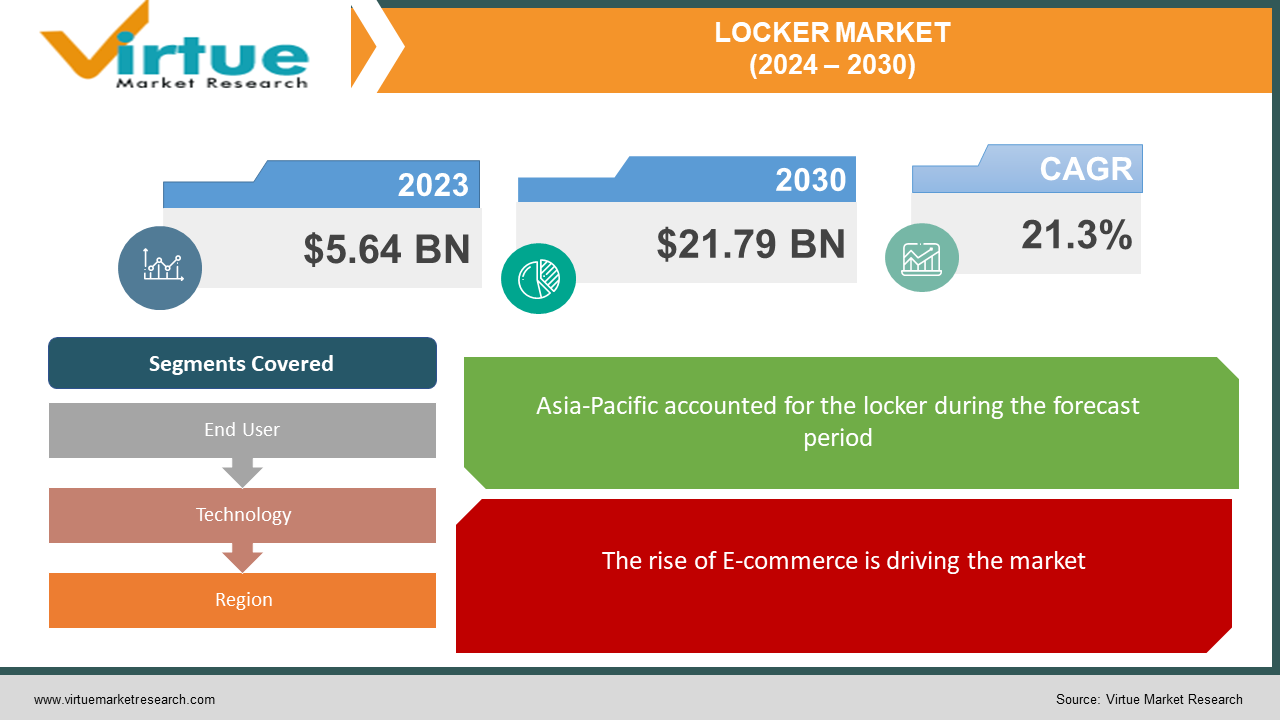

The Global Locker Market was valued at USD 5.64 billion in 2023 and will grow at a CAGR of 21.3% from 2024 to 2030. The market is expected to reach USD 21.79 billion by 2030.

Key Market Insights:

The Locker Market is experiencing a surge, driven by urbanization, growing demand for self-storage solutions, and the booming e-commerce industry. In cities with limited space, lockers provide convenient storage for everything from groceries to gym bags. E-commerce giants are fueling demand for secure lockers for deliveries and returns, while the rise of co-working spaces creates a need for personal storage. However, the market faces challenges. Security concerns are paramount, prompting innovation in smart locker systems with access control and remote monitoring. Additionally, competition is fierce, with traditional locker companies vying for market share with tech-enabled startups. Overall, the Locker Market offers promising growth, but success hinges on innovation, robust security features, and catering to the diverse needs of a dynamic consumer base.

Global Locker Market Drivers:

The rise of E-commerce is driving the market.

E-commerce is a game-changer for the Locker Market. The surge in online shopping creates a challenge for busy consumers who might miss deliveries or worry about packages left unattended. Locker systems provide a secure and flexible solution. Imagine ordering groceries or that new jacket online – instead of waiting at home for a delivery window, you can choose a convenient locker location near your work or home. The package gets delivered securely to the locker, and you receive a notification with a unique code to retrieve it at your leisure. This not only adds flexibility to your schedule but also gives you peace of mind knowing your purchases are safe until you pick them up. This e-commerce-driven demand is a major reason locker adoption is flourishing in residential buildings, office complexes, and even retail stores, creating a win-win situation for both online shoppers and the Locker Market.

Growing Demand for Self-Storage Solutions is driving the market.

Our increasingly mobile lifestyles are creating a storage predicament. Unlike previous generations, we tend to accumulate more possessions but have less space to keep them. This is where lockers come in as a convenient and adaptable storage solution. Imagine you're an adventurer with off-season sports equipment or a student living in a tiny apartment – lockers provide a secure, off-site space for these belongings without cluttering your living area. Need a temporary solution for seasonal items like winter coats or holiday decorations? Lockers offer short-term storage options. They're also ideal for people who travel frequently – you can store luggage or valuables while you're on the go. This growing need for flexible storage solutions across various lifestyles is propelling the Locker Market forward.

Consumers are increasingly concerned about package theft

Locker systems are here to ease your anxieties. Today's consumers prioritize security, and lockers address that concern by providing a haven for your packages and possessions. Imagine the peace of mind of knowing your groceries or that new gadget is securely stored in a locker instead of waiting precariously on your doorstep. Locker systems come equipped with features like unique PIN code access, ensuring only authorized individuals can retrieve items. Remote monitoring capabilities allow you to keep a virtual eye on your belongings, and tamper-proof designs provide an extra layer of security. This focus on robust security features makes lockers a compelling solution for consumers in a world increasingly concerned about theft and unauthorized access.

Global Locker Market challenges and restraints:

High Initial Investment Costs are required.

The high initial investment cost is a major hurdle for the Locker Market, especially for smart locker systems. These advanced lockers come packed with features like digital locks and touchscreens, but this translates to a hefty upfront price tag. The cost encompasses not just the lockers themselves, but also the electronic components needed for their operation. Additionally, software development, particularly for customization, can be expensive. Finally, infrastructure setup adds to the burden, requiring factors like power supply and reliable internet connectivity. This combination of costs can be prohibitive for smaller businesses or organizations with limited budgets, potentially slowing down the wider adoption of locker systems.

Installing locker systems requires sufficient physical space which restricts the market growth.

Space constraints pose a significant challenge for the Locker Market. Installing locker systems, especially in larger quantities, requires ample space to house the lockers and any accompanying equipment. This can be a deal-breaker in densely populated areas like urban centers, where businesses and buildings often have limited square footage. Similarly, smaller businesses or organizations may struggle to find suitable space for locker implementation. Even if space is available, repurposing existing areas for lockers can be a costly and complex undertaking. Retrofitting may involve structural modifications, electrical work, and potentially reconfiguring existing layouts. This can be a major deterrent, especially for businesses with limited resources.

Market Opportunities:

The Locker Market presents a treasure trove of opportunities for innovative companies. The booming e-commerce industry remains a goldmine. By partnering with online retailers and delivery companies, locker providers can create seamless delivery and pick-up networks, offering extended hours and convenient locations. Smart lockers with features like temperature control can cater to specific needs, like storing groceries or pharmaceuticals. Urbanization presents another opportunity. Developments in high-density areas can integrate smart locker systems for residents to securely store packages, groceries, or bulky seasonal items. Universities and co-working spaces can offer locker rentals for students or remote workers to store belongings during the day. Technology will be key to unlocking further potential. Integrating lockers with mobile apps can provide real-time tracking, reservation options, and contactless access. Imagine seamlessly reserving a locker through your phone while shopping online or remotely monitoring your stored items. Additionally, data analytics can help companies optimize locker placement and pricing strategies based on user behavior. Sustainability is an emerging trend. Eco-friendly locker materials and energy-efficient operation systems can attract environmentally conscious customers. The potential for integration with existing building management systems for shared power or temperature control creates a more sustainable future for lockers.

LOCKER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

21.3% |

|

Segments Covered |

By End User, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ricoh, Pitney Bowes, ASSA ABLOY, Quadient, Gibraltar Industries, Bell and Howell, LLC, Cleveron, American Locker, Lyon Workspace Products, Hollman Inc. |

Locker Market Segmentation - By End User

-

Businesses

-

Institutions

-

Consumers

The Locker Market caters to a diverse range of end users, including Businesses (retail stores, gyms, offices, co-working spaces), Institutions (schools, universities, libraries, hospitals), and Consumers utilizing lockers for individual storage needs in various locations. This broad spectrum reflects the versatility of lockers, serving purposes from employee belongings and student storage to convenient parcel pick-up and personal item security.

Locker Market Segmentation - By Technology

-

Traditional Lockers

-

Smart Lockers

Traditional lockers likely hold the dominant position in the locker market for now. Their key advantage lies in simplicity and cost-effectiveness. Mechanical locks and keys are familiar to everyone, requiring minimal maintenance or user training. This affordability makes them a practical solution for many businesses and institutions, especially those needing a large number of lockers on a budget. Smart lockers, despite their technological advancements, face a higher initial investment cost due to the electronics and software involved.

Locker Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific currently holds the dominant position. This region's rapid economic development and urbanization are fueling the need for storage solutions in various sectors like retail, education, and logistics. Additionally, rising disposable incomes are leading to increased demand for convenience, making features offered by smart lockers, like contactless access, particularly appealing. Though North America and Europe have established markets for lockers, Asia-Pacific's projected growth is expected to outpace them in the coming years.

COVID-19 Impact Analysis on the Global Locker Market

The COVID-19 pandemic delivered a mixed bag of impacts for the Global Locker Market. Initially, lockdowns and social distancing restrictions disrupted traditional locker usage, especially in gyms, workplaces, and educational institutions. However, the e-commerce boom triggered by the pandemic proved to be a powerful counterforce. With people staying home and avoiding in-person interactions, the demand for secure and contactless delivery options surged. Locker systems emerged as a perfect solution, offering convenient pick-up locations for online purchases. This e-commerce boom led to a significant rise in smart locker installations across retail stores, apartment complexes, and even neighborhoods. Additionally, concerns about hygiene and germ transmission increased the need for secure storage in public spaces. This led to the exploration of lockers for storing personal belongings like bags and coats, minimizing contact with potentially contaminated surfaces. As the world adjusts to a post-pandemic reality, the Locker Market is expected to maintain a steady growth trajectory. The convenience and security offered by lockers, coupled with the continued rise of e-commerce, will likely outweigh the initial disruptions caused by the pandemic. However, the long-term impact on traditional locker usage in specific sectors like workplaces will depend on the evolution of remote work models and how office spaces adapt to a potentially hybrid work environment.

Latest trends/Developments

The Locker Market is witnessing a wave of innovation driven by technology and evolving consumer needs. Smart lockers are at the forefront, boasting features like touchless access through mobile apps, real-time tracking of stored items, and even temperature control for perishables. This focus on convenience and security is attracting partnerships between locker providers and online retailers, creating seamless delivery and pick-up networks with extended hours and wider accessibility. Urbanization is another key driver, with high-density living spaces integrating smart lockers for residents to manage packages, groceries, or seasonal items. Co-working spaces and universities are jumping on board too, offering locker rentals for on-the-go professionals and students. Sustainability is a rising trend, with eco-friendly materials and energy-efficient operations gaining traction. Imagine lockers seamlessly integrated with building management systems for shared power or temperature control, reducing the environmental footprint. The future of lockers is also phygital, with data analytics playing a crucial role. By analyzing user behavior, locker companies can optimize placement, and pricing strategies, and even predict peak usage times, ensuring a smooth user experience. This blend of cutting-edge technology, strategic partnerships, and a focus on sustainability positions the Locker Market for exciting growth in the years to come.

Key Players:

-

Ricoh

-

Pitney Bowes

-

ASSA ABLOY

-

Quadient

-

Gibraltar Industries

-

Bell and Howell, LLC

-

Cleveron

-

American Locker

-

Lyon Workspace Products

-

Hollman Inc.

Chapter 1. LOCKER MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. LOCKER MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. LOCKER MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. LOCKER MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. LOCKER MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. LOCKER MARKET – By End User

6.1 Introduction/Key Findings

6.2 Businesses

6.3 Institutions

6.4 Consumers

6.5 Y-O-Y Growth trend Analysis By End User

6.6 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 7. LOCKER MARKET – By Technology

7.1 Introduction/Key Findings

7.2 Traditional Lockers

7.3 Smart Lockers

7.4 Y-O-Y Growth trend Analysis By Technology

7.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. LOCKER MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End User

8.1.3 By Technology

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End User

8.2.3 By Technology

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End User

8.3.3 By Technology

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End User

8.4.3 By Technology

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End User

8.5.3 By Technology

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. LOCKER MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Ricoh

9.2 Pitney Bowes

9.3 ASSA ABLOY

9.4 Quadient

9.5 Gibraltar Industries

9.6 Bell and Howell, LLC

9.7 Cleveron

9.8 American Locker

9.9 Lyon Workspace Products

9.10 Hollman Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Locker Market was valued at USD 5.64 billion in 2023 and will grow at a CAGR of 21.3% from 2024 to 2030. The market is expected to reach USD 21.79 billion by 2030.

The rise of E-commerce, consumer’s increasing concerns about package theft, and growing demand for self-storage solutions are the reasons that are driving the market.

Based on user it is divided into three segments – Businesses, Institutions, Consumers

Asia-Pacific is the most dominant region for the Locker Market.

Ricoh, Pitney Bowes, ASSA ABLOY, Quadient