LIQUOR CONFECTIONERY MARKET (2024 - 2030)

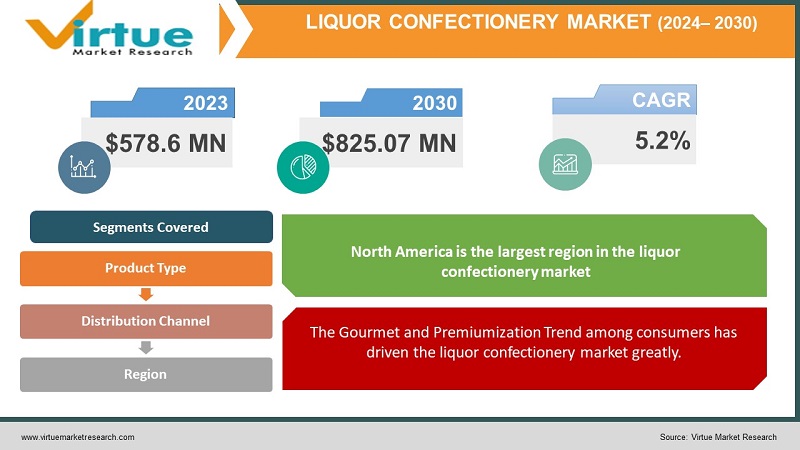

The Global Liquor Confectionery Market was valued at USD 578.6 Million and is projected to reach a market size of USD 825.07 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.2%.

The liquor confectionery market is a niche segment of the confectionery industry, characterized by the infusion of alcoholic beverages into various candy and chocolate products. It offers consumers a unique blend of flavors and indulgence, with products ranging from whiskey-infused chocolates to rum-filled truffles. The market has witnessed growth due to the increasing demand for premium and artisanal sweets, along with the popularity of alcoholic flavor profiles. It is subject to regulatory constraints related to the sale and consumption of alcohol, which can vary significantly by region. Despite these challenges, the liquor confectionery market continues to attract consumers seeking a fusion of sweetness and spirits, presenting opportunities for innovation and market expansion.

Key Market Insights:

The confectionery market in India thrives with a blend of domestic and international manufacturers, offering a diverse range of liquor-infused confectionery to cater to varied consumer preferences. These manufacturers leverage their expertise in both chocolate-making and liquor infusion techniques to create enticing products tailored to India's consumer base.

The consumption of chocolate has been steadily increasing in countries like the United States, where the annual per capita consumption exceeds 11 pounds and offers a supportive backdrop for products such as liquor confectionery. While these products are generally marketed to specific age groups, they primarily cater to consumers seeking unique and experiential treats.

Moreover, the growing popularity of alternative forms of alcohol consumption has led to increased spending on liquor confectionery, further boosting the market. The industry has also seen a surge in new product developments and the availability of various flavors to cater to diverse consumer tastes.

Within the liquor confectionery category, Europe is poised to emerge as a hub for premium offerings, driven by higher consumer acceptance and brand penetration. In countries like Britain, confectionery sales are on the rise, particularly in the premium liquor chocolate segment, targeting specific consumer groups. The United Kingdom has witnessed a growing number of private-label chocolatiers introducing artisanal and specialized products to meet the rising demand in the premium liquor chocolate market.

Liquor Confectionery Market Drivers:

The Gourmet and Premiumization Trend among consumers has driven the liquor confectionery market greatly.

The growing consumer preference for premium and gourmet food products has driven the demand for high-quality, artisanal liquor confectionery. Consumers are increasingly willing to pay a premium for unique and indulgent experiences, and liquor-infused confections cater to this demand. These products often use top-shelf spirits and high-quality ingredients, appealing to consumers seeking luxurious and distinctive flavor profiles.

Gift and Occasion-Based Consumption is a boosting factor for the liquor confectionery market.

Liquid confectionery is often purchased as gifts or for special occasions, such as holidays, birthdays, and celebrations. The association of these products with gift-giving and celebrations boosts their demand during festive seasons and special events. The allure of combining alcohol and confections makes them attractive choices for gifting, which drives sales, particularly in the form of gift sets and custom assortments.

Liquor Confectionery Market Restraints and Challenges:

Regulatory Compliance in the liquor confectionery market might pose challenges.

The liquor confectionery market faces complex and varying regulations related to the production, sale, and consumption of alcoholic products. These regulations can differ widely from one country or region to another, making it challenging for manufacturers to navigate and comply with legal requirements. Ensuring that the alcohol content in confectionery products falls within permissible limits and that labeling and marketing comply with local laws is a constant challenge.

Consumer Preferences and Tastes might change because of which businesses in the liquor confectionery market could face challenges.

Liquor confectionery products often rely on specific alcoholic flavors, which can be polarizing and may not appeal to all consumer groups. Finding the right balance between the distinct taste of alcohol and the sweetness of confectionery to cater to a broad customer base is a continuous challenge. Changes in consumer preferences and trends can pose risks to product sales, requiring companies to continually adapt and innovate to meet evolving tastes

Liquor Confectionery Market Opportunities:

The liquor confectionery market presents several exciting opportunities for growth and innovation. First, the market can capitalize on the growing consumer interest in premium and indulgent treats. As consumers seek unique and luxurious experiences, high-quality liquor-infused chocolates and candies offer a distinct value proposition. The market can benefit from the trend of gifting and special occasions, where liquor confectionery products are often popular choices, providing an avenue for increased sales during holidays and celebrations. The rise of craft and artisanal confectionery brands offers opportunities for differentiation and creativity, enabling companies to develop novel and exclusive flavor combinations to capture a broader audience. As the demand for alcohol-flavored products continues to rise, there is potential for expansion into new geographic regions and collaborations with distilleries or breweries to develop unique, co-branded products. To seize these opportunities fully, companies should focus on both product quality and effective marketing strategies to target the evolving preferences of a diverse customer base.

LIQUOR CONFECTIONERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2 % |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AbteyChocolateFactor, Neuhaus, Mars, Brookside Hershey’s, Ferrero, Vosges Haut-Chocolat, Sugarfina, Liqueur Fills, Booz Drops |

Liquor Confectionery Market Segmentation:

Liquor Confectionery Market Segmentation: By Product Type:

-

Liquor-Filled Chocolates

-

Alcohol-Infused Gummies

-

Liquor-Flavored Truffles

-

Liquor-Infused Lollipops

-

Other Liquor Confectionery Products

The largest segment in the liquor confectionery market by product type is Liquor-Filled Chocolate which has a market share of over 64%. This segment's dominance can be attributed to the enduring popularity of chocolate products and the appeal of combining the rich, creamy texture of chocolate with the flavor notes of various alcoholic beverages. Liquor-filled chocolates offer a sophisticated and indulgent treat that caters to a broad consumer base, making them a preferred choice for those seeking a harmonious blend of sweetness and the distinctive taste of alcohol. The fastest growing segment by product type is Alcohol-Infused Gummies growing with a CAGR of 22.4%, due to their appeal to a broad consumer base, including individuals who may not typically consume alcohol in traditional forms. Alcohol-infused gummies offer a fun and approachable way to enjoy the flavors of liquor, making them particularly popular among younger consumers. They often come in various flavors and shapes, allowing for creativity and customization, which aligns well with the ongoing trend of unique and personalized confectionery experiences.

Liquor Confectionery Market Segmentation: By Distribution Channel:

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Online Retail

-

Convenience Stores

-

Others

The largest segment by distribution channel in the liquor confectionery market is Supermarkets and Hypermarkets holding a market share of 56%. This dominance is primarily due to the extensive reach and accessibility of these retail outlets, which cater to a wide consumer base. Supermarkets and hypermarkets offer a diverse range of products, including liquor confectionery, and attract a broad demographic of shoppers. The convenience of purchasing these treats during routine grocery shopping contributes to their popularity, making this distribution channel the largest in the market. The fastest growing segment is Online Retail growing at a vast rate of 29%. This growth can be attributed to the increasing adoption of e-commerce, especially in the wake of the COVID-19 pandemic, which has accelerated the shift to online shopping. Online retail offers consumers a convenient and accessible platform to explore and purchase a wide range of liquor confectionery products. It provides a broader reach to a global audience, facilitates easy product comparison, and offers a secure environment for age verification and purchasing, which is crucial in the sale of alcohol-related products, contributing to the segment's rapid growth.

Liquor Confectionery Market Segmentation: Regional Analysis:

-

North America

-

Asia- Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest region in the liquor confectionery market having a revenue share of 38%. This can be attributed to a combination of factors, including a well-established confectionery industry, a strong consumer preference for indulgent and premium treats, and a culture that embraces both sweet confections and alcoholic beverages. North America has witnessed a growing interest in artisanal and craft confectionery brands, which aligns with the unique flavor profiles offered by liquor confectionery products. The region's robust distribution channels and increasing online retail presence further contribute to its prominent position in the market. The fastest-growing region in the liquor confectionery market is the Asia-Pacific growing with a CAGR of 24.5%. This growth is driven by several factors, including an expanding middle class with increased disposable income, a growing appetite for premium and luxury products, and a rising interest in Western-style confectionery. The region's diverse and evolving taste preferences offer opportunities for unique flavor combinations, attracting both local and international liquor confectionery brands. The Asia-Pacific market also benefits from the prevalence of gifting culture and special occasions, making it a favorable region for the consumption of these indulgent treats.

COVID-19 Impact Analysis on the Global Liquor Confectionery Market:

The COVID-19 pandemic had a mixed impact on the global liquor confectionery market. While there was an initial disruption due to lockdowns, social distancing measures, and reduced foot traffic in physical stores, the market demonstrated resilience and adaptability. Manufacturers and retailers quickly pivoted to online sales channels to reach consumers. Moreover, the pandemic led to increased consumer interest in premium and indulgent treats as people sought comfort and luxury during challenging times. The gifting culture also remained robust, further bolstering the market. However, the market had to navigate supply chain disruptions and address changing consumer behaviors and preferences, such as a shift toward contactless shopping. Despite the initial challenges, the liquor confectionery market showcased its ability to evolve and meet shifting demands, positioning it for continued growth in the post-pandemic era.

Latest Trends/ Developments:

One trend in the liquor confectionery market is the growing demand for artisanal and craft products. Consumers are increasingly seeking unique and high-quality liquor-infused confectionery items that offer distinct flavors and experiences. This trend is driven by a desire for premium, handcrafted, and locally sourced products, as consumers look for authenticity and a connection to the production process. Artisanal liquor confectionery often incorporates small-batch production methods and innovative flavor combinations, attracting consumers looking for indulgent and personalized treats.

One significant development in the market is the rise of alternative alcoholic beverages in confectionery. Beyond traditional spirits like whiskey and rum, manufacturers are experimenting with a broader range of alcohol options, including craft beers, sparkling wines, and liqueurs. This development caters to diverse consumer tastes and preferences, expanding the range of flavors available in liquor confectionery. It also offers an opportunity for collaboration between confectionery and beverage companies, creating unique cross-branded products that capitalize on the popularity of both craft beverages and indulgent treats. This development not only broadens the product portfolio but also enhances the market's appeal to a wider audience.

Key Players:

- Abtey Chocolate Factory

- Neuhaus

- Mars

- Brookside

- Hershey’s

- Ferrero

- Vosges Haut-Chocolat

- Sugarfina

- Liqueur Fills

- Booz Drops

In December 2021, Hershey’s Company successfully finalized its acquisition of Dot’s Pretzels, the parent company of Dot’s Homestyle Pretzels, and Pretzels Inc., a co-manufacturer of Dot’s Pretzels and other brands. Hershey anticipates that this acquisition will contribute to its snacking powerhouse vision by introducing the fastest-growing large-scale pretzel brand in the United States to its product portfolio.

Chapter 1. GLOBAL LIQUOR CONFECTIONERY MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL LIQUOR CONFECTIONERY MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL LIQUOR CONFECTIONERY MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL LIQUOR CONFECTIONERY MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL LIQUOR CONFECTIONERY MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL LIQUOR CONFECTIONERY MARKET – By Product Type

6.1. Liquor-Filled Chocolates

6.2. Alcohol-Infused Gummies

6.3. Liquor-Flavored Truffles

6.4. Liquor-Infused Lollipops

6.5. Other Liquor Confectionery Products

Chapter 7. GLOBAL LIQUOR CONFECTIONERY MARKET – By Distribution Channel

7.1. Supermarkets and Hypermarkets

7.2. Specialty Stores

7.3. Online Retail

7.4. Convenience Stores

7.5. Others

Chapter 8. GLOBAL LIQUOR CONFECTIONERY MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End User

8.1.3. By Distribution Channel

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By End User

8.2.3. By Distribution Channel

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By End User

8.3.3. By Distribution Channel

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By End User

8.4.3. By Distribution Channel

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By End User

8.5.3. By Distribution Channel

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL LIQUOR CONFECTIONERY MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Abtey Chocolate Factory

9.2. Neuhaus

9.3. Mars

9.4. Brookside

9.5. Hershey’s

9.6. Ferrero

9.7. Vosges Haut-Chocolat

9.8. Sugarfina

9.9. Liqueur Fills

9.10. Booz Drops

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Liquor Confectionery Market was valued at USD 578.6 Million and is projected to reach a market size of USD 825.07 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.2%.

Gourmet and Premiumization Trends among consumers and Gift and Occasion-Based Consumption are drivers of the Liquor Confectionery market.

Based on product type, the Global Liquor Confectionery Market is segmented into Liquor-Filled Chocolates, Alcohol-Infused Gummies, Liquor-Flavored Truffles, Liquor-Infused Lollipops, and Other Liquor Confectionery Products

Abtey Chocolate Factory, Neuhaus, Mars, Brookside, and Hershey’s are a few of the key players operating in the Global Liquor Confectionery Market.