Liquid Synthetic Rubber Market Size (2024 – 2030)

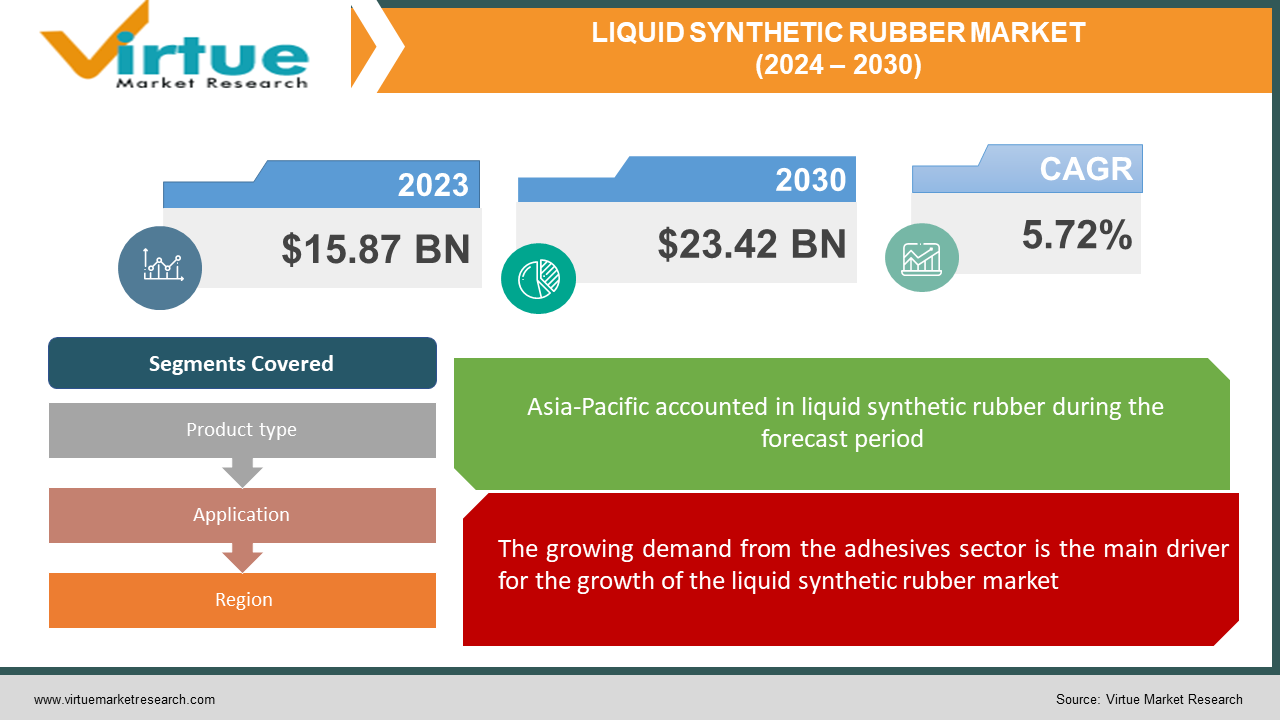

The Liquid Synthetic Rubber Market was valued at USD 15.87 billion in 2023 and is projected to reach a market size of USD 23.42 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.72%.

Liquid synthetic rubber, a versatile material prized for its flow properties and abrasion resistance, is gaining traction across diverse industries. Though a niche market, it's poised for steady growth driven by several factors.

- Widespread Applications: This liquid rubber finds use in a range of products like tires, adhesives, and coatings.

- Automotive Boom: The rise of electric vehicles and the increasing demand for tires with improved wear and tear are fueling market growth.

- Infrastructure Focus: The surge in construction activity, especially in Asia-Pacific, is driving demand for liquid synthetic rubber in adhesives and coatings.

Key Market Insights:

The liquid synthetic rubber market is witnessing rapid expansion due to increasing disposable income and the expanding tire manufacturing sector. Liquid synthetic rubber is a flexible material with many industrial applications. However, the volatility of commodity prices poses challenges. Despite this, there are many opportunities due to the growing industrial applications and the remarkable abrasion resistance of synthetic rubber.

The dominance of China and the United States in the global tire production market, as well as the influence of automobile production models, reflects the complex structure of this region. Market players should keep in mind issues related to falling demand and difficulties in tire production in certain regions. The liquid synthetic rubber market is a tough environment created by many factors that affect its growth, opportunities, and issues.

Liquid Synthetic Rubber Market Drivers:

The growing demand from the adhesives sector is the main driver for the growth of the liquid synthetic rubber market.

The adhesives segment is the main driver behind the significant increase in demand for liquid synthetic rubber in the market. This increase is due to the unique properties of liquid synthetic rubber, which makes it the best choice for many adhesive applications. The glue industry is increasingly using this material due to its strong adhesive properties, flexibility, and compatibility with various materials. The demand for efficient and high-quality adhesive solutions is increasing, which will have a positive impact on the marine synthetic rubber industry.

Growth in tire manufacturing is the driving force for the liquid synthetic rubber market

The notable increase in tire production is one of the main factors driving the liquid synthetic rubber market. Synthetic rubbers, especially polybutadiene (PBR) and styrene-butadiene rubber (SBR) are important for improving tire performance and longevity.

The widespread use of liquid synthetic rubber in tire manufacturing has been accelerated by the adoption of tire labeling laws. Interestingly, polybutadiene is used in the tire parts, as it reduces the amount of wear that is constantly changing while driving.

Since the automobile industry uses about 70% polybutadiene for tire production, market growth is closely related to industry growth. OICA reports that the significant increase in global vehicle production is having a significant impact on the growing demand for tires, which is also driving the growth of the liquid synthetic rubber market.

The continuous growth of the automotive industry, especially in Europe and the Asia-Pacific region, is contributing to the growth of the market. During the forecast period, the rapid expansion of the manufacturing sector and emerging economies, especially in the construction and infrastructure sectors, is expected to boost the growth of the liquid synthetic rubber market.

Liquid Synthetic Rubber Market Restraints and Challenges:

One of the factors restraining the growth of the liquid synthetic rubber market is the variable cost of raw materials.

The liquid synthetic rubber market faces major challenges due to fluctuations in raw material prices. In particular, styrene and butadiene are key ingredients in the production of liquid Styrene-Butadiene Rubber (SBR) and Butadiene Rubber (BR), and their prices are directly impacted by oil price volatility. The problem is exacerbated by the use of chemicals and solvents from the oil and gas industry, such as hexane, cyclohexane, benzene, and toluene, in the production process.

The current crisis in the global chemical sector, resulting from a shift in focus to the rapid expansion of the Asian market and the development of shale gas and coal, adds to the volatility of raw material prices and is a major obstacle and the constant expansion of water.

The global expansion of the marine synthetic rubber sector is facing obstacles due to strict government regulations, especially in Europe and the United States. These regulations, designed to ensure product safety and environmental soundness, disrupt manufacturing processes and may require additional costs to comply. The growth trend of the sector is also affected by trade barriers, geopolitical tensions, and changing geopolitical dynamics, which pose obstacles for market players.

Liquid Synthetic Rubber Market Opportunities:

In terms of market opportunities, the most significant development is the development of bio-based materials for synthetic rubber. This approach represents a huge opportunity for the marine synthetic rubber market as it is part of a growing focus on sustainability.

Biodiversity studies not only show commitment to environmentally friendly methods but also address issues related to resource dependence. The proposed change can attract environmentally conscious customers and improve the environmental friendliness of the production process.

One of the key drivers of innovation in the synthetic rubber sector is the use of bio-based materials, which promotes a strong and sustainable sector.

LIQUID SYNTHETIC RUBBER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.72% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

H.B. Fuller Company, TER HELL & CO. GMBH, KURARAY CO. LTD, Synthomer plc, Evonik Industries, KUMHO PETROCHEMICAL, Lion Elastomers, Royal Adhesives & Sealants, S. Plastic Corp, Addivant |

CUSTOMIZE THIS FULL REPORT AS PER YOUR NEEDS

SEGMENTATION ANALYSIS

Liquid Synthetic Rubber Market Segmentation: By Product Type

-

Liquid Isoprene

-

Liquid Butadiene

-

Liquid Styrene Butadiene

-

Other Product Types (Liquid EPDM and Liquid NBR)

The market for liquid synthetic rubber is divided into liquid isoprene, liquid butadiene, liquid styrene-butadiene, and other product types based on product type. In 2023, the styrene-butadiene liquid market emerged as the leading player, regardless of the product type. This is due to the important role played by the liquid styrene-butadiene rubber as the main component of the tire. It is used in tires, crown/rim/flange, and body, among other things. The increasing emphasis on tire wear and longevity is increasing the demand for liquid styrene-butadiene rubber in the tire industry. The need for liquid styrene-butadiene rubber in the market is also demonstrated by compliance with regulations governing tire labels.

Liquid isoprene, the main ingredient of liquid synthetic rubber, is poised to make big waves in the global market. Its growing demand is due to various factors including its unique flexibility, durability, and distribution across different industries. As manufacturers look for more sustainable materials, isoprene water is emerging as a favorite, providing an environmentally friendly solution without compromising performance. In addition, its compatibility with advanced manufacturing processes contributes to its growing acceptance. The impact of liquid isoprene on the global liquid synthetic rubber market is profound. It promotes innovation, enabling the production of high-quality plastic products with good properties. Additionally, its ability to improve product productivity and longevity is driving its interest in areas ranging from automotive to construction. As the demand for durable and long-lasting materials continues to rise, isoprene liquids are taking the lead, poised to reshape the global synthetic rubber market landscape.

Liquid Synthetic Rubber Market Segmentation: By Application

-

Adhesives

-

Industrial Rubber

-

Tire

-

Polymer Modification

-

Other Applications (Waterproofing Coatings and Footwear)

In 2023, Applications such as adhesives, industrial rubber, tire manufacturing, and polymer modification will be used to segment the market. Notably, in 2023, the tire Industrial Rubber segment held a dominant market share. This is explained by the fact that liquid synthetic rubber is everywhere and everywhere used to make tires. Liquid synthetic rubber is in high demand in the tire industry because of its important role in many tire components. This highlights its critical role in ensuring tire performance and durability and includes accessories and tread, crown/rim/flange, and body. The importance of the tire manufacturing sector is further enhanced by the existence of large tire manufacturing companies in China and Japan. The reasons for this are various factors, including many resources, expensive manufacturing, and many fast companies. As a result, tire manufacturers should continue to see a steady increase in demand for liquid synthetic rubber.

Adhesives play a central role in a variety of industries, from automotive and construction to electronics and healthcare. The adhesives market is growing rapidly, driven by factors such as the proliferation of lightweight and durable materials, advances in adhesive technology, and the growing trend toward smaller electronic devices. Furthermore, strict regulations promoting the use of eco-friendly and sustainable adhesives are also promoting market expansion.

This growth in the adhesives industry has a significant impact on the global liquid synthetic rubber market. Liquid synthetic rubber is an essential ingredient in many adhesive systems, providing flexibility, durability, and bond strength. As the demand for high-performance adhesives continues to rise, the liquid synthetic rubber market is expected to witness significant growth. The default seeds on his ability to improve for the manufacturers, thus moving me to work with the exposure to the company.

What's Next for Your Market? Get a FREE Snapshot Report

Liquid Synthetic Rubber Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest player in the domain that works in the section of China, India, and Japan in Japan. Rapid development in infrastructure, particularly in China and India, has led to an increase in demand for liquid synthetic rubber. The increasing demand for liquid synthetic rubber in the region is due to the increasing demand for adhesives in response to increasing construction and infrastructure activities.

The growing use and production of electric vehicles in the region has increased tire consumption, increasing the auto industry's reliance on liquid synthetic rubber. Mainly, thanks to the existence of tire manufacturing companies in China and Japan, Asia Pacific has the largest market share in terms of volume and revenue. The region is benefiting from a large number of manufacturers, large infrastructure, economic development, and various types of equipment, which are expected to drive the market. forward.

The liquid synthetic rubber (LSR) market in Asia Pacific has been significantly affected by the use of liquid isoprene rubber and SIS block polymers for adhesives. When mixed with natural rubber, liquid isoprene rubber (LR) acts as a reactive plasticizer (NR), softening the properties of materials such as zinc-coated steel wire used in tires. Due to its ability to dissolve hard rubbers and its function as a reactive plasticizer, it improves the processing of rubber compounds and drives market expansion during the forecast period.

China is a major player in the region as the world's largest producer of synthetic rubber and key raw materials such as butadiene, styrene, solvents, and catalysts. During this forecast period, the market is expected to witness significant growth due to China's rapid expansion in the manufacturing sector, particularly in the automotive and construction sectors.

Liquid synthetic rubber (LSR) is increasingly profitable for the developing European automotive industry, which is driving market growth. It is expected that the existence of tire manufacturers such as Bridgestone, Michelin, Goodyear, Pirelli, and Apollo, as well as advanced production methods, will support the expansion of the company.

There will be huge opportunities for market expansion as the equipment and business expansion in North America is expected to increase the demand for adhesives and coatings. To support market expansion in the region, it is expected that the coating manufacturers will solve the problems of weather resistance, mechanical strength, and chemical resistance.

COVID-19 Impact Analysis on the Liquid Synthetic Rubber Market:

In 2020-2021, the COVID-19 pandemic also affected the marine synthetic rubber sector. Car manufacturing has been halted during this pandemic due to the containment measures imposed by the government to prevent the spread of the new COVID-19 disease. As a result, the demand for synthetic rubber auto fluids, such as tires, drive belts, gaskets, hoses, tank liners, and others, has decreased. The crisis caused by infectious diseases has had a significant impact on the demand and demand in the marine synthetic rubber industry.

Latest Trends/ Developments:

Growing demand from the tire sector is a prominent factor in the liquid synthetic rubber market.

Liquid synthetic rubber is widely used in tire manufacturing because it is durable and performs well, which complies with the tire labeling regulations. The main component of tires, polybutadiene, has many uses in other automotive materials, but it works as a sidewall to improve fatigue resistance under constant changes. Industry organizations such as the US Tire Manufacturers Association provide statistics that show that large cars use 11% rubber in their tires, while tires and car tires use 24%. About half of car tires are a mixture of natural rubber and styrene-butadiene rubber.

Additional information from the International Tire and Rubber Association highlights the significant global demand for tires by identifying China and the United States as the two largest tire-producing countries. However, due to the decrease in the demand for original equipment manufacturers (OEM) and replacement parts, tire production has gradually decreased in some regions, including Asia and Europe. For example, according to ATMA, India's total tire sales decreased by 4% to 169.07 million in the financial year 2021-22, compared to the previous year. The liquid synthetic rubber market is affected by the changes in tire manufacturing, which has shaped the current development in the sector.

Key Players:

-

H.B. Fuller Company

-

TER HELL & CO. GMBH

-

KURARAY CO. LTD

-

Synthomer plc

-

Evonik Industries

-

KUMHO PETROCHEMICAL

-

Lion Elastomers

-

Royal Adhesives & Sealants

-

S. Plastic Corp

-

Addivant

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. Liquid Synthetic Rubber Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Liquid Synthetic Rubber Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Liquid Synthetic Rubber Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Liquid Synthetic Rubber Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Liquid Synthetic Rubber Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Liquid Synthetic Rubber Market – By Product Type

6.1 Introduction/Key Findings

6.2 Liquid Isoprene

6.3 Liquid Butadiene

6.4 Liquid Styrene Butadiene

6.5 Other Product Types (Liquid EPDM and Liquid NBR)

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Liquid Synthetic Rubber Market – By Application

7.1 Introduction/Key Findings

7.2 Adhesives

7.3 Industrial Rubber

7.4 Tire

7.5 Polymer Modification

7.6 Other Applications (Waterproofing Coatings and Footwear)

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Liquid Synthetic Rubber Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Liquid Synthetic Rubber Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 H.B. Fuller Company

9.2 TER HELL & CO. GMBH

9.3 KURARAY CO. LTD

9.4 Synthomer plc

9.5 Evonik Industries

9.6 KUMHO PETROCHEMICAL

9.7 Lion Elastomers

9.8 Royal Adhesives & Sealants

9.9 S. Plastic Corp

9.10 Addivant

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Liquid Synthetic Rubber Market was valued at USD 15.87 billion and is projected to reach a market size of USD 23.42 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.72%.

The market is expanding due in large part to the growing demand from the adhesive industry and the noticeable rise in tire production.

Based on Product Type, the Liquid Synthetic Rubber Market is segmented into Liquid Isoprene, Liquid Butadiene, Liquid Styrene Butadiene, and Other Product Types (Liquid EPDM and Liquid NBR).

Asia-Pacific is the most dominant region for the Liquid Synthetic Rubber Market.

H.B. Fuller Company, TER HELL & CO. GMBH, KURARAY CO. LTD, Synthomer plc, Evonik Industries, KUMHO PETROCHEMICAL, Lion Elastomers, Royal Adhesives & Sealants, S. Plastic Corp, Addivant