Liquid Hydrogen Market Size (2024 – 2030)

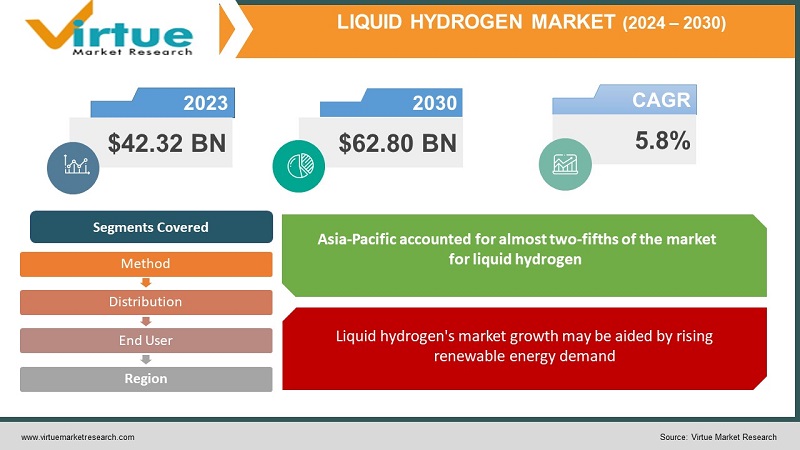

The Global Liquid Hydrogen Market was valued at USD 42.32 billion and is projected to reach a market size of USD 62.80 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.8%.

In addition to being utilized as fuel for internal combustion engines and fuel cells, liquid hydrogen may also be used to chill neutrons for neutron scattering. Given its beneficial qualities, such as ease of storage and transportation, the growing use of green hydrogen in the most rapidly developing sectors requiring significant mobility, such as road freight, marine, and aviation, affects liquid hydrogen demand. The chemical and petrochemical sectors' rising need for liquid hydrogen will fuel the industry even more. The high expense of liquid hydrogen transportation, however, will severely restrict the growth of the liquid hydrogen business.

Key Market Insights:

To meet the rising demand for hydrogen-powered cars, Air Liquid built its biggest liquid hydrogen production and logistics plant in North Las Vegas, Nevada.

The first of its type in China, the Water Electrolysis Tank for Hydrogen Production was revealed by Yingde Gases. A 500Nm3/h hydrogen-generating water electrolysis tank that was fully designed and constructed in-house at Yingde Gases Group's engineering and manufacturing facilities was on display.

The largest manufacturing and logistics infrastructure site for liquid hydrogen was created by Air Liquide. With this structure, the organization has paved the way for other firms to move to the region. As a consequence, the region will receive more investment and jobs.

Plug Power Inc. purchases United Hydrogen Group Inc. By bolstering its manufacturing capacity, the purchase will improve its position for environmentally friendly hydrogen generation in the United States.

Air Products and Chemicals, Inc. purchases Oxygen & Argon Works Ltd. The portfolio and operational capabilities of Air Products and Chemicals, Inc. will be improved by this purchase.

The establishment of Linde Plc's fifth liquid hydrogen facility in the U.S. has strengthened the company's extensive supply network, which already includes facilities in California, Alabama, Indiana, and New York. To fulfill the rising demand from Linde's clients, this new plant in La Porte, Texas, will produce more than 30 tonnes of high-purity liquid hydrogen daily. The sales of Linde Plc's liquid hydrogen products are anticipated to expand as a result of this strategic business expansion.

To hasten the adoption of liquid hydrogen in the heavy mobility market, Air Liquid is merging its expertise with that of global automotive supplier Faurecia, a business of the FORVIA Group.

Global Liquid Hydrogen Market Drivers:

Liquid hydrogen's market growth may be aided by rising renewable energy demand:

When utilized in fuel cells, liquid hydrogen is regarded as a sustainable and clean energy source because it only emits water vapor. The demand for liquid hydrogen as an alternative to conventional fossil fuels has increased due to the rising concern on a worldwide scale about lowering greenhouse gas emissions and switching to greener fuels.

Infrastructure improvements for hydrogen can support the commercial expansion of liquid hydrogen:

For liquid hydrogen to be widely used, a strong hydrogen infrastructure, comprising production, storage, and distribution facilities, must be built. The market for liquid hydrogen is mostly driven by investments in infrastructural expansion and technological developments.

Global Liquid Hydrogen Market Challenges:

It is anticipated that the difficulty of handling and storing liquid hydrogen would limit market expansion:

However, because of its extremely low temperature and significant volatility, liquid hydrogen requires specialized storage and handling infrastructure. It can be difficult to maintain a low temperature and avoid evaporation since cryogenic storage systems must be well-insulated. The infrastructure must be more sophisticated and expensive since the storage tanks must be precisely engineered to resist the severe cold and prevent leakage.

Global Liquid Hydrogen Market Opportunities:

The most profitable prospects are being offered by the industry of rising demand for renewable energy:

Since the world is concentrating on reducing carbon emissions and switching to greener energy sources, liquid hydrogen presents exciting market expansion prospects. Through procedures like electrolysis, liquid hydrogen may be created from renewable energy sources, allowing for the creation of "green hydrogen." A huge potential for liquid hydrogen as a renewable and sustainable fuel is presented by the rising need for clean energy. The market for liquid hydrogen also offers a sizable opportunity in the transportation industry. Liquid hydrogen-fueled hydrogen fuel cell vehicles (FCVs) provide zero-emission mobility with large driving ranges and rapid refueling times. The adoption of liquid hydrogen in the transportation industry will be influenced by the development of more efficient and affordable fuel cell technologies as well as the expansion of hydrogen refueling infrastructure. During the projected period, these aspects are likely to present profitable prospects for the liquid hydrogen market.

LIQUID HYDROGEN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Method, Distribution, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Air Products Inc., Air Liquide, Ballard Power Systems, FuelCell Energy, Inc, ELME MESSER L, FirstElement Fuel, Inc, Linde plc, Cummins Inc, PLUG POWER INC, PowerCell Sweden AB |

Global Liquid Hydrogen Market Segmentation: By Method

-

Electrolysis

-

Steam Reforming

-

Coal Gasification

-

Others

Over the anticipated duration, the steam reforming sector is anticipated to dominate the market by 37%. In the short and medium term, steam reform offers an efficient, affordable, and widely utilized method for producing liquid hydrogen, as well as energy security and environmental benefits. The steam reforming approach has the greatest productivity of the currently available manufacturing methods, ranging from 65.0% to 75.0%. Natural gas is a dependable source of hydrogen with a high hydrogen-to-carbon ratio that is simple to regulate. Additionally, the cost of producing liquid hydrogen by steam reforming is strongly dependent on the price of natural gas, which is currently the least expensive method of producing hydrogen in large quantities.

Significant growth is anticipated for the electrolysis market by 25%. Depending on the electrical source utilized, electrolysis can create hydrogen with no emissions of greenhouse gases. Electrolysis is being studied as a method of producing hydrogen for nuclear and renewable energy sources. These procedures provide emissions standards for pollutants and greenhouse gases that are comparatively low.

Global Liquid Hydrogen Market Segmentation: By Distribution

-

Pipelines

-

Cryogenic Tanks

-

Others

Cryogenic tanks held the largest market share by distribution in 2022, accounting for more than three-fifths of the liquid hydrogen markets by 42%. It is predicted that this segment will continue to hold the top spot throughout the forecast period. Liquid gases including liquid hydrogen, liquid oxygen, and liquefied natural gas (LNG) must be stored and transported in cryogenic tanks. Cryogenic tanks are increasingly needed to assist the storage and transportation sectors as diverse industries grow. Tanks are also used to store and transport liquid hydrogen, which has become popular as a cleaner substitute for conventional fossil fuels.

For the duration of the projected period, the pipeline sector is likely to rule the market by 18%. The pipeline network is the most effective method for supplying energy using liquid hydrogen. However, one option to set up pipeline networks to provide hydrogen is through national or state networks, sometimes referred to as specialized networks. Additionally, they can be included in regional networks.

Global Liquid Hydrogen Market Segmentation: By End-Use Industry

-

Aerospace

-

Automotive and Transportation

-

Energy and Power

-

Industrial Sector

-

Others

According to the end-use industry, the aerospace sector accounted for the highest share in 2022, accounting for more than one-fourth of the market's revenue by 38%. It is anticipated that this sector will continue to hold the top spot during the forecast period. High specific impulse, a gauge of a rocket engine's effectiveness, is offered by liquid hydrogen. Compared to other fuels, it has more thrust per unit of propellant, enabling higher velocity and payloads. The automotive and transportation industry, on the other hand, would report a CAGR of 6.0% throughout the predicted period.

The largest market over the predicted period is accounted for by the automobile industry by 22%. Vehicles powered by liquid hydrogen fuel cells only use electricity for propulsion. Driving it feels exactly like driving a regular electric car. Since electric motors have their full torque even at low speeds, there is almost no vehicle noise and a lively start. Liquid hydrogen fuel cell cars' range is not dependent on the weather in colder climates.

Global Liquid Hydrogen Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Based on revenue, Asia-Pacific accounted for almost two-fifths of the market for liquid hydrogen in 2022, and it is anticipated that it will continue to hold the top spot during the forecast period by 49%. The Chinese government has made clear that it strongly supports fuel cell and hydrogen technology. China has announced many governmental goals and actions to encourage the creation and use of hydrogen, particularly liquid hydrogen. For the market for liquid hydrogen to expand, the government has offered financial incentives, financing programs, and regulatory assistance.

Since the majority of space research organizations, particularly NASA, utilize liquid hydrogen as a fuel for space exploration, the North American market is likely to fast-growing industry 325. Additionally, liquid hydrogen is employed as a satellite launch fuel in other nations. However, the market in North America is somewhat contracting as a result of significant price variations.

COVID-19 Impact on Global Liquid Hydrogen Market:

The COVID-19 epidemic had a substantial impact on the broader hydrogen economy, leading to ongoing delays in several streamlined projects and limited industrial activity, which reduced the amount of hydrogen available to end users. However, the government's support in the form of rules and incentives, together with large investments made by the top companies, is projected to give the industry pace.

Global Liquid Hydrogen Market Recent developments:

The key drivers of the market growth for liquid hydrogen are the development of space exploration programs and the increase of renewable energy sources. Fuel cells, which transform chemical energy into electrical energy with just water and heat as byproducts, depend on liquid hydrogen as a key component. Liquid hydrogen is increasingly in demand as both the need for fuel cells and renewable energy sources rise. Due to its high energy density and low weight, liquid hydrogen is a popular fuel for rockets used in space exploration. The demand for liquid hydrogen is anticipated to rise as more governments and commercial organizations make investments in space exploration programs.

Key Players:

- Air Products Inc.

- Air Liquide

- Ballard Power Systems

- FuelCell Energy, Inc

- ELME MESSER L

- FirstElement Fuel, Inc

- Linde plc

- Cummins Inc

- PLUG POWER INC

- PowerCell Sweden AB

- In June 2022: A joint venture between Air Liquide and Siemens Energy has been established in Europe to manufacture a series of renewable hydrogen electrolyzers on an industrial scale. This partnership will assist Europe in creating a sustainable hydrogen economy and a European electrolysis and hydrogen technology ecosystem.

- In March 2022: In Casa Grande, Arizona, the United States, Air Products Inc., a pioneer in the supply, distribution, and dispensing of hydrogen, plans to build, own, and operate a 10 metric tonne per day green liquid hydrogen production facility. In 2023, the liquid hydrogen project with zero carbon emissions is likely to go online. The company's products will be offered to California and other places that need zero-carbon hydrogen for the hydrogen for the mobility market.

Chapter 1. Liquid Hydrogen Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Liquid Hydrogen Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Liquid Hydrogen Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Liquid Hydrogen Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Liquid Hydrogen Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Liquid Hydrogen Market – By Method

6.1 Introduction/Key Findings

6.2 Electrolysis

6.3 Steam Reforming

6.4 Coal Gasification

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Method

6.7 Absolute $ Opportunity Analysis By Method , 2024-2030

Chapter 7. Liquid Hydrogen Market – By Distribution

7.1 Introduction/Key Findings

7.2 Pipelines

7.3 Cryogenic Tanks

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Distribution

7.6 Absolute $ Opportunity Analysis By Distribution , 2024-2030

Chapter 8. Liquid Hydrogen Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Aerospace

8.3 Automotive and Transportation

8.4 Energy and Power

8.5 Industrial Sector

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End-Use Industry

8.8 Absolute $ Opportunity Analysis By End-Use Industry , 2024-2030

Chapter 9. Liquid Hydrogen Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Method

9.1.3 By End-Use Industry

9.1.4 By Distribution

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Method

9.2.3 By End-Use Industry

9.2.4 By Distribution

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Method

9.3.3 By End-Use Industry

9.3.4 By Distribution

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Method

9.4.3 By End-Use Industry

9.4.4 By Distribution

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Method

9.5.3 By End-Use Industry

9.5.4 By Distribution

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Liquid Hydrogen Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Air Products Inc.

10.2 Air Liquide

10.3 Ballard Power Systems

10.4 FuelCell Energy, Inc

10.5 ELME MESSER L

10.6 FirstElement Fuel, Inc

10.7 Linde plc

10.8 Cummins Inc

10.9 PLUG POWER INC

10.10 PowerCell Sweden AB

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Liquid Hydrogen Market was valued at USD 42.32 billion and is projected to reach a market size of USD 62.80 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.8%.

Liquid hydrogen's market growth may be aided by rising renewable energy demand and Infrastructure improvements for hydrogen can support the commercial expansion of liquid hydrogen are the factors driving the Global Liquid Hydrogen Market.

It is anticipated that the difficulty of handling and storing liquid hydrogen would limit market expansion.

Pipeline sector distribution is the fastest growing in the Global Liquid Hydrogen Market.

North America region is the fastest growing in the Global Liquid Hydrogen Market.