Lipase Market Size (2024 – 2030)

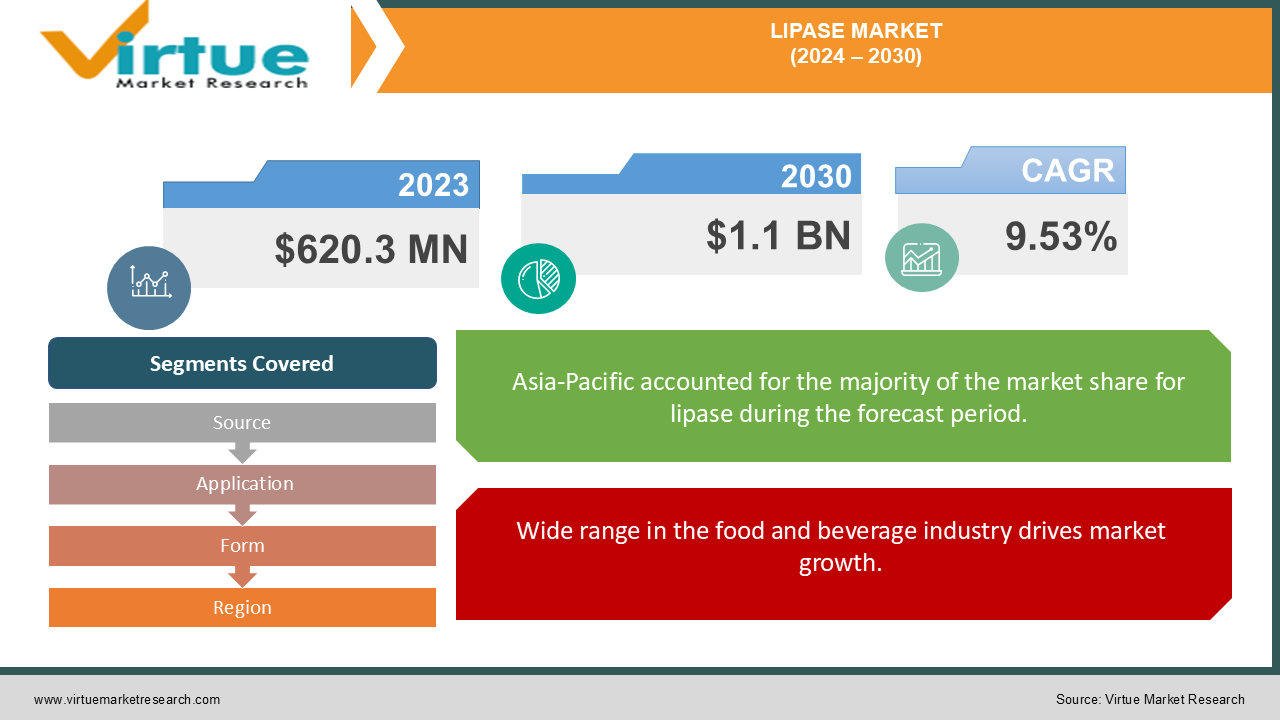

The Lipase Market was valued at USD 620.3 Million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1.1 Billion by 2030, growing at a CAGR of 9.53%.

Lipase is an enzyme that catalyzes the breakdown of triglycerides into fatty acids and free glycerol. It is predominantly found in pancreatic secretions, where it plays a crucial role in fat digestion. Additionally, lipase contributes to the efficacy of various cholesterol-lowering medications. In the food industry, microbial lipases are widely utilized due to their specificity for substrates. These enzymes operate effectively in organic solvents under mild conditions and exhibit significant stability. Commonly used lipases in the food sector include lysophospholipase, phospholipase, and triacylglycerol. Moreover, lipase is increasingly incorporated into household detergents and cleaning products to aid in the removal of fatty residues.

Key Market Insights:

Increasing awareness of the need for healthy and non-chemical ingredients is accelerating the adoption of lipase enzymes across diverse industries, including animal feed.

Key factors propelling the global lipase market include the increased consumption of processed dairy products and meat, as well as heightened awareness of animal health.

Additionally, the numerous health benefits associated with lipase for humans are expected to further stimulate the market's expansion.

In Germany, advancements in technology are focusing on developing genetically modified organisms capable of operating under challenging conditions to enhance dough and cheese-making efficiency. This innovation presents substantial growth opportunities for the lipase market in the country.

Lipase Market Drivers:

Wide range in the food and beverage industry drives market growth.

The utilization of lipase in the food and beverage industry, both as a seasoning agent and for optimizing the shelf life of food products, is anticipated to drive market growth. Microbial lipases are particularly valued in this sector due to their substrate specificity and stability in various environments, including organic solvents. Commonly used lipases in the food industry include lysophospholipase, phospholipase, and triacylglycerol.

These enzymes play a crucial role in the processing of fats and oils, contributing to flavor enhancement through the synthesis of short-chain fatty acid esters, selective hydrolysis of fat triglycerides to release free fatty acids, and reduction of fat content in various food products such as meat and fish. Additionally, lipases are integral to the fermentation process in sausage production, where they interact with long-chain fatty acids produced during ripening to influence the final product. Advantage of Microbial Lipases increases the demand of Lipase.

Microbial lipases are considered more advantageous than those obtained from plant or animal sources due to their diverse catalytic capabilities, high production yields, ease of genetic modification, lack of seasonal variations, consistent availability, greater stability, and economic

viability. The growth rate of microorganisms in cost-effective media further enhances their value. Bacterial strains exhibit superior performance, including optimal activity at neutral or alkaline pH levels and thermostability comparable to that of yeast. As awareness of animal health and the quality of animal-derived products increases, along with a rise in the consumption of enzyme-modified cheese (EMC) and enzyme-modified dairy ingredients (EMDI), the market for lipases has expanded significantly. The additional advantages of microbial lipases over those from animal and plant sources are also driving market growth.

Lipase Market Restraints and Challenges:

Lack of Transparency and Low Expenditure can hinder market growth.

Lack of transparency in patent protection laws may pose challenges to the growth of the lipase market. Additionally, inadequate food processing technology infrastructure in lower and middle-income economies could further impede market expansion. Limited investment in research and development within these economies is also expected to hinder the overall growth rate of the lipase market.

Lipase Market Opportunities:

Increasing concerns and awareness regarding animal health are driving the expansion of the lipase market. The growing consumption of meat products, fueled by population growth, is further contributing to this market's development. In the food sector, lipase enhances product quality by improving flavor, texture, and shelf life. Consequently, the growth and expansion of the food and beverage industry are expected to positively impact the lipase market. Additionally, the multiple health benefits associated with lipase are likely to create further opportunities for market growth.

LIPASE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.53% |

|

Segments Covered |

By Source, Application, Form, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Associated British Foods PLC, Advanced Enzymes Novozymes A/S, E. I. DuPont De Nemours and Company Koninklijke DSM N.V., Enzyme Development Corporation. Renco New Zealand, Chr. Hansen Holdings A/S Amano Enzymes Inc., Clerici-Sacco Group |

Lipase Market Segmentation: By Source

-

Microbial

-

Animal

-

Plant

The versatility of application features and the ease of mass production make microbial lipases the largest and fastest-growing segment in the market. Their extensive range of enzymatic properties and substrate specificity enhances their appeal for industrial use. The industrial sector is expected to see the most significant gains from various lipase sources. In the coming years, lipases are projected to benefit from their adaptability and ongoing market expansion in the detergent and cosmetics industries.

In the food industry, microbial lipases are extensively utilized due to their substrate specificity. They function efficiently under mild conditions and demonstrate significant stability in organic solvents. Common lipases used in the food sector include lysophospholipase, phospholipase, and triacylglycerol. These enzymes are crucial in fat and oil processing, facilitating flavor modification through the synthesis of short-chain fatty acid esters, selective hydrolysis of fat triglycerides to release free fatty acids, and reduction of fat content in various food products, such as meat and fish, to produce leaner options. Furthermore, lipases are crucial in the fermentation phase of sausage production, as they impact the release of long-chain fatty acids during the ripening process.

Lipase Market Segmentation: By Application

-

Animal Feed

-

Dairy

-

Bakery

-

Confectionery

-

Others

The food segment is anticipated to dominate the lipase market due to its crucial role in maintaining a healthy gut and enhancing metabolism. In Germany, where bread and baked goods are staples, the bakery industry is significant. Lipase contributes to this sector by improving dough stability and extending the shelf life of baked products. Additionally, lipase is extensively utilized in the dairy industry for cheese production.

Lipase also plays a key role in transporting dietary lipids within the body and supports pancreatic health, which drives food industry manufacturers to incorporate lipase into their products.

On the other hand, the animal feed segment is projected to experience the highest compound annual growth rate (CAGR) during the forecast period. Animal feed, rich in fiber, vitamins, and minerals, is essential for regulating livestock metabolism. The rise in livestock production driven by increased meat consumption is expected to boost demand for lipase as a valuable enzyme. The need for optimal animal nutrition and the production of high-quality meat are anticipated to drive the growth of the lipase market in the animal feed sector.

Lipase Market Segmentation: By Form

-

Liquid

-

Powder

-

Gel

The liquid form of lipase is anticipated to hold the largest market share. This preference is largely due to its prevalent use in the hydrolysis of milk fat, where it is typically applied in liquid form. Additionally, liquid lipase is commonly utilized as a flavor enhancer and in coffee creamers. Conversely, the powdered form of lipase is expected to experience the highest compound annual growth rate (CAGR).

Lipase Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region leads the lipase market both in market share and revenue by 40% and is expected to maintain its dominance throughout the forecast period. The growth in this region is driven by the increased use of lipase in animal feeds for livestock and the expansion of the food and

beverage industries, particularly in developing economies. The region is anticipated to achieve a substantial growth rate and the highest compound annual growth rate (CAGR) during the forecast period. Factors such as the rising demand for processed foods and growing awareness about food ingredients are fueling this growth. Additionally, the increasing consumption of bakery and confectionery items and meat products due to a growing population will further drive market expansion. India and China are projected to be key contributors to this growth.

In Europe, lipase also holds a significant market share. The growing demand for processed foods and heightened awareness of health-conscious products are driving the adoption of enzymes, such as lipase, within the European food industry. This trend is contributing to the expansion of the global market. Carbohydrates lead the market in type segmentation, followed by proteases and lipases. In Europe, the bakery sector is the largest application segment due to high bread and baked goods consumption, where lipase enhances dough stability and extends product shelf life. The dairy industry is the second-largest application for lipase, particularly in cheese processing. Europe is also advancing in the development of genetically modified organisms that can operate under challenging conditions to enhance process efficiency.

COVID-19 Pandemic: Impact Analysis

The COVID-19 lockdown restrictions and associated labor constraints led to a decline in lipase production and sales. The outbreak severely disrupted supply chains, causing significant delays in the procurement of raw materials. Consequently, producers faced substantial challenges in inventory management, further exacerbating the impact on the lipase market.

Latest Trends/ Developments:

Advanced Enzymes, an Indian company specializing in modern assessment chemicals, has expanded its production facility in Madhya Pradesh to better address the growing demand for microbial catalysts among end users. Additionally, Chr. Hansen launched SPICEIT®, a cheese product that incorporates lipases to enhance its flavor profile. By converting milk-fat triglycerides into unsaturated fats, the product achieves a distinctive and intriguing taste.

Key Players:

These are top 10 players in the Lipase Market:-

-

Associated British Foods PLC

-

Advanced Enzymes Novozymes A/S

-

E. I. DuPont De Nemours and Company Koninklijke DSM N.V.

-

Enzyme Development Corporation. Renco New Zealand

-

Chr. Hansen Holdings A/S Amano Enzymes Inc.

-

Clerici-Sacco Group

- In 2022, Sacco Systems announced its expansion into the Nordic countries with the rebranding of its subsidiary to Sacco System Nordic AB.

Chapter 1. Lipase Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Lipase Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Lipase Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Lipase Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Lipase Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Lipase Market – By Source

6.1 Introduction/Key Findings

6.2 Microbial

6.3 Animal

6.4 Plant

6.5 Y-O-Y Growth trend Analysis By Source

6.6 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Lipase Market – By Form

7.1 Introduction/Key Findings

7.2 Liquid

7.3 Powder

7.4 Gel

7.5 Y-O-Y Growth trend Analysis By Form

7.6 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 8. Lipase Market – By Application

8.1 Introduction/Key Findings

8.2 Animal Feed

8.3 Dairy

8.4 Bakery

8.5 Confectionery

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Lipase Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Source

9.1.3 By Form

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Source

9.2.3 By Form

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Source

9.3.3 By Form

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Source

9.4.3 By Form

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Source

9.5.3 By Form

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Lipase Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Associated British Foods PLC

10.2 Advanced Enzymes

10.3 Novozymes A/S

10.4 E. I. DuPont De Nemours and Company

10.5 Koninklijke DSM N.V.

10.6 Enzyme Development Corporation.

10.7 Renco New Zealand

10.8 Chr. Hansen Holdings A/S

10.9 Amano Enzymes Inc.

10.10 Clerici-Sacco Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Increasing awareness of the need for healthy and non-chemical ingredients is accelerating the adoption of lipase enzymes across diverse industries, including animal feed.

The top players operating in the Lipase Market are - Associated British Foods PLC, Advanced Enzymes, Novozymes A/S, E. I. DuPont De Nemours and Company, Koninklijke DSM N.V., Enzyme Development Corporation, Renco New Zealand, Chr. Hansen Holdings A/S, Clerici-Sacco Group and Amano Enzymes Inc.

The COVID-19 lockdown restrictions and associated labor constraints led to a decline in lipase production and sales.

In the food sector, lipase enhances product quality by improving flavor, texture, and shelf life. Consequently, the growth and expansion of the food and beverage industry are expected to positively impact the lipase market.

The growing demand for processed foods and heightened awareness of health-conscious products are driving the adoption of enzymes, such as lipase, within the European food industry. This trend is contributing to the expansion of the global market.