Liming & Acidifying Agrochemical Agents Market Size (2024 – 2030)

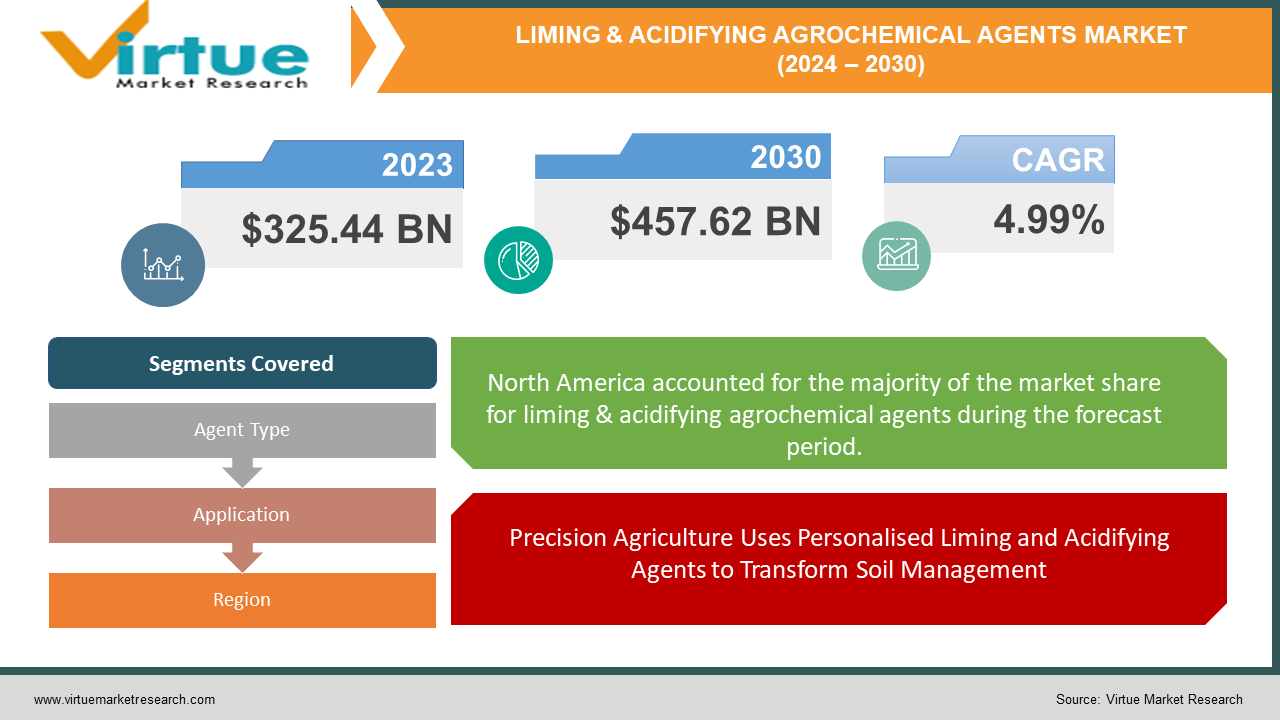

The Global Liming & Acidifying Agrochemical Agents Market was valued at USD 325.44 billion in 2023 and is projected to reach a market size of USD 457.62 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.99%.

Agrochemical compounds that liming and acidify are like soil adjusters. There are two primary categories of them: acidifying and liming agents. Acidic soil is a common agricultural problem that can be raised in pH by liming chemicals like limestone. This facilitates healthy growth and improves nutrient absorption by plants. Conversely, acidifying treatments provide the ideal environment for crops that require acid, such as blueberries, by bringing the pH of too-alkaline soil down. For different crops to flourish, the proper soil environment must be ensured by both kinds of agents. Materials known as liming agents raise the pH of acidic soil by neutralizing it. They are frequently employed to solve acidic soil, a major issue in agriculture.

Less frequently used but essential are acidifying chemicals for crops like blueberries, azaleas, and rhododendrons that grow well in acidic soil.

Key Market Insights:

According to a 2023 survey, 65% of farmers worldwide are actively putting sustainable farming principles into reality. The demand for agents made of industrial or organic ingredients is increased by the emphasis on environmentally friendly agriculture. According to a survey conducted in 2022, 72% of farmers now understand how crucial soil pH is to agricultural output. The growing consciousness among farmers leads to a rise in the need for liming and acidifying products to establish the best possible soil for their crops. The information and study show that manufacturers have a great chance to take advantage of the growing trend of precision agriculture by creating and promoting targeted application technologies for liming and acidifying products. Growing consumer demand for organic produce presents a profitable potential for businesses to invent and market environmentally acceptable acidifying and liming solutions.

Global Liming & Acidifying Agrochemical Agents Market Drivers:

Precision Agriculture Uses Personalised Liming and Acidifying Agents to Transform Soil Management

The use of liming and acidifying compounds to maintain soil health is being revolutionized by precision agriculture. Cutting-edge instruments such as GPS-guided application and soil mapping guarantee precise dispersal, reducing wastage and maximizing efficacy in redressing pH imbalances. This enhances soil health by supporting a flourishing microbiome, enhanced water retention, and increased nutrient availability, all of which contribute to strong crops and environmentally friendly farming methods. Meanwhile, demand for these agents is being driven by an increasing recognition of the crucial role soil pH plays in crop performance. Liming and acidifying agents help to peak yields, better nutrient efficiency, and the building of a strong foundation for long-term agricultural success by reversing imbalances and fostering an environment for optimal nutrient uptake.

Eco-Friendly Liming and Acidifying Agents are in Demand Due to Soil Management and Sustainability

Due to health and environmental concerns, the market for liming and acidifying chemicals is seeing a unique opportunity because of the surge in the consumption of organic products. To maintain healthy soil, organic farming places a high priority on natural soil amendments such as liming/acidifying agents obtained from organic matter. This is an important technique for certain organic crops, such as blueberries, which need acidic conditions. Furthermore, the development of eco-friendly agents and the emphasis on sustainability in organic farming go hand in hand, offering producers a great chance to serve this expanding market segment and help ensure a more sustainable future for agriculture.

Global Liming & Acidifying Agrochemical Agents Market Restraints and Challenges:

There are obstacles in the way of the global market for agrochemical agents that lime and acidify. Farmers and manufacturers alike may face difficulties due to regional variations in the strict laws governing use and application. Over-application can damage crops, therefore it's important to apply correctly. It is essential to teach farmers about proper use. Furthermore, some farmers may not be able to acquire these agents due to the high cost of shipping associated with their weight and mass. Finally, price swings brought on by the cost of raw materials and transportation can make it challenging for farmers to stick to their budgets, which may discourage them from using these agents consistently.

Global Liming & Acidifying Agrochemical Agents Market Opportunities:

The market for liming and acidifying agrochemical chemicals appears to have a promising future. Since exact application maximizes the efficiency of these agents, the advent of precision agriculture generates considerable demand for them. Growing consumer desire for organic produce drives demand for sustainable solutions, providing opportunities for environmentally friendly products derived from industrial waste or organic materials. Growing agricultural industries in developing economies offer unrealized market growth potential as farmers realize how crucial it is to maintain soil pH for higher yields. Finally, ongoing product innovation can encourage broader acceptance by bringing in new clients with quicker-acting formulae, more nutrients, or combo goods.

LIMING & ACIDIFYING AGROCHEMICAL AGENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.99% |

|

Segments Covered |

By Agent Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Bayer AG, Compass Minerals International Corp., Corteva Inc., Dow Chemical Company, ICL Fertilizers, Israel Chemicals Ltd, Sumitomo Chemical Co., Syngenta Group |

Global Liming & Acidifying Agrochemical Agents Market Segmentation: By Agent Type

-

Liming Agents

-

Acidifying Agents

By type of agent, the global market for liming and acidifying agrochemical agents can be divided. Now, liming agents like hydrated lime and limestone rule the market. They are a well-liked option for combating acidic soil, a problem that is common in many agricultural regions. Nevertheless, acidifying agents have a promising future. This market is predicted to increase at the quickest rate because of the popularity of organic farming and the unique needs of some crops.

Global Liming & Acidifying Agrochemical Agents Market Segmentation: By Application

-

Crop Type

-

Farming Practice

It is also possible to divide the worldwide market for liming and acidifying agricultural chemicals based on application. A crucial element is cropping type, with agents meeting particular requirements. For instance, whereas fruits like blueberries need a very acidic soil, grains like maize and wheat prefer a somewhat acidic soil. Farming methods are also important. When employing these agents, conventional agriculture—which now makes up the greater segment—may give priority to elements like cost and ease of application. However, the application segment with the fastest predicted growth is predicted to be organic farming. Organic farmers prioritize soil health and may be more likely to use these agents for maximum crop performance, even if it involves somewhat higher prices, because of the growing demand for organic produce.

Global Liming & Acidifying Agrochemical Agents Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Regional divisions are another way to break down the worldwide market for liming and acidifying agrochemical chemicals. North America already uses these agents widely and has a thriving agriculture industry. However, because soil management techniques have been used for a long time, its growth may be sluggish. The Asia-Pacific area, on the other hand, is anticipated to grow at the quickest rate. Demand in this case is being driven by elements like the quickly developing agriculture in China and India and farmers' increasing knowledge of the condition of their soil. The necessity to preserve soil quality and abide by laws about environmentally friendly farming practices is probably what drives Europe's developed and sustainability-focused agriculture sector. Modern methods are being adopted by South America's sizable agricultural industry, and as farmers learn more about these agents' ability to increase yields, it is anticipated that their use will increase.

COVID-19 Impact Analysis on the Global Liming & Acidifying Agrochemical Agents Market:

The global market for liming and acidifying agrochemical agents is affected in a complicated way by the COVID-19 pandemic. The epidemic may have encouraged growth even if labor shortages and supply chain disruptions may have temporarily hindered production and distribution, possibly resulting in shortages or price increases. A greater emphasis on regional farming and food security may have created a need for crop yield optimization. Consequently, there may be an increase in the application of liming and acidifying compounds to maintain the ideal pH of the soil for improved plant development.

Recent Trends and Developments in the Global Liming & Acidifying Agrochemical Agents Market:

There have been some intriguing developments in the global market for agrochemical chemicals that lime and acidify. The growth of precision agriculture is one important trend. Here, farmers use technology and data to identify precise locations inside a field that need a given dosage of these chemicals. In addition to ensuring ideal soil health, this reduces waste. Another motivator is sustainability. Concerns regarding the effects on the environment and possible legislation are reflected in the increased interest in eco-friendly agents made from organic ingredients or industrial wastes. Lastly, there is a boom in product development. Whether it's faster-acting formulae, formulations with extra beneficial nutrients, or even combo products with both liming and acidifying capabilities, manufacturers are always coming up with new and creative ways to produce more effective agents.

Key Players:

-

BASF SE

-

Bayer AG

-

Compass Minerals International Corp.

-

Corteva Inc.

-

Dow Chemical Company

-

ICL Fertilizers

-

Israel Chemicals Ltd

-

Sumitomo Chemical Co.

-

Syngenta Group

Chapter 1. Liming & Acidifying Agrochemical Agents Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Liming & Acidifying Agrochemical Agents Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Liming & Acidifying Agrochemical Agents Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Liming & Acidifying Agrochemical Agents Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Liming & Acidifying Agrochemical Agents Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Liming & Acidifying Agrochemical Agents Market – By Agent Type

6.1 Introduction/Key Findings

6.2 Liming Agents

6.3 Acidifying Agents

6.4 Y-O-Y Growth trend Analysis By Agent Type

6.5 Absolute $ Opportunity Analysis By Agent Type, 2024-2030

Chapter 7. Liming & Acidifying Agrochemical Agents Market – By Application

7.1 Introduction/Key Findings

7.2 Crop Type

7.3 Farming Practice

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Liming & Acidifying Agrochemical Agents Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Agent Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Agent Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Agent Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Agent Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Agent Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Liming & Acidifying Agrochemical Agents Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Bayer AG

9.3 Compass Minerals International Corp.

9.4 Corteva Inc.

9.5 Dow Chemical Company

9.6 ICL Fertilizers

9.7 Israel Chemicals Ltd

9.8 Sumitomo Chemical Co.

9.9 Syngenta Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Liming & Acidifying Agrochemical Agents Market size is valued at $325.44 billion in 2023.

The worldwide Global Liming & Acidifying Agrochemical Agents Market growth is estimated to be 4.99% from 2024 to 2030.

The Global Liming & Acidifying Agrochemical Agents Market is segmented By Agent Type (Liming Agents, Acidifying Agents); By Application (Crop Type, Farming Practice), and by Region.

There are a few reasons why the market for agrochemical chemicals that lime and acidify is predicted to expand globally. First, a greater emphasis on optimizing soil health and the growth of precision agriculture will result in a more focused use of these agents. Second, the demand for these items is being driven by farmers' increasing understanding of the crucial role that soil pH plays in crop yields. Lastly, the creation of fresh, more effective liming and acidifying compounds may contribute to a rise in their use in the upcoming years.

The global market for liming and acidifying agrochemical agents was probably affected by the COVID-19 epidemic in many ways. One could argue that labor shortages and supply chain disruptions have constrained output and distribution. However, a greater emphasis on regional farming and food security might have raised demand for these goods.