Light Emitting Polymer (LEP) Market Size (2024 – 2030)

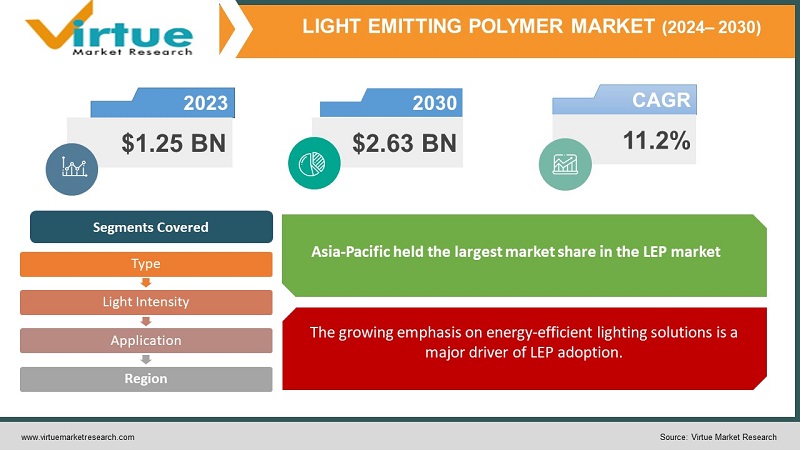

The Global Light Emitting Polymer Market was valued at USD 1.25 billion and is projected to reach a market size of USD 2.63 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.2%.

In recent years, the Light Emitting Polymer (LEP) industry has experienced remarkable growth, primarily fuelled by the increasing need for versatile and energy-efficient lighting solutions. This evolving market has undergone significant transformations, adapting to changing demands and technological advancements. As it continues to evolve, the LEP market offers substantial prospects for further innovation and expansion. The industry's past growth, current dynamics, and future potential make it an exciting sector to watch, with ongoing developments shaping the landscape and driving its future trajectory.

Key Market Insights:

The growth is primarily attributed to the widespread adoption of LEP technology in the consumer electronics sector, particularly in smartphones and televisions. LEPs offer vivid, high-contrast displays while being energy-efficient, making them a preferred choice for manufacturers and consumers alike.

A notable trend in the LEP market has been the industry's dedication to enhancing luminance and stability. Manufacturers have committed substantial resources to research and development efforts aimed at addressing challenges such as lower brightness levels compared to certain competitors. Furthermore, LEP technology is gaining ground in emerging applications like automotive lighting, where their flexibility and energy-saving capabilities are highly advantageous. Geographically, Asia-Pacific, especially countries like South Korea and Japan, has emerged as a significant center for LEP research and production, contributing significantly to the market's expansion. However, as the LEP market continues to evolve, it faces stiff competition from other OLED technologies and must navigate regulatory hurdles concerning materials and toxicity to maintain its growth trajectory.

LEP Market Drivers:

The growing emphasis on energy-efficient lighting solutions is a major driver of LEP adoption.

The Light Emitting Polymer (LEP) market is experiencing substantial growth due to a heightened focus on energy-efficient lighting solutions. With global sustainability concerns and a growing emphasis on reducing energy consumption, LEPs have emerged as a promising technology. Their energy-saving properties make them an attractive choice for various lighting applications, including commercial, industrial, and residential settings. In an era where businesses and consumers alike seek eco-friendly alternatives, LEPs are ideally positioned to meet this demand, thereby contributing to their increasing adoption and overall market growth.

The integration of LEP displays in smartphones and other consumer electronics devices is fueling market growth.

The integration of LEP displays into smartphones and a wide array of other consumer electronics devices is a pivotal driver of market expansion. LEP technology offers vibrant and flexible display options, resulting in high-resolution screens that significantly enhance the overall user experience. As consumer expectations continue to rise, demanding sleek and innovative gadgets with superior visual quality, manufacturers are increasingly turning to LEPs to meet these demands. This trend has led to a notable surge in LEP-enabled products across the consumer electronics market, firmly establishing their position within this sector.

The automotive industry's shift towards advanced lighting solutions has created a significant demand for LEPs.

The automotive industry's ongoing shift towards advanced lighting solutions has generated substantial demand for Light Emitting Polymers. LEPs, with their versatility and energy efficiency, have emerged as the preferred choice for various automotive lighting applications. From headlights to interior lighting, LEPs are making inroads into multiple aspects of vehicle design. As automakers strive to enhance safety, aesthetics, and energy efficiency, LEPs are serving as a key enabler, driving their adoption within the automotive sector. Their unique characteristics are reshaping the way vehicles are illuminated, thereby contributing to the LEP market's sustained growth.

R&D and Innovation are leading to the development of more durable and cost-effective LEP materials, enhancing their commercial viability.

Research and development initiatives and ongoing innovations play a pivotal role in propelling the LEP market forward. These efforts are leading to the development of more durable and cost-effective LEP materials, significantly enhancing their commercial viability. Enhanced materials offer improvements in luminance, stability, and lifespan, addressing some of the historical limitations of the technology. As researchers continue to refine LEP technology, it becomes increasingly competitive in comparison to other display and lighting solutions. This continuous improvement fosters its adoption across various industries, solidifying its position as a versatile and promising lighting and display technology.

LEP Market Challenges:

Reducing production costs of high-quality LEP materials while maintaining performance is a key challenge for manufacturers.

A primary challenge in the Light Emitting Polymer (LEP) market is the need to reduce production costs for high-quality LEP materials while simultaneously maintaining their performance. Achieving this delicate balance is crucial for manufacturers as it directly impacts the cost-effectiveness and commercial viability of LEP-based products. Cost reductions are essential for broadening market accessibility and competitiveness, but they must be executed without compromising the technology's core attributes, such as brightness and durability. Striking this equilibrium remains a significant hurdle for LEP manufacturers seeking to expand their market share and cater to a diverse range of applications.

LEPs can be sensitive to environmental factors, affecting their lifespan and consequently hampering market growth.

LEPs can exhibit sensitivity to environmental factors, presenting challenges that affect their lifespan and, consequently, hinder overall market growth. Environmental conditions, such as moisture and oxygen exposure, can degrade LEP materials over time, impacting their performance and longevity. Addressing this sensitivity and enhancing the robustness of LEPs in diverse environmental settings is a critical concern. Manufacturers must invest in research and development efforts to create more resilient LEP materials that can withstand varying conditions, ensuring consistent and prolonged performance, and thereby bolstering market confidence.

Competition in the LEP market can impact pricing and profitability.

Intense competition within the LEP market poses challenges related to pricing and profitability. As the market continues to evolve, numerous players are vying for market share, leading to competitive pricing strategies. While competition can benefit consumers by driving down prices, it can also exert pressure on manufacturers' profit margins. To remain competitive, LEP companies must continually innovate, improve efficiency, and differentiate their products. Balancing competitive pricing with profitability is a complex undertaking that requires strategic planning and adaptability in a rapidly changing market landscape. Navigating this competitive terrain is one of the key challenges facing participants in the LEP market.

LEP Market Opportunities:

The adoption of smart lighting solutions, including LEP-based systems presents a substantial growth opportunity.

The Light Emitting Polymer (LEP) market is poised for substantial growth through the adoption of smart lighting solutions. As the world increasingly embraces the benefits of intelligent and energy-efficient lighting systems, LEP-based technologies offer a significant opportunity. These solutions can be seamlessly integrated into smart homes, commercial buildings, and urban infrastructure, allowing for advanced control, energy savings, and enhanced user experiences. With the demand for smart lighting on the rise, LEP manufacturers have the opportunity to develop cutting-edge products that cater to this evolving market, driving revenue and expanding their footprint in the smart lighting industry.

Penetration of LEP technology in emerging markets presents lucrative opportunities due to rapid urbanization and infrastructure development.

The penetration of LEP technology in emerging markets presents lucrative opportunities for industry players. Rapid urbanization and infrastructure development in these regions have created a growing demand for efficient lighting solutions. LEPs, with their flexibility, energy efficiency, and potential for diverse applications, are well-suited to address the unique needs of emerging markets. Manufacturers can capitalize on this opportunity by establishing a presence in these regions, offering cost-effective LEP solutions, and partnering with local stakeholders to leverage the burgeoning opportunities presented by urban expansion and modernization efforts.

Collaborations between technology companies and lighting manufacturers can lead to innovative LEP applications and expand market reach.

Collaborations between technology companies and lighting manufacturers offer a promising avenue for driving innovation and expanding the reach of LEP technology. Joint ventures and partnerships can lead to the development of innovative LEP applications that cater to a wide range of industries and use cases. By combining expertise in materials science, electronics, and lighting design, such collaborations can unlock new possibilities for LEPs, such as advanced wearable displays, architectural lighting innovations, and unique signage solutions. These cooperative efforts enable companies to access complementary technologies and markets, ultimately fueling growth and diversification within the LEP market.

LIGHT EMITTING POLYMER (LEP) MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.2% |

|

Segments Covered |

By Type, Light Intensity, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Universal Display Corporation, LG Display Co., Ltd., Osram GmbH, Sumitomo Chemical Co., Ltd., DuPont de Nemours, Inc., Novaled GmbH, Konica Minolta, Inc., OLEDWorks LLC, BASF SE, Samsung Display Co., Ltd. |

Light Emitting Polymer Market Segmentation: By Type

-

Passive Matrix

-

Active Matrix

In 2022, the Passive Matrix segment held the largest market share in the Light Emitting Polymer (LEP) market with a CAGR of 12.6%. This dominance can be attributed to its historical presence and established use in various applications. Passive matrix LEP displays have been widely used in smaller electronic devices, such as older-generation digital watches and simple graphical displays, where cost-effectiveness and lower power consumption are crucial factors.

Moreover, the Active Matrix LEP segment is experiencing rapid growth and is the fastest-growing segment in the LEP market with a CAGR of 17.8%. Active matrix LEP displays have gained prominence in recent years due to their superior performance characteristics, especially in larger displays like OLED TVs and high-end smartphones. These displays use thin-film transistors (TFTs) to control individual pixels, resulting in higher refresh rates, better color accuracy, and enhanced overall quality.

Light Emitting Polymer Market Segmentation: By Light Intensity

-

Low

-

Medium

-

High

In 2022, the Low light intensity segment held the largest market share in the Light Emitting Polymer (LEP) market. This is because Low-intensity LEPs are highly energy-efficient and are suitable for applications that require gentle ambient lighting or discrete status indicators. They are often chosen for their ability to provide a soft glow while minimizing power consumption. Additionally, they find use in decorative lighting applications where accentuating aesthetics without excessive brightness is the objective.

Moreover, the Medium light intensity segment is likely the fastest-growing in the LEP market. This growth can be attributed to its versatility and broader range of applications. Medium-intensity LEPs strike a balance between brightness and power consumption, making them suitable for various lighting scenarios. They are increasingly adopted in automotive lighting as automakers seek energy-efficient and customizable lighting solutions for interior and exterior applications. Additionally, their use in architectural lighting, including facades and accent lighting, is on the rise due to their ability to provide attractive and adaptable illumination.

Light Emitting Polymer Market Segmentation: By Application

-

Commercial

-

Industrial

-

Residential

-

Others

In 2022, Commercial applications, including signage and lighting in retail and office spaces, often held the largest market revenue share due to the large-scale adoption of LEP technology. These segments benefit from the need for eye-catching displays and efficient lighting solutions in commercial environments. The revenue share is driven by sustained demand from the retail, hospitality, and corporate sectors, where aesthetics and energy-efficient lighting are key considerations.

Moreover, the Residential application segment for Light Emitting Polymers (LEP) is the fastest-growing and driving substantial demand. This was propelled by the surge in smart home trends, emphasizing automated and energy-efficient lighting solutions. LEPs, renowned for their energy efficiency and design versatility, catered to this demand, providing homeowners with customizable, aesthetically pleasing lighting options. Additionally, the increasing focus on sustainability and eco-friendly products further boosted LEP adoption, given their lightweight and potentially recyclable properties.

Light Emitting Polymer Market Segmentation: By Geography

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, Asia-Pacific held the largest market share in the LEP market. This was driven by the region's robust electronics manufacturing industry, including countries like China, Japan, and South Korea, where LEPs found extensive use in consumer electronics, displays, and lighting solutions.

Moreover, the Asia-Pacific region is also the fastest-growing market for LEPs. This growth was attributed to the increasing demand for consumer electronics, rising disposable incomes, and the adoption of energy-efficient lighting technologies.

In North America, particularly the United States, held a significant market share in the LEP industry. The region was a key hub for technological innovation and the development of LEP-based products. The North American market experienced steady growth due to the demand for LEPs in applications like OLED displays, signage, and smart lighting systems. The emphasis on energy efficiency and sustainability also contributed to growth.

COVID-19 Impact Analysis on the Global LEP Market:

The COVID-19 pandemic had a multifaceted impact on the global Light Emitting Polymer (LEP) market. Initially, it disrupted supply chains and manufacturing operations, leading to production delays and shortages of key components. With economic uncertainty, there was a temporary slowdown in consumer spending, affecting demand for LEP-based products in industries like consumer electronics and automotive. However, as remote work and online activities surged during lockdowns, there was increased demand for electronic displays and devices, partially offsetting the downturn. Additionally, the pandemic accelerated trends such as energy efficiency and digitalization, creating opportunities for LEP applications in smart lighting and signage. Adaptation and innovation have been key in navigating the evolving landscape.

Latest Trends/Developments:

LEPs continued to gain traction in the development of flexible and bendable displays and lighting solutions. This trend was driven by the technology's inherent flexibility and ability to conform to various shapes. In 2020, the global flexible electronics market was valued at over $24 billion, showcasing the significance of this trend.

The demand for energy-efficient lighting solutions remained strong, and LEPs were seen as a promising option due to their low power consumption. Sustainable and eco-friendly materials were also a focus, aligning with global environmental initiatives. LEPs' potential recyclability and lower environmental impact compared to traditional lighting technologies contributed to this trend.

LEPs found applications in the healthcare sector, particularly in wearable devices. These devices incorporated LEPs for various purposes, such as biosensing and patient monitoring. The increasing adoption of wearable technology and the need for lightweight, flexible, and low-power displays drove this trend.

Key Players:

-

Universal Display Corporation

-

LG Display Co., Ltd.

-

Osram GmbH

-

Sumitomo Chemical Co., Ltd.

-

DuPont de Nemours, Inc.

-

Novaled GmbH

-

Konica Minolta, Inc.

-

OLEDWorks LLC

-

BASF SE

-

Samsung Display Co., Ltd.

In July 2023, Researchers at the Max Planck Institute for Polymer Research developed a novel material concept that could simplify the production of efficient blue organic light-emitting diodes (OLEDs). They addressed the issue of charge trapping by using a new class of molecules with a unique spatial arrangement resembling a coaxial cable. This arrangement shields the electron-conducting core from impurities, allowing efficient electron transport. This breakthrough could streamline the design of blue OLEDs, potentially leading to cost-effective and high-efficiency displays and lighting solutions.

Chapter 1. Light Emitting Polymer (LEP) Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Manual Service Disconnect Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Light Emitting Polymer (LEP) Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Light Emitting Polymer (LEP) MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Light Emitting Polymer (LEP) Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Light Emitting Polymer (LEP) Market– By Type

6.1 Introduction/Key Findings

6.2 Passive Matrix

6.3 Active Matrix

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Light Emitting Polymer (LEP) Market– By Light Intensity

7.1 Introduction/Key Findings

7.2 Low

7.3 Medium

7.4 High

7.5 Y-O-Y Growth trend Analysis By Light Intensity

7.6 Absolute $ Opportunity Analysis By Light Intensity, 2024-2030

Chapter 8. Light Emitting Polymer (LEP) Market– By Application

8.1 Introduction/Key Findings

8.2 Commercial

8.3 Industrial

8.4 Residential

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 9. Automotive Manual Service Disconnect Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Light Intensity

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Light Intensity

9.2.4 By By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Light Intensity

9.3.4 By By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Light Intensity

9.4.4 By By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Light Intensity

9.5.4 By By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Light Emitting Polymer (LEP) Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Universal Display Corporation

10.2 LG Display Co., Ltd.

10.3 Osram GmbH

10.4 Sumitomo Chemical Co., Ltd.

10.5 DuPont de Nemours, Inc.

10.6 Novaled GmbH

10.7 Konica Minolta, Inc.

10.8 OLEDWorks LLC

10.9 BASF SE

10.10 Samsung Display Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Light Emitting Polymer Market was valued at USD 1.25 billion and is projected to reach a market size of USD 2.63 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.2%.

Key drivers include the emphasis on energy-efficient lighting solutions, integration into consumer electronics like smartphones, and the shift towards advanced lighting solutions in the automotive industry.

The market is segmented into Passive Matrix and Active Matrix. The Active Matrix segment is the fastest-growing with a CAGR of 17.8%.

Asia-Pacific dominates the LEP market, and it is also the fastest-growing region, driven by strong electronics manufacturing and demand for LEP technology.

Key players include Universal Display Corporation, LG Display Co., Ltd., Osram GmbH, Sumitomo Chemical Co., Ltd., and DuPont de Nemours, Inc., among others.