Light Beer Market Size (2024 – 2030)

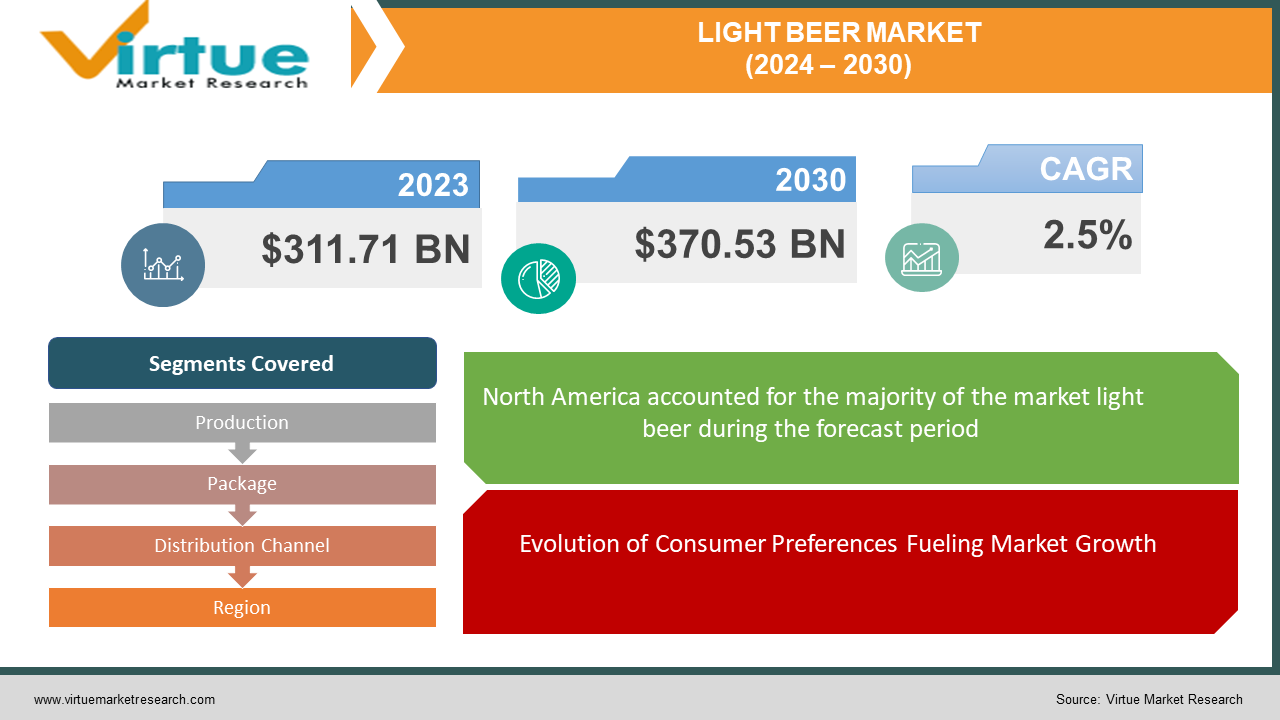

The Global Light Beer market size was valued at USD 311.71 billion in 2023 and is estimated to reach an expected value of USD 370.53 billion by 2030, registering a CAGR of 2.5% during the forecast period (2024 – 2030).

The inception of beer traces back to the early Neolithic period, establishing itself as one of the most ancient beverages and globally the most widely consumed alcoholic drink. Light beer, characterized by its lower alcoholic content and reduced calorie content, is typically crafted using four fundamental ingredients: malted cereal grains, hops, water, and yeast, undergoing fermentation over a specific duration. Additionally, beer may incorporate flavoring components such as herbs and fruits. The market offers diverse types of beers, with ale and lager being the two predominant commercially consumed varieties.

In recent years, the beer consumption landscape has witnessed a notable surge, propelled by an increase in disposable income and shifts in consumer preferences. The light beer market has further benefited from an unprecedented rise in the youth population and an upsurge in female drinkers. The market's growth is augmented by the consolidation of on-premises distribution channels.

Forecasting the future, the light beer market is poised to sustain its upward trajectory. A pivotal driver for market expansion is the escalating demand for alcoholic beverages characterized by lower alcohol content and fewer calories. Additionally, the market is expected to thrive due to the growing favorability of light beer among health-conscious young adults seeking a balanced lifestyle.

Key Market Insights:

According to the United Nations, the global youth population is anticipated to increase by 7% to reach 1.3 million by 2030, propelling the light beer market. The acceptance of drinking trends among women worldwide, driven by financial independence and the rise in social and professional gatherings, significantly contributes to the growth of the light beer market. On-premise distribution channels, encompassing establishments like restaurants, cafes, discos, and bars, play a pivotal role in serving light beer and specialty cocktails. The surge in demand for on-premise consumption is attributed to the rise in disposable income and evolving consumer preferences.

However, the light beer market faces challenges related to volatile prices of raw materials used in beer production. Fluctuations in prices, influenced by factors like drought and environmental issues impacting crop production, result in a supply-demand gap within the industry. This, in turn, hampers production and leads to increased product prices, impeding market growth. Recent advancements in honey-derived products present a promising alternative for creating innovative alcoholic beverages, potentially steering the future growth of this industry.

Global Light Beer Market Drivers:

Evolution of Consumer Preferences Fueling Market Growth:

The global light beer market is being propelled by the transformative shift in consumer preferences. Many countries worldwide are undergoing rapid urbanization and experiencing improved financial conditions, resulting in an overall increase in disposable income. Particularly in developed economies like Europe and North America, there is a notable inclination among young, aspirational drinkers towards contemporary beer options over traditional choices like beer and rum. This shift is indicative of a gradual movement towards healthier alcoholic beverages, such as light beer, due to their lower calorie and alcohol content.

Expansion of On-Premise Distribution Channels Driving Market Momentum:

A significant driver for the global light beer market is the proliferation of on-premise distribution channels. Establishments like restaurants, cafes, discos, and bars play a pivotal role in serving light beer and crafting special cocktails. The surge in demand for on-premise consumption is closely tied to the rise in disposable income and evolving consumer preferences. The increasing number of restaurants and bars has further contributed to elevated consumption of light beer, reflecting a growing preference for on-premise drinking experiences.

Global Light Beer Market Restraints and Challenges:

Volatile Pricing of Raw Materials as a Growth Impediment:

The light beer market faces hindrances due to the unpredictable pricing of raw materials involved in beer manufacturing. Fluctuations in prices, influenced by factors such as drought and environmental issues impacting crop production, result in a supply-demand gap within the industry. This factor not only diminishes production levels but also leads to heightened product prices, creating obstacles for market growth.

Emergence of Seltzers as a Market Disruptor:

The burgeoning popularity of seltzers in the realm of alcoholic beverages poses a challenge to the light beer market. Seltzer, characterized by carbonated or plain water with additional carbon dioxide bubbles, stands out from other carbonated beverages due to its absence of minerals and additives. With variations such as light, hard, and flavored, the global seltzer market reached a size of 8.95 billion USD in 2021. Addressing the increasing preference for seltzers as an alternative to light beer becomes a significant hurdle for the light beer market.

Global Light Beer market Opportunities:

Innovation in Healthier, Naturally Sweetened Alcoholic Beverages:

The light beer industry is witnessing a promising trend with the advent of honey-derived products, offering a sustainable alternative for crafting unique alcoholic beverages. This innovation is propelling the industry's growth prospects. Utilizing honey fermentation, a variety of novel drinks are being created, including sherry-like wines, fruit-infused honey wines, and diverse meads.

These beverages are being introduced in an array of flavors, influenced by the source of the honey, the yeast utilized in fermentation, and the inclusion of various additives. For example, the launch of Anheuser-Busch's Natural Light Naturdays Strawberry Lemonade Beer in the U.S. market is a strategic move to expand their market presence.

The adoption of such innovative brewing methods is leading to the creation of products that align with consumer tastes and are positioned as premium offerings. Given that beer is often regarded as a high-quality, sophisticated, and premium alcoholic drink, these new brewing techniques present a substantial opportunity for success and market growth.

LIGHT BEER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2.5% |

|

Segments Covered |

By Production, Package, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABInBev, MillerCoors, Heineken USA, Pabst, Diageo-Guinness, Carlsberg, Asahi Breweries, Suntory Beer, Arpanoosh, ErdingerWeibbrau |

Global Light Beer market Segmentation: By Production

-

Macro-brewery

-

Micro-brewery

-

Craft brewery

-

Others

The global light beer market is segmented based on production into macro-brewery, micro-brewery, craft brewery, and other categories. The craft brewery segment leads in market contribution and is projected to grow at a CAGR of 2.5% during the forecast period. The Brewers Association's Chief Economist predicts a steady growth for small craft brewers in the next five years within the mature beer market.

The micro-brewery segment ranks as the second largest. Gaining steady popularity, micro-breweries are increasingly competing in the market. The trend towards unique, flavored light beers is expected to boost the demand for microbreweries. Micro-breweries are becoming significant in the light beer market due to their unique flavors and special ingredients. A notable trend in this sector is "Collaboration," where breweries share brewing concepts, techniques, and technologies. The rising preference for flavored beer is also augmenting the micro-brewery market.

Global Light Beer market Segmentation: By Package

-

Glass

-

PET bottle

-

Metal can

-

Other

The market segments by packaging into glass, PET bottle, metal can, and others. The PET bottle segment is the leading contributor and is anticipated to grow at a CAGR of 2.8%. Many beer manufacturers are transitioning from glass to PET packaging due to its beneficial properties like high design flexibility, lightweight, and recyclability. PET bottles are significantly lighter than glass, enhancing supply chain performance and reducing packaging-related production costs.

The glass segment holds the second-largest share. Glass is a traditional packaging material for light beer, offering longer cooling and good preservation. It is favored for its aesthetic appeal and sustainability, being reusable, recyclable, and made from natural materials like silica, limestone, and soda ash. Glass bottles provide a premium feel and sustainable packaging solution.

Global Light Beer market Segmentation: By Distribution Channel

-

Hypermarkets & Supermarket

-

On-trade

-

Specialty Stores

-

Convenience Store

-

Other

The market is categorized into hypermarkets & supermarkets, on-trade, specialty stores, convenience stores, and others. Hypermarkets and supermarkets are the leading segments and are expected to grow at a CAGR of 2.9%. Their popularity is driven by a wide range of products under one roof, ample parking, and convenient hours. Factors like urbanization, the rise in the working-class population, and competitive pricing enhance their popularity in both developed and developing regions. The presence of store associates offering product assistance and knowledge further drives customer preference for this channel.

Global Light Beer market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In regional segmentation, North America held the largest market share in 2023, accounting for nearly two-fifths of the global market, and is expected to maintain its lead through 2028. This dominance is attributed to social media influence and local promotional events. However, the Asia-Pacific region is projected to experience the highest CAGR during the forecast period. The growth in Asia-Pacific is attributed to expanding access to light beer distribution channels. The region led in revenue share in 2021 and is expected to become the fastest-growing market. The demand for light beer is particularly rising in the developing countries of this region, driven by lifestyle changes. Following North America, Asia Pacific and Europe were significant in terms of revenue in 2023. Latin America also presents a key market, with notable developments expected within the forecast period.

COVID-19 Impact Analysis on the Global Light Beer market:

The COVID-19 pandemic significantly altered alcohol consumption habits and locations due to government-imposed mobility restrictions. The closure of retail outlets profoundly affected markets in Italy, the United Kingdom, and Colombia. Traditional tourist hotspots in the United States also felt the pandemic's impact. According to The Brewers of Europe, 2020's COVID-19 related governmental measures severely impacted pubs and restaurants, slashing European beer sales by 42% and diminishing the beer industry's positive economic contribution. Brewers faced legal challenges, including complete bans on alcohol sales in India and South Africa and restrictions on home brewing in Mexico. The Beer Institute reported a substantial decline in U.S. beer retail sales, amounting to approximately USD 20 billion. Sales in pubs and restaurants plummeted, placing considerable pressure on the sector. However, there has been a significant surge in off-market sales, such as e-commerce and retail outlets, which are anticipated to aid the market's recovery in the upcoming years.

Recent Trends and Developments in the Light Beer Market:

November 2022: HEINEKEN organized its 2022 Capital Markets Event on December 1st and 2nd. During this event, HEINEKEN’s Executive Team planned to present updates and additional insights into EverGreen, HEINEKEN’s forward-looking strategy for evolving the beer industry and related areas.

September 2022: HEINEKEN Vietnam inaugurated its largest brewery in the country. Spanning 40 hectares in the My Xuan Industrial Zone, Phu My – Ba Ria Vung Tau, the HEINEKEN Vietnam Vung Tau Brewery boasts an annual capacity of 11 million hectoliters, making it the largest brewery in Southeast Asia.

January 2022: Bud Light introduced Bud Light NEXT, the world's first zero-carb beer. This innovative lager, containing no carbohydrates and only 80 calories per can, was launched alongside its unique NFT N3XT Collection.

Key Players:

-

ABInBev

-

MillerCoors

-

Heineken USA

-

Pabst

-

Diageo-Guinness

-

Carlsberg

-

Asahi Breweries

-

Suntory Beer

-

Arpanoosh

-

ErdingerWeibbrau

Chapter 1. Light Beer market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Light Beer market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Light Beer market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Light Beer market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Light Beer market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Light Beer market – By Production

6.1 Introduction/Key Findings

6.2 Macro-brewery

6.3 Micro-brewery

6.4 Craft brewery

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Production

6.7 Absolute $ Opportunity Analysis By Production, 2024-2030

Chapter 7. Light Beer market – By Package

7.1 Introduction/Key Findings

7.2 Glass

7.3 PET bottle

7.4 Metal can

7.5 Other

7.6 Y-O-Y Growth trend Analysis By Package

7.7 Absolute $ Opportunity Analysis By Package, 2024-2030

Chapter 8. Light Beer market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Hypermarkets & Supermarket

8.3 On-trade

8.4 Specialty Stores

8.5 Convenience Store

8.6 Other

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Light Beer market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Production

9.1.3 By Package

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Production

9.2.3 By Package

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Production

9.3.3 By Package

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Production

9.4.3 By Package

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Production

9.5.3 By Package

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Light Beer market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ABInBev

10.2 MillerCoors

10.3 Heineken USA

10.4 Pabst

10.5 Diageo-Guinness

10.6 Carlsberg

10.7 Asahi Breweries

10.8 Suntory Beer

10.9 Arpanoosh

10.10 ErdingerWeibbrau

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Light Beer market size is valued at USD 311.71 billion in 2023.

The worldwide Global Light Beer market growth is estimated to be 2.5% from 2024 to 2030.

The Global Light Beer market is segmented by Production (Macro-brewery, Micro-brewery, Craft brewery, and Others), by Package (Glass, PET bottle, Metal can, Other), by Distribution Channel (Hypermarkets & Supermarket, On-trade, Specialty Stores, Convenience Store, Other).

AnThe growing demand from consumers for healthier beverage options is expected to propel expansion in the global light beer market. Significant prospects are presented by low-calorie substitutes, growing market penetration, and innovations in brewing methods.

The COVID-19 epidemic caused major disruptions in manufacturing, distribution, and supply chains, which in turn had an influence on the global light beer market.