Lithium Nickel Manganese Cobalt Oxides Market Size (2024 – 2030)

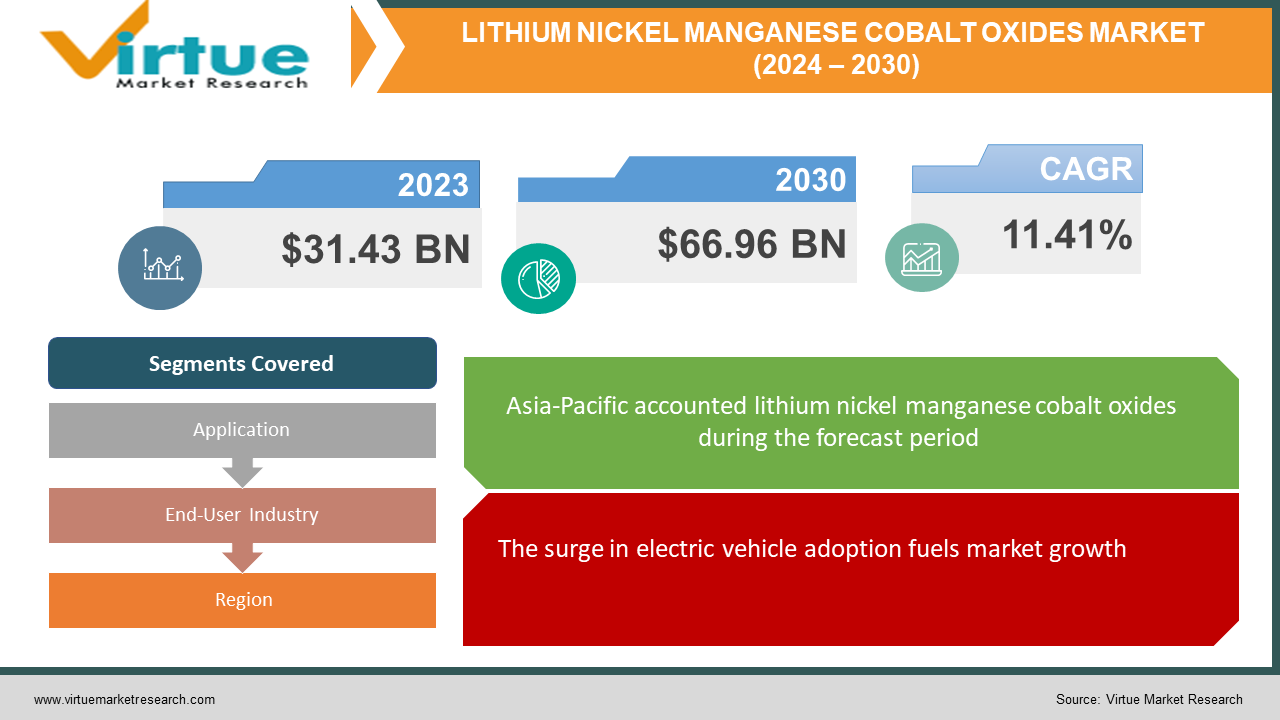

The Global Lithium Nickel Manganese Cobalt Oxides Market was valued at USD 31.43 billion in 2023 and is projected to reach a market size of USD 66.96 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.41%.

Lithium nickel manganese cobalt oxide (Li-NMC) plays an important role in the production of lithium-ion batteries, especially in electric vehicles and energy storage. Li-NMC cathodes are made from a mixture of lithium, nickel, manganese, cobalt, and oxygen and provide high energy, stability, and long cycle life. These materials, which include variants such as NMC111, NMC532, and NMC622, work better than cathode materials such as LiCoO2. Compared with the old model, the cobalt content of the Li-NMC cathode has been reduced, which not only increases the energy storage capacity but also solves the cost problem. However, challenges to cobalt extraction remain, such as high operating temperature limits and environmental considerations. Research is dedicated to reducing these limitations while pushing the boundaries of lithium-ion battery technology to create a future of efficient and effective solutions.

Key Market Insights:

Asia-Pacific is the largest market for Li-NMC, driven by the rapid adoption of electric vehicles and energy storage systems in countries like China, Japan, and South Korea. Ongoing research and development efforts are focused on improving the performance and efficiency of Li-NMC batteries, including increasing energy density, enhancing cycling stability, and reducing costs. The Li-NMC market is witnessing a growing focus on sustainable and ethical sourcing of raw materials, as well as advancements in recycling technologies to minimize environmental impact. Li-NMC oxide materials are finding new applications beyond batteries, including in catalysis, electrochromic devices, sensors, and solid-state electrolytes, driving diversification in the market.

Lithium Nickel Manganese Cobalt Oxides Market Drivers:

The surge in electric vehicle adoption fuels market growth.

The increase in electric vehicle adoption globally is a primary driver. Li-NMC batteries, with their high energy density and relatively lower cost compared to other chemistries like lithium cobalt oxide, are integral to the EV market's growth. Government incentives, stricter emissions regulations, and consumer demand for sustainable transportation are accelerating this trend. As automakers invest heavily in electric vehicle development, increasing demand for lithium ternary batteries is driving market growth.

Technological Advancements accelerate the market growth.

Continuous research and development improve the performance, safety, and durability of lithium ternary batteries. Innovations in cathode materials, electronic design, and battery performance are leading to improvements in energy density, cycle life, and charging. These advances not only expand the capabilities of ternary lithium batteries but also help reduce costs, making them more competitive with other energy storage technologies.

Energy Storage Solutions act as a Catalyst for the Lithium Nickel Manganese Cobalt Oxides market.

The transition to renewable energy sources such as solar and wind requires the use of energy-saving solutions to reduce interconnected problems. Due to their scalability, high energy density, and cost-effectiveness, lithium ternary batteries are increasingly used in sustainable energy storage systems (ESS). Demand for ternary lithium batteries in ESS is growing as utilities and businesses invest in power grid projects to improve grid security and incorporate more renewable energy.

Lithium Nickel Manganese Cobalt Oxides Market Restraints and Challenges:

Cobalt Dependency and Price Volatility restrain the market growth.

Despite efforts to reduce cobalt content in lithium ternary batteries due to ethical and supply chain concerns, cobalt is still a key component in many models. Most of the world's cobalt is mined in politically unstable regions, resulting in poor supply and unstable prices. Changes in cobalt prices could affect the total cost of lithium ternary batteries, affect competition with other chemicals, and impact business growth.

Safety Concerns and Regulatory Compliance prove to be a challenge in the Lithium Nickel Manganese Cobalt Oxides sector.

Safety issues such as thermal runaway and fire also pose problems for ternary lithium batteries. While ternary lithium batteries are safer than alternatives such as lithium cobalt oxide, problems resulting from the battery's electrified or exploding batteries can erode consumer confidence and lead to inspections. Compliance with stringent safety regulations, especially in the transportation and energy storage sectors, increases the complexity and cost of lithium ternary batteries to be produced, which may limit market expansion.

Limited High-Temperature Performance hinders the market growth.

Li-NMC batteries may experience capacity fade and degradation at elevated temperatures, impacting their performance and reliability in hot climates or high-temperature operating conditions. This limitation poses challenges for applications such as electric vehicles in regions with hot climates, where battery cooling systems must work harder to maintain optimal operating temperatures. Addressing high-temperature performance issues requires innovative battery designs, materials, and thermal management solutions, which may increase manufacturing costs and complexity.

Lithium Nickel Manganese Cobalt Oxides Market Opportunities:

The global lithium nickel manganese cobalt oxide (Li-NMC) market offers significant opportunities. The rapid expansion of the electric vehicle (EV) market is a significant opportunity, and it is good that lithium ternary batteries have become an important part of the EV market due to their high energy density and cost-effectiveness. Demand for ternary lithium batteries is expected to increase as governments around the world implement stricter emissions regulations and provide incentives to encourage the use of electric vehicles. Moreover, the increasing demand for renewable energy requires energy-saving solutions, which increases the demand for lithium ternary batteries (ESS) for sustainable energy applications. Technological advances to improve battery performance, safety, and durability have further improved market prospects, allowing ternary lithium batteries to enter new applications beyond vehicles and energy storage. Additionally, efforts to improve supply chain resilience and sustainability provide stakeholders with the opportunity to invest in responsible practices and technology, address environmental concerns, and build long-term business.

LITHIUM NICKEL MANGANESE COBALT OXIDES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.41% |

|

Segments Covered |

By Application, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sumitomo Metal Mining Co., Ltd., L&F , STL (Schlenk Technologies), Umicore , TODA KOGYO CORP, Johnson Matthey, Tianjiao Technology, Easpring Material Technology, 3M, Shanshan Advanced Materials |

Lithium Nickel Manganese Cobalt Oxides Market Segmentation - by Application

-

Batteries

-

Catalysts

-

Electrochromic devices

-

Sensors

-

Solid-State Electrolytes

-

Ceramics & Coatings

-

Others

In 2023, based on the Application, Batteries hold the largest market share with over 70% of the market. The basis of this dominance lies in the rapid growth of the global electric vehicle market. Demand for ternary lithium batteries, a key component of electric vehicles, is on the rise as governments worldwide implement stricter emissions regulations and provide incentives to promote the adoption of electric vehicles.

While Li-NMC oxide is heavily used in the manufacturing of Batteries it has wide applications in other fields as well.

Lithium Nickel Manganese Cobalt Oxides Market Segmentation - by End-User Industry

-

Automotive Industry

-

Energy Industry

-

Electronics Industry

-

Chemical Industry

-

Other Industries

In 2023, based on the End-User Industry, the Automotive Industry holds a significant portion of the market share and is expected to grow at a 13.73% CAGR during the forecast period. The automotive industry, especially those related to catalytic converters, can be very important due to the use of catalytic converters in cars to reduce emissions. Li-NMC oxide can play an important role in improving the performance and efficiency of catalytic converters, thus contributing to the reduction of emissions.

As demand for renewable energy increases, the energy storage industry, including lithium-ion batteries and supercapacitors, is likely to gain importance. Li-NMC oxide nanoparticles can be widely used in energy storage applications such as grid storage and home appliances, thus guiding the development of this field.

The electronics industry is an important market for Li-NMC oxide nanoparticles, especially in electronic devices, where they can improve the performance of electronic equipment. The market is expected to grow as the demand for consumer electronics, smart devices, and technology increases.

Lithium Nickel Manganese Cobalt Oxides Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023 based on Region, Asia-Pacific has the largest market share, with over 35% market share. Asia-Pacific is a strong force in the lithium nickel manganese cobalt oxide (Li-NMC) market due to its key role in electric vehicles (EVs) and energy storage. The Asia-Pacific region, led by countries such as China, Japan, South Korea, and India, has a large and rapidly growing economy. Government measures to encourage the use of electric vehicles, strict emissions regulations, and the main target of renewable energy are increasing the demand for lithium ternary batteries. Additionally, the Asia-Pacific region is a manufacturing hub for leading battery manufacturers such as CATL, LG Chem, and Panasonic, driving innovation and increasing capacity in ternary lithium batteries. Technological advancement, combined with government support and a strong foundation, has put the region at the forefront of battery research and innovation. As the transition to clean energy accelerates, the lithium ternary product market in the Asia-Pacific region is expected to continue growing in the coming year, providing ample opportunities for growth and sustainable development.

While Asia Pacific leads the Global Lithium Nickel Manganese Cobalt Oxides market, other regions such as North America and Europe are experiencing rapid growth and present huge opportunities for Lithium Nickel Manganese Cobalt Oxides market vendors.

COVID-19 Impact Analysis on the Global Lithium Nickel Manganese Cobalt Oxides Market:

The COVID-19 pandemic has had a major impact on the global lithium nickel manganese cobalt oxide (Li-NMC) industry, disrupting supply chains, disrupting production capacity, and reducing demand in many end markets. In the early phase of the pandemic, lockdowns and movement restrictions disrupted production and transportation, causing delays in the production and delivery of lithium ternary oxides. In addition, reduced consumer spending and economic uncertainty have led to a decline in electric vehicle sales and energy storage projects, further reducing demand for lithium ternary materials.

However, as the world gradually recovers from the effects of the pandemic and the economy recovers, the market's prospects for ternary lithium materials are also showing signs of improvement. The government is stepping up efforts to support economic growth by investing in infrastructure, planning for clean energy, and promoting electric vehicles. Additionally, increased sustainability and decarbonization after the pandemic are expected to increase demand for lithium ternary materials for electric vehicles, energy storage, and renewable energy projects, providing opportunities for job growth and innovation in the coming years.

Latest Trends/ Developments:

The global lithium nickel manganese cobalt oxide (Li-NMC) market has witnessed many significant trends and developments that have shaped its path. One important factor is the increasing demand for high nickel content NMC samples such as NMC811 (8:1:1 ratio) as electric vehicles and energy storage applications become more energy efficient and the battery lasts longer. Manufacturers have invested in R&D to improve NMC composition, increase performance, and reduce costs, creating new opportunities for lithium NMC materials in emerging markets.

Li-NMC oxide nanoparticles are used as catalysts for various chemical reactions, including hydrogenation, oxidation, and polymerization processes. These catalysts are used to be effective in the production of specialty chemicals, chemicals, and petrochemicals and to select the desired products.

Li-NMC oxide sensors are used in many sensing applications such as gas sensors, humidity sensors, and biosensors. These sensors use the advanced surface and tunable properties of Li-NMC oxide materials to detect gases, moisture, and biomolecules with high sensitivity and selectivity for use in environmental monitoring, diagnostics, and industrial safety.

Li-NMC oxide materials exhibit electrical conductivity, allowing them to change color in response to applied voltage. In this way, it can be used in electrochromic products such as smart car windows, rearview mirrors, and guides, providing clarity in buildings and vehicles, reducing glare, and saving energy.

Key Players:

-

Sumitomo Metal Mining Co., Ltd.

-

L&F

-

STL (Schlenk Technologies)

-

Umicore

-

TODA KOGYO CORP

-

Johnson Matthey

-

Tianjiao Technology

-

Easpring Material Technology

-

3M

-

Shanshan Advanced Materials

Chapter 1. Lithium Nickel Manganese Cobalt Oxides Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Lithium Nickel Manganese Cobalt Oxides Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Lithium Nickel Manganese Cobalt Oxides Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Lithium Nickel Manganese Cobalt Oxides Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Lithium Nickel Manganese Cobalt Oxides Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Lithium Nickel Manganese Cobalt Oxides Market – By Application

6.1 Introduction/Key Findings

6.2 Batteries

6.3 Catalysts

6.4 Electrochromic devices

6.5 Sensors

6.6 Solid-State Electrolytes

6.7 Ceramics & Coatings

6.8 Others

6.9 Y-O-Y Growth trend Analysis By Application

6.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Lithium Nickel Manganese Cobalt Oxides Market – By End-User Industry

7.1 Introduction/Key Findings

7.2 Automotive Industry

7.3 Energy Industry

7.4 Electronics Industry

7.5 Chemical Industry

7.6 Other Industries

7.7 Y-O-Y Growth trend Analysis By End-User Industry

7.8 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 8. Lithium Nickel Manganese Cobalt Oxides Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By End-User Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By End-User Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By End-User Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By End-User Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By End-User Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Lithium Nickel Manganese Cobalt Oxides Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Sumitomo Metal Mining Co., Ltd.

9.2 L&F

9.3 STL (Schlenk Technologies)

9.4 Umicore

9.5 TODA KOGYO CORP

9.6 Johnson Matthey

9.7 Tianjiao Technology

9.8 Easpring Material Technology

9.9 3M

9.10 Shanshan Advanced Materials

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Lithium Nickel Manganese Cobalt Oxides Market was valued at USD 31.43 billion in 2023 and is projected to reach a market size of USD 66.96 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.41%.

The segments under the Global Lithium Nickel Manganese Cobalt Oxides Market by Application are Batteries, Catalysts, Electrochromic devices, Sensors, Solid-State Electrolytes, Ceramics & Coatings.

Asia-Pacific region is the dominant for Global Lithium Nickel Manganese Cobalt Oxides Market.

Sumitomo Metal Mining Co., Ltd., L&F, STL (Schlenk Technologies), Umicore, TODA KOGYO CORP, etc.

The COVID-19 pandemic has had a major impact on the global lithium nickel manganese cobalt oxide (Li-NMC) industry, disrupting supply chains, disrupting production capacity, and reducing demand in many end markets. In the early phase of the pandemic, lockdowns and movement restrictions disrupted production and transportation, causing delays in the production and delivery of lithium ternary oxides. In addition, reduced consumer spending and economic uncertainty have led to a decline in electric vehicle sales and energy storage projects, further reducing demand for lithium ternary materials.