LFP Cathode Powder Market Size (2024 – 2030)

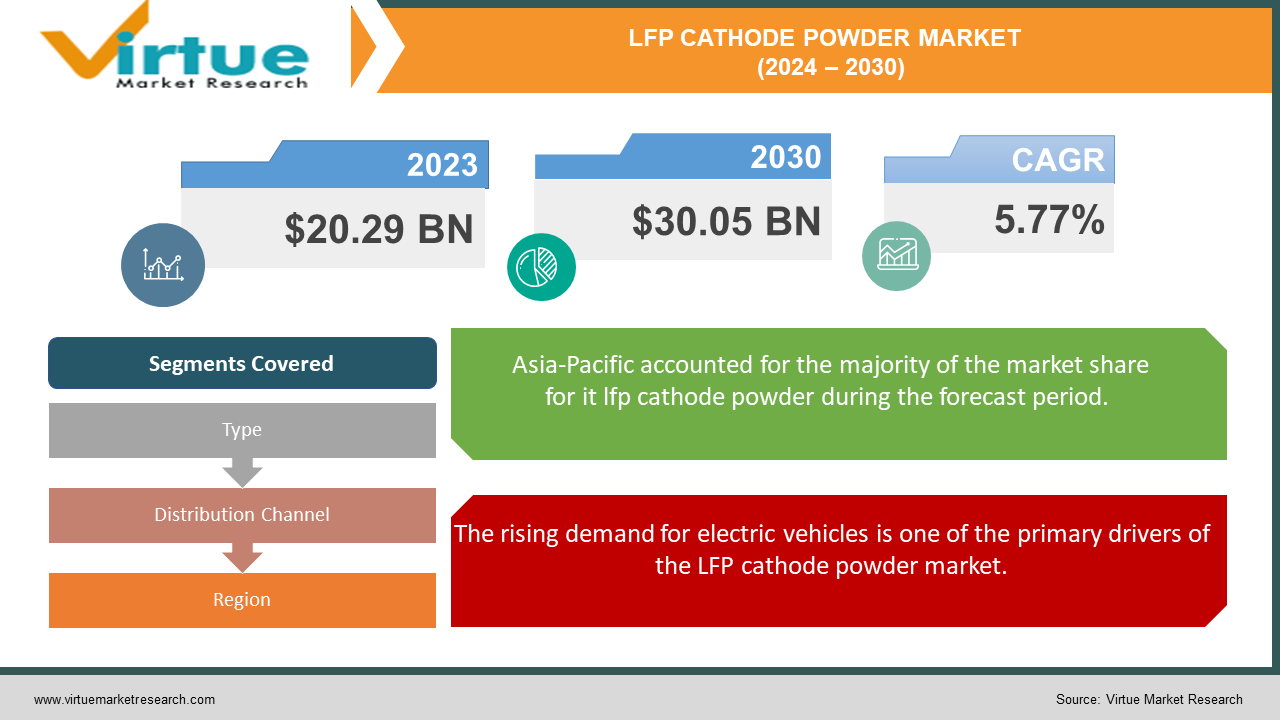

The Global LFP Cathode Powder Market was valued at USD 20.29 Billion in 2023 and is projected to reach a market size of USD 30.05 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.77%.

The market for lithium iron phosphate (LFP) cathode powder is expected to grow significantly between 2024 and 2030 due to the growing need for safe, dependable, and effective battery solutions in a variety of industries. Due to its superior thermal stability, extended cycle life, and inherent safety benefits over alternative cathode materials, lithium-ion batteries rely heavily on LFP cathode powder. Because of these qualities, Lithium-Polymer (LFP) batteries are perfect for use in energy storage systems (ESS), consumer electronics, and electric vehicles (EVs). The demand for sustainable and renewable energy sources around the world is one of the main factors driving the LFP cathode powder market upward. Globally, governments and organizations are putting more and more emphasis on encouraging clean energy solutions and lowering carbon emissions.

Key Market Insights:

Lithium iron phosphate (LFP) batteries are expected to account for roughly 50% of the total lithium-ion battery demand by 2030, driven by their affordability and safety characteristics.

The average lifespan of an LFP battery is estimated to be around 7-10 years, compared to 3-5 years for traditional lithium-ion batteries like NMC or NCA.

The current energy density of LFP cathodes is around 140-170 Wh/kg, while NCA or NMC cathodes can reach 200-250 Wh/kg. However, the gap is expected to narrow with ongoing research advances.

The electric vehicle market is projected to consume over 1.5 million tons of LFP cathode powder annually by 2030, highlighting the strong correlation between EV demand and LFP cathode powder consumption.

China is not only the leading producer of LFP cathode powder but also the world's largest consumer, with domestic demand expected to surpass 1 million tons annually by 2030.

The average cost of LFP cathode powder is currently around USD 10-15 per kilogram. However, advances in production processes and economies of scale could bring down the costs in the future.

The global production capacity of LFP cathode powder is expected to reach over 1.8 million tons by 2025, indicating significant expansion plans by major players to meet rising demand.

Around 20% of the LFP cathode powder market is comprised of smaller regional players, with the remaining 80% dominated by established international manufacturers.

The recycling rate for lithium-ion batteries, including LFP batteries, remains relatively low at around 5%. Improving recycling infrastructure is crucial for a sustainable LFP cathode powder market.

LFP Cathode Powder Market Drivers:

The rising demand for electric vehicles is one of the primary drivers of the LFP cathode powder market.

Because of their long cycle life, affordability, and safety, LFP batteries are especially well-suited for use in electric vehicles. LFP batteries are a safer option for automotive applications because they are less likely to experience thermal runaway or catch fire than other lithium-ion batteries. Furthermore, LFP batteries are more affordable than other cathode materials like nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminium (NCA), which attracts manufacturers and customers on a budget. The need for LFP cathode powders is being further fueled by the expanding driving range of electric vehicles, upgrades to the infrastructure for charging them, and developments in battery technology. The demand for dependable and effective battery solutions will rise in tandem with automakers' continued expansion of their electric vehicle lineup, supporting the LFP cathode powder market.

The expansion of renewable energy sources and the growing need for efficient energy storage solutions are significant drivers of the LFP cathode powder market.

Renewable energy sources like solar and wind are becoming more and more integrated into the power grid as a result of the global shift towards clean energy. However because these sources are sporadic, grid stability and dependability are hampered, which makes effective energy storage technologies necessary. Because LFP batteries can store energy steadily for extended periods, they are ideal for energy storage applications. They are perfect for use in energy storage systems because they have high thermal stability, excellent cycle life, and a lower degradation rate than other battery chemistries. The demand for LFP batteries is anticipated to increase as nations invest in smart grid technologies and renewable energy infrastructure, propelling the growth of the LFP cathode powder market.

LFP Cathode Powder Market Restraints and Challenges:

The high initial cost of LFP batteries relative to conventional lead-acid and certain other lithium-ion batteries is one of the main issues facing the LFP cathode powder market. Even though LFP batteries have many benefits in terms of longevity, safety, and thermal stability, their initial cost can prevent them from being widely used, especially in markets where prices are tight. Another major obstacle is the fluctuating prices of the raw materials needed to produce LFP cathode powder. Due to supply chain interruptions, geopolitical concerns, and changes in market demand, the prices of essential raw materials like lithium, iron, and phosphate can change. The overall cost of LFP batteries may be impacted by these variations, which makes it difficult for producers to keep prices stable and profits high. The LFP cathode powder market faces significant competition from other battery technologies, particularly nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA) batteries. These batteries offer higher energy densities compared to LFP batteries, making them more suitable for applications requiring compact and lightweight battery solutions, such as consumer electronics and some electric vehicles.

LFP Cathode Powder Market Opportunities:

The market for LFP cathode powder could grow significantly as a result of technological developments in the production of LFP batteries. The goal of research and development is to enhance LFP batteries' overall performance, charge-discharge efficiency, and energy density. It is anticipated that advances in materials science, such as the creation of solid-state electrolytes and sophisticated electrode materials, will improve the performance of LFP batteries. Furthermore, improvements in precision engineering and automation in battery manufacturing processes are lowering production costs and increasing the scalability of lithium-ion polymer (LFP) battery production. Thanks to these technological advancements, LFP batteries are becoming more competitive with other battery chemistries and have a wider range of possible applications in different industries.

LFP CATHODE POWDER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.77% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Targray (USA), Pulead Technology Industry (China), Tesla (US), Novarials Corporation (USA), Johnson Matthey (UK), Aleees (China), Lithium Australia (Australia), Sumitomo Osaka Cement (Japan), BASF (Germany), Guizhou Anda Energy (China) |

LFP Cathode Powder Market Segmentation: By Type

-

Natural LFP Cathode Powder

-

Synthetic LFP Cathode Powder

Natural LFP cathode powder is the dominant segment. It is derived from naturally occurring minerals and processed to meet the necessary specifications for battery applications. This type of LFP cathode powder is generally more cost-effective due to the abundance of natural resources and less complex processing methods. Natural LFP powder is commonly used in applications where cost efficiency is a priority and the performance requirements are moderate. This segment is significant in regions with abundant raw materials and established mining industries.

The market with the fastest growth is synthetic LFP cathode powder. Chemical synthesis procedures are used to produce it, providing exact control over the material's composition, purity, and characteristics. Because of its improved performance and consistency, this market segment is suited for high-end applications where efficiency and dependability are essential. For advanced battery applications like energy storage systems, electric vehicles, and high-end consumer electronics, synthetic lithium-ion batteries (LFP) powder is recommended. Better control over particle size, distribution, and chemical composition is achieved during the precise manufacturing process of synthetic LFP powder, which improves battery performance.

LFP Cathode Powder Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors and Wholesalers

-

Online Sales

The direct sales channel involves manufacturers selling LFP cathode powder directly to battery manufacturers and other end-users. This approach allows manufacturers to maintain better control over pricing, quality, and customer relationships. Direct sales are particularly beneficial for large-scale transactions and strategic partnerships, enabling customized solutions and bulk supply agreements. This channel is often used by major LFP cathode powder producers who have the resources and capabilities to manage direct customer interactions and logistics.

The online sales channel is gaining traction due to the increasing digitalization of procurement processes and the shift towards e-commerce across industries. This channel offers convenience, transparency, and accessibility, making it an attractive option for small and medium-sized enterprises, research labs, and individual consumers. Online platforms provide detailed product information, technical specifications, and customer reviews, enabling buyers to make informed decisions. The growth of online sales is supported by advancements in logistics and supply chain management, ensuring timely delivery and efficient order fulfillment. This channel is expected to grow significantly, driven by the ongoing digital transformation and the increasing preference for online purchasing.

LFP Cathode Powder Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

With a market share of roughly 45–50% worldwide, Asia-Pacific dominates the LFP cathode powder industry. Numerous factors contribute to this dominance, such as the region's strong manufacturing base, large investments in renewable energy, and the quick uptake of electric vehicles (EVs). The region's governments are actively encouraging the use of electric vehicles (EVs) by offering tax breaks, subsidies, and strict emission standards. As an illustration, China's New Energy Vehicle (NEV) policy has significantly increased sales of EVs and, as a result, the market for LFP batteries.

In the market for LFP cathode powder, North America is growing at the fastest rate currently observed, and in the upcoming years, it is expected to overtake other regions. North America currently accounts for between 20 and 25 percent of the global market share, but several growth factors are expected to cause this to rise dramatically. The US government is making significant investments in renewable energy sources and green technologies. The demand for LFP batteries is anticipated to increase as a result of the Biden Administration's infrastructure plan, which calls for significant investments in renewable energy and EV infrastructure.

COVID-19 Impact Analysis on the LFP Cathode Powder Market:

The pandemic's initial lockdowns in China, a major producer of LFP cathode powder, caused a significant disruption to the global supply chain. Production facilities shut down, transportation networks were hampered, and export restrictions were implemented. This led to a shortage of LFP cathode powder and price hikes for existing stock. With lockdowns and travel restrictions, demand for consumer electronics, a significant user of LFP cathode powder for smartphones and laptops, plummeted. This initially created uncertainty for LFP cathode powder manufacturers. While some sectors faced a demand slowdown, the electric vehicle industry emerged as a source of stability. Governments around the world, recognizing the need for sustainable transportation, continued to invest in EV infrastructure and incentives. This sustained demand for LFP cathode powder is crucial for the long-range and stable performance of lithium-ion batteries in EVs.

Latest Trends/ Developments:

Environmental concerns are driving a shift towards ethically sourced and processed lithium. Manufacturers are partnering with mining companies that prioritize responsible practices to minimize environmental impact and reduce the carbon footprint throughout the supply chain. Researchers are constantly striving to improve the energy density of LFP cathodes, which is a key metric for electric vehicle range and overall battery performance. This could involve innovations in particle size control, doping with other elements, or exploring novel material combinations. While LFP batteries excel in safety and lifespan, their charging speed has traditionally been slower compared to LCO. Developments in electrode design and electrolyte formulations are being explored to improve charging rates without compromising safety or stability. Developing cost-effective methods for LFP cathode powder production is crucial for making LFP batteries more affordable. This could involve streamlining manufacturing processes, exploring alternative precursors, or optimizing production yields.

Key Players:

-

Targray (USA)

-

Pulead Technology Industry (China)

-

Tesla (US)

-

Novarials Corporation (USA)

-

Johnson Matthey (UK)

-

Aleees (China)

-

Lithium Australia (Australia)

-

Sumitomo Osaka Cement (Japan)

-

BASF (Germany)

-

Guizhou Anda Energy (China)

Chapter 1. LFP Cathode Powder Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. LFP Cathode Powder Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. LFP Cathode Powder Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. LFP Cathode Powder Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. LFP Cathode Powder Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. LFP Cathode Powder Market – By Type

6.1 Introduction/Key Findings

6.2 Natural LFP Cathode Powder

6.3 Synthetic LFP Cathode Powder

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. LFP Cathode Powder Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors and Wholesalers

7.4 Online Sales

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. LFP Cathode Powder Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. LFP Cathode Powder Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Targray (USA)

9.2 Pulead Technology Industry (China)

9.3 Tesla (US)

9.4 Novarials Corporation (USA)

9.5 Johnson Matthey (UK)

9.6 Aleees (China)

9.7 Lithium Australia (Australia)

9.8 Sumitomo Osaka Cement (Japan)

9.9 BASF (Germany)

9.10 Guizhou Anda Energy (China)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The rapid adoption of electric vehicles (EVs) is a primary driver. LFP batteries, with their exceptional safety, long lifespan, and good thermal stability, are increasingly preferred by EV manufacturers, particularly for budget-oriented models.

LFP batteries currently have a lower energy density compared to NCA or NMC cathodes. This translates to a shorter driving range for EVs or less energy storage capacity in stationary applications. This remains a hurdle for some high-performance EV models or applications requiring high energy density.

Targray (USA), Pulead Technology Industry (China), Tesla (US), Novarials Corporation (USA), Johnson Matthey (UK), Aleees (China), Lithium Australia (Australia), Sumitomo Osaka Cement (Japan), BASF (Germany), Guizhou Anda Energy (China).

With a market share of roughly 45–50% worldwide, Asia-Pacific dominates the LFP cathode powder industry.

In the market for LFP cathode powder, North America is growing at the fastest rate currently observed, and in the upcoming years, it is expected to overtake other regions.