LEO and GEO Satellite Market Size (2023 - 2030)

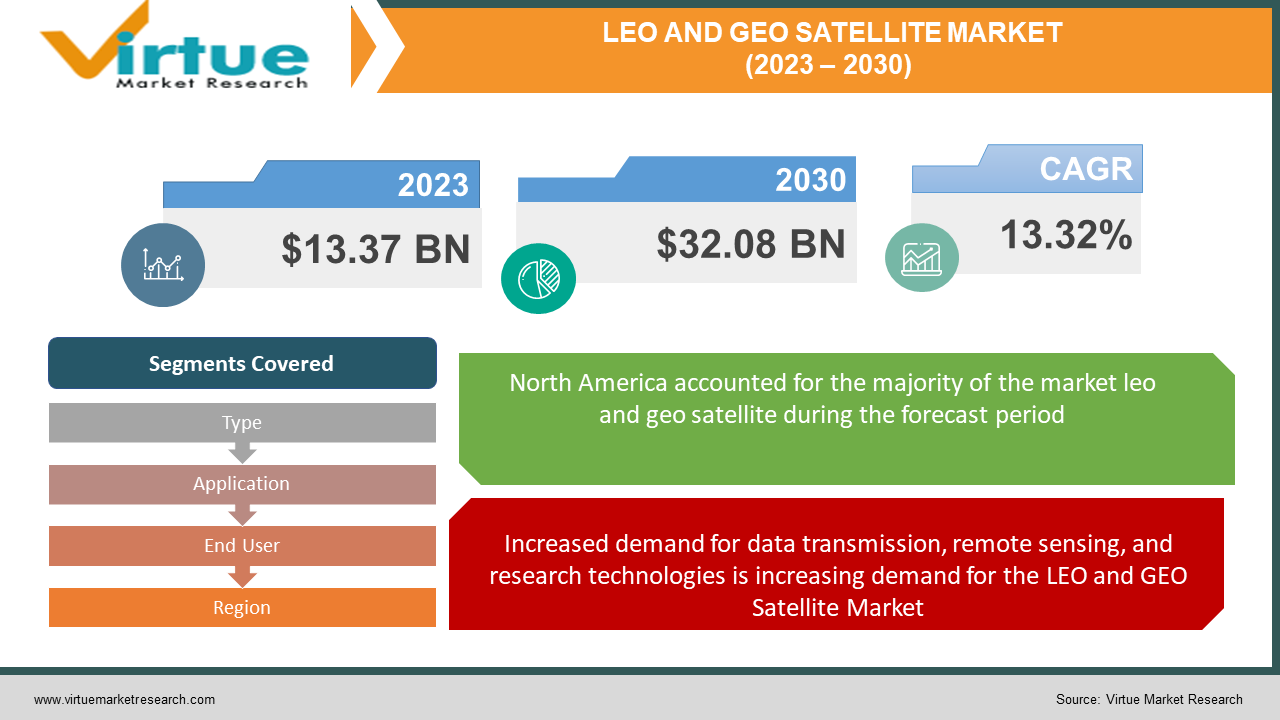

The Global LEO and GEO Satellite Market was valued at USD 13.37 billion and is projected to reach a market size of USD 32.08 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.32%.

Low Earth Orbit (LEO) satellites are being created to travel in orbits 200–2,000 km above the surface of the Earth. For these satellites to make a full orbit of the globe in 90 to 120 minutes, they must move at a speed of roughly 27,000 kph. LEO satellites are also employed for a variety of tasks, including data transmission, remote sensing, and investigation. Geostationary Earth Orbit (GEO) satellites are sent into orbit above the equator from west to east at the same speed as the Earth. They are launched by launch systems on a precise trajectory. Satellites that must stay in orbit above a specific location on Earth, like telecommunication satellites, use GEO. GEO satellite networks can also deliver extremely high broadband data throughput, with downlink speeds of up to 50 Mbps and uplink speeds of up to 5 Mbps. Furthermore, since they can observe certain locations in real time to study how weather patterns emerge, weather monitoring satellites can also employ GEO.

Global LEO and GEO Satellite Market Drivers:

Increased demand for data transmission, remote sensing, and research technologies is increasing demand for the LEO and GEO Satellite Market.

LEO satellites are being constructed to orbit 200–2,000 km above the surface of the Earth. For these satellites to make a full orbit of the globe in 90 to 120 minutes, they must move at a speed of roughly 27,000 kph. Applications for LEO orbit include data transmission, remote sensing, and research. To maintain coverage, LEO spacecraft frequently work with other satellites or constellations.

These constellations, which are often made up of more than 18 satellites, offer continuous communication over a specific coverage region. There are several well-known LEO communications satellite constellations, including GLOBALSTAR, IRIDIUM, ORBCOMM, and LEO ONE. Due to its benefits, including shorter orbital periods, greater orbital velocities, shorter trips, low cost, and decreased latency, the use of LEO satellites has grown over time. Because of their proximity to the Earth and capacity to produce higher-resolution imagery, satellites in this orbit are frequently utilised for satellite imaging.

The Evolution of IoT (Internet of Things) is driving growth in the LEO and GEO Satellite Market.

A combination of technological developments in smaller, higher-resolution cameras and improved attitude control, as well as increased demand for voice communications, internet access, and Earth observation, has led to a rise in LEO satellites. Opportunities including technical development, increased private investment, and expansion in public sector investment have propelled this segment's growth. This increase is anticipated to be accelerated by the Internet of Things (IoT) development, expansion of commercial applications, and rising demand from the defence industry.

Global LEO and GEO Satellite Market Challenges:

Government policies at all levels have an impact on how the LEO and GEO satellite ecosystem and their development. There isn't currently a thorough global or domestic on-orbit regulation regime. There are rules governing the spectrum and remote sensing satellite launches and re-entry in the US, but none are governing on-orbit operations like rendezvous and proximity operations, space-based Space Situational Awareness (SSA), or RF mapping. An international agreement has not been achieved regarding the more than 70 countries that are involved in LEO and GEO satellite activities, and there are a few signs that suggest that there will be a full global regime in addition to the high-level requirements of the Outer Space Treaty. Operators have indicated an interest in creating regulations that would provide investors security, but there are worries about onerous requirements that would cause businesses to relocate from one jurisdiction to another. For the next ten years, it will be difficult to set laws and regulations for the rapidly changing commercial space industry since operator and policymaker roles don't often coincide on timelines and because international community agreements require a lot of work.

Global LEO and GEO Satellite Market Opportunities:

LEO satellites now have greater potential for optical communications in orbit thanks to recent advancements in laser beam-pointing technology. This technology enables communication between Earth and distant space destinations like Mars and the moon and is employed in missions like the Artemis Programme. This technology facilitates communication among the satellites in a constellation because the number of LEO constellations is growing. The prospect for the growth of the LEO satellite market has expanded as a result of recent advancements in alternative power-sharing technologies (using wireless optical technology) that can meet the power requirements of high data rate communication.

COVID-19 Impact on Global LEO and GEO Satellite Market:

Due to the COVID-19 problem, there is now uncertainty in the LEO and GEO satellite markets, a significant slowdown in the supply chain, a decline in business confidence, and an escalating level of panic among specific client sectors. Countries all around the world have implemented tight limitations that might last for days or even months. Numerous businesses have stopped operations as a result of the epidemic and are waiting for better market circumstances.

The COVID-19 pandemic's effects include a slowdown in key actors' operations, a lack of components, and a delay in satellite development and launches. Satellite launches have been delayed as a result of supply chain difficulties brought on by the pandemic. Regulations governing the import and export of commodities have also contributed to a shortage of components, delaying manufacture and satellite launches.

Due to production halts in China, South Korea, and Taiwan, the availability of satellite launch services and satellite manufacture has also been hampered. SpaceX has to put off the creation of a new user terminal for its Starlink satellite broadband system due to constrained semiconductor availability. The epidemic has slowed down the progress of numerous projects. However, following the pandemic, several important players in the LEO and GEO satellite industries are concentrating on offering broadband internet services all over the world via thousands of LEO satellites, which is anticipated to propel the growth of the LEO and GEO satellite market over the course of the forecast period.

Global LEO and GEO Satellite Market Recent Developments:

-

In August 2021, the Space Development Agency launched a test satellite. The Prototype Infrared Payload, or PIRPL, onboard the Cygnus NG-16 spacecraft is intended to evaluate the effectiveness of a multispectral sensor for the detection of ballistic missiles from low orbits. For the creation of four satellites with a large field of vision and overhead permanent infrared sensors, L3Harris and SpaceX have been granted $193 million and $149 million, respectively.

-

In April 2023, Sateliot's first low-Earth orbit (LEO) satellite was sent into orbit, which was the first step towards the Spain-based company's ambition to eventually place 250 satellites in orbit to deliver 5G-based narrowband IoT (NB-IoT) connectivity.

-

In February 2022, 49 Starlink spacecraft were launched by SpaceX from Florida's NASA Kennedy Space Centre (KSC). To offer speedier satellite internet, these spacecraft join the current constellation of 1700+ LEO satellites.

-

In December 2021, Surrey Satellite Technology Ltd (SSTL) was chosen by the UK Space Agency to head a study that would identify the criteria for a challenging mission to deorbit two non-operational space debris targets.

-

In December 2021, a contract for a Mid Wave Infra-Red (MWIR) thermal imaging satellite, which will pave the way for a proposed constellation of seven MWIR satellites, was signed between Surrey Satellite Technology Ltd (SSTL) and Satellite Vu. The 100kg class DarkCarb small satellite from SSTL's Carbonite line serves as the foundation for Satellite Vu's MWIR satellite.

LEO AND GEO SATELLITE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

13.32% |

|

Segments Covered |

By Type, Application, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Airbus S.A.S., The Boeing Company, Israel Aerospace Industries Ltd., Lockheed Martin Corporation, Mitsubishi Electric Corporation, INTELSAT S.A., Inmarsat plc., L3 Harris Corporation, Thales Group, Qualcomm Inc, Topcon Corporation |

Global LEO and GEO Satellite Market Segmentation: By Type

-

Small Satellite

-

Cube Satellite

-

Medium Satellite

-

Large Satellite

The market segment with the most share in 2022 was small satellite, and it is anticipated that this segment would expand at the highest CAGR throughout the forecast period. The global LEO satellite market is being driven by an increase in demand for tiny satellites due to the advantages and benefits they provide. A small satellite, also known as a miniaturised satellite or small sat, weighs less than 1,200 kg (2,600 lb) and has a smaller overall mass. The term "small" is used to describe all of these satellites and other classifications are used to categorise them according to their mass. To lower the high financial expenses of launch vehicles and related construction costs, satellites can be made smaller.

Global LEO and GEO Satellite Market Segmentation: By Application

-

Communication

-

Earth Observation & Remote Sensing

-

Scientific Research and Technology Demonstration

-

Others

The market segment with the biggest share in 2022 was communication, which is also anticipated to experience the fastest CAGR growth over the forecast period. The market is growing as a result of the increase in demand for small satellites and mobile satellite services for earth observation in the energy, oil & gas, defence, and agricultural sectors. In the context of the existing communication infrastructure, satellite communication refers to the usage of an artificial satellite in a network. Satellites in low Earth orbit (LEO) can assist in bridging the digital divide by connecting disconnected people.

Global LEO and GEO Satellite Market Segmentation: By End User

-

Commercial Use

-

Government & Military Use

- Others

The market segment with the biggest market share in 2022 was Commercial Use, which is anticipated to expand at a CAGR over the forecast period. The global market is being driven by increasing government, private, and public investment in the LEO. Commercial LEO activities are typically not taken into account by the industry since they are thought to be either too expensive or unlikely to generate a return on investment. The ideal time frames for satellite remote sensing, research and development, media, launch services (including crew and payload), and satellite remote sensing are already identified. the capacity to maintain entrepreneurial activity and make it possible for organisations to add substantial value. On the other hand, some points along the value chain that do not currently provide a lot of market value may start to do so. Leo is expanding past NASA's requirements. These areas, which are significant economic and operational drivers for the industry, are anticipated to grow faster with a cutting-edge satellite and launch service infrastructure in place.

Global LEO and GEO Satellite Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

Middle East and Africa

-

South America

In 2022, North America held the greatest market share, and over the forecast period, it is expected to grow at the highest CAGR. In 2022, Europe was the second-largest market. The US provides a thriving market for LEO satellite systems in North America. To increase the effectiveness and efficiency of satellite communication, the U.S. government is investing more money in cutting-edge LEO satellite technologies. The increasing investment in satellite equipment to enhance the defence and surveillance capabilities of the armed services is one of the key factors projected to drive the LEO satellite market in North America.

Global LEO and GEO Satellite Market Key Players:

-

Airbus S.A.S.

-

The Boeing Company

-

Israel Aerospace Industries Ltd.

-

Lockheed Martin Corporation

-

Mitsubishi Electric Corporation

-

INTELSAT S.A.

-

Inmarsat plc.

-

L3 Harris Corporation

-

Thales Group

-

Qualcomm Inc

-

Topcon Corporation

Chapter 1. LEO and GEO Satellite Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. LEO and GEO Satellite Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. LEO and GEO Satellite Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. LEO and GEO Satellite Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. LEO and GEO Satellite Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. LEO and GEO Satellite Market - By Type

6.1 Small Satellite

6.2 Cube Satellite

6.3 Medium Satellite

6.4 Large Satellite

Chapter 7. LEO and GEO Satellite Market - By Application

7.1 Communication

7.2 Earth Observation & Remote Sensing

7.3 Scientific Research and Technology Demonstration

7.4 Others

Chapter 8. LEO and GEO Satellite Market - By End User

8.1 Commercial Use

8.2 Government & Military Use

8.3 Others

Chapter 9. LEO and GEO Satellite Market - By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Rest of the World

Chapter 10. LEO and GEO Satellite Market - Key Players

10.1 Airbus S.A.S.

10.2 The Boeing Company

10.3 Israel Aerospace Industries Ltd.

10.4 Lockheed Martin Corporation

10.5 Mitsubishi Electric Corporation

10.6 INTELSAT S.A.

10.7 Inmarsat plc.

10.8 L3 Harris Corporation

10.9 Thales Group

10.10 Qualcomm Inc

10.11 Topcon Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global LEO and GEO Satellite Market was estimated to be worth USD 11.8 Billion in 2022 and is projected to reach a value of USD 32.09 Billion by 2030, growing at a CAGR of 13.32 %during the forecast period 2023-2030

The Segments under the Global LEO and GEO Satellite Market by End-user Commercial Use, Government & Military Use, and Others

Some of the top industry players in the LEO and GEO Satellite Market are Airbus S.A.S., The Boeing Company, Israel Aerospace Industries Ltd., Lockheed Martin Corporation, Mitsubishi Electric Corporation, etc.

The Global LEO and GEO Satellite markets are segmented based on Type, Application, End-user, and region.

North America region held the highest share in the Global LEO and GEO Satellite market.