Leisure Travel Market Size (2024 – 2030)

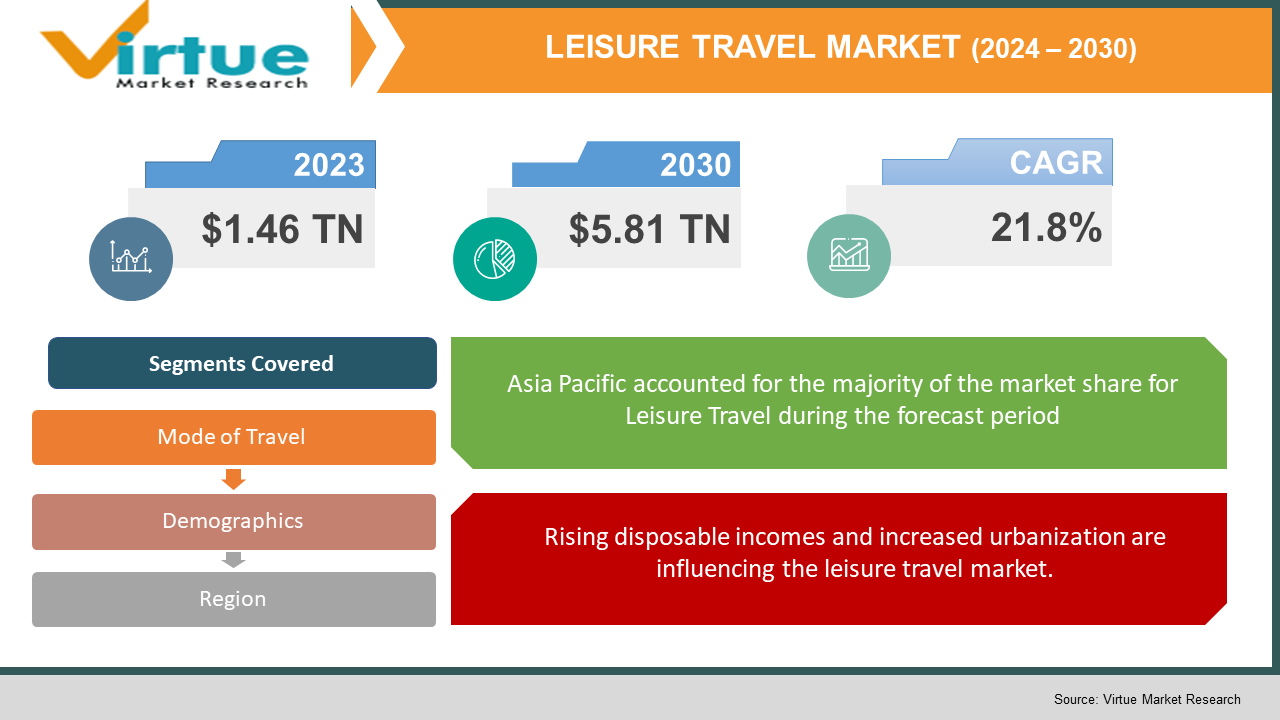

The global leisure travel market was valued at USD 1.46 trillion in 2023 and is projected to reach a market size of USD 5.81 trillion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 21.8%.

The leisure travel market is a dynamic and evolving sector. Technology continued to play a significant role in the leisure travel market. Online booking platforms, travel apps, and other digital tools were widely used by travelers for planning and booking their trips. There was a growing demand for personalized travel experiences. Travelers sought unique and tailored experiences, and companies in the leisure travel sector were increasingly focusing on providing customized options. Awareness of environmental issues and the importance of sustainable travel practices were gaining prominence. Many travelers were looking for eco-friendly and socially responsible travel options. The trend of valuing experiences over possessions is influencing the leisure travel market. Travelers were seeking memorable experiences and adventures, driving the demand for experiential tourism. Health and wellness tourism were growing segments within the leisure travel market. Travelers were interested in destinations and activities that promoted relaxation, fitness, and overall well-being. Solo travel continued to be a growing trend, with more individuals choosing to explore destinations on their own. Travel companies were adapting to cater to the needs and preferences of solo travelers. The popularity of alternative accommodations, such as vacation rentals through platforms like Airbnb, was on the rise. This provided travelers with more diverse and unique lodging options.

Key Market Insights:

The rapid expansion showcases the industry's resilience and pent-up demand post-pandemic. Travelers prioritize unique experiences and cultural immersion over traditional sightseeing. Sustainability and responsible tourism are gaining traction. Travelers seek customized itineraries, shorter trips, and remote workcations, blurring the lines between leisure and business travel. Social media and online travel platforms heavily influence destination choices and booking decisions. Travel companies leverage AI for personalized recommendations, dynamic pricing, and targeted marketing. Chatbots and virtual assistants enhance customer service. Smart hotels and connected devices personalize in-room experiences and streamline operations. VR tours and AR filters showcase destinations immersively, influencing booking decisions. Alternative accommodations, such as vacation rentals and home-sharing platforms, gained popularity. This provided travelers with more diverse lodging options beyond traditional hotels. The number of solo travelers was increasing, driven by a desire for independence and self-discovery. The leisure travel industry responded by offering solo-friendly packages and accommodations. Wellness tourism is a key segment, with travelers seeking destinations and activities that promote relaxation, health, and well-being. This included spa retreats, fitness-focused trips, and destinations known for their natural beauty. The COVID-19 pandemic had a profound impact on the leisure travel market. Lockdowns, travel restrictions, and health concerns led to disruptions and a decline in travel during certain periods. Travel companies are adapting and implementing health and safety measures, flexible cancellation policies, and promoting destinations perceived as safer for travel.

Leisure Travel Market Drivers:

Rising disposable incomes and increased urbanization are influencing the leisure travel market.

A burgeoning middle class across various regions, particularly in developing countries, leads to increased disposable incomes. This translates to greater expenditure on leisure activities, with travel often ranking high on the priority list. Rapid urbanization concentrates populations in cities, fostering a cosmopolitan culture with a strong desire for exploration and new experiences. Urban dwellers are typically more exposed to travel ideas and opportunities, further fueling the demand. Work-life balance is gaining prominence, with people prioritizing experiences over material possessions. Travel fulfills this desire for personal growth, cultural immersion, and adventure. Millennial and Gen Z generations, with their penchant for exploration and experiential living, are driving demand for unique and authentic travel offerings. Booming economies in nations like China, India, and Brazil are creating a burgeoning middle class with more money to spend on leisure activities. This translates to increased travel budgets and a wider pool of potential travelers. Travelers are venturing beyond traditional tourist hotspots, seeking authentic experiences in lesser-known locations.

The leisure travel market has witnessed a significant shift towards technology-driven personalization.

The leisure travel market has witnessed a significant shift towards technology-driven personalization. With the prevalence of online booking platforms, mobile apps, and advanced analytics, travel companies are increasingly leveraging technology to provide tailored experiences for individual travelers. Travelers are expecting a more personalized approach to their journeys, from customized travel itineraries to real-time recommendations based on their preferences. Artificial intelligence and machine learning algorithms were employed to analyze traveler data and deliver personalized suggestions for accommodations, activities, and even dining options. This trend aimed at enhancing customer satisfaction and loyalty by creating more meaningful and unique travel experiences. The ease and convenience of booking flights, hotels, and tours online has revolutionized travel planning. Comparison tools, personalized recommendations, and mobile apps further enhance the user experience. Travel inspiration and recommendations are readily available on social media, fueling wanderlust and influencing travel decisions. Influencer marketing has become a powerful tool for destinations and travel companies. For example, AI can suggest destinations based on past travel patterns or recommend personalized travel packages. Technology enables the creation of highly customized travel experiences. From the moment a traveler starts planning a trip, various digital platforms can assist in curating personalized itineraries that align with specific interests and preferences. Travelers can input their preferences, such as preferred activities, types of cuisine, cultural interests, and more, into travel platforms. AI algorithms then analyze this information to suggest tailored itineraries, highlighting local attractions and experiences that match the traveler's profile. This level of personalization enhances the overall travel experience by offering unique and relevant suggestions. This real-time interaction enhances convenience and engagement throughout the travel experience.

Evolving travel trends and growing niche markets are becoming more common.

Travelers are increasingly conscious of their environmental impact and are opting for eco-friendly destinations and responsible travel practices. This opens opportunities for sustainable tourism initiatives and eco-lodges. The demand for unique and immersive experiences is rising, leading to the popularity of adventure travel, culinary tourism, voluntourism, and wellness retreats. Specialized travel options catering to specific interests, such as solo travel, family travel, LGBTQ+ travel, and senior travel, are gaining traction by offering tailored experiences. Tourism businesses are collaborating with local communities to create mutually beneficial partnerships. This may involve supporting local businesses, hiring local guides, and contributing to community development projects. Socially responsible tourism seeks to minimize negative cultural impacts and ensure that the economic benefits of tourism are shared with the local population. Travelers, in turn, seek authentic and immersive experiences that foster cultural exchange and understanding. Certifications such as Earth Check, Travelife, and Rainforest Alliance are recognized in the travel industry as indicators of sustainable and responsible tourism practices. Accommodations, tour operators, and even entire destinations are striving to obtain and display these certifications to build trust with environmentally and socially conscious travelers. The presence of such certifications can influence travel decisions by signaling a commitment to responsible practices. Travel companies, NGOs, and destination marketing organizations are actively engaging in educational campaigns to raise awareness about sustainable travel practices. Online platforms provide information on eco-friendly accommodations, responsible tourism guidelines, and tips for minimizing one's environmental impact while traveling. Empowering travelers with knowledge allows them to make informed decisions that align with their values. Many destinations are developing and implementing sustainable tourism policies and strategies. Collaboration between governments, NGOs, and private sector entities is essential to creating a framework that encourages responsible tourism practices. Initiatives may include regulations on waste management, protection of natural habitats, and community-based tourism development.

Leisure Travel Market Restraints and Challenges:

Global economic instability and uncertainty can significantly impact the leisure travel market.

Economic instability and uncertainty can significantly impact the leisure travel market. Economic downturns, recessions, or financial crises can lead to reduced consumer spending on non-essential items, including leisure travel. During periods of economic uncertainty, individuals and families may prioritize saving over discretionary spending, leading to a decline in travel bookings and tourism-related activities. Reduced consumer confidence and disposable income can result in decreased demand for leisure travel services, affecting airlines, hotels, tour operators, and other travel-related businesses. The leisure travel industry is highly sensitive to economic conditions, making it vulnerable to fluctuations in global financial markets. Economic uncertainty can influence consumer confidence and, subsequently, their spending behavior. During periods of economic instability, consumers tend to become more cautious with their discretionary spending, prioritizing essential needs over non-essential ones. The leisure travel industry heavily relies on consumer spending. Reduced consumer confidence may lead to a decrease in travel bookings, vacations, and other non-essential travel expenditures. Travelers may postpone or cancel trips, opt for budget-friendly options, or choose to stay closer to home.

Geopolitical events and travel restrictions have a significant impact on the leisure market.

Geopolitical events, such as political instability, terrorism, natural disasters, and health crises (as seen with the COVID-19 pandemic), can significantly disrupt the leisure travel market. These events can lead to travel advisories, safety concerns, and the implementation of travel restrictions, impacting both domestic and international travel. Travel restrictions and safety concerns can result in canceled or postponed trips, reduced bookings, and a general reluctance to travel. Geopolitical uncertainties can also create volatility in currency exchange rates, affecting travel costs and pricing. The sudden and unpredictable nature of geopolitical events makes it challenging for the leisure travel industry to plan and adapt, leading to short-term disruptions and long-term uncertainty. Wars, terrorist threats, and political instability in certain regions deter travelers, impacting tourism in those areas. Recent examples include the Ukraine war and ongoing tensions in the Middle East. Diplomatic disputes, strained relations between countries, and unexpected border closures can disrupt travel plans abruptly. The uncertainty regarding visas, entry permissions, and the political climate can deter tourism. Global conflicts and political instability often lead to disruptions in air travel, fuel supplies, and tourism infrastructure. This can result in flight cancellations, increased costs, and overall unpredictability, discouraging travel plans.

Environmental and health concerns are influencing travel behavior.

Environmental issues, such as natural disasters, climate change, and pollution, can impact travel destinations and activities. Additionally, health concerns, including the spread of infectious diseases, can have a significant impact on leisure travel. Events like the COVID-19 pandemic highlighted the vulnerability of the industry to global health crises and the importance of addressing health and safety concerns. Environmental and health concerns can result in the closure of popular tourist destinations, changes in travel patterns, and increased scrutiny of hygiene and safety standards. Travelers may alter their plans or avoid certain destinations altogether due to perceived health risks. The industry is challenged to implement and communicate stringent health and safety measures to rebuild traveler confidence. Hurricanes, floods, wildfires, and other natural disasters can disrupt travel plans, damage infrastructure, and deter future visits to affected areas. Overcrowded destinations and unsustainable tourism practices can strain local resources, damage ecosystems, and negatively impact local communities, influencing travelers' choices.

Global Leisure Travel Market Opportunities:

Travelers crave more than just ticking off landmarks; they seek immersive experiences that resonate with their passions and connect them to different cultures. Think culinary adventures in Tuscany, volunteering with wildlife conservation in Africa, or learning traditional weaving techniques in Guatemala. Travelers want journeys tailored to their interests and values. AI-powered recommendations, curated itineraries based on personality, and niche travel packages catering to specific passions offer deeper and more meaningful experiences. Travel as a tool for personal growth and well-being is a rising trend. Yoga retreats in the Himalayas, wellness getaways in Iceland, or mindful hiking excursions in Bhutan cater to this growing desire for holistic rejuvenation. VR and AR can transform travel planning and enhance travel experiences. Imagine exploring potential destinations virtually before booking, immersing yourself in historical sites through AR overlays, or learning a new language through interactive VR experiences. Blockchain technology can revolutionize travel booking, making transactions more secure and transparent. Smart contracts can automate ticketing and accommodation processes, while decentralized marketplaces can offer peer-to-peer travel options with increased trust and efficiency. Travelers are increasingly seeking eco-friendly options, such as glamping in national parks, supporting community-based tourism initiatives, or choosing carbon-neutral airlines and accommodations. Responsible travel involves respecting local cultures, minimizing environmental impact, and avoiding activities that harm wildlife or communities. Ethical tourism practices and educational programs can promote responsible choices among travelers. Travelers desire authentic experiences that benefit local communities. Homestays, guided tours led by locals, and supporting local artisans and businesses foster cultural understanding and contribute to sustainable development.

LEISURE TRAVEL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

21.8% |

|

Segments Covered |

By Mode of Travel, Demographics, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

American Express Travel, Travel Leaders Group, Expedia Group, TUI Group., Carlson Wagonlit Travel, Thomas Cook Limited, JTB Americas Group, Priceline Group, World Travel, Inc., Cox & Kings Ltd. |

Leisure Travel Market Segmentation: By Mode of Travel

-

Air

-

Car

-

Rail

-

Cruise

Air travel is dominant, with around 60–65% of the market share in 2023. Speed, convenience, and global reach make it the preferred choice for long-distance trips, vacations, and business travel. Air travel reigns supreme due to its unbeatable combination of speed, efficiency, and access to remote destinations. It allows travelers to cover large distances quickly, enabling shorter trips and maximizing vacation time. Additionally, airlines offer diverse routes, competitive fares, and convenient booking options, solidifying their position as the primary vehicle for leisure travel. Car travel Car travel holds approximately 25–30% of the market. It is witnessing the most significant growth spurred by increasing car ownership, rising fuel efficiency, and the desire for personalized, spontaneous adventures. Families with children find road trips ideal, and younger generations increasingly embrace spontaneous explorations in campervans or RVs. Affordable car rentals and carpooling platforms further support this trend. Rail travel Enjoys a smaller share of 5–10% but with significant regional variations. Europe sees strong rail tourism, while it plays a smaller role in other regions like North America. Scenic routes, comfort, and sustainability are its key draws.

Leisure Travel Market Segmentation: By Demographics

-

Millennials

-

Gen Z

-

Gen X

-

Baby Boomers

Millennials (Gen Y) dominate, with around 35–40% sharing tech-savvy, adventure-seeking, and experience-driven traits; they prioritize authenticity, cultural immersion, and off-the-beaten-path destinations. Millennials currently reign supreme due to their sheer population size, disposable income, and active travel habits. Their preference for unique experiences and diverse destinations drives trends in the industry. Gen Z is a rapidly growing segment that holds a 20–25% share. Highly digital and environmentally conscious, they value sustainable travel, social media-worthy experiences, and budget-friendly options. Gen Z is catching up rapidly, fueled by its digital influence, growing spending power, and focus on sustainable and budget-friendly travel. Their distinct preferences will reshape the market in the coming years. Gen X holds a 20–25% share seeking relaxation, family time, and value for money; they often choose beach vacations, cruises, or all-inclusive packages.

Leisure Travel Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia Pacific holds 38.7% of the shares; it is the largest and fastest-growing market, driven by rising disposable income and a vast middle class in countries like China and India. The Asia-Pacific region dominates the leisure travel market with its massive market share and strong growth trajectory. Factors like a booming middle class, favorable government policies, and diverse attractions contribute to its leadership.

Europe holds 28.5% of the market; it is a mature market with established travel cultures and diverse destinations. France, Spain, and Italy remain popular tourist spots. North America holds 22.3% of the share, with spending travelers drawn to iconic landmarks and theme parks. Travel within the region is common.

COVID-19 Impact Analysis on the Global Leisure Travel Market.

The COVID-19 pandemic has had a significant and multifaceted impact on the leisure travel market, causing both immediate disruption and long-term shifts in traveler preferences and industry practices. Global travel volume plummeted by over 70% in 2020, resulting in massive revenue losses for travel companies and widespread job losses within the industry. Government-imposed lockdowns, border closures, and quarantine requirements severely limited travel options and created considerable uncertainty for potential travelers. International travel restrictions led to a surge in domestic travel as people sought leisure opportunities closer to home. Travelers prioritized health and safety, with increased demand for contactless solutions, enhanced hygiene protocols, and flexible cancellation policies. Travelers have become more value-conscious, seeking flexible packages, deals, and personalized experiences. Trustworthy brands and destinations with strong health and safety measures are favored. Online booking platforms, virtual tours, and contactless technologies gained traction, shaping the future of travel booking and information gathering. The pandemic heightened awareness of environmental concerns, leading to increased interest in eco-friendly travel options and responsible tourism practices. Remote work trends have led to the emergence of bleisure travel, where business trips combine with leisure activities. While the market has shown signs of recovery in 2023, full pre-pandemic levels are not expected until 2025 or later. Asia-Pacific and Latin America are expected to lead the recovery due to their strong domestic markets and growing middle classes. The demand for personalized, authentic, and meaningful travel experiences is likely to remain strong. Technology will continue to play a crucial role in travel planning, booking, and experience personalization. Sustainability and responsible tourism practices will become increasingly important for attracting travelers. Overall, the COVID-19 pandemic has fundamentally reshaped the leisure travel market. While challenges remain, the industry is adapting and innovating to cater to the evolving needs of travelers in a post-pandemic world.

Latest Trends/ Developments:

Eco-conscious travelers are driving demand for responsible tourism practices. This includes eco-friendly accommodation, responsible wildlife encounters, minimizing plastic waste, and supporting local communities. Destinations focused on sustainability are seeing a surge in popularity. With flexible work arrangements, travelers are opting for shorter, more frequent trips for leisure or bleisure (blending business and leisure). Weekend getaways, city breaks, and remote working retreats are booming. With flexible work arrangements, travelers are opting for shorter, more frequent trips for leisure or bleisure (blending business and leisure). Weekend getaways, city breaks, and remote working retreats are booming. AI-powered travel platforms personalize recommendations, optimize itineraries, and offer dynamic pricing. Chatbots offer 24/7 assistance, while virtual reality tours give travelers a taste of destinations before booking. More people are embracing solo travel for adventure, self-discovery, and personal growth. Solo-friendly destinations, tours, and communities are catering to this growing segment. Travelers seek holistic experiences that combine relaxation, physical activity, and mental well-being. Spa vacations, yoga retreats, and outdoor adventures focused on mindfulness are in high demand. Travelers crave unique and authentic experiences that go beyond mainstream tourist attractions. They seek local guides, homestays, and activities that offer deeper cultural immersion. Destinations and travel providers are making efforts to become more accessible for people with disabilities and diverse needs. This includes barrier-free facilities, inclusive tours, and accessible transportation options. Specific interests like food tourism, adventure travel, and cultural immersion are witnessing dedicated platforms, tours, and communities catering to passionate travelers. Travel trends can be influenced by global events, political instability, and economic fluctuations. It's crucial to stay informed about changing travel advisories and adapt plans accordingly. Virtual reality experiences may provide new ways to explore destinations before or after physical travel. Technology and data-driven insights may further personalize travel recommendations and provide unique local experiences. Sharing economy platforms like Airbnb and Glamping offer new lodging options catering to diverse budgets and preferences. The future of leisure travel promises to be exciting and dynamic, with constant innovation and evolving traveler expectations.

Key Players:

-

American Express Travel

-

Travel Leaders Group

-

Expedia Group

-

TUI Group.

-

Carlson Wagonlit Travel

-

Thomas Cook Limited

-

JTB Americas Group

-

Priceline Group

-

World Travel, Inc.

-

Cox & Kings Ltd.

Chapter 1. Leisure Travel Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Leisure Travel Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Leisure Travel Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Leisure Travel Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Leisure Travel Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Leisure Travel Market – By Mode of Travel

6.1 Introduction/Key Findings

6.2 Air

6.3 Car

6.4 Rail

6.5 Cruise

6.6 Y-O-Y Growth trend Analysis By Mode of Travel

6.7 Absolute $ Opportunity Analysis By Mode of Travel, 2024-2030

Chapter 7. Leisure Travel Market – By Demographics

7.1 Introduction/Key Findings

7.2 Millennials

7.3 Gen Z

7.4 Gen X

7.5 Baby Boomers

7.6 Y-O-Y Growth trend Analysis By Demographics

7.7 Absolute $ Opportunity Analysis By Demographics, 2024-2030

Chapter 8. Leisure Travel Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Mode of Travel

8.1.3 By Demographics

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Mode of Travel

8.2.3 By Demographics

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Mode of Travel

8.3.3 By Demographics

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Mode of Travel

8.4.3 By Demographics

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Demographics

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Leisure Travel Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 American Express Travel

9.2 Travel Leaders Group

9.3 Expedia Group

9.4 TUI Group.

9.5 Carlson Wagonlit Travel

9.6 Thomas Cook Limited

9.7 JTB Americas Group

9.8 Priceline Group

9.9 World Travel, Inc.

9.10 Cox & Kings Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global leisure travel market was valued at USD 1.46 trillion in 2023 and is projected to reach a market size of USD 5.81 trillion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 21.8%.

The Rising Disposable Incomes and Increased Urbanization, The Technology-Driven Personalization, Evolving Travel Trends and Growing Niche Markets, Government Initiatives, Evolving Ecosystem.

Asia-Pacific holds 38.7% of the total market share driven by rising disposable income and a vast middle class in countries like China and India.

Asia-Pacific holds the title of the fastest-growing region in the leisure travel market. This is fueled by factors such as increased economic stability, which empowers more people to travel, and investments in airports, hotels, and transportation networks, which make travel easier and more accessible.

Artificial Intelligence and Machine Learning, Tech-Driven Advancements, Focus on personalized and hyper-local experiences, Sustainability Focus, Rise of Alternative Accommodations, Collaboration, and Partnerships.