Legal Cannabis Market Size (2025 – 2030)

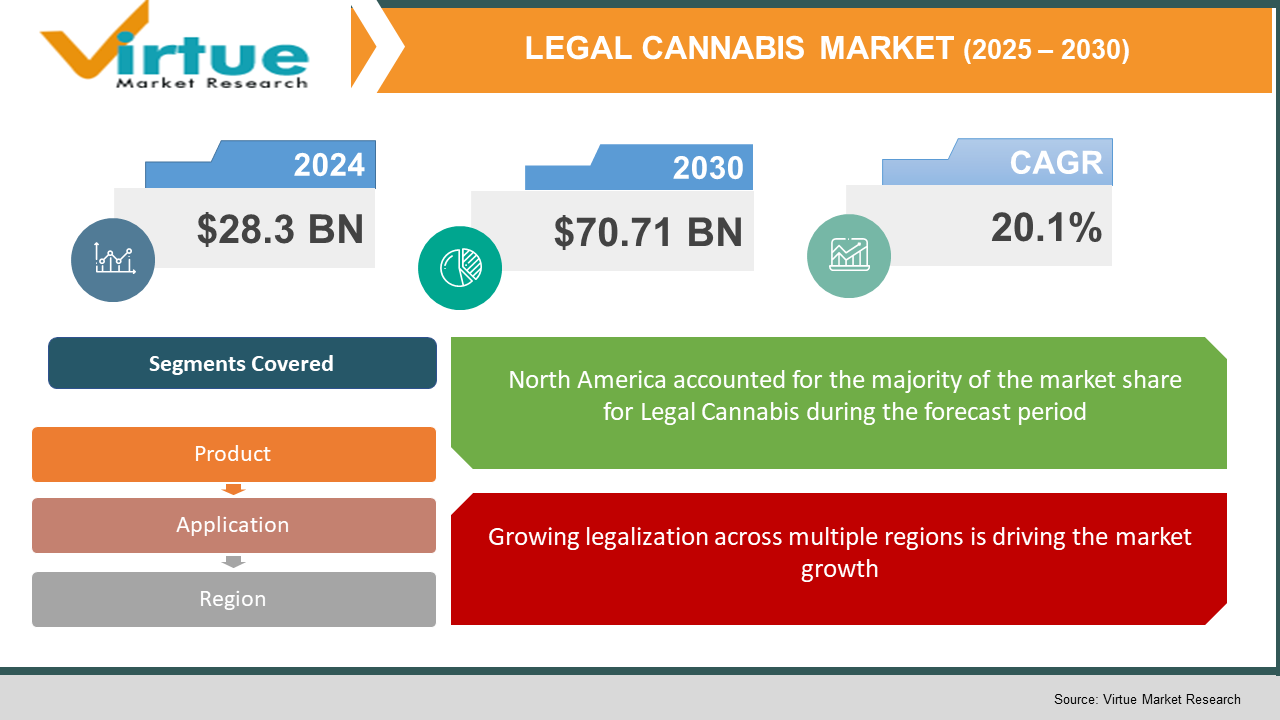

The Global Legal Cannabis Market was valued at USD 28.3 billion in 2024 and will grow at a CAGR of 20.1% from 2025 to 2030. The market is expected to reach USD 70.71 billion by 2030.

The Legal Cannabis Market includes cannabis products sold for medical, recreational, and wellness purposes within legal frameworks across different regions. Cannabis legalization in various countries, growing medical applications, and rising social acceptance are contributing to market growth. Legal cannabis is increasingly used for chronic pain management, anxiety relief, and as an alternative to traditional pharmaceuticals. With an expanding consumer base and the entry of new players, the market is experiencing rapid innovation in product offerings, including edibles, oils, tinctures, and topical products. Government regulations, product quality control, and investment in cannabis research are playing a vital role in shaping the industry landscape.

Key market insights:

- The United States holds over 70% of the total revenue share in North America due to widespread legalization across multiple states and a mature retail infrastructure.

- Medical cannabis accounts for approximately 55% of total sales, fueled by increasing prescriptions for chronic pain, epilepsy, and cancer-related symptoms.

- Edibles and cannabis-infused beverages are the fastest-growing product categories, growing at a CAGR of 23% from 2025 to 2030.

- The Asia-Pacific market is expected to grow by 28% CAGR, led by legalization movements in Thailand, Australia, and South Korea.

- Europe’s cannabis market reached USD 5.8 billion in 2024, with Germany, the UK, and the Netherlands leading in medical cannabis adoption.

- Technological advancements in cannabis cultivation such as hydroponics and indoor vertical farming are driving production efficiency and consistency.

- Increasing M&A activity is seen, with over 200 deals closed globally in 2024 alone, signifying market consolidation and expansion.

- Legal and compliant CBD products now constitute nearly 18% of the total legal cannabis market revenue, driven by their popularity in wellness and skincare sectors.

Global Legal Cannabis Market Drivers

Growing legalization across multiple regions is driving the market growth

One of the primary drivers of the global legal cannabis market is the increasing wave of cannabis legalization across countries and regions. Over the past decade, several nations including Canada, the United States, Uruguay, and parts of Europe have legalized cannabis for either medical or recreational use. This trend has not only opened up massive economic opportunities but has also facilitated the development of regulatory frameworks that ensure product quality and consumer safety. In the United States alone, more than 20 states have legalized cannabis for adult recreational use, while over 35 states have allowed its use for medical purposes. Legalization has helped to destigmatize cannabis use, allowing for the proliferation of dispensaries, branded products, and robust supply chains. Moreover, the tax revenues generated from legal cannabis sales are being reinvested into public services, encouraging more governments to consider similar policies. In addition, international trade agreements and regulatory harmonization across regions, such as those initiated by the European Union, are paving the way for a global cannabis trade network. Legalization efforts are further bolstered by increasing public awareness of cannabis’ medical benefits and safety compared to other controlled substances. These legal advancements provide stability and predictability, fostering a favorable business environment that attracts investments, accelerates innovation, and supports job creation in the cannabis industry.

Medical use and therapeutic benefits is driving the market growth

The legal cannabis market is significantly driven by its expanding use in medical treatments and its widely recognized therapeutic benefits. Numerous scientific studies have shown that cannabinoids, such as THC and CBD, possess anti-inflammatory, analgesic, neuroprotective, and anti-anxiety properties. These findings have led to increased acceptance of medical cannabis among healthcare professionals and patients. Conditions commonly treated with medical cannabis include chronic pain, multiple sclerosis, epilepsy, cancer-related symptoms, PTSD, and anxiety disorders. Medical cannabis is often considered a safer and less addictive alternative to opioids and other prescription medications. The demand for cannabis-based pharmaceuticals is rising, with governments allowing limited prescriptions under regulatory frameworks. Countries like Germany, Italy, and Australia have implemented structured medical cannabis programs, resulting in steady demand from patients and healthcare institutions. The development of precise formulations, such as cannabis oils, tinctures, and capsules, has made dosage control and administration more accessible and reliable for patients. In addition, the involvement of pharmaceutical companies in cannabis research and drug development has legitimized the medical cannabis space and boosted investor confidence. Clinical trials and government-funded research projects are continuously exploring new therapeutic applications, further solidifying cannabis as a mainstream medical product. This ongoing medical validation is expected to remain a major driver in the global legal cannabis market.

Changing consumer preferences and wellness trends is driving the market growth

The global legal cannabis market is being influenced by changing consumer preferences and increasing interest in wellness-oriented lifestyles. Consumers are increasingly seeking natural and plant-based alternatives to traditional health and recreational products, and cannabis fits well into this trend. Products such as CBD oils, cannabis-infused beverages, topical creams, and gummies are gaining popularity among wellness-conscious consumers who are looking for functional benefits like relaxation, pain relief, better sleep, and mood enhancement. Cannabis products are now available in a variety of consumption formats, making them more approachable for new users. This versatility has expanded the target demographic beyond traditional users to include older adults, women, and professionals. Lifestyle branding and sophisticated packaging have helped elevate the perception of cannabis from a taboo product to a mainstream wellness item. In addition, the endorsement of cannabis use by public figures and influencers has contributed to its social normalization. Companies are investing heavily in R&D to formulate products that are tailored to specific needs, such as stress relief or fitness recovery. Consumers are also more informed today, seeking products that are organic, sustainably grown, and third-party tested. The emphasis on transparency and health-consciousness aligns perfectly with the cannabis value proposition, propelling consumer demand. As wellness continues to be a dominant global trend, cannabis stands to gain from its alignment with natural health, relaxation, and self-care markets.

Global Legal Cannabis Market Challenges and Restraints

Regulatory inconsistency and legal complexities is restricting the market growth

One of the most significant challenges facing the global legal cannabis market is the inconsistency and complexity of regulatory frameworks across different countries and even within regions of the same country. In many cases, cannabis remains federally illegal while being allowed at the state or provincial level, such as in the United States. This discrepancy creates challenges in areas like interstate commerce, banking, advertising, and research. Businesses often struggle to scale due to the fragmented nature of compliance requirements, varying tax codes, and differing restrictions on product types, potency, and packaging. Internationally, there is no uniform standard for medical or recreational cannabis, making it difficult to establish cross-border trade or uniform quality assurance protocols. This lack of harmonization not only increases operational costs for cannabis companies but also limits consumer access to safe and standardized products. Regulatory unpredictability can also discourage investment and innovation in the sector. For instance, a change in political leadership can result in shifts in enforcement policies, creating uncertainty in the market. Moreover, delays in licensing approvals and an opaque regulatory process can bottleneck market entry for new players. These legal challenges act as a deterrent for small and medium enterprises and hinder the overall pace of industry growth. Resolving these regulatory complexities will be crucial for ensuring long-term stability and market maturity.

Stigma and lack of clinical validation is restricting the market growth

Despite increasing legalization and acceptance, the legal cannabis market continues to face social stigma and a lack of comprehensive clinical validation. In many parts of the world, cannabis is still associated with recreational drug use, crime, or youth delinquency. This perception can deter potential consumers, investors, and even healthcare professionals from fully embracing cannabis products. Cultural resistance in conservative societies often influences public policy, delaying legalization or leading to overly restrictive regulations. In addition to societal perceptions, the scientific community has not yet fully validated many of the claimed medical benefits of cannabis through large-scale, peer-reviewed clinical trials. Most existing studies are either observational or small-scale, leading to skepticism about efficacy and safety. This lack of robust evidence makes it difficult for healthcare providers to prescribe cannabis with confidence and for insurers to cover cannabis-based treatments. Furthermore, the classification of cannabis as a controlled substance in many countries restricts the scope of academic and clinical research. The absence of standardized dosing guidelines and product quality variability also complicates clinical usage. These limitations contribute to ongoing resistance from parts of the medical community and regulatory bodies. Without broad scientific consensus and cultural acceptance, the growth potential of the legal cannabis market may be hindered despite favorable economic and legal trends.

Market opportunities

The legal cannabis market holds immense opportunities driven by evolving regulations, growing health consciousness, and emerging product innovation. As legalization spreads across continents, new markets are opening up, especially in Asia-Pacific and Latin America, which have begun embracing cannabis for medical use and, in some cases, decriminalization for personal use. These emerging markets offer a large, untapped consumer base, encouraging companies to expand geographically. Technological advancements in cultivation, such as climate-controlled greenhouses and AI-powered crop monitoring, are enhancing crop yield and product consistency, creating competitive advantages for early adopters. Furthermore, the expansion of product categories such as cannabis beverages, edibles, and skincare presents new avenues for revenue generation beyond traditional flower and oil formats. The integration of cannabis into mainstream wellness products is especially promising, with opportunities in fitness recovery, sleep aids, and stress management solutions. Partnerships between pharmaceutical companies and cannabis startups are fostering drug development initiatives targeting conditions like epilepsy, multiple sclerosis, and anxiety. On the retail front, innovations like e-commerce platforms, cannabis delivery services, and branded experiences in dispensaries are improving customer accessibility and loyalty. Countries that implement favorable taxation and streamlined licensing procedures stand to attract significant foreign direct investment. With growing consumer education and transparency, brands that focus on quality assurance, sustainability, and social responsibility will likely build strong reputations and capture market share. These evolving dynamics position the legal cannabis market as one of the most lucrative and transformative sectors in the global economy.

LEGAL CANNABIS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

20.1% |

|

Segments Covered |

By product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Canopy Growth Corporation, Aurora Cannabis Inc., Tilray, Inc., Cronos Group Inc., GW Pharmaceuticals, Cura leaf Holdings, Green Thumb Industries, Trulieve Cannabis Corp., Med Men Enterprises, Cresco Labs |

Legal Cannabis Market Segmentation

Legal Cannabis Market Segmentation: By Product:

- Flower

- Oil

- Edibles

- Tinctures

- Topicals

- Capsules

- Beverages

Flower remains the most dominant product category in the legal cannabis market. It accounts for nearly 40% of total sales globally due to its familiarity among traditional consumers and broad availability in both medical and recreational dispensaries. Flower offers quick onset effects and is often more affordable compared to processed formats like oils or edibles. While new product formats are gaining traction, flower continues to appeal to a large user base and benefits from simple cultivation and distribution logistics.

Legal Cannabis Market Segmentation By Application:

- Medical Use

- Recreational Use

- Wellness and Personal Care

Medical use is the dominant application segment, representing over 55% of total market revenue in 2024. This is largely driven by legal frameworks that prioritize cannabis access for medical conditions and by strong demand from patients seeking alternatives to conventional drugs. Medical cannabis has broader acceptance among regulators, healthcare providers, and insurers in some countries, further reinforcing its dominance over recreational or wellness-focused applications.

Legal Cannabis Market Regional segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the most dominant region in the global legal cannabis market, contributing more than 75% of global revenue in 2024. The United States leads the way with a sophisticated infrastructure of licensed producers, retail outlets, and established consumer demand. Legalization at the state level has created a robust domestic market, while Canada’s nationwide legalization since 2018 has fostered growth in exports and medical research. The region is also a hub for innovation, investment, and product development. Public support, tax revenue benefits, and entrepreneurial activity continue to drive growth in this region. With well-developed distribution networks and a mature regulatory environment, North America sets the benchmark for other regions entering the legal cannabis industry.

COVID-19 Impact Analysis on the Legal Cannabis Market

The COVID-19 pandemic had a complex impact on the legal cannabis market. Initially, the market faced supply chain disruptions due to restrictions on international trade, transportation bottlenecks, and labor shortages. Many cultivation facilities and dispensaries faced temporary shutdowns or limited operating hours, affecting product availability. However, as the pandemic progressed, cannabis was deemed an essential service in several regions, including parts of the United States and Canada, which helped stabilize the market. Lockdown-induced anxiety, stress, and sleep disorders drove increased consumer demand for both medical and recreational cannabis. Online sales channels and home delivery services witnessed a sharp rise as consumers shifted to digital purchasing. Companies that adapted quickly to e-commerce trends and contactless transactions gained significant traction. The pandemic also sparked interest in cannabis as a wellness product, accelerating the growth of CBD-infused items. However, challenges persisted in terms of delayed regulatory approvals, slower investment activity, and cautious expansion strategies by businesses. Despite these obstacles, the crisis highlighted the resilience of the cannabis industry and underscored the importance of digital transformation and regulatory clarity. As the world transitions to a post-COVID landscape, many of the adaptations made during the pandemic are expected to become permanent features, providing long-term momentum to the legal cannabis market.

Latest trends/Developments

The legal cannabis market is experiencing rapid evolution marked by several notable trends and developments. One key trend is the emergence of cannabis-infused beverages, which are attracting both health-conscious and recreational consumers looking for alternatives to alcohol. Major beverage companies are entering the cannabis space through partnerships and product launches. Another trend is the rise of luxury cannabis brands that focus on premium packaging, organic ingredients, and curated experiences. Additionally, terpene-focused products are gaining attention for their tailored flavor profiles and targeted effects. In cultivation, sustainable practices such as organic farming, water conservation, and renewable energy use are becoming standard to meet environmental and consumer expectations. Technological innovations are also reshaping operations, with AI and data analytics being used for yield optimization and quality control. The market is seeing a surge in clinical trials and R&D collaborations, aiming to expand the therapeutic applications of cannabis. Personalized cannabis products based on DNA profiling and biometric data are being developed to cater to specific consumer needs. Meanwhile, legislative progress continues globally, with more countries exploring legalization or decriminalization pathways. Governments are also working on creating standardized regulations for testing, labeling, and marketing. These developments are contributing to greater legitimacy and consumer trust. Social equity initiatives and community reinvestment programs are gaining momentum, aiming to make the cannabis industry more inclusive. Overall, these trends are reshaping the cannabis ecosystem, positioning it for sustained and diversified growth.

Key Players:

- Canopy Growth Corporation

- Aurora Cannabis

- Tilray

- Cronos Group

- Curaleaf

- Green Thumb Industries

- Trulieve

- HEXO Corp

- Organigram Holdings

- Cresco Labs

Chapter 1. Legal Cannabis Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Legal Cannabis Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Legal Cannabis Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Legal Cannabis Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Legal Cannabis Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Legal Cannabis Market – By product

6.1 Introduction/Key Findings

6.2 Flowers

6.3 Edibles

6.4 Concentrates

6.5 Topicals

6.6 tinctures

6.7 Capsules

6.8 Y-O-Y Growth trend Analysis By product

6.9 Absolute $ Opportunity Analysis By product, 2025-2030

Chapter 7. Legal Cannabis Market – By application

7.1 Introduction/Key Findings

7.2 medical use

7.3 recreation use

7.4 wellness and personal care

7.5 Y-O-Y Growth trend Analysis By application

7.7 Absolute $ Opportunity Analysis By application, 2025-2030

Chapter 8. Legal Cannabis Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By product

8.1.3 By application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By product

8.2.3 By application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By product

8.3.3 By application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By product

8.4.3 By application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By prodct

8.5.3 By application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Legal Cannabis Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Canopy Growth Corporation

9.2 Aurora Cannabis Inc.

9.3 Tilray, Inc.

9.4 Cronos Group Inc.

9.5 GW Pharmaceuticals

9.6 Cura leaf Holdings

9.7 Green Thumb Industries

9.8 Trulieve Cannabis Corp.

9.9 Med Men Enterprises

9.10 Cresco Labs

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Legal Cannabis Market was valued at USD 28.3 billion in 2024

Legalization, medical applications, and wellness trends are the key drivers

Segments include products like flower, edibles, oils, and applications such as medical, recreational, and wellness use.

North America is the most dominant region in the legal cannabis market.

Leading players include Canopy Growth, Curaleaf, Aurora Cannabis, and Tilray.