Leather Market Size (2025-2030)

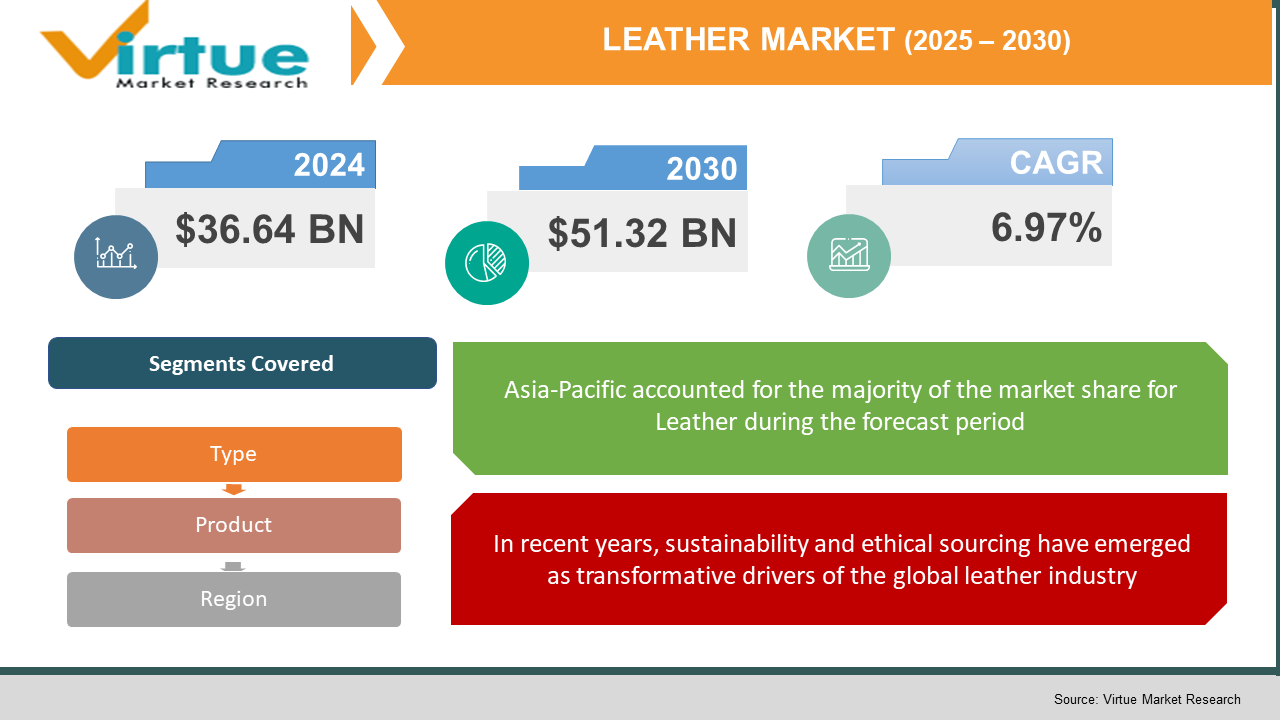

The Leather Market was valued at USD 36.64 billion in 2024 and is projected to reach a market size of USD 51.32 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.97%.

Leather presents a broad field of applications across fashion, footwear, automotive, furniture, and accessories and indeed, remains dynamic and in a state of change. Its durability and aesthetic appeal, coupled with its versatility, ensure that leather remains a premium material choice within both luxury and mass-market. Traditional leather production still operates on higher margins; however, there have been rising concerns regarding the environment and its ethical implications, which have been forcing a change toward a more sustainable model with alternatives such as eco-leather and vegan leather. Tanning technology and bio-based materials, along with supply chain transparency, are gradually changing the paradigm. Thus, with the increasing demand from customers for quality and sustainable products, the leather industry finds itself at a watershed moment: balancing time-honoured craftsmanship with modern sustainability trends.

Key Market Insights:

The footwear segment accounts for nearly 40% of global leather usage. This is driven by rising demand for stylish and durable shoes, especially in emerging economies.

Countries like India, China, and Vietnam are major leather producers, contributing over 60% of global output. Competitive labour costs and strong export networks fuel their dominance.

Over 30% of major leather brands have adopted blockchain or RFID-based systems to track sourcing and ensure ethical production. Transparency has become a differentiator in a competitive market.

Leather Market Drivers:

The leather market is significantly driven by the global fashion and footwear industries, which account for a major share of leather consumption.

From shoes and bags to jackets and belts, leather stands out amongst many because of its vintage, premium allure, and durability, reflected in its timeless aesthetic. Rising income among consumers in developing parts of the world, like the Asia-Pacific and Latin America, has increased demand for fashionable and upscale leather products. Leather remains a hallmark of luxury, as proof of use among high-end brands, including Gucci, Prada, and Louis Vuitton. Gen Z and Millennials appreciate the age of luxury and craftsmanship for brand prestige; they now fuel the swift development of the leather market. Seasonal and cyclical trends in clothing, as well as fashion weeks, contribute to the cyclical demand for leather, making this material a dynamic and responsive one in the apparel supply chain. Also, the e-commerce concept has made leather goods accessible to the urban and semi-urban circles for access to premium offerings. The beauty of this material, suiting formal and casual occasions, will keep it relevant in global fashion for years to come. These are some factors that contribute to the slow yet still very resilient growth in the leather market across various fashion sub-segments.

In recent years, sustainability and ethical sourcing have emerged as transformative drivers of the global leather industry.

Today, the leather industry is being transformed by sustainability and ethical sourcing. In developed economies, consumers are increasingly making demands for alternatives to traditional animal leather, due to awareness of animal welfare as well as environmental concerns. This has allowed for vegan and plant-based leather alternatives made from such substances as mycelium, pineapple leaves (Piñatex), cork, and recycled plastic to spring up. These green innovations are soaking up investments from fashion houses and manufacturers of automobiles and furniture alike. In parallel, major brands such as Adidas, Stella McCartney, and Tesla are embracing the integration of vegan leather into the market and starting to lay down some new avenues of offer. On its own, the government incentives and the regulatory support for sustainable manufacturing lend weight to this shift, encouraging companies to develop low-impact materials and reducing their carbon footprint. Enhanced consumer confidence in these alternatives comes from the rise of cruelty-free certifications and transparent supply chain technologies like blockchain. Given the worldwide growth of sustainable fashion, the companies that manage to conform to these changes are expected to achieve prolonged business success and brand loyalty. The movement is therefore not only changing the course of product innovations but also changing the standards of the entire leather ecosystem.

Leather Market Restraints and Challenges:

One of the major challenges facing the leather industry is the environmental impact associated with traditional leather processing, especially tanning, which often involves toxic chemicals like chromium.

These include environmental pollution, the production of hazardous wastes, and high carbon emissions brought about by tanning inefficiencies, usually involving toxic chemicals like chromium. It is a problem that has been developing for years, and eating through huge amounts of consumables has drawn increasing maternal scrutiny from environmental regulators. In response to international environmental and labour regulations, many countries have formulated overly strict regulations concerning the environment and work that have brought up the operational cost and forced tanneries to invest in costly technologies for treatment and sustainability. Increasing consumer consciousness also provoked the backlash against unethical sourcing and production practices and, thus, prompted old heads to reconsider the profit margins with compliance and sustainability.

Leather Market Opportunities:

The leather market is seeing tremendous prospects in light of sustainability-based bio- and vegan-leather alternatives manufactured from mushroom mycelium, pineapple leaves, or recycled plastics, among other materials. The latter prospects are equally good for eco-conscious consumers who are increasing in number, especially in North America and Europe. On the other hand, smart textiles and IoT-linked leather products in situations like temperature-regulating automotive seats or biometric leather wearables are also presenting great possibilities in fashion, automotive, and furniture industries. Major brands and startups are investing heavily in eco-innovation, which will allow the leather market to move towards a more ethical and technology-driven environment, creating avenues for new revenue streams and global partnerships.

LEATHER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.97% |

|

Segments Covered |

By Product, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Aditya Birla Group, ECCO Leather, LVMH Moët Hennessy Louis Vuitton SE, Wolverine World Wide, Nike, Timberland, Horween Leather Company |

Leather Market Segmentation:

Leather Market Segmentation: By Type

- Genuine Leather

- Synthetic Leather

- Bio-Based Leather

The leather market is divided into categories according to type- Genuine, Synthetic, and Bio-Based Leather-with each catering to a separate set of end-user preferences and industrial needs. Genuine leather is thought of as an item of luxury with remarkable durability, which has always and mostly been used in the high-end fashion, automotive, and upholstery segments made from animal hides. Synthetic leather (PU/PVC-based) gives an alternative that is fairly easy to mass-produce and is more acceptable from an animal rights standpoint. It, however, has become very important in the global footwear and budget fashion industries. The most rapidly evolving segment, on the other hand, is the bio-based leather sourced from sustainable materials like mushroom mycelium, pineapple leaves (Piñatex), and recycled composites. This handsome leather attracts consumers and brands conscious of the environment and want to achieve their ESG goals. Many large brands are now shifting toward more bio-based alternatives to coincide with global sustainability trends. In the years to come, this category holds the promise of the highest CAGR, with restrictions tightening on environmental concerns and changes in consumer preferences. All of these types offer their particular advantages and disadvantages for aesthetics, price, durability, and sustainability.

Leather Market Segmentation: By Product

- Footwear

- Clothing

- Accessories

- Upholstery

- Automotive Interiors

- Industrial Belts & Equipment

In terms of product, the leather market is extremely diverse, which can be seen in Footwear, Garments, Accessories, Upholstery, Automotive Interiors, and Industrial Belts & Equipment. Footwear has the largest value in this market because most of the world's population demands stylish yet very durable shoes for either premium or mass-market segments. Garments, as well as accessories such as jackets, belts, handbags, and wallets, make a noteworthy contribution, especially in fashion-conscious Europe and North America. The fast-moving automotive interior segment: luxury vehicles, as well as electric cars, both emphasise the interior cabin aesthetics of leather-rich designs. Upholstery furniture involved in home décor-are considerably relying on both genuine and synthetic leather for durability and elegance. Emerging markets are consuming more leather-covered furniture owing to urbanisation and lifestyle touch-ups. The segment of the industrial belt and equipment going skinny uses thick, treated leather as a mechanical inevitability in manufacturing, adding to diversity in the market. Sustainability pours into each of these product categories, with brands providing increasingly vegan leather alternatives and transparent sourcing discipline. Product innovation, along with customisation of design, will further fuel growth across these segments during the forecast period.

Leather Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Asia-Pacific is the winner in regard to the leather industry, since it has sufficient raw materials, manufacturing capacity, and production based in export-oriented countries such as India, China, and Vietnam. Europe remains a significant market for such leather trade due to high-end fashion, automotive interiors, and luxury goods, even though Europe is home to heritage brands that have been supported by sophisticated processing technologies. Innovation, sustainability, and strong demand for luxury leather goods for apparel, furniture, and footwear enable North America to have a good share. South America is looking to make a mark with respect to livestock resources and the tanning sector, especially in Brazil and Argentina. The Middle East and Africa are gradually adjusting to urbanisation, infrastructure development, and increasing consumer spending for lifestyle products. The market landscape is anticipated to be additionally moulded by regional trade agreements and technological collaborations during the forecast period.

COVID-19 Impact Analysis on the Leather Market:

The COVID-19 pandemic had unprecedented effects on the leather market worldwide, disrupting both supply chains and consumer demand. Leather production in important regions like China, India, and Italy was temporarily suspended owing to factory shutdowns, labour shortages, and restrictions on transportation. Demand for leather goods in the fashion, automotive, and furniture industries dwindled during the initial months of the pandemic, as retail stores were closed and international trade slowed. While brands in luxury leather witnessed decreased sales, small and medium enterprises faced huge backlogs of unsold inventory and serious cash-flow limitations. The crisis also acted as a catalyst for digitalisation, forcing leather businesses to embrace e-commerce and direct-to-consumer sales. Sustainable and ethical leather sourcing became a focus for consumers, who, during the post-pandemic era, identified environmental and health issues brought by the crisis. Markets recovered unevenly; developed markets recovered faster, with stronger online infrastructure and consumer spending. To sum it all up, the pandemic has caused immediate dislocations in the leather market, but in the long term, it has favoured resilience, innovation, and sustainability, thus transforming the leather market.

Latest Trends/ Developments:

The leather market is changing fast, influenced by sustainability, advances in material science, and changes in consumer preferences. Leading the way are bio-based and biodegradable leathers made from mushroom mycelium, pineapple leaves, cacti, or even shrimp shells—all viable alternatives to animal hide. Chemical-free tanning is gaining popularity, be it vegetable tanning or chrome-free leather manufacture, due to stringent global regulations and consumer demand for clean products. Biotech-driven leather finishing methodologies-never before seen-are now being adopted that substitute for some of the very harmful PFAS with silk-based systems: radical in terms of delivery on durability and safety. From fashion's perspective, designers have presented modular, sustainable leather articles that demonstrate artisan-like craftsmanship and long-term utility. As transparency in raw material sourcing and supply chain ethics emerges, brands are also investing in traceability solutions and responsible certifications. The leather industry is poised to move beyond tradition: fusing time-honoured craftsmanship with advanced innovation in an environmentally conscious marketplace.

Key Players:

- Aditya Birla Group

- ECCO Leather

- LVMH Moët Hennessy Louis Vuitton SE

- Wolverine World Wide, Inc.

- Nike, Inc.

- Timberland LLC

- Horween Leather Company

- Kering S.A.

- Gucci S.p.A.

- Hermès International S.A.

- Ariat International, Inc.

- Tata International Ltd.

- Tejidos Royo

- LANXESS AG

- C.F. Stead Ltd.

Chapter 1. Leather Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. LEATHER MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. LEATHER MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. LEATHER MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. LEATHER MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. LEATHER MARKET – By Product

6.1 Introduction/Key Findings

6.2 Footwear

6.3 Clothing

6.4 Accessories

6.5 Upholstery

6.6 Automotive Interiors

6.7 Industrial Belts & Equipment

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. LEATHER MARKET – By Type

7.1 Introduction/Key Findings

7.2 Genuine Leather

7.3 Synthetic Leather

7.4 Bio-Based Leather

7.5 Y-O-Y Growth trend Analysis By Type

7.6 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 8. LEATHER MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Type

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. LEATHER MARKET – Company Profiles – (Overview, Product Type , Portfolio, Financials, Strategies & Developments)

9.1 Aditya Birla Group

9.2 ECCO Leather

9.3 LVMH Moët Hennessy Louis Vuitton SE

9.4 Wolverine World Wide, Inc.

9.5 Nike, Inc.

9.6 Timberland LLC

9.7 Horween Leather Company

9.8 Kering S.A.

9.9 Gucci S.p.A.

9.10 Hermès International S.A.

9.11 Ariat International, Inc.

9.12 Tata International Ltd.

9.13 Tejidos Royo

9.14 LANXESS AG

9.15 C.F. Stead Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Leather Market was valued at USD 36.64 billion in 2024 and is projected to reach a market size of USD 51.32 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.97%.

The growing demand for premium leather goods and fashion accessories is a major driver of the leather market. Additionally, innovations in sustainable and bio-based leather materials are fueling industry growth

Based on Service Provider, the Leather Market is segmented into material manufacturers, Raw Material Suppliers, Lab information management systems, Distributors & Wholesalers, and End-to-End Solution Providers.

Asia-Pacific is the most dominant region for the Leather Market.

Aditya Birla Group, ECCO Leather, LVMH Moët Hennessy Louis Vuitton SE, Wolverine World Wide, Nike, Timberland, Horween Leather Company are the key players in the Leather Market