Leak Test Equipment Market Size (2024 – 2030)

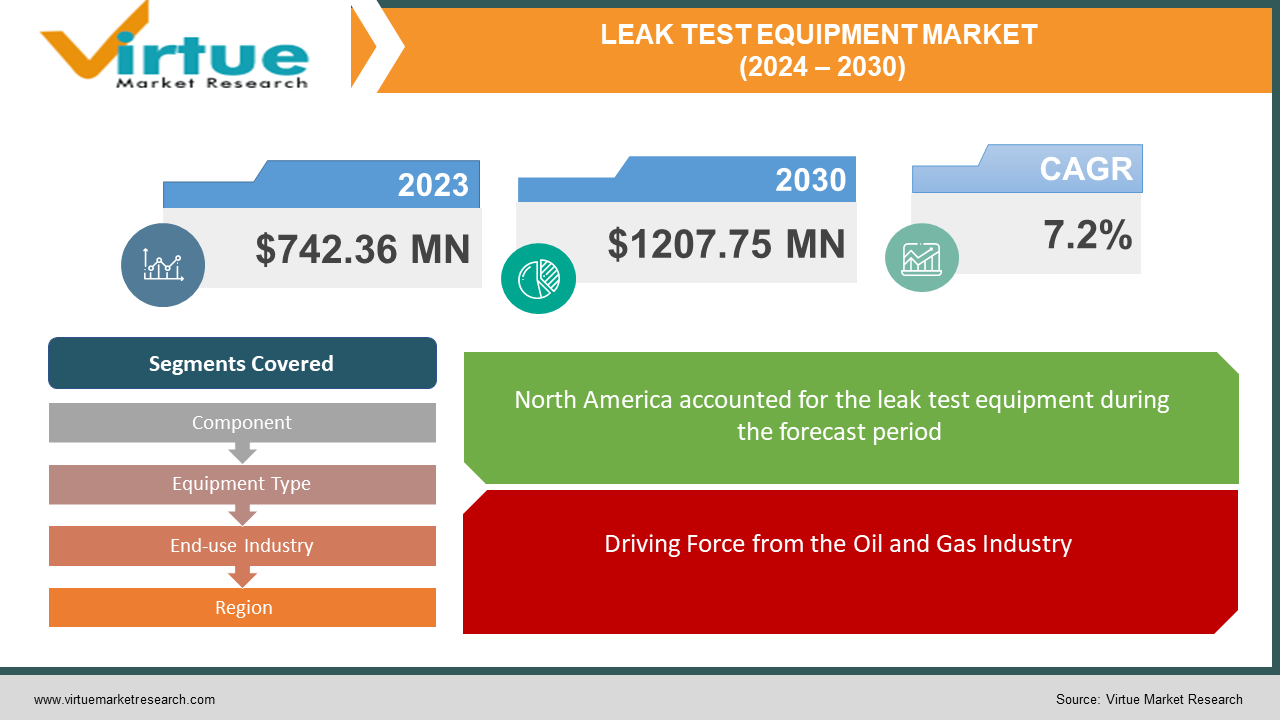

The Global Leak Test Equipment Market size was exhibited at USD 742.36 million in 2023 and is projected to hit around USD 1207.75 million by 2030, growing at a CAGR of 7.2% during the forecast period from 2024 to 2030.

The rise in incidents involving oil and gas leaks in pipelines and storage tanks at production facilities, coupled with stringent government regulations mandating the use of leak test equipment, has become a prevalent issue. This equipment plays a crucial role in identifying manufacturing defects, ensuring product integrity, and enhancing consumer safety by detecting the leakage of liquids, vacuum, or gases from sealed components or systems. However, the entry of new startups into the market is currently restraining the growth of the leak test equipment market.

Leak test equipment is employed by industries to identify various defects in the manufacturing of pipelines and storage tanks. It comprises a set of tools designed to assess the quality of products storing and transporting oil, chemicals, gases, and other materials, ultimately safeguarding workers from potential industrial hazards. The market is anticipated to experience growth in the forecast period, driven by stringent government regulations focusing on labor safety.

Key Market Insights:

The leak test equipment market is poised for growth due to advancements in technology, necessitated by the imperative to ensure the secure and reliable transportation of hydrocarbon fluids while mitigating environmental disasters and financial losses. Notably, sensor technology has undergone significant evolution, featuring enhanced sensitivity, accuracy, and faster response times. The integration of the Internet of Things (IoT) allows for remote monitoring of pipelines, facilitating real-time data transmission to central control centers for prompt leak detection.

Innovations in the field include the latest offering from "innomatec," a leading provider of leak testing, flow measurement, and functional testing solutions – the LTC-802 M-Performance. This cutting-edge leak testing solution is expected to revolutionize quality assurance processes for companies by significantly reducing testing times and improving production cycles.

Adhering to international labor standards, the International Labor Organization (ILO) has implemented approximately 40 standards aimed at ensuring the safety of employees across various industries. These standards encompass conventions such as Hygiene (Commerce and Offices), Safety and Health in Construction, Occupational Safety and Health (Dock Work), Working Environment (Air Pollution, Noise and Vibration), Safety and Health in Agriculture, Chemicals, and Safety in the Working Environment. The growing awareness of personal safety is a significant factor contributing to market growth. Meanwhile, increased investments in safety and favorable initiatives by market players present lucrative opportunities. However, the market faces impediments in the form of potential substitutes, hindering growth during the forecast period.

Global Leak Test Equipment Market Drivers:

Driving Force from the Oil and Gas Industry:

Numerous countries are directing their attention toward the establishment of extensive oil and gas pipeline networks, recognizing them as secure and economically efficient modes of transportation. These pipelines offer a safe and efficient means of transporting oil and gas through urban areas, minimizing potential hindrances. The ongoing proposal and development of cross-country oil and gas pipelines for expedited hydrocarbon transportation are anticipated to propel the Leak Test Equipment Market. Conditions characterized by high temperature, pressure, and corrosion pose risks of leaks. The corrosion of pipelines and tanker vessels is attributed to the presence of oxygen, water, carbon dioxide, and hydrogen sulphide in crude oil and natural gas. Corrosion can manifest internally and externally, with internal corrosion influenced by natural gas and crude oil constituents, and external corrosion predominantly driven by environmental factors such as temperature changes and rainfall. Growing concerns regarding harmful greenhouse gas emissions, the expansion of oil and gas pipeline infrastructure, and the imposition of stringent government rules and regulations are pivotal factors driving market growth.

Advancements in Testing Equipment Fueling Market Expansion:

The burgeoning leak test equipment market is set to surge forward with advancements in technology and innovative enhancements. Leading the way is ultrasonic leak detection technology, providing high precision and efficiency in the early detection of leaks. The integration of high-speed data acquisition solutions, exemplified by companies like Advantech, enables real-time ultrasound pipeline monitoring by collecting substantial data volumes crucial for rapid leak identification.

The Rubin Design Bureau has unveiled its state-of-the-art autonomous underwater vehicle (AUV) named Argus, designed with versatility in mind. Argus fulfills various essential tasks crucial to offshore field exploration and development, from exploring subsea natural resources to gathering data on water environments and seabed conditions. Its capabilities extend to identifying suitable areas for pipeline laying in offshore projects and monitoring the health of seabed equipment. Argus excels in swiftly detecting issues such as oil or gas leaks, insulation damage, and subsea pipeline shifts. This innovative technology serves as an invaluable asset in offshore operations.

Global Leak Test Equipment Market Restraints and Challenges:

Substantial Initial Investment: The financial commitment associated with acquiring leak test equipment, particularly advanced technologies, can be significant, creating a hurdle for small and medium-sized enterprises (SMEs) and impeding market growth.

The considerable initial investment required for leak test equipment, especially in advanced technologies, presents a formidable challenge for small and medium-sized enterprises (SMEs). This financial obstacle acts as a deterrent for SMEs, limiting their capacity to embrace and deploy these essential technologies. Consequently, the growth of the leak test equipment market faces restrictions, curtailing its expansion and potential impact. To overcome this challenge, it is imperative to stimulate innovation and inclusivity within the industry, enabling a broader range of businesses to adopt efficient leak testing methods. Policymakers and industry stakeholders should explore initiatives, such as financial assistance programs or collaborative research ventures, to alleviate the financial burden and promote the widespread adoption of leak test technologies.

Technical Complexity: The operation and maintenance of leak test equipment demands a level of technical expertise, and the intricacy of certain equipment can present challenges, requiring additional training and incurring extra costs.

The technical intricacies associated with operating and maintaining leak test equipment pose notable challenges for users. Advanced technologies often demand a high level of technical expertise, potentially causing operational difficulties. This complexity not only extends the learning curve for users but also mandates additional training, resulting in added costs for businesses. As technology progresses, addressing the skills gap becomes essential to ensure the efficient and accurate operation of leak test equipment. Companies may need to invest in comprehensive training programs to empower their workforce and enhance technical proficiency. Collaborative endeavors between equipment manufacturers and end-users can play a crucial role in simplifying user interfaces and providing support systems to mitigate the impact of technical complexity, facilitating widespread adoption of these critical technologies.

Global Leak Test Equipment Market Opportunities:

Opportunities Arising from Emerging Economies:

The significant opportunities for the leak test equipment market lie in the rapid industrialization observed in emerging economies. Heightened manufacturing activities and an increased focus on elevated quality standards in nations like China, India, and Brazil are driving the demand for leak test equipment.

The ongoing industrialization in emerging economies provides a substantial growth avenue for the leak test equipment market. China, India, and Brazil are witnessing a surge in manufacturing activities, accompanied by an emphasis on stringent quality standards. This surge in production underscores the need for robust quality control measures, with leak test equipment emerging as a crucial component in ensuring product integrity. As these economies solidify their roles in the global manufacturing landscape, the demand for dependable leak test solutions is expected to rise. Industry participants have the opportunity to capitalize on this trend by expanding their footprint and product offerings in these burgeoning markets. Collaborative initiatives, technology transfer, and strategic partnerships can further facilitate the integration of leak test equipment into the evolving industrial scenarios of emerging economies, fostering mutual growth and development.

LEAK TEST EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Component, Equipment Type, End-use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Inficon, ATEQ Corp, LACO Technologies Pfeiffer Vacuum GmbH, Ceta Testsysteme GmbH, Cosmo Instruments Co., ltd. , InterTech Development Company, Uson, L.P, Vacuum Instruments Corporation, LLC TASI Group |

Global Leak Test Equipment Market Segmentation: By Component

-

Hardware

-

Detectors

-

Sensors

-

Accessories

-

Others

-

Software

-

Services

-

Calibration

-

Training

-

Repair/Maintenance

-

Rental

-

Others

The global leak test equipment market is categorized into hardware, software, and services based on components. The services segment is projected to exceed USD 260 million in revenue by 2030. Within the services segment, the calibration sub-segment is anticipated to grow at a significant CAGR of over 9% during the forecast period. Calibration of leak test equipment is crucial in determining leakage rates, ensuring compliance with industry standards, and maintaining leak tightness specifications. Companies like Uson, L.P. have introduced advanced "Leak Master and Transducer Calibration Laboratory" facilities to offer precise calibration services, emphasizing their commitment to effective calibration practices.

Global Leak Test Equipment Market Segmentation: By Equipment Type

-

Portable

-

Fixed

In the categorization of leak test equipment based on equipment type, there are two distinct categories: portable and fixed. The portable equipment type segment is expected to dominate a larger market share, fueled by the growing demand for portable leak test equipment. Portable leak test equipment is applied for on-site leak detection within a company's premises and at various remote locations worldwide. Well-established players in the industry are experiencing an upswing in demand for portable leak test equipment. As an illustration, Pfeiffer Vacuum, a provider of leak test equipment, announced the sale of multiple ASM 310 portable helium-based leak detectors during the Vacuum Expo.

Global Leak Test Equipment Market Segmentation: By End-use Industry

-

HVAC/R

-

Automotive and Transportation

-

Medical and Pharmaceutical

-

Packaging

-

Industrial

-

Others

The segmentation of the leak test equipment market by end-use industry includes HVAC/R, automotive & transportation, medical & pharmaceutical, packaging, industrial, and others. The "others" category in end-use industries encompasses aerospace & defense and power & energy sectors. Automotive manufacturers worldwide rely on leak test equipment of superior quality to identify defects in products or automotive components such as power steering, engine blocks, brakes, and emission control. The production of defective items can result in escalating warranty claims and pose risks to consumer safety. The procedures for leak testing in the automotive sector are predominantly outlined by various standard organizations, including the American Society for Testing and Materials and the Society of Automotive Engineers.

Global Leak Test Equipment Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is poised to command a substantial share of the overall market, with expectations of maintaining a higher market share throughout the forecast period. This prominence can be attributed to the presence of well-established industry players across the region, particularly in the U.S. and Canada. Key participants in the North American leak test equipment market include Uson, L.P., Vacuum Instruments Corporation, LLC, ATEQ Corp., InterTech Development Company, and LACO Technologies. Additionally, North America is experiencing a heightened adoption rate of leak test equipment, driven by the continuous expansion of the automotive industry in the region. Numerous U.S.-based companies are actively innovating technologically advanced leak testing equipment to meet the diverse demands across various industries.

The European market is anticipated to undergo substantial growth at a significant compound annual growth rate (CAGR) during the forecast period. This expansion is attributed to legal initiatives undertaken by the European Union to minimize overall leakage. Notably, the HVAC/R industry in Europe is obligated to employ leak test equipment due to the presence of European Fluorinated Gas (F Gas) Regulations. These regulations mandate rigorous measures for leakage reduction, compelling enterprises in the HVAC/R sector to comply. Furthermore, the market in Europe is witnessing increased strategic mergers and acquisitions (M&A) as companies aim to enhance their capabilities in the leak test equipment sector.

COVID-19 Impact on the Global Leak Test Equipment Market:

COVID-19 made a significant impact on the global leak test equipment market with disruption of global supply chains which resulted in a shortage of critical components and delayed production, affecting the industry's ability to meet customer demands. Moreover, project delays and cancellations in industries like automotive and aerospace, coupled with reduced capital spending, led to decreased demand for leak test equipment.

Furthermore, the outbreak resulted in widespread mobility limitations and economic disruptions which caused shifts in every sector. The implementation of lockdowns and travel constraints led to a notable reduction in the consumption of transportation fuels such as aviation fuel and gasoline which affected the leak test equipment market in the oil and gas industry.

Recent Trends and Innovations in the Global Leak Test Equipment Market:

-

In July 2023, Tema Sinergie introduced the AGLTS 2, an automated glove leak testing system tailored for the pharmaceutical industry. This system builds upon the features and stability of its predecessor, the automatic glove testing system while incorporating significant advancements.

-

In July 2023, the Dubai Electricity and Water Authority (DEWA) launched an innovative smart facility at its Research and Development (R&D) Centre. This facility is designed to simulate various scenarios of water leakage in transmission pipelines. Leveraging a combination of software and hardware within the Internet of Things (IoT) framework, the facility allows for comprehensive remote monitoring and control. Its primary purpose is to facilitate the assessment, improvement, and experimentation of novel leak detection methods.

-

In May 2023, ION Science unveiled the Panther gas leak detector, representing the latest innovation in gas leak detection. This advanced device, offering double the sensitivity of its predecessor, the Gas Check G, is poised to revolutionize the gas leak detection market.

Key Players:

-

Inficon

-

ATEQ Corp

-

LACO Technologies

-

Pfeiffer Vacuum GmbH

-

Ceta Testsysteme GmbH

-

Cosmo Instruments Co., ltd.

-

InterTech Development Company

-

Uson, L.P

-

Vacuum Instruments Corporation, LLC

-

TASI Group

Chapter 1. Leak Test Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Leak Test Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Leak Test Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Leak Test Equipment Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Leak Test Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Leak Test Equipment Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Detectors

6.4 Sensors

6.5 Accessories

6.6 Others

6.7 Software

6.8 Services

6.9 Calibration

6.10 Training

6.11 Repair/Maintenance

6.12 Rental

6.13 Others

6.14 Y-O-Y Growth trend Analysis By Component

6.15 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Leak Test Equipment Market – By Equipment Type

7.1 Introduction/Key Findings

7.2 Portable

7.3 Fixed

7.4 Y-O-Y Growth trend Analysis By Equipment Type

7.5 Absolute $ Opportunity Analysis By Equipment Type, 2024-2030

Chapter 8. Leak Test Equipment Market – By End-use Industry

8.1 Introduction/Key Findings

8.2 HVAC/R

8.3 Automotive and Transportation

8.4 Medical and Pharmaceutical

8.5 Packaging

8.6 Industrial

8.7 Others

8.8 Y-O-Y Growth trend Analysis By End-use Industry

8.9 Absolute $ Opportunity Analysis By End-use Industry, 2024-2030

Chapter 9. Leak Test Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Equipment Type

9.1.4 By By End-use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Equipment Type

9.2.4 By End-use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Equipment Type

9.3.4 By End-use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Equipment Type

9.4.4 By End-use Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Equipment Type

9.5.4 By End-use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Leak Test Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Inficon

10.2 ATEQ Corp

10.3 LACO Technologies

10.4 Pfeiffer Vacuum GmbH

10.5 Ceta Testsysteme GmbH

10.6 Cosmo Instruments Co., ltd.

10.7 InterTech Development Company

10.8 Uson, L.P

10.9 Vacuum Instruments Corporation, LLC

10.10 TASI Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Leak Test Equipment Market size is valued at USD 742.36 million in 2023.

The worldwide Global Leak Test Equipment Market growth is estimated to be 7.2% from 2024 to 2030.

The Global Leak Test Equipment Market is segmented By Components (Hardware (Detectors, Sensors, Accessories, Others), Software, Services (Calibration, Training, Repair/Maintenance, Rental, Others), By Equipment Type (Portable, Fixed), By End-use Industry (HVAC/R, Automotive and Transportation, Medical and Pharmaceutical, Packaging, Industrial).

The Global Leak Test Equipment Market is poised for future growth and opportunities driven by advancements in technology, expanding applications across diverse industries, and the increasing focus on environmental sustainability. The integration of smart technologies and the rise of emerging economies further contribute to the market's potential evolution.

The COVID-19 pandemic disrupted the Global Leak Test Equipment Market, causing supply chain interruptions, production delays, and reduced capital spending across industries. Project cancellations, economic uncertainties, and decreased demand for equipment due to mobility restrictions significantly impacted the market during the pandemic.