Lead-to-account matching and routing software Market Size (2024 – 2030)

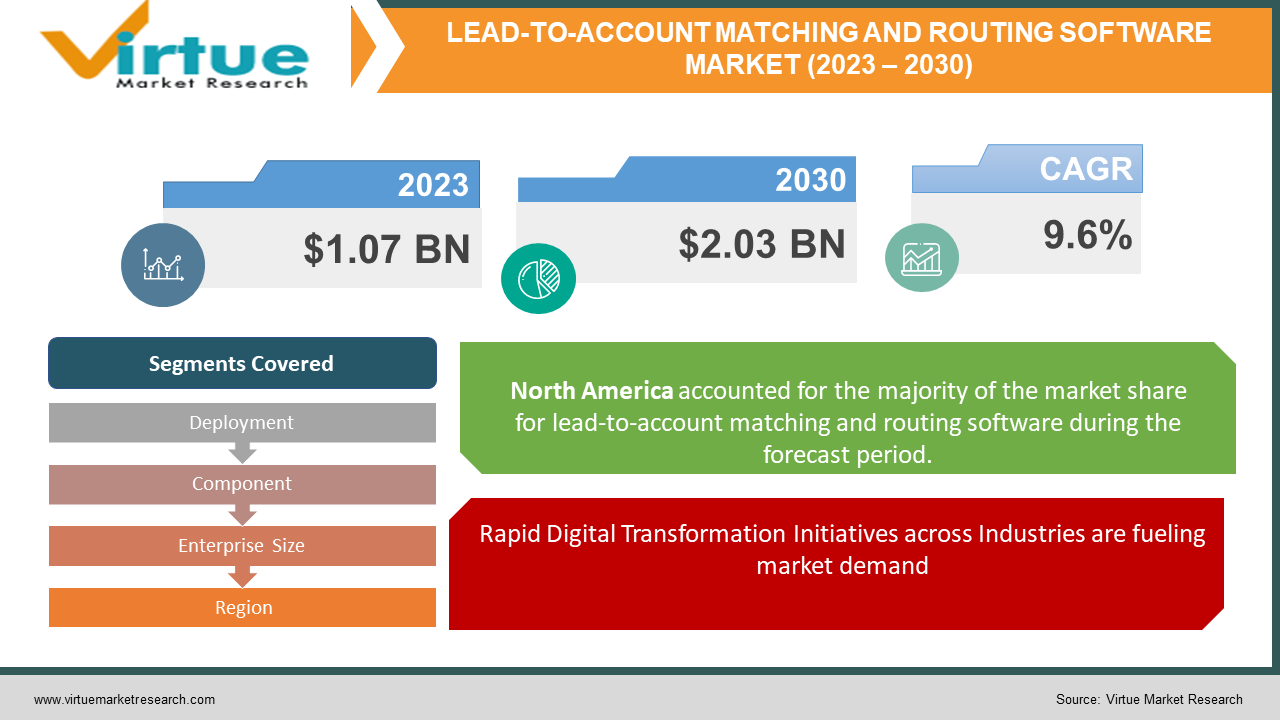

The Global Lead-to-Account Matching and Routing Software Market was valued at USD 1.07 billion in 2023 and is projected to reach a market size of USD 2.03 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.6%.

The global lead-to-account matching and routing software market is experiencing a transformative phase driven by the digital revolution and the increasing focus on enhancing customer experiences. Businesses across industries are adopting these solutions to efficiently manage leads, streamline complex sales processes, and optimize sales team workflows. These software tools play a vital role in integrating seamlessly with CRM systems, providing valuable insights into customer interactions, and automating lead-to-account matching, leading to improved customer engagement, accelerated sales cycles, and enhanced operational efficiency. Despite challenges related to data privacy, high costs, manual processes, and regulatory compliance, the market continues to grow. The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies, coupled with a focus on personalized customer experiences and strategic collaborations among key players, further propel the market's evolution.

Key Market Insights:

The global lead-to-account matching and routing software market is witnessing significant growth driven by various factors. Rapid digital transformation initiatives across industries are fueling the demand for efficient lead management and accurate routing. As businesses transition their operations online, the integration of lead-to-account matching and routing software becomes crucial, ensuring leads are promptly matched with the right accounts and directed to appropriate sales teams. This integration enhances customer engagement, accelerates sales cycles, and improves overall operational efficiency, leading to widespread adoption across industries. Moreover, there is a growing emphasis on enhancing customer relationship management (CRM). Businesses are recognizing the importance of understanding customer behavior and preferences to tailor their sales strategies effectively. Lead-to-account matching and routing software seamlessly integrate with CRM systems, providing valuable insights into customer interactions. By ensuring timely follow-ups and personalized communication, businesses can build stronger relationships with their customers, driving increased customer satisfaction and loyalty.

In the complex landscape of B2B sales, where multiple decision-makers and stakeholders are involved, lead-to-account matching and routing software simplify intricate sales processes. These solutions automate the matching of leads to specific accounts, ensuring the right stakeholders within an organization are engaged. By automating this process, businesses can navigate the complexity of B2B sales more efficiently, leading to quicker deal closures and improved revenue generation. The ability of lead-to-account matching and routing software to handle multifaceted sales structures positions them as indispensable tools for businesses operating in intricate B2B environments.

Global lead-to-account matching and routing software market Drivers:

Rapid Digital Transformation Initiatives across Industries are fueling market demand:

The surge in digital transformation initiatives across various industries acts as a significant driver for the global lead-to-account matching and routing software market. As businesses shift their operations online, the need for efficient lead management and accurate routing becomes paramount. Lead-to-account matching and routing software facilitate seamless integration with digital platforms, ensuring that leads are promptly matched with the right accounts and directed to the appropriate sales teams. This integration enhances customer engagement, accelerates sales cycles, and improves overall operational efficiency, driving the widespread adoption of these solutions across industries.

Growing Emphasis on Customer Relationship Management (CRM) is boosting market sales:

The growing emphasis on enhancing customer relationships and delivering personalized experiences propels the demand for lead-to-account matching and routing software. Businesses recognize the importance of understanding customer behavior and preferences to tailor their sales strategies effectively. Lead-to-account matching and routing software integrate seamlessly with CRM systems, enabling businesses to gain valuable insights into customer interactions. By ensuring timely follow-ups and personalized communication, businesses can build stronger relationships with their customers, leading to increased customer satisfaction and loyalty.

Increasing Complexity in B2B Sales Processes is contributing to market growth:

In the complex landscape of B2B sales, where multiple decision-makers and stakeholders are involved, lead-to-account matching and routing software simplify intricate sales processes. These solutions automate the matching of leads to specific accounts, ensuring that the right stakeholders within an organization are engaged. By automating this process, businesses can navigate the complexity of B2B sales more efficiently, leading to quicker deal closures and improved revenue generation. The ability of lead-to-account matching and routing software to handle multifaceted sales structures positions them as indispensable tools for businesses operating in intricate B2B environments.

Focus on Data-driven Decision Making is helping in market expansion:

Data-driven decision-making has become a cornerstone of successful business strategies. Lead-to-account matching and routing software contribute significantly to this approach by providing valuable data and analytics on lead interactions and conversions. Businesses leverage this data to analyze sales performance, identify trends, and optimize their sales processes. The actionable insights derived from these software solutions empower businesses to make informed decisions, allocate resources effectively, and enhance overall sales outcomes. The focus on data-driven decision-making acts as a key driver for the adoption of lead-to-account matching and routing software, especially among forward-thinking enterprises aiming for sustainable growth and competitiveness.

Global lead-to-account matching and routing software market Restraints and Challenges:

Privacy and Security Concerns are limiting market growth:

One of the significant restraints faced by the global lead-to-account matching and routing software market is the ongoing tussle between public administration and large corporate houses concerning the privacy and security of digital data. The conflict around data management software, especially in the domain of digital data privacy, restrains the emerging trends in the lead-to-account matching and routing software market. As businesses increasingly rely on these solutions for their sales operations, ensuring the privacy and security of sensitive customer data remains a challenge.

High Installation and Maintenance Costs are slowing down the adoption rates:

The higher cost associated with the installation and maintenance of digital systems poses a significant limitation for the growth of the lead-to-account matching and routing software market in various verticals. Implementing advanced lead-to-account matching and routing software requires substantial initial investments. Additionally, ongoing maintenance costs add to the financial burden for businesses, particularly small and medium enterprises (SMEs). This financial constraint hampers the widespread adoption of these solutions, especially among smaller businesses with limited budgets.

Manual CRM Systems and Data Inconsistencies hindering market growth:

Although CRM systems have the inherent capability to manage lead-to-account matching and routing, the manual nature of these processes often leads to inefficiencies and data inconsistencies. Inadequate automation in CRM systems results in time-consuming manual efforts, leading to errors in lead-to-account matching. Businesses struggle with the challenges of data duplication, outdated information, and inaccurate lead routing. Overcoming these manual processes and data inconsistencies presents a significant challenge for the lead-to-account matching and routing software market, requiring innovative solutions to seamlessly integrate with existing CRM systems and enhance automation.

Regulatory Compliance Challenges:

The evolving landscape of data protection regulations and compliance requirements poses challenges for lead-to-account matching and routing software providers. Adhering to diverse regulatory frameworks across different regions and industries demands continuous updates and modifications to software functionalities. Ensuring compliance with data protection laws, such as GDPR in Europe and similar regulations in other regions, adds complexity to the development and implementation of lead-to-account matching and routing solutions. Businesses operating in multiple jurisdictions face the challenge of aligning their software solutions with varying regulatory requirements, making it essential for software providers to navigate this complex landscape effectively.

LEAD-TO-ACCOUNT MATCHING AND ROUTING SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9.6% |

|

Segments Covered |

By Deployment, Component, Enterprise Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bizible, Caliber Mind, Engagio, Eustace Consulting, Inc., Lane Four (Nuvem Inc., Lead space, Lean Data, Openprise Inc., Ring Lead, Inc, Calendly |

Lead-to-account matching and routing software Market Segmentation: By Deployment

-

Cloud-Based Lead-to-Account Matching and Routing Software

-

On-Premise Lead-to-Account Matching and Routing Software

Cloud-based solutions dominate the market with a commanding share of approximately 75% in 2023. The cloud-based segment is the fastest-growing, anticipated to expand at a compound annual growth rate (CAGR) of 9.3% from 2024 to 2030. Its market dominance can be attributed to real-time data accessibility, scalability, and cost-effectiveness. Cloud-based solutions offer advantages such as reduced upfront costs, streamlined workflow, and ease of deployment, making them the preferred choice for businesses seeking efficient lead management solutions.

On-premise solutions hold a significant market share of around 25% in 2023. Despite facing competition from cloud-based counterparts, certain industries, particularly those with stringent data security and compliance requirements, favor on-premise solutions. Industries such as finance and government, prioritizing data control and security, drive the demand for on-premise lead-to-account matching and routing software. While the market share is smaller compared to cloud-based solutions, the on-premise segment caters to specific market niches, ensuring its sustained presence.

Lead-to-account matching and routing software Market Segmentation: By Component

-

Software

-

Service

The software segment holds a significant share in the lead-to-account matching and routing software market, accounting for approximately 65% of the market in 2023. Lead-to-account matching and routing software solutions offer advanced algorithms and automation capabilities, enabling businesses to efficiently match leads with relevant accounts and route them to appropriate sales teams. This software segment drives the overall market growth by providing essential tools for precise lead management and streamlined sales operations.

The services segment contributes to the remaining market share, constituting approximately 35% in 2023. Lead-to-account matching and routing services include implementation, customization, training, and support services. These services are crucial for businesses, especially those lacking in-house expertise, as they ensure the effective deployment and utilization of lead-to-account matching and routing software solutions. Service providers play a vital role in assisting businesses in optimizing their sales processes, thereby boosting the demand for services in this market.

Lead-to-account matching and routing software Market Segmentation: By Enterprise Size

-

SME

-

Large Enterprises

Large enterprises hold a significant market share of around 60% in 2023. These enterprises adopt lead-to-account matching and routing software to manage a large volume of leads, streamline complex sales processes, and optimize sales team workflows. The scalability, customization options, and integration capabilities of these solutions make them invaluable for large enterprises with diverse sales requirements. The demand for efficient lead management solutions among large enterprises fuels the growth of this segment in the market.

The SME segment represents a noteworthy portion of the lead-to-account matching and routing software market, constituting approximately 40% of the market share in 2023. Small and medium enterprises leverage these solutions to efficiently manage leads, automate sales processes, and enhance customer interactions. Lead-to-account matching and routing software empower SMEs to compete effectively in the market by providing advanced tools to handle their sales operations, thereby driving the segment's growth.

Lead-to-account matching and routing software Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America maintains its dominance in the global lead-to-account matching and routing software market, contributing 40% to the overall market growth during the forecast period. The region's leadership is attributed to the increasing need for effective customer relationship management, efficient supply chain management, and rapid advances in digital technologies. Enhanced user experience, intuitive workflows, and mobile accessibility have transformed sales effectiveness, driving the adoption of lead-to-account matching and routing software among North American enterprises.

The Asia-Pacific region accounts for approximately 28% of the global market share in 2023. Economic powerhouses such as China and India lead the adoption of lead-to-account matching and routing software in this region. China, with its thriving industrial sector and growing demand for efficient sales solutions, holds a significant market share within Asia-Pacific. The region's adoption of these solutions aligns with its focus on enhancing operational efficiency and delivering superior customer experiences, driving market growth.

COVID-19 Impact Analysis on the Global lead-to-account matching and routing software market:

COVID-19 has had a financial impact on all types of business enterprises around the world. As per the report, the global growth rate of the market has dropped significantly, which was recorded to be 11.2% during the previous analysis period of 2015 to 2021. On the contrary, the global shift of businesses over digital or online platforms accelerated during the pandemic years leading to some favorable opportunities for the lead-to-account matching and routing software market. This hike in demand for digital marketing and services is poised to be the stimulating factor in reviving the lead-to-account matching and routing software market size in the post-pandemic years.

Latest Trends/ Developments:

The global lead-to-account matching and routing software market is experiencing a transformative phase marked by several notable trends and developments. One of the key trends shaping the market landscape is the rapid integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies. These advancements have significantly enhanced the software's capabilities, allowing for more accurate analysis of extensive datasets. As a result, businesses can predict customer behaviors with higher precision, automate lead-matching processes, and optimize sales strategies based on data-driven insights. Additionally, there is a growing emphasis on enhancing user experience and accessibility. User-centric design and intuitive interfaces have become focal points for software developers. This trend is driven by the need to ensure seamless adoption and efficient utilization of lead-to-account matching and routing software across various industries. User-friendly interfaces enable sales teams to navigate the software effortlessly, leading to improved productivity and streamlined operations. Moreover, the market is witnessing an increased demand for cloud-based solutions. Cloud deployment offers real-time data accessibility, scalability, and cost-effectiveness. Businesses are recognizing the benefits of reduced upfront costs, streamlined workflows, and ease of deployment associated with cloud solutions. This preference for cloud-based deployment reflects a broader shift towards flexible and scalable software solutions, aligning with the evolving needs of modern enterprises.

Another significant trend is the focus on personalized customer experiences. Lead-to-account matching and routing software are now equipped with features that enable businesses to tailor their interactions with customers. By leveraging data analytics and automation, businesses can create personalized marketing campaigns, targeted communications, and tailored sales pitches. This trend aligns with the broader industry shift towards customer-centric approaches, enhancing customer satisfaction and loyalty. Furthermore, the market is witnessing strategic collaborations and partnerships among key players. These collaborations aim to combine expertise and resources to innovate and develop advanced solutions. Partnerships with CRM providers, AI technology firms, and data analytics companies have become commonplace, fostering innovation and driving the evolution of lead-to-account matching and routing software.

Key Players:

-

Bizible

-

Caliber Mind

-

Engagio

-

Eustace Consulting, Inc.

-

Lane Four (Nuvem Inc.)

-

Lead space

-

Lean Data

-

Openprise Inc.

-

Ring Lead, Inc

-

Calendly

- In a transformative collaboration, LeanData and Equilar have joined forces to present a pioneering solution that delivers real-time executive transition insights. This strategic alliance is poised to reshape how organizations approach executive transitions as key signals for sales teams while delivering faster organization intelligence and supercharging connections with influential decision-makers.

Chapter 1. Lead-to-Account Matching and Routing Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Lead-to-Account Matching and Routing Software Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Lead-to-Account Matching and Routing Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Lead-to-Account Matching and Routing Software Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Lead-to-Account Matching and Routing Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Lead-to-Account Matching and Routing Software Market – By Deployment Mode

6.1 Introduction/Key Findings

6.2 Cloud-Based Lead-to-Account Matching and Routing Software

6.3 On-Premise Lead-to-Account Matching and Routing Software

6.4 Y-O-Y Growth trend Analysis By Deployment Mode

6.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 7. Lead-to-Account Matching and Routing Software Market – By Component

7.1 Introduction/Key Findings

7.2 Software

7.3 Service

7.4 Y-O-Y Growth trend Analysis By Component

7.5 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 8. Lead-to-Account Matching and Routing Software Market – By Enterprise Size

8.1 Introduction/Key Findings

8.2 SME

8.3 Large Enterprises

8.4 Y-O-Y Growth trend Analysis By End User

8.5 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Lead-to-Account Matching and Routing Software Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Enterprise Size

9.1.4 By Deployment Mode

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Enterprise Size

9.2.4 By Deployment Mode

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Enterprise Size

9.3.4 By Deployment Mode

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Enterprise Size

9.4.4 By Deployment Mode

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Enterprise Size

9.5.4 By Deployment Mode

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Lead-to-Account Matching and Routing Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Bizible

10.2 Caliber Mind

10.3 Engagio

10.4 Eustace Consulting, Inc.

10.5 Lane Four (Nuvem Inc.)

10.6 Lead space

10.7 Lean Data

10.8 Openprise Inc.

10.9 Ring Lead, Inc

10.10 Calendly

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global lead-to-account matching and routing software market was valued at USD 1.07 billion in 2023 and is projected to reach a market size of USD 2.03 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.6%.

The global lead-to-account matching and routing software market drivers include rapid digital transformation initiatives, growing emphasis on customer relationship management, increasing complexity in B2B sales processes, and a focus on data-driven decision-making.

The segments under the Global lead-to-account matching and routing software market by Deployment include Cloud-Based Lead-to-Account Matching and Routing Software and On-Premise Lead-to-Account Matching and Routing Software.

North America is the most dominant region for the Global lead-to-account matching and routing software market.

The leading players in the Global lead-to-account matching and routing software market include Bizible, Caliber Mind, Engagio, Eustace Consulting, Inc., Lane Four (nuvem inc.), LeadSpace, LeanData, Openprise Inc., RingLead, Inc., and Calendly.