LDPE Breathable Films & Membranes Market Size (2024 – 2030)

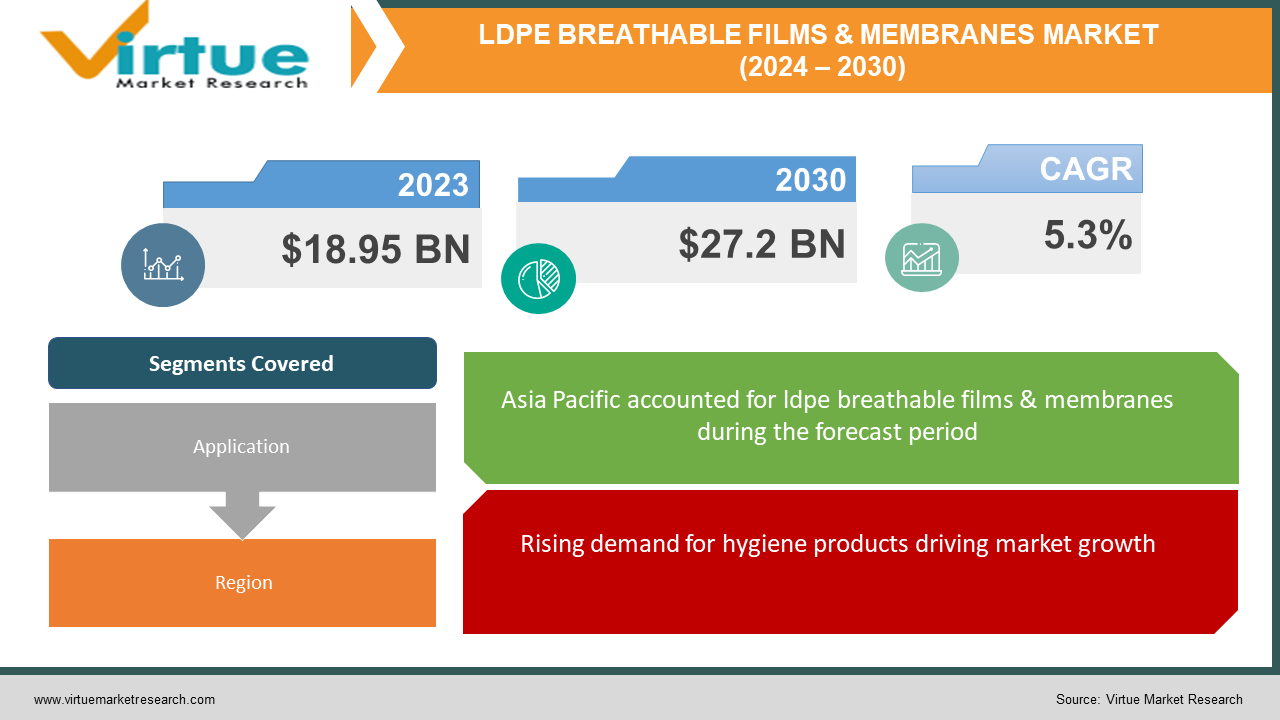

The global breathable films market size was valued at USD 18.95 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030. The global LDPE Breathable Films & Membranes Market industry is projected to grow from to USD 27.2 billion by 2030.

Global LDPE Breathable Films & Membranes refer to a diverse group of thin, flexible sheets made from Low-Density Polyethylene (LDPE) with the special property of allowing air and moisture to pass through while remaining waterproof. These films and membranes find applications across various industries due to their combination of breathability, waterproofness, and relative affordability. This stands for Low-Density Polyethylene, a widely used plastic known for its flexibility, durability, and relative inertness. It forms the base material for these films and membranes.

Key Market Insights:

The LDPE Breathable Films & Membranes market is experiencing steady growth, fueled by rising demand for hygiene products, protective clothing, and construction materials. Key drivers include growing disposable income, increasing hygiene awareness, and stricter sustainability regulations. Advancements in nanomaterials, coating technologies, and manufacturing processes are enhancing film performance and affordability. However, fluctuating raw material prices, competition from alternatives, and stringent environmental regulations pose challenges. Despite these hurdles, the market is expected to maintain growth due to increasing demand and technological innovation. Manufacturers who prioritize sustainability and cost-effectiveness will remain competitive in this promising space.

LDPE Breathable Films & Membranes Market Drivers:

Rising demand for hygiene products driving market growth.

This includes baby diapers, adult incontinence products, and feminine hygiene products. The growing global population, particularly in developing regions with increasing purchasing power, is a major driver for this segment. Additionally, rising awareness of hygiene and improved product designs are contributing to the demand.

Increasing focus on comfort and performance in various applications

Beyond diapers and wipes, breathable LDPE films are making waves in diverse industries. Imagine homes "breathing" with moisture-wicking roofing membranes, food staying fresher in packaging that regulates air, and medical garments providing both protection and comfort. This versatility thrives on innovation. New technologies are weaving magic into these films, making them softer, stronger, and more durable than ever. Imagine roofs impervious to rain yet letting trapped moisture escape, preventing mold and boosting energy efficiency. Picture packaging films keep fruits crisp by managing condensation, and reducing food waste. Think of medical textiles that allow air circulation for patient comfort while maintaining essential barriers. These advancements are not just possibilities, they're driving the adoption of LDPE breathable films, transforming comfort, performance, and sustainability in unexpected ways.

Consumers are increasingly seeking eco-friendly options, and LDPE is considered more recyclable compared to some alternative materials used in breathable films

The sustainability wave is crashing onto the breathable film market, and LDPE is riding the crest. Consumers are choosing eco-friendly options, and LDPE's recyclability compared to alternatives is a major draw. Imagine diapers and packaging responsibly discarded, not lingering in landfills for centuries. But the green benefits go beyond recycling. Breathable LDPE membranes in buildings act like tiny environmental heroes. They wick away moisture, preventing mold and the need for energy-guzzling dehumidifiers. Picture homes staying healthier and cooler naturally, reducing dependence on air conditioning and its carbon footprint. Additionally, LDPE films are often thinner and lighter than alternatives, leading to reduced transportation emissions throughout their lifecycle. So, choosing LDPE breathable films isn't just about individual products, it's about contributing to a more sustainable future, building by building, package by package.

LDPE Breathable Films & Membranes Market challenges and restraints:

Price fluctuation in raw material

LDPE's double-edged sword: affordability and vulnerability. Its oil-based origins tie its price to the volatile oil market, creating a rollercoaster for manufacturers. Imagine costs swinging with each barrel's price change, impacting product affordability and squeezing profit margins. This uncertainty can be a major hurdle, requiring careful planning and strategic pricing strategies to navigate the fluctuations. While cost-effective compared to some alternatives, LDPE's price swings demand constant market awareness and adaptation to ensure financial stability in this dynamic landscape.

Competition from alternative materials

The game doesn't end at LDPE. Breathable films are a diverse bunch, and competition is fierce! Imagine non-woven fabrics, lightweight and breathable, ideal for medical applications. Bioplastics, eco-warriors with compostable qualities, lure sustainability-focused players. Each contender brings unique strengths. Non-wovens boast excellent filtration, while bioplastics shine in compostable packaging. This diversity creates a dynamic market where LDPE needs to constantly innovate. Can it offer the same level of filtration as non-wovens? Can it match the eco-friendly appeal of bioplastics? Staying ahead means understanding these competitors' strengths and weaknesses, constantly improving LDPE's properties, and finding strategic niches where it excels. It's a race for breathability, and only the most adaptable materials will win.

Limited availability of skilled workforce

Crafting high-quality, consistent films demands specialized knowledge of polymer science, manufacturing processes, and quality control. Imagine the intricate dance of temperature, pressure, and additives, each step influencing the film's breathability, strength, and durability. Unfortunately, a looming threat hangs over this industry: a shortage of skilled workers. This gap poses a significant challenge, potentially hindering the market's growth. Without enough experts to operate complex machinery, maintain quality standards, and innovate new film properties, the potential of LDPE breathable films may not be fully realized. Addressing this skills gap through targeted training programs, attracting young talent, and promoting rewarding careers within this industry is crucial to ensuring its future remains as breathable as the films it produces.

Geopolitical and economic instability

Trade wars and economic downturns can throw a wrench into the LDPE breathable film market. Imagine tariffs raising import costs, disrupting raw material access, and squeezing manufacturers' margins. Consumers tightening budgets might prioritize essentials, impacting demand for hygiene products or construction projects. Global instability can also hinder research and development, slowing down innovation. These headwinds require agility and resilience from businesses. Diversifying supply chains, focusing on essential applications, and adapting production costs become crucial for navigating turbulent times.

Market Opportunities:

From premium diapers with biodegradability to smart clothing with haptic feedback, the LDPE Breathable Films & Membranes market brims with opportunities. Hygiene products crave ultra-thin, breathable films, while medical applications seek advanced wound dressings and drug delivery patches. Construction can benefit from high-performance roofing membranes and sustainable building wraps. Emerging technologies offer exciting integrations with sensors and interactive packaging elements. To stay ahead, manufacturers must prioritize sustainability with recycled materials and efficient processes, keeping affordability in mind. This diverse market is ripe for innovation, with potential across industries, waiting to be unlocked

LDPE BREATHABLE FILMS & MEMBRANES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.3% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mitsui Chemicals, Inc., Toray Industries, Inc., Berry Global Group, Inc., Ahlstrom Corporation, Covestro AG |

LDPE Breathable Films & Membranes Market Segmentation - by Application

-

Hygiene

-

Building & Construction

-

Packaging

-

Memedical & Healthcare

Among the diverse applications of LDPE breathable films, the hygiene sector reigns supreme, soaking up most LDPE. Driven by a rising population, higher disposable incomes, and growing hygiene awareness, baby diapers, adult incontinence products, and feminine hygiene products lead the charge. Think diapers wicking away moisture, keeping babies comfortable, and feminine hygiene products managing odor, all thanks to LDPE's breathability. While construction membranes shield buildings from water damage, and food packaging films extend shelf life, the sheer volume of hygiene products utilizing LDPE keeps it firmly in the top spot. Medical and healthcare applications like wound dressings and surgical drapes are gaining traction, but for now, hygiene remains the undisputed champion of LDPE consumption

LDPE Breathable Films & Membranes Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia Pacific is the fastest-growing region. Driven by factors like rising disposable income, increasing population, and growing awareness of hygiene and healthcare. Countries like China, India, and Japan are major contributors. North America showing moderate growth but it is a dominant player in the market. Europe is showing moderate growth. Established market with mature technologies, but facing saturation in some segments. Latin America has high growth potential. Increasing urbanization, rising disposable income, and developing healthcare infrastructure are positive indicators. Middle East & and Africa have high growth potential but showing slower growth.

COVID-19 Impact Analysis on the LDPE Breathable Films & Membranes Market

The COVID-19 pandemic tossed it around, messing with supplies, causing demand to jump from one area to another (think building materials taking a backseat while hospitals needed more stuff), and even making it hard to find enough people to keep things running smoothly. But hold on, there's a silver lining! People becoming super germ-conscious led to a boom in things like diapers and masks that use these films. Even doctors seeing patients online needed special packaging for their tools, thanks to these handy membranes. Plus, everyone's newfound love for the environment pushed companies to make these films more eco-friendly.

Latest trends/Developments

The LDPE Breathable Films & Membranes market is buzzing with innovation, driven by sustainability, performance, and comfort. Sustainability takes center stage with bio-based LDPE alternatives gaining traction, offering compostability without compromising breathability. Recycled LDPE content is also rising, driven by circular economy efforts. Performance advancements come in the form of nanotechnologies that enhance breathability, waterproofing, and even self-cleaning properties. Imagine clothing that wicks away moisture even better or packaging films that extend shelf life through precise moisture control. Comfort isn't left behind, with softer, more pliable LDPE films emerging, ideal for applications like medical textiles and hygiene products. Additionally, research into incorporating odor-control properties is underway, promising fresher experiences. These trends highlight a market focused on responsible manufacturing, pushing the boundaries of functionality, and prioritizing user comfort. By embracing these advancements, LDPE Breathable Films & Membranes is poised to capture new market segments and solidify their position as a versatile and sustainable material for the future.

Key Players:

-

Mitsui Chemicals, Inc.

-

Toray Industries, Inc.

-

Berry Global Group, Inc.

-

Ahlstrom Corporation

-

Covestro AG

Chapter 1. LDPE BREATHABLE FILMS & MEMBRANES MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. LDPE BREATHABLE FILMS & MEMBRANES MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. LDPE BREATHABLE FILMS & MEMBRANES MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. LDPE BREATHABLE FILMS & MEMBRANES MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. LDPE BREATHABLE FILMS & MEMBRANES MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. LDPE BREATHABLE FILMS & MEMBRANES MARKET – By application

6.1 Introduction/Key Findings

6.2 Hygiene

6.3 Building & Construction

6.4 Packaging

6.5 Memedical & Healthcare

6.6 Y-O-Y Growth trend Analysis By application

6.7 Absolute $ Opportunity Analysis By application, 2024-2030

Chapter 7. LDPE BREATHABLE FILMS & MEMBRANES MARKET , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By application

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By application

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By application

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By application

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By application

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. LDPE BREATHABLE FILMS & MEMBRANES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Mitsui Chemicals, Inc.

8.2 Toray Industries, Inc.

8.3 Berry Global Group, Inc.

8.4 Ahlstrom Corporation

8.5 Covestro AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global breathable films market size was valued at USD 18.95 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030. The global LDPE Breathable Films & Membranes Market industry is projected to grow from USD 18.95 billion to USD 27.2 billion by 20302.

Rising demand for hygiene products, increasing focus on comfort and performance in various applications, Consumers are increasingly seeking eco-friendly options, and LDPE is considered more recyclable compared to some alternative materials used in breathable films these are the reasons that are driving the market.

Based on Application it is divided into four segments - Hygiene, Building & Construction, Packaging, and Medical & Healthcare.

Asia-Pacific is the most dominant region for the LDPE Breathable Films & Membranes Market.

Mitsui Chemicals, Inc., Toray Industries, Inc., Berry Global Group, Inc., Ahlstrom Corporation, Covestro AG.