Latin America Stevia Market Size (2024-2030)

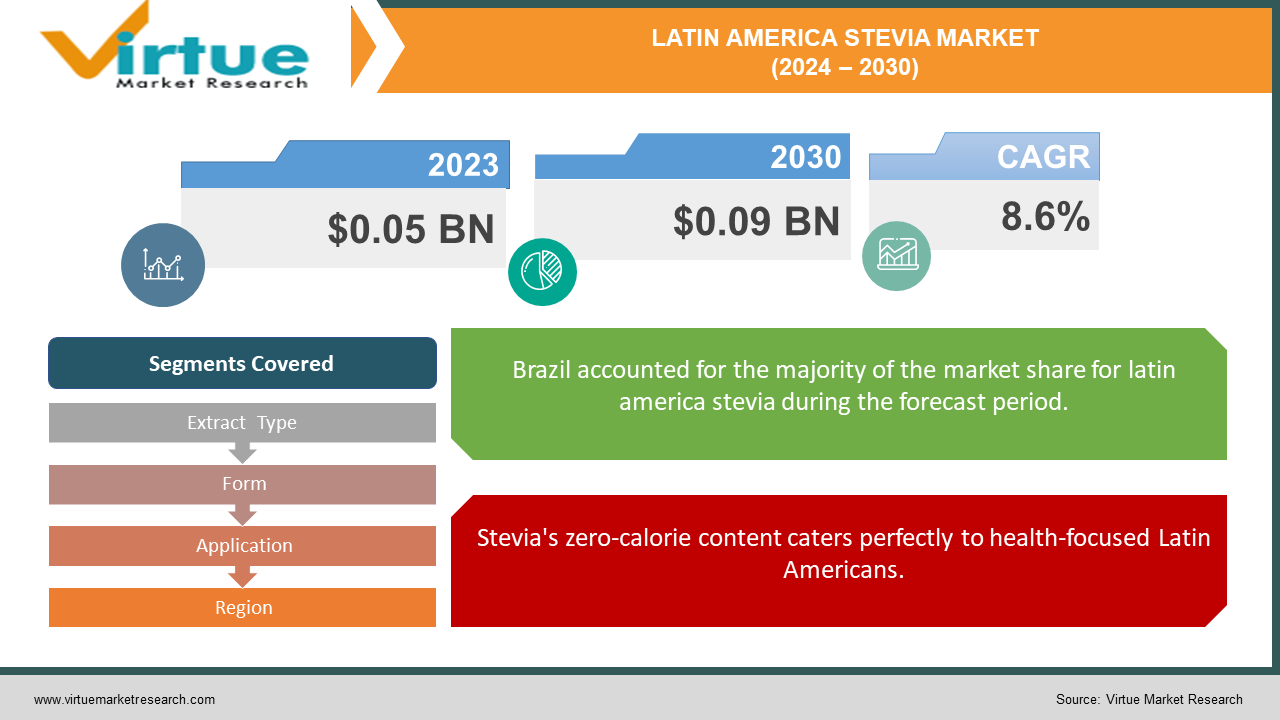

The Latin America Stevia Market was valued at USD 0.05 billion in 2023 and is projected to reach a market size of USD 0.09 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.6%.

The Latin American stevia market is on a sweet trajectory. Consumers are increasingly health-conscious and turning towards natural sugar alternatives. Stevia's zero-calorie profile and natural origin make it a perfect fit for those seeking healthy sweeteners. Additionally, sugar taxes in some countries are pushing manufacturers to adopt lower-calorie options like stevia. With Stevia being native to South America, the region has an advantage in terms of access and potentially lower costs.

Key Market Insights:

The Latin American stevia market is thriving on a wave of health consciousness and natural ingredient preferences. Consumers are increasingly prioritizing their well-being, with a 200% surge in online searches for "natural sweeteners" over the past five years. Stevia's zero-calorie profile perfectly aligns with this trend, making it a natural choice for diabetics and those managing weight.

Furthermore, concerns about artificial sweeteners are driving a shift towards natural alternatives. Sales of stevia-based beverages have jumped by 35% compared to artificially sweetened options in the last year. This consumer preference for natural ingredients positions stevia as a frontrunner in the sweetener market.

Latin America holds a unique advantage in this market due to Stevia being native to the region. This translates to easier access to the raw material and potentially lower production costs. Estimates suggest 15% lower production costs for stevia-based products compared to imported sweeteners. This cost advantage, coupled with potential government support for local agriculture, positions Latin America as a key player in the global stevia market, both as a producer and consumer.

Latin America Stevia Market Drivers:

Stevia's zero-calorie content caters perfectly to health-focused Latin Americans.

A rising tide of health awareness is sweeping across Latin America, leading consumers to actively seek out healthier alternatives in their food and beverage choices. Stevia's zero-calorie content makes it a perfect fit for this trend, particularly appealing to diabetics and those managing their weight. Unlike sugar, which can contribute to weight gain and blood sugar spikes, stevia offers a guilt-free sweetness, allowing consumers to indulge without compromising their health goals.

Concerns about artificial sweeteners push consumers towards natural alternatives like stevia.

Concerns surrounding the safety and potential health risks of artificial sweeteners are prompting a significant shift towards natural alternatives like stevia. Consumers are increasingly seeking out products with clean labels and recognizable ingredients, and stevia aligns perfectly with this desire for naturality. This trend goes hand-in-hand with the growing preference for whole foods and a more natural approach to health and wellness.

Sugar taxes implemented in some Latin American countries incentivize manufacturers to adopt lower-calorie sweeteners like stevia.

In a bid to combat health issues like obesity and diabetes, some Latin American governments are implementing sugar taxes. These taxes disincentivize the use of sugar in food and beverage production, making it financially beneficial for manufacturers to adopt lower-calorie sweeteners like stevia. This government intervention creates a favorable market environment for stevia producers and manufacturers, further accelerating its growth trajectory.

Being native to South America, stevia enjoys easier access and potentially lower production costs.

Being native to South America, Stevia enjoys a significant logistical advantage in the region. This translates to easier access to the raw material, potentially leading to lower production costs for stevia-based products compared to imported sweeteners. This cost advantage, coupled with potential government support for local agriculture, positions Latin America as a key player in the global stevia market, both as a producer and consumer. This regional advantage allows Latin America to capitalize on the global stevia demand and potentially become a leader in stevia production.

Latin America Stevia Market Restraints and Challenges:

While the Latin American stevia market is flourishing, it's not without its hurdles. One of the key challenges is price. Although local production might offer some cost advantages, stevia can still be more expensive for consumers compared to traditional sugar. This can be a significant barrier for budget-conscious shoppers who may prioritize affordability over health benefits.

Another hurdle is taste perception. While advancements have been made in refining stevia's taste, some consumers still find a lingering aftertaste that differs from sugar. This can limit its appeal for those seeking a taste experience identical to sugar.

Regulatory hurdles also pose a challenge. Standardization of stevia use and labeling varies across Latin American countries. This inconsistency can be a headache for manufacturers looking to expand their stevia-based product lines across borders. Furthermore, ensuring a consistent supply of high-quality stevia leaves can be a challenge for some producers, even though the plant is native to the region. Limited availability of the raw material can restrict production capabilities and hinder market growth.

Finally, stevia faces stiff competition from established sweeteners. Sugar and artificial sweeteners have a strong foothold in the market, requiring ongoing marketing efforts to educate consumers about stevia's health benefits and overcome established taste preferences. Overcoming these challenges will be crucial for the Latin American stevia market to reach its full potential.

Latin America Stevia Market Opportunities:

The future of Latin America's stevia market is brimming with exciting opportunities. Innovation is key, with possibilities for new formulations that address lingering taste concerns and cater to specific dietary needs. Blending stevia with other natural sweeteners can further widen the consumer base by creating a more balanced taste profile. Stevia's potential extends beyond just sweetness too. Its health benefits, like blood sugar management, can be explored in functional food applications, catering to the growing demand for health-promoting products. While beverages are currently king, the stevia market has room for significant expansion. Bakery goods, confectionery, dairy products, and frozen foods all present opportunities to broaden the application of stevia, giving consumers more choices that fit their preferences and dietary needs. The booming e-commerce market in Latin America offers a golden opportunity for stevia brands. Online platforms can connect directly with health-conscious shoppers across the region, making stevia products more accessible than ever before. Finally, with a focus on sustainability becoming increasingly important to consumers, highlighting stevia's natural origin and potentially lower environmental impact compared to sugar can be a powerful differentiator in the market. By capitalizing on these opportunities, the Latin American stevia market is poised for continued growth and success.

LATIN AMERICA STEVIA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.6% |

|

Segments Covered |

By extract Type, form, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile and Rest of Latin America |

|

Key Companies Profiled |

Nestlé, The Coca-Cola Company, PepsiCo, Cargill, Ingredion Incorporated, Tate & Lyle, PureCircle, GLG Life Tech, Archer Daniels Midland, Sunwin Stevia International, Chr. Hansen, Stevia Corp, Ingredi |

Latin America Stevia Market Segmentation:

Latin America Stevia Market Segmentation: By Extract Type:

- Whole Leaf

- Powdered Stevia

- Liquid Stevia

The dominant segment in the Latin American stevia market by Extract Type is Powdered Stevia. This concentrated form is popular for its ease of use in baking and home consumption. However, the fastest-growing segment is Liquid Stevia. Its high concentration makes it ideal for industrial applications in beverages and food manufacturing, catering to the rising demand for stevia-based products.

Latin America Stevia Market Segmentation: By Application:

- Beverages

- Bakery & Confectionery

- Tabletop Sweeteners

- Dairy Products

- Convenience Foods

The Latin American stevia market is segmented by application, with Beverages currently holding the dominant position. Stevia's use of various beverages like soft drinks, juices, and energy drinks drives this segment's growth. However, Bakery & Confectionery is emerging as the fastest-growing segment. Consumers seeking sugar substitutes for baked goods and confectionery are propelling this segment forward.

Latin America Stevia Market Segmentation: By Form:

- Dry Stevia

- Liquid Stevia

Dominating the Latin American stevia market by form is Dry Stevia (powdered stevia and stevia leaf extracts). This is due to its ease of use in home baking and household applications. However, the fastest-growing segment is Liquid Stevia. The beverage industry, a major stevia user, prefers liquid stevia for its efficient incorporation during manufacturing.

Latin America Stevia Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

The undisputed leader in the Latin American stevia market, Brazil boasts a large diabetic and obese population, driving a strong demand for natural sweeteners. Growing health awareness and government initiatives further fuel the market's growth. Expect to see a thriving market for all stevia applications, with a focus on innovation and affordability.

Following Brazil's lead, Argentina presents a promising market for stevia. Consumers are increasingly health-conscious, and sugar taxes incentivize manufacturers to adopt stevia as a lower-calorie sweetener. The market is expected to see significant growth in beverages, bakery goods, and tabletop sweeteners.

COVID-19 Impact Analysis on the Latin America Stevia Market:

The COVID-19 pandemic's impact on the Latin American stevia market was a rollercoaster ride. Initial disruptions arose from lockdowns and travel restrictions hindering the movement of stevia leaves and finished products. Consumer priorities shifted towards essential items, potentially leading to a temporary decline in demand for stevia. Additionally, the closure of restaurants and cafes, major users of stevia-based beverages, might have caused a short-term market slump.

However, the pandemic also presented unexpected opportunities. The heightened focus on health and well-being during this time potentially increased interest in stevia as a natural, zero-calorie sweetener. Lockdowns and stay-at-home measures also fueled a rise in home baking, boosting the demand for dry stevia products like stevia powder for use in recipes. The surge in e-commerce further benefited the market by making stevia products more accessible to consumers.

Latest Trends/ Developments:

The Latin American stevia market is abuzz with innovation and a focus on well-being. A key trend is the exploration of stevia's potential health benefits beyond just sweetness. This has led to its incorporation into functional food applications. Imagine sugar-free yogurt fortified with stevia to promote gut health, or stevia-sweetened protein bars that manage blood sugar levels. These are just a few examples of how stevia is evolving from a simple sweetener to a functional ingredient.

Furthermore, sustainability is becoming a significant selling point. As consumers become more eco-conscious, companies are highlighting stevia's natural origin and potentially lower environmental footprint compared to sugar. Sustainable sourcing and production practices are gaining traction in the Latin American stevia market, appealing to environmentally responsible shoppers.

Finally, the booming e-commerce market presents a golden opportunity for stevia brands. Online platforms allow direct-to-consumer sales, making stevia products more accessible than ever before in remote areas or for busy individuals. Brands are capitalizing on this by leveraging social media marketing and influencer outreach to effectively target online audiences. These trends showcase the dynamism of the Latin American stevia market, where innovation, a focus on health and sustainability, and embracing e-commerce opportunities will be key drivers of continued growth in the coming years.

Key Players:

- Nestlé

- The Coca-Cola Company

- PepsiCo

- Cargill

- Ingredion Incorporated

- Tate & Lyle

- PureCircle

- GLG Life Tech

- Archer Daniels Midland

- Sunwin Stevia International

- Chr. Hansen

- Stevia Corp

- Ingredi

Chapter 1. Latin America Stevia Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Stevia Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Stevia Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Stevia Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Stevia Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Stevia Market– By Extract Type

6.1. Introduction/Key Findings

6.2. Whole Leaf

6.3. Powdered Stevia

6.4. Liquid Stevia

6.5. Y-O-Y Growth trend Analysis By Extract Type

6.6. Absolute $ Opportunity Analysis By Extract Type , 2024-2030

Chapter 7. Latin America Stevia Market– By Application

7.1. Introduction/Key Findings

7.2 Beverages

7.3. Bakery & Confectionery

7.4. Tabletop Sweeteners

7.5. Dairy Products

7.6. Convenience Foods

7.7. Y-O-Y Growth trend Analysis By Application

7.8. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Latin America Stevia Market– By Form

8.1. Introduction/Key Findings

8.2 Dry Stevia

8.3. Liquid Stevia

8.4. Y-O-Y Growth trend Analysis Form

8.5. Absolute $ Opportunity Analysis Form , 2024-2030

Chapter 9. Latin America Stevia Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Latin America

9.1.1. By Country

9.1.1.1. Mexico

9.1.1.2. Brazil

9.1.1.3. Argentina

9.1.1.4. Chile

9.1.1.5. Rest of Latin America

9.1.2. By Extract Type

9.1.3. By Form

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Latin America Stevia Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nestlé

10.2. The Coca-Cola Company

10.3. PepsiCo

10.4. Cargill

10.5. Ingredion Incorporated

10.6. Tate & Lyle

10.7. PureCircle

10.8. GLG Life Tech

10.9. Archer Daniels Midland

10.10. Sunwin Stevia International

10.11. Chr. Hansen

10.12. Stevia Corp

10.13. Ingredi

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Latin America Stevia Market was valued at USD 0.05 billion in 2023 and is projected to reach a market size of USD 0.09 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.6%.

Surging Health Consciousness, Natural Sweetener Preference, Government Incentives for Reduced Sugar Consumption, and Local Production Advantage.

Beverages, Bakery & Confectionery, Tabletop Sweeteners, Dairy Products, Convenience Foods.

Brazil reigns supreme as the most dominant region in the Latin American stevia market, driven by its large diabetic and health-conscious population, and government initiatives.

Nestlé, The Coca-Cola Company, PepsiCo, Cargill, Ingredion Incorporated, Tate & Lyle, PureCircle, GLG Life Tech, Archer Daniels Midland, Sunwin Stevia International, Chr. Hansen, Stevia Corp, Ingredi