Latin American Media Streaming Market Size (2024-2030)

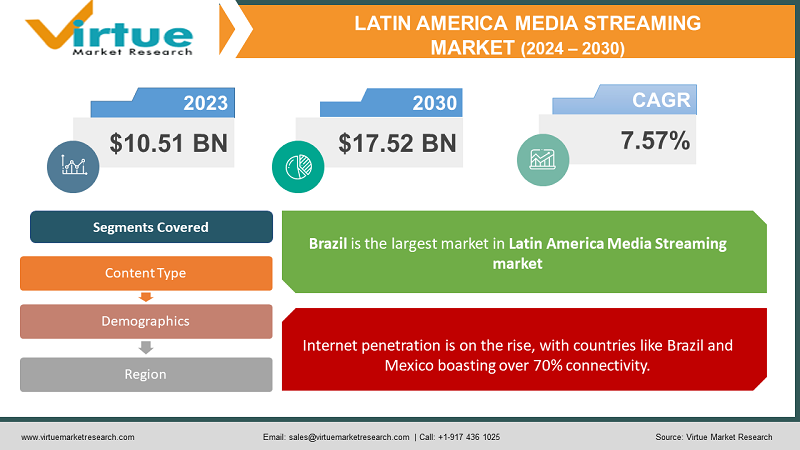

The Latin American media streaming market was valued at USD 10.51 billion in 2023 and is projected to reach a market size of USD 17.52 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.57%.

While locally generated material is gaining traction, Hollywood hits continue to connect. Viewers are drawn to stories that mirror their own cultures and experiences, whether they be Mexican dramedies or Brazilian crime thrillers. Here's where local players excel, cultivating devoted fan bases with relatable stories. While subscription video-on-demand (SVOD) is the most popular, advertising-based VOD is also rather important. Because of its low cost, AVOD appeals to consumers on a budget and is frequently combined with telecom plans. It's revolutionary, particularly in areas with unequal income distribution. Inconsistent internet infrastructure might try viewers' patience, and piracy is still a problem. Regional players, however, are coming up with new ideas and providing services like data-saving and offline watching. Latin America's media streaming business is poised for rapid expansion due to its youthful, technologically literate populace and thriving mobile ecosystem.

Key Market Insights:

The Latin American media streaming market is experiencing a dynamic transformation, driven by a convergence of factors like rising internet penetration, increasing disposable income, and a growing appetite for local and international content. This growth is primarily driven by the over-the-top (OTT) services segment, as consumers ditch traditional cable and satellite subscriptions for on-demand, personalized viewing experiences. While international players like Netflix and Disney+ hold significant market share, regional powerhouses are making waves. Platforms like GloboPlay (Brazil), Claro Video (Mexico), and Televisa OTT (Mexico) are capturing audiences with compelling original content and strategic partnerships. This blend of local flavor and global reach is a recipe for success. With a mobile-first population, smartphone accessibility is crucial. Streaming platforms are optimizing their interfaces and offerings for mobile devices, ensuring seamless viewing experiences on the go. This caters to the dynamic lifestyles and tech-savvy nature of Latin American consumers. Consumers crave high-quality, diverse content. Platforms are investing heavily in original productions, strategic acquisitions, and partnerships to expand their libraries and cater to specific niches. Local languages, cultural nuances, and diverse storytelling are key differentiators in this competitive landscape. While subscription models currently dominate, ad-supported tiers are gaining traction. This caters to cost-conscious consumers and opens up new revenue streams for platforms. Finding the right balance between ad experience and user satisfaction will be crucial. Streaming platforms are venturing beyond just movies and shows. Live sports, music streaming, and even educational content are finding their place on these platforms, creating multifaceted entertainment hubs for consumers. Piracy, inconsistent internet infrastructure, and economic fluctuations pose challenges. However, increased government support, infrastructure development, and innovative payment solutions are paving the way for continued growth.

Latin America Media Streaming Market Drivers:

Latin America is experiencing a digital revolution. Internet penetration is on the rise, with countries like Brazil and Mexico boasting over 70% connectivity.

Latin America beats to the beat of increasingly accessible smartphones these days. Global behemoths like Samsung and local businesses like Xiaomi and Motorola are joined by a wide selection of options at reasonable prices in the market. This affordability opens up a universe of possibilities, rather than just allowing you to purchase a gadget. Particularly in urban regions, younger, tech-savvy populations view smartphones as portals to entertainment, social interaction, and education. The region's 4G and 5G network rollout is happening so quickly that it's like adding gasoline to the fire of rising mobile data usage. In addition to improving streaming, this bandwidth explosion is making it easier for everyone to access top-notch material, even in faraway locations. There is a symphony of local and international streaming services available in app stores. These productions, which range from hilarious comedy to engrossing telenovelas, connect with the local languages and sensibilities.

Compared to other regions, Latin American streaming services are generally more affordable. This makes them accessible to a wider demographic.

Latin American streaming services tend to be more affordable when compared to their international equivalents. Streaming platforms offer a range of subscription tiers and flexible payment alternatives in recognition of the wide variations in disposable money. The goal is to make sure that everyone can find a pricing point that fits with their financial rhythm, whether it be family plans or ad-supported models. The pay-as-you-go method serves those with variable revenue sources or different budgets. Comprehending the subtleties of regional economies is essential for affordability. To ensure that the cost of the membership is in line with the purchasing power of the area, several platforms sell their plans in local currencies. Because of this harmony of currencies, local audiences can access streaming services without experiencing the startling dissonance of higher prices resulting from foreign exchange changes. Inclusion is more important than quantity when it comes to Latin America's streaming market's affordability advantage.

Latin America Media Streaming Market Restraints and Challenges:

One of the significant challenges facing the cards and payments market in Poland is the limited digital infrastructure, particularly in rural and remote areas.

In major cities like São Paulo and Mexico City, streaming might seem like a seamless symphony. However, venture beyond the urban bustle, and the melody falters. Rural areas often struggle with meager bandwidth. Even when bandwidth exists, consistency is often a luxury. This inconsistency not only frustrates viewers but also discourages potential subscribers, creating a vicious cycle that impedes market growth. As if unreliable connections weren't enough, frequent outages add another jarring note to the symphony. This digital divide has far-reaching consequences. It excludes vast segments of the population from the cultural and educational opportunities that streaming offers. It stifles the growth of the streaming market itself, as millions of potential customers are left on the sidelines. And it creates a two-tiered society where access to information and entertainment becomes a privilege enjoyed by the few rather than a right shared by all.

Latin America has a high prevalence of piracy, fueled by factors like affordability concerns and limited access to legal content libraries.

With legal streaming services sometimes perceived as expensive, piracy offers a seemingly free alternative, particularly for individuals with limited disposable income. Some legal platforms might not cater to specific local preferences or lack diverse offerings, pushing users towards pirated sources that boast wider libraries. Complex subscription processes or geo-restrictions can frustrate users, making piracy seem like a more convenient option. Content creators and distributors are rightfully deprived of their rightful income, hindering their ability to invest in producing high-quality content. With piracy eroding potential returns, studios and platforms have become hesitant to invest in local content creation, stifling the growth of the industry. Pirated content often comes with security risks, malware threats, and poor streaming quality, compromising the overall user experience.

Latin America Media Streaming Market Opportunities:

Latin America is a treasure trove of diverse stories, cultures, and artistic expressions. The demand for locally produced content is booming, creating a golden age for regional creators. Streaming platforms are recognizing this potential and investing heavily in original productions that resonate with local audiences. Mobile phones are not just communication devices in Latin America; they're gateways to entertainment. With increasing smartphone penetration and expanding 4G and 5G networks, on-the-go streaming is poised for explosive growth. Platforms can leverage this by offering mobile-optimized interfaces, offline viewing options, and data-saving features, ensuring a seamless and enjoyable experience even on the move. Spanish and Portuguese are spoken by millions across the globe, opening a vast potential audience for Latin American content. By offering multilingual dubbing and subtitles, platforms can transcend regional boundaries and tap into international markets. Imagine Brazilian thrillers captivating audiences in Japan, or Colombian comedies making viewers in Europe laugh out loud – language becomes a bridge, not a barrier, in this global symphony. The streaming market thrives on collaboration. Strategic partnerships between local and international players can accelerate growth.

LATIN AMERICA MEDIA STREAMING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.57% |

|

Segments Covered |

By Content Type, Demographics, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Brazil, Argentina, Colombia, Chile, Rest of Latin America |

|

Key Companies Profiled |

Netflix, Disney+, Amazon Prime , YouTube, Claro Video, Globoplay, Blim, Star+ |

Latin America Media Streaming Market Segmentation

Latin America Media Streaming Market Segmentation: By Content Type:

- Video Streaming

- Audio Streaming

- Live Streaming

Video streaming is the largest segment, accounting for around 75% of the market in 2023. This segment encompasses movies, TV shows, documentaries, and original content, further divided by genre and target audience. Live streaming is the fastest-growing segment. The emergence of social media platforms, gaming platforms such as Twitch, and the growing need for live events, webinars, and virtual conferences have led to a notable surge in live streaming. Live streaming is rapidly growing in the media streaming industry because it enables viewers to communicate with producers, engage in real-time material, and participate in events. Audio streaming includes music streaming platforms like Spotify and Apple Music, which have been gaining significant traction.

Latin America Media Streaming Market Segmentation: By Demographics

- Millennials

- Generation Z

- Generation X

- Baby Boomers

Millennials hold the largest share, around 35% of the streaming market in 2023. They're tech-savvy, mobile-first, and open to exploring diverse content, making them highly attractive to streaming platforms. Generation Z is closely behind, with a share of around 30%. Gen Z is the fastest-growing demographic in the market. Their digital native status makes them comfortable with streaming, and they're early adopters of new technologies and trends. Generation X comprises roughly 20% of the market. Gen X users tend to be more selective in their streaming choices and value quality over quantity. They're also more likely to subscribe to niche platforms catering to their specific interests. Baby Boomers represent approximately 15% of the market. Baby Boomers are the slowest-growing demographic but still hold significant potential. As internet access and digital literacy improve, their adoption of streaming services is expected to rise. Gen Z is the fastest-growing demographic, indicating their increasing influence on future market trends.

Latin America Media Streaming Market Segmentation: Regional Analysis

- Colombia

- Brazil

- Argentina

- Chile

- Rest of Latin America

Brazil is the largest market, accounting for around 50% of the market share in 2023. Boasting a large population, strong internet penetration, and a thriving tech ecosystem, Brazil provides fertile ground for streaming services. With over 210 million inhabitants, Brazil offers a vast potential audience for streaming services. Over 70% of Brazilians have internet access, creating a readily connected user base. Local players like Globoplay and Claro Video compete effectively with global giants, offering diverse content and competitive pricing. Argentina is expected to have the fastest growth. Argentina boasts a young, tech-savvy population and a growing digital infrastructure. Governments and private companies are investing heavily in infrastructure development, bridging the digital divide, and bringing more people online. Mobile devices are the primary access point for streaming, and this region witnesses rapid smartphone penetration. Local and regional players are offering budget-friendly options, making streaming more accessible to a wider audience. Argentina and Chile are driven by high disposable incomes and a strong cultural affinity for streaming entertainment. The rest of the Latin America region, encompassing countries like Peru, and Ecuador, holds the remaining 10% share. While still emerging, these markets are witnessing rapid growth fueled by increasing internet penetration and mobile adoption.

COVID-19 Impact Analysis on the Latin American Media Streaming Market.

With lockdowns and social distancing measures in place, homes became the epicenter of life. This surge in home entertainment translated into a dramatic increase in streaming consumption. People turned to platforms for movies, shows, and music, seeking solace, entertainment, and connection. This captive audience fueled a subscription boom, with platforms like Netflix and Disney+ witnessing record user growth in the region. The pandemic acted as a digital catalyst, pushing many who were hesitant to go online to embrace streaming. This digital inclusion opened doors for millions, expanding the market reach and creating a new generation of avid streamers. Additionally, improved internet infrastructure due to government initiatives further fueled this digital leap, making streaming more accessible than ever before. With international productions facing disruptions, local content took center stage. Platforms invested heavily in regional originals, reflecting local cultures and stories. This resonated deeply with audiences, fostering a sense of connection and pride. Shows like "La Casa de Papel" and "Narcos" became global hits, showcasing the power of local storytelling on a global stage. Latin American streaming platforms, already known for their competitive pricing, became even more budget-friendly during the pandemic. Flexible payment options and mobile-first strategies catered to diverse economic realities, ensuring everyone could join the streaming party. This affordability advantage proved crucial in retaining and attracting new users, solidifying the market's growth trajectory. While the pandemic played a positive role, challenges remain. Uneven internet infrastructure in rural areas still hinders access, and piracy continues to be a concern. However, the industry is addressing these challenges through infrastructure improvements, anti-piracy initiatives, and content diversification.

Latest Trends/ Developments:

Regional productions captivate audiences with their authentic storytelling and relatable themes. From gritty dramas like "Narcos: Mexico" to heartwarming comedies like "Club de Cuervos," local content is resonating deeply and driving subscriber growth for platforms like Netflix and Globoplay. Streaming giants are pouring millions into creating high-quality local content, recognizing its potential to attract and retain viewers. A wave of talented actors, directors, and writers is pushing creative boundaries, bringing fresh perspectives to the screen. Improved production infrastructure and wider internet access are facilitating content creation across the region. Affordable devices, expanding 4G and 5G networks, and mobile-first platform strategies are making streaming accessible to a wider audience than ever before. Platforms are optimizing apps for smaller screens, offering offline viewing options, and integrating with mobile wallets for seamless payment, ensuring everyone can join the entertainment party. While global giants dominate, niche platforms are carving out their own space. They cater to specific genres or interests, like MUBI for arthouse cinema or Flow for sports streaming. These players offer curated content experiences and often have more flexible pricing models, attracting dedicated audiences. This trend signifies a shift towards personalization, where viewers seek content that resonates with their unique preferences.

Key Players:

- Netflix

- Disney+

- Amazon Prime

- YouTube

- Claro Video

- Globoplay

- Blim

- Star+

Chapter 1. Latin America Media Streaming Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Media Streaming Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Media Streaming Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Media Streaming Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Media Streaming Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Media Streaming Market– By Content Type

6.1. Introduction/Key Findings

6.2. Video Streaming

6.3. Audio Streaming

6.4. Live Streaming

6.5. Y-O-Y Growth trend Analysis By Content Type

6.6. Absolute $ Opportunity Analysis By Content Type , 2024-2030

Chapter 7. Latin America Media Streaming Market– By Demographics

7.1. Introduction/Key Findings

7.2. Millennials

7.3. Generation Z

7.4. Generation X

7.5. Baby Boomers

7.6. Y-O-Y Growth trend Analysis By Demographics

7.7. Absolute $ Opportunity Analysis By Demographics , 2024-2030

Chapter 8. Latin America Media Streaming Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Latin America

8.1.1. By Country

8.1.1.1. Mexico

8.1.1.2. Brazil

8.1.1.3. Argentina

8.1.1.4. Chile

8.1.1.5. Rest of Latin America

8.1.2. By Content Type

8.1.3. By Demographics

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Latin America Media Streaming Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Netflix

9.2. Disney+

9.3. Amazon Prime

9.4. YouTube

9.5. Claro Video

9.6. Globoplay

9.7. Blim

9.8. Star+

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The digital revolution and affordability are the main drivers for this market.

Uneven infrastructure and the digital divide, content piracy, regulatory challenges, and payment limitations are the main concerns.

Netflix, Disney+, Amazon Prime, YouTube, Claro Video, Globoplay, Blim, and Star+ are the key players.

Brazil currently holds the largest market share, estimated at around 50%.

Argentina exhibits the fastest growth in the regional market.