Latin America Fruit and Vegetable Seeds Market Size (2024-2030)

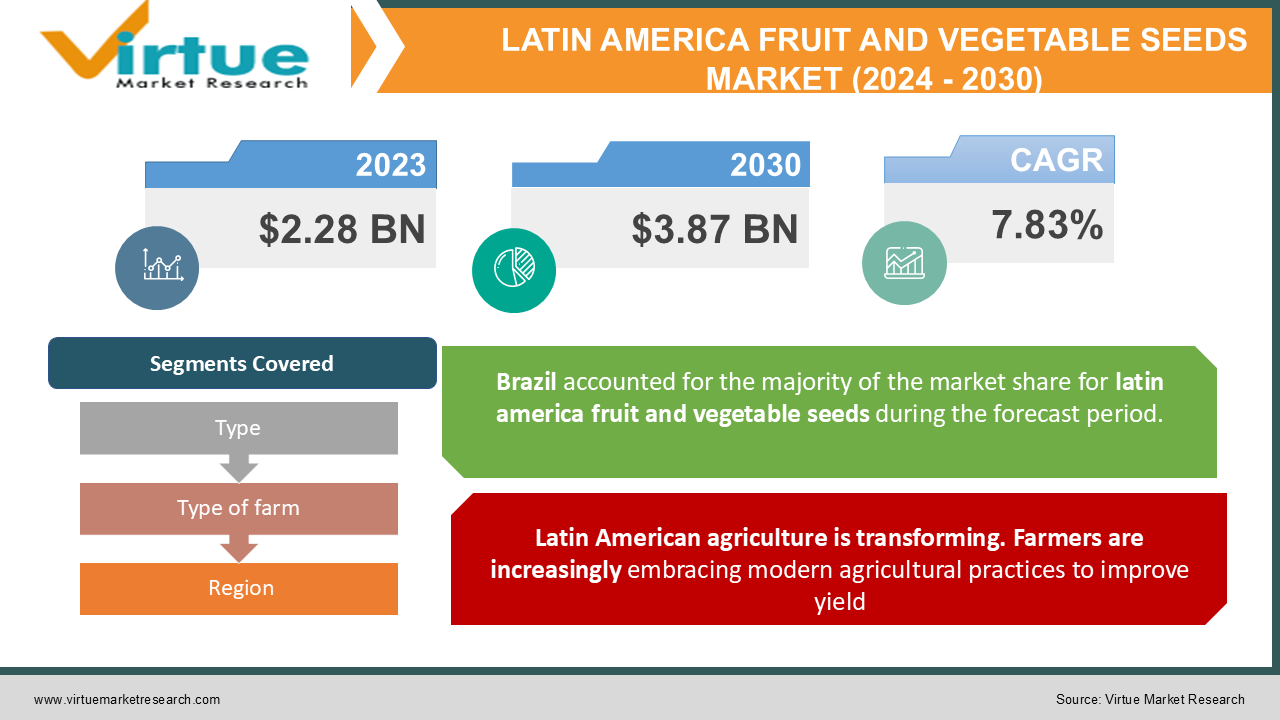

The Latin America Fruit and Vegetable Seeds Market was valued at USD 2.28 Billion and is projected to reach a market size of USD 3.87 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.83%.

Latin America is a top agricultural region because of its diverse range of weather and lush terrain. The Latin American market for fruit and vegetable seeds, a vibrant industry set for rapid expansion in the upcoming years, is what drives this agricultural prowess. There's a growing middle class and expanding population in Latin America, which is driving increasing demand for fresh produce. Additionally, as consumers' preferences for nutrient-dense products grow, there is an increased need for premium seeds due to their increased health consciousness. Many Latin American governments recognize the importance of a robust agricultural sector for food security and economic development. Government initiatives promoting investment in modern agricultural practices, including the use of improved seeds, are contributing to market growth.

Key Market Insights:

The direct-to-farmer distribution channel accounted for the largest share of the Latin America Fruit and Vegetable Seeds Market in 2023, valued at $1.6 billion, followed by the wholesale distribution channel, valued at $1.2 billion.

The online distribution channel for fruit and vegetable seeds is gaining traction in the region, driven by the increasing internet penetration and e-commerce adoption, with a market value of $160 million in 2023.

The market for climate-resilient seeds, designed to withstand the impacts of climate change, such as droughts and extreme temperatures, was valued at $240 million in 2023, reflecting the growing concern over food security in the region.

In 2023, the collective government funding and support for the Latin America Fruit and Vegetable Seeds Market stood at $320 million, aimed at promoting sustainable agriculture practices and ensuring food security in the region.

The direct-to-farmer distribution channel accounted for the largest share of the Latin America Fruit and Vegetable Seeds Market in 2023, valued at $1.6 billion, followed by the wholesale distribution channel, valued at $1.2 billion.

Latin America Fruit and Vegetable Seeds Market Drivers:

Across Latin America, a health and wellness revolution is unfolding. Consumers are increasingly prioritizing fresh fruits and vegetables in their diets, driven by a heightened awareness of the link between nutrition and well-being.

As consumers become more discerning, the demand for high-quality, disease-resistant, and nutrient-rich seeds is escalating. This translates to a flourishing market for improved seed varieties, including hybrids with enhanced vitamin and mineral content. Seed companies are actively developing varieties that cater to this growing health consciousness, such as tomatoes boasting higher lycopene content or leafy greens with increased levels of folate. The rise of functional foods, enriched with specific health benefits, is creating new opportunities in the seed sector. Seeds for fruits and vegetables known for their unique health properties, like berries rich in antioxidants or cruciferous vegetables with potential cancer-fighting properties, are experiencing a surge in demand. This trend incentivizes seed companies to invest in the research and development of varieties specifically tailored to the functional food market. Latin American cuisines have always placed a strong emphasis on essentials like rice and beans. However, diversification of diets is occurring as a result of the rising popularity of foreign cuisines and a greater awareness of global food trends. This results in an increased need for seeds for a greater range of fruits and vegetables, including some that aren't typically grown in the area.

Latin American agriculture is transforming. Farmers are increasingly embracing modern agricultural practices to improve yields, optimize resource utilization, and enhance overall farm efficiency.

For farmers, increasing output is a primary goal. High-yielding seed types are therefore in greater demand. Currently, seed firms are working hard to create seeds that will germinate more easily, be more resilient to pests and diseases, and grow well in a variety of environments. This promotes food security and economic expansion by ensuring farmers make the most of their resources and land. Latin America is seeing a rise in the use of precision agriculture, a data-driven farming method. This entails monitoring weather patterns, crop health, and soil conditions using technology like sensors and computer tools. Afterward, this data is utilized to optimize growing conditions and make well-informed decisions concerning resource allocation. The popularity of precision farming is driving the demand for seeds with certain qualities that work well with these CEA techniques like greenhouses and vertical farming is revolutionizing agriculture in some parts of Latin America. These controlled environments allow for year-round production and minimize the impact of external factors like weather or pests. This emerging trend creates a demand for specialized seeds suited to these controlled environments. Seed companies are developing varieties with specific light and temperature requirements, optimized growth cycles, and higher tolerance for close spacing – all essential for success in CEA systems.

Latin America Fruit and Vegetable Seeds Market Restraints and Challenges:

Seed regulations vary considerably across Latin American countries. Seed quality standards, testing procedures, and licensing requirements can differ significantly, creating confusion and hindering cross-border trade. This makes it difficult for seed companies to operate efficiently across the region, limiting market reach and innovation. In some cases, existing seed regulations might be poorly enforced, creating an uneven playing field. This can disadvantage companies adhering to stricter standards and discourage investment in research and development of improved seed varieties. Poorly developed transportation infrastructure can hinder the timely and efficient distribution of seeds to farmers, especially in remote areas. This can lead to delays, stockouts, and ultimately, reduced agricultural productivity. The seed distribution system in some Latin American countries can be fragmented, with multiple intermediaries involved. This can lead to price markups for farmers and limit their access to essential information and technical support from seed companies.

Latin America Fruit and Vegetable Seeds Market Opportunities:

As the organic movement gains momentum and people's regard for heritage varieties rises, heirlooms and organic seeds are becoming increasingly sought. Seed companies can benefit from this trend by offering certified organic seeds and emphasizing the unique flavor characteristics and cultural significance of heritage types. This caters to a growing consumer base that values fruits and vegetables not just for their health advantages but also for their cultural and environmental significance. The allure of international cuisine combined with an emphasis on specific health benefits is driving the desire for unique and practical fruits and vegetables. The popularity of international cuisines and a focus on specific health benefits are driving demand for exotic and functional fruits and vegetables. Seed companies can tap into this opportunity by introducing seeds for fruits like dragon fruit, known for its high antioxidant content, or vegetables like black garlic, prized for its immune-boosting properties. By offering seeds for these unique and health-oriented options, seed companies can cater to a growing segment of adventurous and health-conscious consumers.

LATIN AMERICA FRUIT AND VEGETABLE SEEDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

7.83% |

||

|

Segments Covered |

By Type, Type of farm, and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Bayer AG , Corteva Agriscience , Sakata Seed America , Biofábrica Fundación Hondureña para el Desarrollo Agropecuario (FHDA) , Vertical Harvest , Geno Green , Status |

Latin America Fruit and Vegetable Seeds Market Segmentation:

Latin America Fruit and Vegetable Seeds Market Segmentation: By Type:

- Conventional Seeds

- Genetically Modified (GM) Seeds

- Hybrid Seeds

Conventional Seeds (65-70%) These unadulterated seeds hold the lion's share of the market. Their affordability, widespread availability, and suitability for traditional farming practices make them the go-to choice for many farmers. Additionally, some regions have cultural preferences for non-GMO options, further solidifying the position of conventional seeds. Conventional seeds have been the cornerstone of Latin American agriculture for generations. Conventional seeds are generally less expensive than their GM or hybrid counterparts. This affordability makes them particularly attractive to small-scale farmers with limited resources.

Despite the dominance of conventional seeds, GM seeds are experiencing the fastest growth within the market. Some Latin American governments recognize the potential of GM technology to boost agricultural productivity and food security. These governments might offer incentives or streamline regulations for GM seed use, encouraging wider adoption. The potential for increased yield and reduced crop losses with GM seeds translates to higher profits for farmers. This economic incentive is particularly attractive in a region striving for agricultural sustainability and economic growth. The initial wave of GM seed adoption primarily focuses on crops like soybeans and maize, which offer significant potential yield improvements. This targeted approach allows farmers to weigh the benefits against potential risks more readily.

Latin America Fruit and Vegetable Seeds Market Segmentation: By Type of farm:

- Outdoor Cultivation

- Controlled-Environment Agriculture (CEA)

Outdoor Cultivation holds the lion's share, this segment accounts for roughly 80-85% of the market. Traditional farming practices like open fields and row cropping dominate vast swathes of arable land across Latin America. Open-field farming leverages existing infrastructure and established practices, making it readily accessible to many farmers. This accessibility fuels its dominant position in the market. Outdoor cultivation allows for large-scale production, catering to the demands of a growing population and facilitating exports. This scalability is crucial for ensuring food security and economic development in the region.

CEA techniques offer a high degree of control over environmental factors like light, temperature, and humidity. This allows for optimized growing conditions, leading to increased yields and improved crop quality. CEA practices are known for their efficient water utilization. This is becoming increasingly important in regions facing water scarcity challenges. Establishing a CEA facility requires significant upfront investment in infrastructure, technology, and climate control systems. This can be a barrier for some farmers.

Latin America Fruit and Vegetable Seeds Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

Brazil's market share in the Latin American fruit and vegetable seeds market is estimated to be around 35%, making it the most dominant player in the region. As the largest economy and agricultural powerhouse in Latin America, Brazil stands out as a dominant force in the region's fruit and vegetable seeds market. With its vast arable lands, favorable climate conditions, and well-established agricultural sector, Brazil has cultivated a thriving seed industry.

In this field, Colombia has shown itself to be the nation with the fastest growth. Colombia's tropical temperature and varied geography make it the perfect place to grow a variety of fruits and vegetables, such as bananas, coffee, flowers, and other tropical fruits.

COVID-19 Impact Analysis on the Latin America Fruit and Vegetable Seeds Market:

Lockdowns and border restrictions hampered the movement of goods, including imported seeds. This created temporary shortages and price fluctuations for certain seed varieties, particularly those sourced from outside the region. Social distancing measures and lockdowns disrupted the agricultural workforce, impacting seed production, distribution, and even planting activities. This temporary labor shortage could have led to potential yield reductions. The initial panic buying and subsequent disruptions in food supply chains led to a surge in demand for certain fruits and vegetables, particularly those with longer shelf lives. This, in turn, impacted seed sales for those specific crops. The pandemic highlighted the importance of robust domestic seed production. Governments and private companies invested in strengthening local seed production capabilities to reduce reliance on imports and ensure the continued availability of essential seed varieties. Social distancing measures and restrictions on movement accelerated the adoption of e-commerce platforms for seed purchases. This provided farmers with a convenient and safe way to access seeds, even in remote locations.

Latest Trends/ Developments:

Biofortification is a process of breeding crops to increase their content of essential vitamins and minerals. This trend is gaining traction in Latin America as consumers become more health-conscious. Seed companies are developing varieties of fruits and vegetables rich in nutrients like iron, zinc, and vitamin A, specifically addressing deficiencies prevalent in certain regions. Biofortified seeds not only enhance the nutritional value of produce but also contribute to a healthier population. Water scarcity is a growing concern across Latin America. To address this challenge, seed companies are focusing on developing drought-tolerant varieties of fruits and vegetables. These seeds require less water to thrive, enabling farmers to cultivate crops in drier regions and optimize water usage in areas with limited resources. This trend promotes sustainable agriculture and ensures food security in the face of climate change. Blockchain technology offers promising applications for the seed industry. Blockchain can be used to ensure seed traceability, tracking the journey of seeds from production to retail. This transparency fosters consumer trust and helps combat seed counterfeiting, a prevalent issue in some regions. Additionally, blockchain can be used to streamline transactions and facilitate secure financial interactions between farmers and seed companies.

Key Players:

- Bayer AG

- Corteva Agriscience

- Sakata Seed America

- Biofábrica Fundación Hondureña para el Desarrollo Agropecuario (FHDA)

- Vertical Harvest

- Geno Green

- Status

Chapter 1. Latin America Fruit and Vegetable Seeds Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Fruit and Vegetable Seeds Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Fruit and Vegetable Seeds Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Fruit and Vegetable Seeds Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Fruit and Vegetable Seeds Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Fruit and Vegetable Seeds Market– By Type

6.1. Introduction/Key Findings

6.2. Conventional Seeds

6.3. Genetically Modified (GM) Seeds

6.4. Hybrid Seeds

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Latin America Fruit and Vegetable Seeds Market– By Type of farm

7.1. Introduction/Key Findings

7.2 Outdoor Cultivation

7.3. Controlled-Environment Agriculture (CEA)

7.4. Y-O-Y Growth trend Analysis By Type of farm

7.5. Absolute $ Opportunity Analysis By Type of farm , 2024-2030

Chapter 8. Latin America Fruit and Vegetable Seeds Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Latin America

8.1.1. By Country

8.1.1.1. Mexico

8.1.1.2. Brazil

8.1.1.3. Argentina

8.1.1.4. Chile

8.1.1.5. Rest of Latin America

8.1.2. By Type

8.1.3. By Type of farm

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Latin America Fruit and Vegetable Seeds Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Bayer AG

9.2. Corteva Agriscience

9.3. Sakata Seed America

9.4. Biofábrica Fundación Hondureña para el Desarrollo Agropecuario (FHDA)

9.5. Vertical Harvest

9.6. Geno Green

9.7. Status

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Increasing consumer health consciousness is driving a surge in demand for fresh fruits and vegetables. This translates to a greater need for high-quality seeds to cultivate these healthy and nutritious options.

Latin American countries have varying regulations regarding genetically modified organisms (GMOs) and seed imports. This complexity can create hurdles for seed companies seeking to introduce new and improved varieties

Bayer AG, Corteva Agriscience, Sakata Seed America, Biofábrica Fundación

Hondureña para el Desarrollo Agropecuario (FHDA), Vertical Harvest, Geno Green.

Brazil's market share in the Latin American fruit and vegetable seeds market is estimated to be around 35%, making it the most dominant player in the region

In this field, Colombia has shown itself to be the nation with the fastest growth.

Colombia's tropical temperature and varied geography make it the perfect place to

grow a variety of fruits and vegetables, such as bananas, coffee, and flowers.