Latin America Extruded Snacks Market Size (2024-2030)

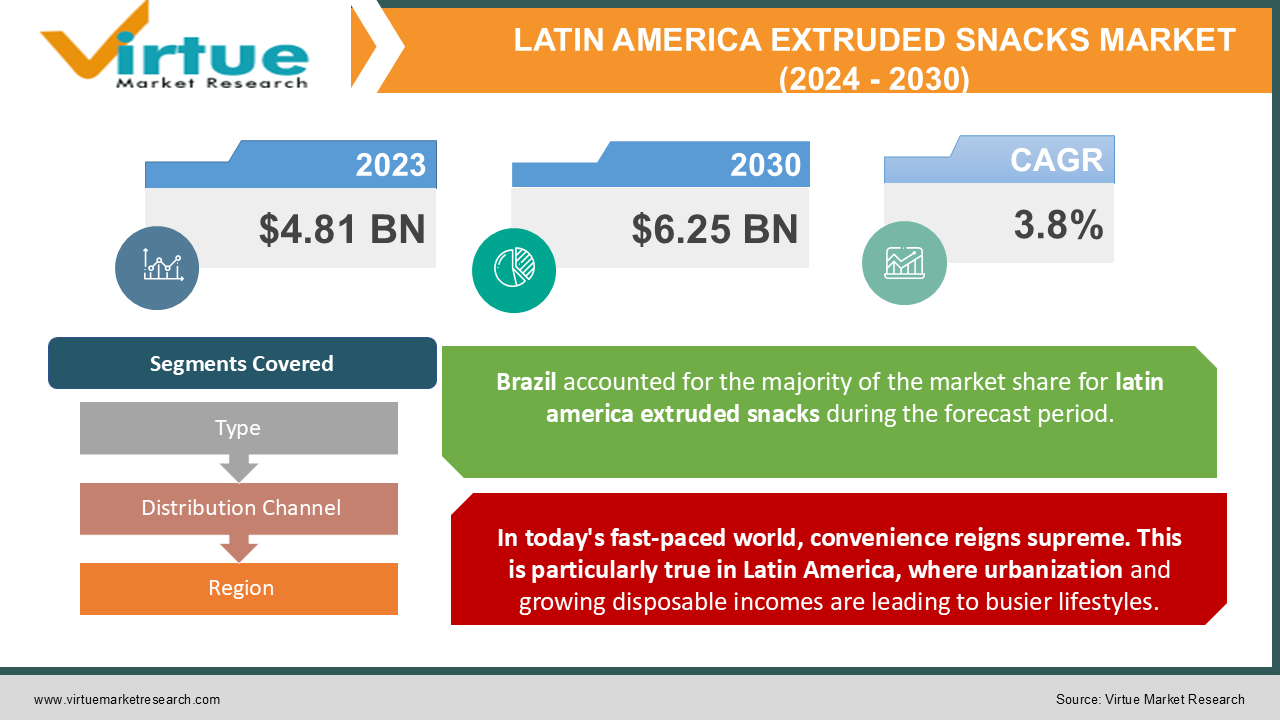

The Latin America Extruded Snacks Market was valued at USD 4.81 Billion and is projected to reach a market size of USD 6.25 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.8%.

The Latin American extruded snacks market is a flavourful tapestry woven with a rich variety of crunchy, puffed, and savory delights. This market, fueled by a growing population with evolving tastes, is experiencing a period of exciting growth and diversification. Extruded snacks come in a dazzling array of shapes, sizes, flavors, and textures. From classic corn puffs and cheese curls to innovative veggie sticks and protein-packed twists, there's something to satisfy every taste bud. Extruded snacks are a perfect on-the-go option. Their portability, long shelf life, and minimal preparation make them ideal for busy lifestyles, school lunches, or quick after-work snacks. Extruded snacks generally fall within an accessible price range, making them a budget-friendly indulgence for consumers across various income brackets. The rise of the snacking culture in Latin America has created a demand for convenient, bite-sized treats. Extruded snacks perfectly fit this trend, offering a delicious option for between-meal snacking.

Key Market Insights:

The demand for extruded snacks is projected to reach $36.2 billion globally in 2024, with Latin America accounting for around 23.2% of the market share.

Brazil's extruded snack business is predicted to grow to $3.1 billion by 2024 thanks to its large population and culture of nibbling.

Extruded snack demand is expected to reach $36.2 billion worldwide in 2024, with roughly 23.2% of the market share coming from Latin America.

Brazil's vast population and snacking culture are expected to propel the country's extruded snack market to reach $3.1 billion in 2024.

The supermarkets and hypermarkets segment are expected to be the largest distribution channel for extruded snacks in Latin America, with an estimated value of $3.2 billion in 2024.

The convenience stores segment's sales of extruded snacks in the region are forecasted to reach $1.8 billion by the end of 2024, driven by the increasing demand for on-the-go snacking options.

The Latin American extruded snacks market is projected to create employment opportunities for over 180,000 people by the end of 2024, with Brazil and Mexico accounting for the largest share of the workforce.

The average price of potato-based extruded snacks in the region is expected to be around $2.2 per kilogram in 2024, subject to fluctuations based on raw material costs and supply chain dynamics.

The average price of corn-based extruded snacks in the Latin American market is projected to reach $1.8 per kilogram by the end of 2024, reflecting the demand for affordable and popular snacking options.

Latin America Extruded Snacks Market Drivers:

In today's fast-paced world, convenience reigns supreme. This is particularly true in Latin America, where urbanization and growing disposable incomes are leading to busier lifestyles.

Extruded snacks don't need much preparation. These single-serve packs or resealable bags are convenient for on-the-go consumption, hectic mornings, or post-school hunger pangs. Extruded snacks reduce the possibility of spoiling and provide a convenient snack option whenever needed thanks to their extended shelf life. This is especially helpful for homes with busy schedules where it may be difficult to plan meals in advance. Unlike preparing snacks from scratch, extruded snacks decrease food waste. Because of their pre-portioned packing, food spoiling is prevented, and the entire product is used. Extruded snacks offer a dazzling array of shapes, sizes, flavors, and textures. From classic corn puffs and cheese curls to innovative veggie sticks, protein-packed twists, and bite-sized crackers, there's something to satisfy every taste bud and craving. This variety caters to different moods and preferences, making extruded snacks a versatile snacking option.

Latin America boasts a young and vibrant population with a growing fondness for snacking. This cultural shift towards snacking throughout the day presents a significant opportunity for the extruded snacks market.

Traditional three-square meals are gradually being replaced by a preference for smaller, more frequent meals and snacking throughout the day. Extruded snacks perfectly fit this trend, offering a convenient and satisfying way to curb hunger pangs between meals. Snacking has become a social activity in Latin America, particularly among younger demographics. Extruded snacks are perfect for sharing with friends during movie nights, game nights, or casual gatherings. Their portability and variety make them ideal for these social occasions. Extruded snacks are often strategically placed near checkout counters in supermarkets and convenience stores, enticing impulse purchases. Their attractive packaging, bold flavors, and association with fun often trigger these impulsive snacking decisions. Manufacturers are increasingly targeting their marketing efforts towards millennials and Gen Z, the primary drivers of the snacking culture. Social media campaigns, influencer partnerships, and eye-catching packaging designs are used to appeal to these demographics.

Latin America Extruded Snacks Market Restraints and Challenges:

Customary extruded snacks frequently have harmful fats and high sodium content, which can aggravate conditions including heart disease and hypertension. Health-conscious consumers are discouraged from indulging in these delicacies because of this notion. Due to the high sugar content of many extruded foods, there are worries about weight gain, sugar crashes, and other health issues that may result from consuming too much sugar. Concerns may also be raised by the existence of hidden sugars in substances like corn syrup. The use of artificial flavors, colors, and preservatives in some extruded snacks raises eyebrows among consumers seeking natural and clean-label products. These ingredients can be perceived as unhealthy and potentially harmful. Investing in research and development to create healthier extruded snack options using whole grains, lower sodium alternatives, natural sweeteners, and healthy fats is crucial. This caters to the growing demand for nutritious yet delicious snacking options. The cost of raw materials like corn, wheat, and vegetable oils used in extruded snack production can fluctuate significantly. These price hikes can force manufacturers to raise the price of their products, potentially putting them out of reach for budget-conscious consumers.

Latin America Extruded Snacks Market Opportunities:

Whole grains are gaining traction as consumers seek snacks rich in fiber and essential nutrients. Manufacturers can introduce extruded snacks made with whole-wheat flour, brown rice flour, or quinoa, catering to this growing demand. The demand for protein-rich snacks continues to surge. Extruded snacks can be reformulated with ingredients like lentils, chickpeas, or pea protein, appealing to fitness enthusiasts and health-conscious consumers seeking satiating snacks. Consumers are drawn to snacks infused with functional ingredients that offer additional health benefits. This could include extruded snacks fortified with vitamins and minerals, prebiotics to promote gut health, or even added superfood ingredients like spirulina or chia seeds. While Latin Americans have a love for sweet treats, there's a growing interest in reduced-sugar options. Manufacturers can explore natural sweeteners like stevia or monk fruit extract, or even offer portion-controlled, lower-sugar versions of popular extruded snacks. Latin American consumers are eager to explore flavors from around the world. Extruded snacks can be infused with ethnic spices like chipotle chili, jerk seasoning, or even za'atar, creating exciting fusion flavors.

LATIN AMERICA EXTRUDED SNACKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

3.8% |

||

|

Segments Covered |

By Type, Distribution Channel and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

PepsiCo , Mondelez International , Nestlé , The Kellogg Company , Grupo Bimbo , Yemal, Arcor, Snack |

Latin America Extruded Snacks Market Segmentation:

Latin America Extruded Snacks Market Segmentation: By Type

- Corn

- Wheat

- Rice

- Mixed Grains

- Others

In the market for extruded snacks in Latin America, corn is king. Both producers and customers favour it because of its familiar taste, cost, and adaptability. People of all ages love the classic corn puffs, cheese curls, and tortilla chips that are mainstays in this section. In Latin America, corn is a cheap and easily obtainable crop, which makes it an economical option for producers looking to maintain their products' accessibility to a wide range of consumers. Corn's neutral flavor profile allows for endless possibilities when it comes to seasonings and flavouring. From classic cheese to fiery chili and even sweet and savory combinations, corn serves as a blank canvas for creating a vast array of extruded snack flavors. Corn can be extruded into a variety of shapes and textures, from light and airy puffs to denser, more substantial curls and chips. This versatility allows manufacturers to cater to different preferences for crunch and mouthfeel.

While corn continues to be the dominant product in the Latin American extruded snack market, Mixed Grains is probably increasing at the fastest rate. The demand for extruded snacks prepared with a blend of grains or alternative flours is being driven by the growing popularity of gluten-free diets and the growth in health consciousness. Snacking on these seems to be healthier than conventional corn-based snacks. Manufacturers can blend different flours with ingredients like legumes or seeds to create functional extruded snacks. These snacks might be fortified with protein, fiber, or even prebiotics, appealing to health-conscious consumers seeking added benefits beyond basic sustenance. Blending grains and flours opens doors to exciting new flavor and texture combinations. This can attract adventurous consumers seeking a departure from traditional corn-based options.

Latin America Extruded Snacks Market Segmentation: By Distribution Channel

- Hypermarkets and Supermarkets

- Independent Retailers

- Convenience Stores

- E-commerce Platforms

Hypermarkets and Supermarkets remain the kingpins of snack distribution in Latin America. They offer a vast selection of extruded snack brands and cater to a broad consumer base through one-stop shopping convenience. Consumers can purchase a variety of groceries, including extruded snacks, during their regular shopping trips. This convenience factor is highly valued in today's busy lifestyles. Large supermarkets offer valuable shelf space for extruded snack brands. This allows manufacturers to showcase their products directly to a vast audience and potentially influence purchasing decisions. Supermarkets play a crucial role in promoting extruded snacks through targeted in-store displays, special offers, and loyalty program integrations. This can significantly boost brand awareness and sales.

E-commerce platforms are the fastest-growing distribution channel in the Latin American extruded snacks market. E-commerce allows consumers to shop for snacks from the comfort of their homes, particularly in areas with limited access to supermarkets. Subscription boxes curated with a selection of innovative or regionally inspired extruded snacks can attract adventurous consumers seeking new flavors. This creates a sense of discovery and brand loyalty. The convenience of home delivery eliminates the need for physical shopping trips and provides direct access to a wider range of products.

Latin America Extruded Snacks Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

Brazil stands as the most dominant country in the Latin American extruded snacks market. With a large population, a thriving snacking culture, and a well-developed food industry, Brazil has established itself as a major consumer and producer of extruded snacks. Brazil has a mature and diverse snacking industry, with a strong presence of both local and international brands, creating a significant demand for extruded snacks. Brazilian companies have invested heavily in state-of-the-art production facilities and capacity expansions to meet the growing domestic and export demand for extruded snacks.

Colombia has emerged as the fastest-growing country in the Latin American extruded snacks market. Colombia's increasing urbanization has led to a shift in consumer lifestyles, with a growing demand for convenient and on-the-go snacking options, including extruded snacks. Colombia's economic growth and rising disposable incomes have enabled consumers to indulge in a wider variety of snacking products, boosting the demand for extruded snacks.

COVID-19 Impact Analysis on the Latin America Extruded Snacks Market:

As lockdowns became widespread, people stocked up on essential goods, including shelf-stable snacks like extruded snacks. This resulted in a temporary surge in demand, particularly for familiar, budget-friendly options like corn-based puffs and chips. Strict border controls and lockdowns disrupted the flow of raw materials and finished products. Manufacturers faced challenges acquiring corn, wheat, and other ingredients, leading to potential shortages and production slowdowns. Movement restrictions and transportation limitations hampered the ability to deliver extruded snacks to retailers. This created bottlenecks in the distribution network, impacting product availability in certain regions. Panic buying subsided as people adjusted to the new normal. However, consumer behavior shifted towards prioritizing essential items over discretionary purchases like snacks. This led to a potential decline in overall demand for extruded snacks.

Latest Trends/ Developments:

Consumers are increasingly concerned about the environmental impact of packaging. Manufacturers are exploring compostable or biodegradable packaging materials like bagasse or plant-based films to reduce their environmental footprint. Partnering with local farmers for ingredients and exploring ways to upcycle food waste into snacks are ways manufacturers can demonstrate environmental responsibility and potentially shorten supply chains. This can also resonate with consumers seeking transparency and ethical sourcing practices. Optimizing production processes to minimize waste and breakage, coupled with offering smaller portion sizes for individual consumption, can significantly reduce overall food waste in the extruded snacks market. Latin American palates are known for their adventurous spirit. Manufacturers are experimenting with bold and unique flavor combinations, drawing inspiration from global cuisines or ethnic spices. This can range from sweet chili and chipotle flavors to fusion options like mango-habanero or churro-inspired extruded snacks. Limited-edition seasonal flavors can add a touch of novelty and excitement to the market. Pumpkin spice for fall, mango chili for summer, or even regional fruit-inspired flavors can entice consumers and drive repeat purchases. Livestream shopping platforms and influencer marketing partnerships are gaining traction, allowing brands to showcase their products in an interactive and engaging way. This can be particularly effective for launching new extruded snack flavors or functionalities. E-commerce platforms provide a treasure trove of customer data on purchasing habits and preferences.

Key Players:

- PepsiCo

- Mondelez International

- Nestlé

- The Kellogg Company

- Grupo Bimbo

- Yemal

- Arcor

- Snack

Chapter 1. Latin America Extruded Snacks Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Extruded Snacks Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Extruded Snacks Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Extruded Snacks Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Extruded Snacks Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Extruded Snacks Market– By Type

6.1. Introduction/Key Findings

6.2. Corn

6.3. Wheat

6.4. Rice

6.5. Mixed Grains

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Latin America Extruded Snacks Market– By Distribution channel

7.1. Introduction/Key Findings

7.2 Hypermarkets and Supermarkets

7.3. Independent Retailers

7.4. Convenience Stores

7.5. E-commerce Platforms

7.6. Y-O-Y Growth trend Analysis By Distribution channel

7.7. Absolute $ Opportunity Analysis By Distribution channel , 2024-2030

Chapter 8. Latin America Extruded Snacks Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Latin America

8.1.1. By Country

8.1.1.1. Mexico

8.1.1.2. Brazil

8.1.1.3. Argentina

8.1.1.4. Chile

8.1.1.5. Rest of Latin America

8.1.2. By Type

8.1.3. By Distribution channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Latin America Extruded Snacks Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. PepsiCo

9.2. Mondelez International

9.3. Nestlé

9.4. The Kellogg Company

9.5. Grupo Bimbo

9.6. Yemal

9.7. Arcor

9.8. Snack

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Consumers are becoming more environmentally conscious, and manufacturers are responding with eco-friendly packaging and local sourcing practices. Reducing food waste through optimized production and portion control is another sustainable factor influencing the market.

A major concern is the perception that extruded snacks are generally unhealthy due to high sodium, sugar, and fat content. This perception can deter health-conscious consumers who are increasingly seeking out snacks with added nutritional benefits

PepsiCo, Mondelez International, Nestlé, Kellogg Company, Grupo Bimbo,Yemal, Arcor, Snack

Brazil's market share in the Latin American extruded snacks market is estimated to be around 36.9%, solidifying its position as the dominant player in the region.

Colombia's market share in the Latin American extruded snacks market is estimated to be around 14.3%, and it is expected to continue its rapid growth trajectory in the coming years.