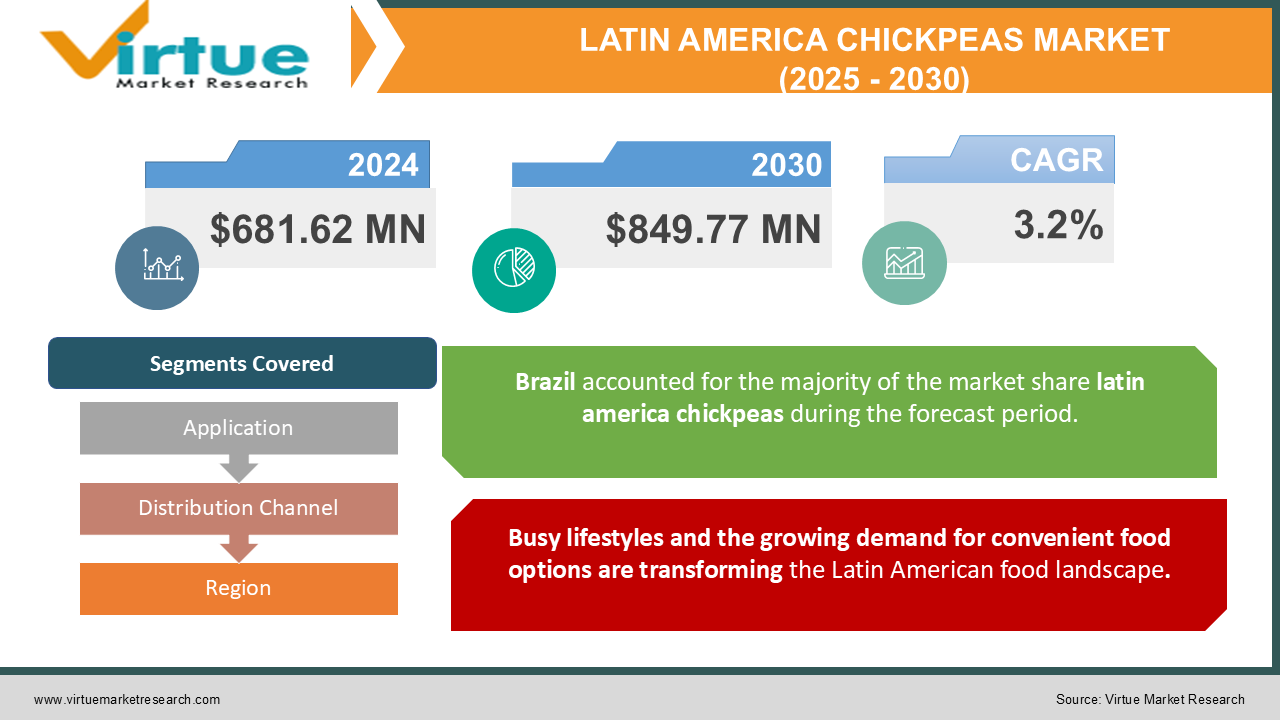

Latin American Chickpeas Market Size (2025-2030)

The Latin American chickpeas Market was valued at USD 681.62 Million in 2024 and is projected to reach a market size of USD 849.77 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.2%.

Chickpeas, also known as garbanzo beans, are a versatile legume gaining popularity in Latin America. A strong tradition of using chickpeas in savory stews and soups like "pozole" in Mexico and Guatemalan "pepian" exists. Here, chickpeas are often consumed whole or roughly broken. Chickpea consumption is rising in countries like Brazil, Argentina, and Colombia, primarily driven by health-conscious consumers. Here, there's a growing demand for pre-cooked or ready-to-eat chickpea products like hummus and chickpea flour-based snacks. The rise of plant-based diets is creating a demand for protein alternatives. Chickpeas offer a readily available and affordable source of plant-based protein, appealing to vegans and vegetarians. The growing demand for convenient food options is a key driver. Chickpeas can be easily incorporated into various dishes, from salads and wraps to soups and curries, catering to busy lifestyles.

Key Market Insights:

- In 2024, the chickpeas market for the traditional cuisine industry is projected to reach $744 million. The chickpeas market for the ethnic food industry is expected to be valued at $620 million in 2024.

- In 2024, the chickpeas market for the gluten-free food industry is projected to reach $403 million. The chickpeas market for the organic food industry is expected to be valued at $310 million in 2024.

- In 2024, the chickpeas market for the convenience food industry is projected to reach $203 million. The chickpeas market for the food service providers industry is expected to be valued at $135 million in 2024.

- The chickpeas market for the food logistics industry is expected to be valued at $68 million in 2024. In 2024, the chickpeas market for the food testing and analysis industry is projected to reach $51 million.

- In 2024, the chickpeas market for the protein supplements industry is projected to reach $139 million. The chickpeas market for the pet food industry is expected to be valued at $104 million in 2024.

Latin America Chickpeas Market Drivers:

Busy lifestyles and the growing demand for convenient food options are transforming the Latin American food landscape. Chickpeas perfectly fit this evolving need while offering culinary versatility.

Customers are looking for quick, healthful solutions that don't need a lot of prep. This demand is met by the availability of canned and precooked chickpeas. These choices are perfect for hectic weekday dinners because they can be quickly and easily added to a variety of cuisines. Chickpeas are making a comeback in the expanding snacking industry in Latin America. Variously seasoned roasted chickpeas are a tasty and nutritious substitute for processed snacks or regular potato chips. Chickpea flour is also being utilized to make creative gluten-free crackers and snacks. Latin American cuisine is known for its rich diversity, and chickpeas are making their way into various regional dishes. Traditional stews and soups are getting a protein boost with the addition of chickpeas. Additionally, the rising popularity of ethnic cuisines like Middle Eastern and Indian food is introducing consumers to new ways to enjoy chickpeas, such as hummus and falafel.

Latin America is witnessing a significant shift towards health and wellness consciousness. Consumers are increasingly prioritizing nutritious and protein-rich foods in their diets, and chickpeas are emerging as superstars in this arena.

The nutritional value of chickpeas is immense. They are a great source of nutritional fiber, vital vitamins, and minerals, as well as plant-based protein. They are perfect for people looking to improve their general health and well-being because of their well-rounded profile. Chickpeas provide a convenient and reasonably priced source of complete protein for individuals who are vegetarians, vegans, or trying to cut back on their animal intake. About 15 grams of protein can be found in one cup of cooked chickpeas, which makes them a great substitute for protein sources derived from animals. The rise of specific dietary trends like flexitarianism (reducing meat consumption while occasionally including it) and pescetarianism (focusing on plant-based protein with occasional seafood) creates fertile ground for chickpeas. They offer a versatile and protein-rich option to seamlessly integrate into these dietary patterns.

Latin America Chickpeas Market Restraints and Challenges:

Most Latin American countries rely on imports to meet their chickpea demand. This dependence on external sources exposes the market to global price fluctuations. Unfavorable weather conditions in major chickpea-producing regions can lead to supply chain disruptions and price hikes. Sudden price increases can make chickpeas a less affordable option for budget-conscious consumers. This can hinder market growth, particularly in regions with lower average incomes. The cost of storing and transporting imported chickpeas can be significant, impacting the final price paid by consumers. Improving storage infrastructure and exploring alternative transportation options could help mitigate these costs. While awareness of chickpeas is growing in Latin America, there's still a need to educate consumers about their versatility and culinary potential. Many consumers might only associate them with traditional stews and soups, limiting their perception of how chickpeas can be incorporated into meals. Chickpea consumption patterns vary across Latin America. While some regions have a strong tradition of using chickpeas, others might require more targeted marketing and education efforts to overcome potential resistance to unfamiliar ingredients. Chickpeas face competition from established staples like rice, beans, and corn in some Latin American countries. These ingrained dietary habits might require innovative approaches to position chickpeas as a valuable and versatile addition to the Latin American pantry. Compared to developed markets, Latin America might lag in chickpea product innovation. This limits consumer choices and hinders the market's potential to capture the interest of health-conscious and convenience-seeking demographics.

Latin America Chickpeas Market Opportunities:

Reducing reliance on imports through increased domestic chickpea production presents a significant opportunity. Investing in research to develop chickpea varieties that are drought-resistant and thrive in diverse Latin American climates is crucial. Providing training, subsidies, and access to improved chickpea farming techniques can incentivize farmers to cultivate chickpeas, fostering a secure domestic supply chain. Collaboration between governments, agricultural research institutions, and private companies can accelerate advancements in chickpea cultivation practices. Expanding the selection of ready-to-eat chickpea goods to include pre-marinated chickpeas for easy meal prep, microwaveable chickpea bowls, and seasoned chickpea snacks appeals to consumers with hectic schedules. There are several uses for chickpea flour as a gluten-free substitute. This creates opportunities for novel items like tortillas made from chickpeas and baking ingredients and pasta made from them. Latin American chefs can experiment by incorporating chickpeas into traditional dishes, creating exciting fusion recipes. This can introduce chickpeas to a wider audience while leveraging familiar flavors.

LATIN AMERICA CHICKPEAS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024- 2030 |

|

CAGR |

3.2% |

|

Segments Covered |

By Application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile, and Rest of Latin America |

|

Key Companies Profiled |

Agrosementia, BUNGE Argentina, Ingredion, Grupo Herdez, JBS S.A, Manufactura Nacional de Harinas, NotCo, YEMA |

Latin America Chickpeas Market Segmentation:

Latin America Chickpeas Market Segmentation: By Application:

- Kabuli Chickpeas

- Desi Chickpeas

Currently, Kabuli chickpeas hold the lion's share of the Latin American market, accounting for roughly 70-75% of total chickpea consumption. Kabuli chickpeas, with their larger size, light beige color, and mild, nutty flavor, are incredibly versatile. They adapt well to various culinary applications, from hearty stews and soups to creamy hummus and falafel. This adaptability makes them a favorite among home cooks and restaurants alike. The uniform size and light color of Kabuli chickpeas hold aesthetic appeal. They visually enhance dishes and contribute to a more consistent texture, particularly important in salads and cold appetizers. Kabuli chickpeas are generally more readily available in Latin American grocery stores compared to Desi varieties. This wider accessibility makes them the default choice for many consumers.

In Latin America, desi chickpeas presently account for 25–30% of the market. However, within the chickpea market, this segment is expanding at the quickest rate. Compared to Kabuli, Desi chickpeas have a stronger, earthier flavor profile. Those with experimental palates and those who are familiar with cuisines that feature Desi chickpeas will find this unique taste especially appealing as it adds depth and complexity to recipes. While the protein and fiber contents of Desi chickpeas are similar to those of Kabuli chickpeas, they may be slightly superior in terms of specific micronutrients like iron and folate. Desi variations may appeal to health-conscious consumers looking for a potentially more nutritious option.

Latin America Chickpeas Market Segmentation: By Distribution Channel

- Traditional Wet Markets

- Grocery Stores and Supermarkets

- Hypermarkets

- Online Grocery Platforms

Traditional Wet Markets hold a strong grip on chickpea distribution in Latin America, accounting for roughly 40-50% of the market share. Consumers can choose from various chickpea varieties, often purchasing smaller quantities based on immediate needs. Wet markets function as social hubs, fostering interaction with vendors who can provide insights into chickpea varieties, preparation tips, and traditional recipes. While offering a vibrant atmosphere, wet markets might have a more limited selection of pre-cooked or innovative chickpea products compared to other channels.

Online Grocery Platform is a rapidly growing channel that holds a market share of approximately 5-10% and is experiencing significant growth. Consumers can browse a wide selection of chickpea products from the comfort of their homes and have them delivered directly. Online platforms might offer access to specialty or imported chickpea products not readily available in traditional stores. E-commerce grocery delivery might not be readily available in all regions of Latin America, particularly rural areas. As convenience stores become more ubiquitous, they might offer a wider variety of pre-cooked chickpea snacks and ready-to-eat options, catering to busy urban consumers on the go.

Latin America Chickpeas Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

With an astounding 26% of the Latin American chickpea market, Brazil is without a doubt the market leader. This supremacy can be ascribed to several important reasons that have elevated Brazil's chickpea sector to a leadership position. With its enormous amounts of fertile land and ideal climate, Brazil is a global agricultural powerhouse. Large-scale chickpea farming has been made easier as a result, guaranteeing a consistent supply to satisfy domestic and global demand. The highly developed and technologically advanced food processing sector in Brazil makes it possible to process and add value to chickpeas efficiently. To accommodate a range of consumer tastes, this involves producing a variety of chickpea-based items, including flour, snacks, and ready-to-eat meals.

While Brazil dominates the overall market, Argentina is emerging as the fastest-growing chickpeas market in Latin America. With a market share of 24%, Argentina's chickpea industry is experiencing rapid growth. Argentina has been actively promoting agricultural diversification and crop rotation practices, encouraging farmers to incorporate chickpeas into their crop cycles. This has led to an increase in chickpea production, contributing to the market's growth. Argentinians are increasingly embracing plant-based diets and seeking alternative protein sources. Chickpeas, being a nutrient-dense and versatile legume, has gained popularity among health-conscious consumers, driving market expansion.

COVID-19 Impact Analysis on the Latin America Chickpeas Market:

The initial phase of the pandemic witnessed panic buying, leading to temporary shortages of dried chickpeas in some regions. Disruptions in global supply chains and transportation restrictions further hampered smooth chickpea imports. Consumers, prioritizing essential items, might have reduced their chickpea purchases initially, especially if they weren't regular consumers. This could have impacted overall chickpea sales in the short term. With lockdowns and social distancing measures in place, online grocery shopping witnessed a significant surge. While this might have benefited chickpea sales through e-commerce platforms, not all consumers had access to reliable internet or online grocery delivery services. While the initial disruptions might have eased, the pandemic exposed vulnerabilities in global supply chains. Building resilient supply chains with a focus on regional production or strategic partnerships with reliable chickpea producers can mitigate future risks. The surge in online grocery shopping is likely to continue at a normalized pace, offering chickpea producers and distributors new avenues to reach consumers directly or through online retailers.

Latest Trends/ Developments:

The growing popularity of ethnic cuisines like Middle Eastern and Indian food is creating exciting opportunities for chickpeas. Restaurants are featuring chickpea-based dishes like falafel and curries, familiarizing consumers with these culinary staples and potentially creating a lasting demand for chickpeas at home. While plant-based meat alternatives receive significant attention, the focus is shifting towards a broader range of plant-based options. Chickpea-based snacks, pasta, and even chickpea flour used as a gluten-free baking alternative are gaining traction, offering consumers diverse ways to incorporate chickpeas into their diets. Subscription boxes delivering curated selections of healthy or plant-based snacks are gaining popularity. Chickpea-based snacks can be a perfect fit for these boxes, reaching a targeted audience of health-conscious consumers. Additionally, D2C models are emerging, where chickpea producers and innovative chickpea-based food companies are exploring online marketplaces or subscription models to reach consumers directly. Food technology (food tech) startups are entering the Latin American chickpea market, developing innovative chickpea-based products using new processing techniques. These innovations could lead to products with improved texture, extended shelf life, or even novel chickpea-based ingredients for food manufacturers.

Key Players:

- Agrosementia

- BUNGE Argentina

- Ingredion

- Grupo Herdez

- JBS S.A

- Manufactura Nacional de Harinas

- NotCo

- YEMA

Chapter 1. Latin America Chickpeas Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Chickpeas Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Chickpeas Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Chickpeas Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Chickpeas Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Chickpeas Market– By Application

6.1. Introduction/Key Findings

6.2. Kabuli Chickpeas

6.3. Desi Chickpeas

6.4. Y-O-Y Growth trend Analysis By Application

6.5. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. Latin America Chickpeas Market– By Distribution channel

7.1. Introduction/Key Findings

7.2 Traditional Wet Markets

7.3. Grocery Stores and Supermarkets

7.4. Hypermarkets

7.5. Online Grocery Platforms

7.6. Y-O-Y Growth trend Analysis By Distribution channel

7.7. Absolute $ Opportunity Analysis By Distribution channel , 2024-2030

Chapter 8. Latin America Chickpeas Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Latin America

8.1.1. By Country

8.1.1.1. Mexico

8.1.1.2. Brazil

8.1.1.3. Argentina

8.1.1.4. Chile

8.1.1.5. Rest of Latin America

8.1.2. By Distribution channel

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Latin America Chickpeas Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Agrosementia

9.2. BUNGE Argentina

9.3. Ingredion

9.4. Grupo Herdez

9.5. JBS S.A

9.6. Manufactura Nacional de Harinas

9.7. NotCo

9.8. YEMA

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The rise of plant-based diets across the globe is finding fertile ground in Latin America. Consumers seeking alternative protein sources are drawn to chickpeas for their impressive content of protein and fiber, making them a healthy and versatile dietary addition.

While domestic chickpea production exists in some Latin American countries, it might not always meet the growing demand. Encouraging and supporting local chickpea farmers can help reduce dependence on imports and build a more resilient supply chain.

Agrosementia, BUNGE Argentina, Ingredion, Grupo Herdez, JBS S.A,

Manufactura Nacional de Harina's, NotCo, YEMA.

With an astounding 26% of the Latin American chickpea market, Brazil is without a doubt the market leader

Argentina is emerging as the fastest-growing chickpeas market in Latin

America. With a market share of 24%, Argentina's chickpea industry is experiencing