Latin America Agricultural Micronutrients Market Size (2024 - 2030)

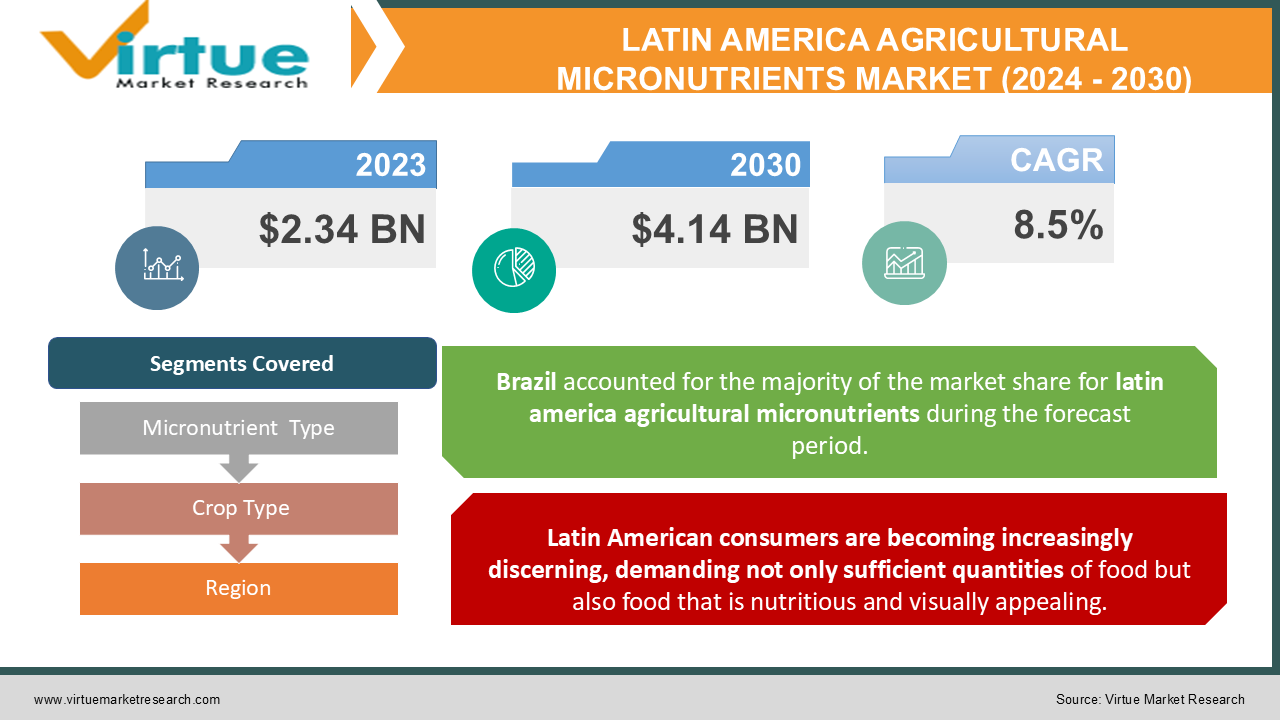

The Latin America Agricultural Micronutrients Market was valued at USD 2.34 Billion and is projected to reach a market size of USD 4.14 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.5%.

In Latin America, the agriculture industry is changing. A growing number of farmers are realizing how important micronutrients are to improving plant resilience, maximizing crop yields, and ultimately guaranteeing food security for an expanding population. Latin American consumers are requesting wholesome, high-quality cuisine. Micronutrients are essential for improving the nutritional profile of crops, which increases their consumer appeal and may result in higher profits for farmers. Technological advancements are paving the way for the development of more efficient and targeted micronutrient delivery systems. This can involve formulations with improved bioavailability or slow-release mechanisms for sustained nutrient availability to plants. Sustainable agricultural practices are gaining traction in Latin America. Micronutrients can play a role in sustainable farming by promoting soil health and potentially reducing reliance on macronutrients like nitrogen, phosphorus, and potassium, which can have environmental drawbacks when used in excess.

Key Market Insights:

Because of its emphasis on sustainable farming methods and output optimization, Brazil is expected to consume $1.7 billion worth of agricultural micronutrients domestically in 2024.

Given Argentina's dedication to raising agricultural production, the country's domestic market for agricultural micronutrients is expected to be worth $1.1 billion by the end of 2024.

With variations depending on quality and formulation parameters, the average cost of iron-based micronutrients in the Latin American market is projected to be approximately $5.2 per kilogram in 2024.

It is projected that the agricultural micronutrient market in Latin America will invest $280 million in research and development by 2024, with a particular emphasis on creating novel and customized formulations for particular crop kinds and soil types.

By 2024, the agricultural micronutrient industry based on copper is expected to be worth $2.7 billion worldwide, with over $700 million coming from Latin America.

A new agricultural micronutrient manufacturing plant in Brazil is expected to cost, on average, $24 million by 2024 when land acquisition, equipment, and startup expenses are taken into consideration.

Argentina's attempts to draw investments and support the industry are reflected in the estimated $18 million average cost of establishing a new agricultural micronutrient production facility in 2024.

Based on quality, brand, and formulation considerations, the average cost of molybdenum-based micronutrients in the Latin American market is anticipated to be approximately $8.4 per kilogram in 2024.

It is projected that the global market for agricultural micronutrients based on chlorine will reach $920 million by 2024, with Latin America accounting for about $240 million of this total.

Brazil's advanced infrastructure and technological skills are predicted to translate into an average cost of $1.6 per kilogram for agricultural micronutrient processing and formulation by 2024.

Latin America Agricultural Micronutrients Market Drivers:

Latin American consumers are becoming increasingly discerning, demanding not only sufficient quantities of food but also food that is nutritious and visually appealing.

Micronutrients are necessary for plants to grow and flourish. Inadequate levels of essential micronutrients like zinc, iron, and boron can result in stunted development, reduced fruit and vegetable yields, and a reduction in the overall nutritional value. By making sure the soil contains the proper number of micronutrients, farmers can grow crops with a richer nutritional profile, potentially including higher concentrations of vitamins, minerals, and antioxidants. This produces crops that are more beneficial to consumers' health and more aesthetically beautiful. Latin America is a major exporter of agricultural products, with a growing focus on high-value crops like fruits, vegetables, and specialty grains. These export markets often have stringent quality criteria, like minimum micronutrient content limitations.

The overreliance on macronutrient fertilizers, coupled with factors like erosion and climate change, has led to significant depletion of essential micronutrients in the soil.

Micronutrient fertilizers offer a targeted approach to addressing soil deficiencies. Unlike traditional macronutrient fertilizers, micronutrients are applied in smaller quantities, delivering the specific elements needed to restore soil health and promote optimal plant growth. This targeted approach minimizes environmental impact compared to excessive use of macronutrients, which can have unintended consequences like soil salinization or water pollution. Micronutrients are essential to the upkeep of robust soil ecosystems. Micronutrients can enhance soil fertility and structure by encouraging beneficial microbial activity and root growth. Consequently, this improves the ability to retain water and lessens the need for intensive irrigation, which is a major issue in areas of Latin America that are vulnerable to drought. Furthermore, healthy soils have a higher capacity to store carbon, which helps to lessen the effects of climate change. Climate change presents a significant threat to agricultural productivity in Latin America. Micronutrients can play a vital role in helping crops adapt to environmental stresses.

Latin America Agricultural Micronutrients Market Restraints and Challenges:

While awareness about micronutrients is growing, knowledge gaps persist among some farmers, particularly smallholders in remote areas. Traditional practices and limited access to extension services can hinder the adoption of micronutrient fertilization techniques. Effective micronutrient application requires knowledge of factors like soil type, crop requirements, and the specific micronutrient formulation. A lack of understanding regarding optimal application rates and timing might lead to underutilization or misuse of micronutrients, hindering their effectiveness. Some farmers might prioritize immediate results and focus solely on macronutrient fertilizers, overlooking the long-term benefits of micronutrients in promoting soil health and sustainable practices. When considering the cost per unit, micronutrient fertilizers may be more costly than conventional macronutrient fertilizers. This price differential can be a major deterrent for farmers with little resources, especially smallholders who are working with narrow profit margins. For farmers used to quick fixes, the long-term advantages of micronutrients, such as enhanced soil health and possibly increased yields, might not be immediately evident. This may make people hesitant to spend money on micronutrient fertilizers, particularly in light of the scarcity of small-scale agriculture-specific funding options.

Latin America Agricultural Micronutrients Market Opportunities:

Advancements in precision agriculture techniques offer exciting possibilities for optimizing micronutrient use. Soil testing combined with data analysis can guide the application of micronutrients based on specific field requirements. This targeted approach minimizes waste, maximizes efficiency, and ensures crops receive the precise micronutrients they need for optimal growth. Traditional micronutrients can be prone to leaching or fixation in the soil, reducing their effectiveness. The development of slow-release formulations or encapsulated micronutrients can offer a solution. These formulations release micronutrients gradually over time, ensuring a more consistent supply to plants and maximizing nutrient uptake efficiency. Biofertilizers containing beneficial microbes can enhance the bioavailability of micronutrients in the soil, promoting better plant uptake. Additionally, micronutrient-coated seeds can provide a targeted initial boost of essential nutrients during the critical germination and seedling stages. Micronutrients play a crucial role in promoting beneficial soil microbial activity and fostering healthy root development. This translates to improved soil structure, increased water retention capacity, and reduced reliance on irrigation, a critical benefit in drought-prone regions. Additionally, healthy soils are better equipped to store carbon, mitigating the effects of climate change.

ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.5% |

|

Segments Covered |

By Micronutrient Type, crop type, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile and Rest of Latin America |

|

Key Companies Profiled |

Elantas GmbH (Germany), Axalta Coating Systems (the U.S.), Von Roll Holdings AG (Switzerland), Hitachi Chemicals Company Ltd. (Japan), 3M Company (the U.S.), and Kyocera Corporation (Japan) |

Latin America Agricultural Micronutrients Market Segmentation:

Latin America Agricultural Micronutrients Market Segmentation: By Micronutrient Type:

- Zinc (Zn)

- Boron (B)

- Copper (Cu)

- Manganese (Mn)

- Molybdenum (Mo)

- Iron (Fe)

- Cobalt (Co)

Zinc (Zn) holds the crown as the most dominant micronutrient in the Latin American Agricultural micronutrient market, capturing an estimated 30-35% share. Zinc plays a vital role in a wide range of crops, from fruits and vegetables (particularly stone fruits and citrus) to cereals and legumes. It is essential for plant growth, seed production, and disease resistance. Zinc deficiencies are prevalent in many Latin American soils due to factors like leaching and erosion. Zinc application offers a targeted solution to replenish depleted levels and ensure optimal crop growth.

With a projected growth rate of more than 5% per year, boron (B) is quickly becoming a fast-growing segment within the Latin American Agricultural micronutrient market. The boron market is being driven by the rising demand for high-value products such as fruits, nuts, and vegetables. For fruit and vegetable quality to be at its best, boron is required for cell wall production, sugar transfer, and pollen development. Deficits in boron are becoming more widely known, especially in crops like avocados and stone fruits. Farmers can overcome these limitations and grow superior food that satisfies export requirements by applying targeted boron.

Latin America Agricultural Micronutrients Market Segmentation: By Crop Type:

- Fruits and Vegetables

- Cereals

- Pulses and Oilseeds

- Others

In the Latin American Agricultural Micronutrients Market, fruits and vegetables are the dominant product category, contributing significantly to the demand for micronutrients. Micronutrients such as calcium, zinc, and boron help produce fruits and vegetables with more vivid colors, a firmer texture, and a longer shelf life, which increases their visual appeal to customers. For human health, micronutrients are vital. Farmers contribute to a more nutrient-dense food supply by guaranteeing that fruits and vegetables have sufficient levels of micronutrients. High-value fruits and vegetables are exported by several Latin American nations. These exports frequently have strict quality restrictions, such as minimum requirements for vitamin content. Applying micronutrients enables farmers to grow food of export quality and gain access to exclusive markets.

Specialty crops represent the fastest-growing segment within the Latin American Agricultural Micronutrients Market. Specialty crops often command premium prices in international markets. Micronutrients empower farmers to cultivate these high-value crops and maximize their profitability. Many specialty crops are cultivated using sustainable and organic farming methods. Micronutrients can effectively address potential nutrient deficiencies in organic fertilizers, ensuring the health and productivity of these specialty crops.

Latin America Agricultural Micronutrients Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

In Latin America, Brazil leads the way in the market for agricultural micronutrients. Brazil has become a major producer and user of micronutrients for a range of agricultural purposes due to its extensive agricultural sector, ideal climate, and strong emphasis on sustainable farming methods. Brazil boasts a vast and diverse agricultural sector, encompassing a wide range of crops, from grains and oilseeds to fruits and vegetables. This expansive agricultural landscape creates a significant demand for micronutrients to enhance crop yields, quality, and soil health.

Colombia has emerged as the fastest-growing country in the Latin American agricultural micronutrient market. Colombia has actively pursued diversification efforts within its agricultural sector, venturing into new crop varieties and expanding its agricultural frontiers. This diversification has driven the demand for specific micronutrient formulations tailored to different crop types and soil conditions. Colombian agricultural policies have emphasized sustainable intensification strategies, encouraging the efficient use of micronutrients to optimize crop yields while minimizing environmental impact.

COVID-19 Impact Analysis on the Latin America Agricultural Micronutrients Market:

Strict lockdown restrictions that were imposed in several Latin American countries seriously affected the micronutrient supply chains. Movement limitations made it difficult to transfer completed micronutrient goods and raw materials, which caused shortages and price swings in some areas. The epidemic caused a downturn in the world economy, which in turn reduced demand for several agricultural products, especially those sold to the restaurant and hospitality industries. As a result, the market for the micronutrients used in these crops experienced a brief decline. COVID-19 labor shortages at micronutrient manufacturing facilities and agricultural operations were caused by 19 outbreaks and social distancing practices. Farmers trying to obtain micronutrients faced logistical difficulties and a reduction in output capacity as a result. Lockdowns and social distancing measures accelerated the adoption of e-commerce platforms for purchasing agricultural inputs, including micronutrients. This trend offered farmers a convenient and potentially safer way to access micronutrients during a time of restricted movement.

Latest Trends/ Developments:

A more focused approach to micronutrient application is replacing the conventional "one-size-fits-all" method. With the aid of data analytic tools and soil testing, farmers may pinpoint specific micronutrient deficits in their farms. With this knowledge, they are better equipped to decide what kind and how many micronutrients are needed for the best crop growth in particular regions. VRA and other precision agriculture technologies are transforming the way micronutrients are used. VRA systems use sensor and GPS data to dynamically modify the rate at which micronutrients are applied, taking into account the unique requirements of various zones within a field. By doing this, waste is reduced, resources are allocated as efficiently as possible, and crops are given the precise micronutrients they require for healthy growth.

Key Players:

- BASF SE

- The Mosaic Company

- Yara International ASA

- Nouryon

- Fertipar

- Tecnoagro

- Agrolatina

- Bio Fertilizantes

- Symborg

Chapter 1. Latin America Extruded Snacks Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Extruded Snacks Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Extruded Snacks Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Extruded Snacks Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Extruded Snacks Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Extruded Snacks Market– By Micronutrient Type

6.1. Introduction/Key Findings

6.2. Zinc (Zn)

6.3. Boron (B)

6.4. Copper (Cu)

6.5. Manganese (Mn)

6.6. Molybdenum (Mo)

6.7. Iron (Fe)

6.8. Cobalt (Co)

6.9. Y-O-Y Growth trend Analysis By Micronutrient Type

6.10. Absolute $ Opportunity Analysis By Micronutrient Type , 2024-2030

Chapter 7. Latin America Extruded Snacks Market– By Crop Type

7.1. Introduction/Key Findings

7.2 Fruits and Vegetables

7.3. Cereals

7.4. Pulses and Oilseeds

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Crop Type

7.7. Absolute $ Opportunity Analysis By Crop Type , 2024-2030

Chapter 8. Latin America Extruded Snacks Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Latin America

8.1.1. By Country

8.1.1.1. Mexico

8.1.1.2. Brazil

8.1.1.3. Argentina

8.1.1.4. Chile

8.1.1.5. Rest of Latin America

8.1.2. By Micronutrient Type

8.1.3. By Crop Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Latin America Extruded Snacks Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. BASF SE

9.2. The Mosaic Company

9.3. Yara International ASA

9.4. Nouryon

9.5. Fertipar

9.6. Tecnoagro

9.7. Agrolatina

9.8. Bio Fertilizantes

9.9. Symborg

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Latin America Agricultural Micronutrients Market was valued at USD 2.34 Billion and is projected to reach a market size of USD 4.14 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.5%.

Limited awareness among farmers can restrict the overall growth of the micronutrient market. If farmers don't perceive the value proposition of micronutrients, they might be hesitant to adopt these practices, hindering market expansion.

BASF SE, The Mosaic Company, Yara International ASA, Nouryon, Fertipar, Tecnoagro, Agrolatina, Bio Fertilizantes, Symborg

Brazil's market share in the Latin American agricultural micronutrient market is estimated to be around 38.5%, solidifying its position as the dominant player in the region

Colombia's market share in the Latin American agricultural micronutrients market is estimated to be around 14.2%, and it is expected to continue its rapid growth trajectory in the coming years.