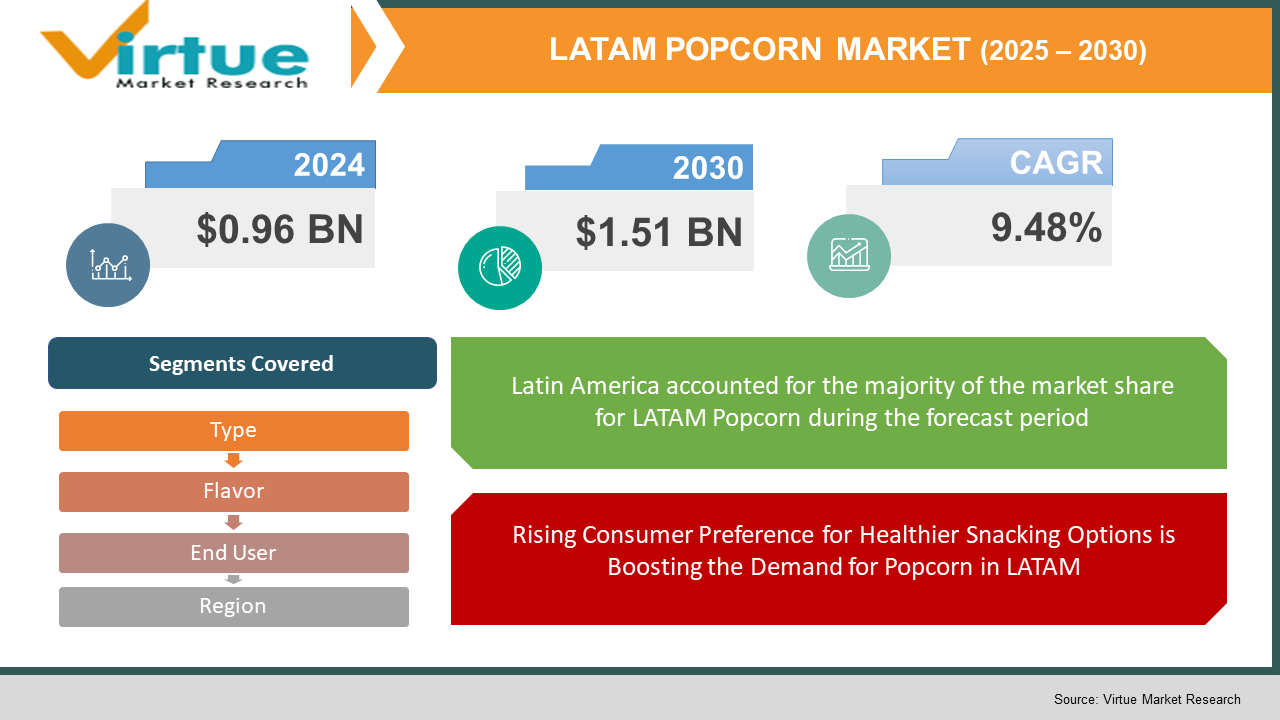

LATAM Popcorn Market Size (2025-2030)

The LATAM Popcorn Market was valued at USD 0.96 billion in 2024 and is projected to reach a market size of USD 1.51 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.48%.

The Latin America (LATAM) popcorn market is witnessing significant growth, fueled by changing consumer preferences, increasing demand for convenient snacking options, and the rising popularity of ready-to-eat (RTE) popcorn. With a strong cultural affinity for snacking and the growing influence of global food trends, the region is experiencing a surge in demand for flavored and gourmet popcorn varieties. The expansion of modern retail channels, including supermarkets, convenience stores, and online platforms, has further facilitated easy access to a diverse range of popcorn products, contributing to market expansion. Additionally, the increasing health consciousness among consumers has fueled demand for healthier snack alternatives, leading to the introduction of organic, low-fat, and air-popped popcorn options. With the evolving snacking culture and rising disposable incomes, the LATAM popcorn market is poised for sustained growth in the coming years.

Key Market Insights:

- The LATAM popcorn market is witnessing steady growth, driven by changing consumer lifestyles and the increasing demand for convenient, on-the-go snack options. Studies indicate that over 60% of Latin American consumers prefer snacking over traditional meals, with popcorn emerging as a top choice due to its light and crunchy texture. Ready-to-eat (RTE) popcorn has gained massive popularity, accounting for a significant portion of total sales, as consumers look for hassle-free, pre-packaged options. Additionally, microwave popcorn remains a household staple, particularly in urban areas where convenience plays a major role in purchasing decisions.

- Flavored popcorn is becoming a major trend in the LATAM market, with caramel and cheese flavors leading the segment. Reports suggest that nearly 40% of popcorn consumers in the region prefer sweet flavors, while 35% opt for savory options. This demand has prompted manufacturers to introduce a diverse range of innovative flavors, including spicy, chocolate, and exotic fruit-infused varieties. Countries like Brazil and Mexico are leading in flavored popcorn consumption, with local brands expanding their portfolios to cater to evolving taste preferences.

- The rising focus on health-conscious snacking is also shaping the LATAM popcorn market, with more consumers seeking organic, gluten-free, and low-calorie options. Research indicates that nearly 30% of snack buyers in the region actively look for healthier alternatives, leading to the growth of air-popped and whole grain popcorn products. International brands and regional manufacturers are responding by launching popcorn varieties with reduced sodium, no artificial additives, and high-fiber content to attract health-conscious consumers.

LATAM Popcorn Market Drivers:

Rising Consumer Preference for Healthier Snacking Options is Boosting the Demand for Popcorn in LATAM

Consumers across Latin America are becoming increasingly health-conscious, leading to a increasing preference for low-calorie, whole-grain snack options like popcorn. Unlike traditional fried snacks, popcorn is perceived as a healthier alternative due to its fiber-rich nature and low-fat content. This shift is further fueled by the rising awareness of diet-related health issues, such as obesity and heart disease, prompting consumers to opt for air-popped and minimally processed popcorn varieties. As a result, manufacturers are introducing organic, gluten-free, and low-sodium popcorn products to cater to the evolving demands of health-conscious consumers.

Expanding E-commerce and Online Retail Channels are Driving Popcorn Sales in the Region

The rapid digital transformation in Latin America has significantly impacted consumer purchasing habits, with online retail and e-commerce platforms witnessing substantial growth. With the convenience of doorstep delivery, a wider variety of flavors, and exclusive online discounts, more consumers are opting to purchase popcorn through digital channels. Platforms like Mercado Libre, Amazon, and local grocery delivery services are making it easier for brands to reach a broader audience. The trend of online grocery shopping, fueled by the pandemic, has further strengthened the demand for ready-to-eat and microwave popcorn, leading to increased market penetration.

Increasing Popularity of Flavored and Gourmet Popcorn is Driving Market Growth

Latin American consumers are showing a rising interest in innovative and exotic popcorn flavors, moving beyond the traditional butter and salt variants. Gourmet popcorn offerings, such as caramel, cheese, spicy chili, and chocolate-coated varieties, are gaining popularity, especially among younger consumers. This trend is driven by social media influence, where visually appealing and unique flavors are trending among snack enthusiasts. Additionally, the increasing presence of gourmet popcorn brands in movie theaters, shopping malls, and specialty snack stores is contributing to the expansion of the premium popcorn segment in LATAM.

Growth of the Entertainment Industry is Positively Impacting Popcorn Consumption

Popcorn remains an essential snack associated with entertainment experiences, including movie theaters, sports events, and concerts. The recovering cinema industry in Latin America, following the pandemic, has led to a resurgence in demand for popcorn, particularly in multiplexes and independent theaters. Additionally, the surge of home entertainment, fueled by streaming services like Netflix and Disney+, has boosted at-home popcorn consumption. As more consumers opt for movie nights and gaming sessions at home, the demand for microwave and ready-to-eat popcorn continues to rise, reinforcing its position as a staple snack in LATAM households.

LATAM Popcorn Market Restraints and Challenges:

Supply Chain Disruptions and Fluctuating Raw Material Costs are Hindering Market Growth

The LATAM popcorn market faces significant challenges because of supply chain inefficiencies and the fluctuating costs of raw materials, particularly corn. Many countries in the region rely on corn imports, making them vulnerable to price volatility caused by factors such as climate change, geopolitical tensions, and trade restrictions. Additionally, inadequate infrastructure and logistical challenges in certain regions lead to distribution delays and increased transportation costs, affecting the overall profitability of popcorn manufacturers. Furthermore, the competition from traditional local snacks and regulatory hurdles related to food safety and labeling requirements pose additional challenges for companies trying to expand their market presence.

LATAM Popcorn Market Opportunities:

The LATAM popcorn market is witnessing growing opportunities due to the rising consumer preference for healthier snacking options. As awareness about nutrition grows, demand for organic, non-GMO, and low-calorie popcorn is surging, encouraging manufacturers to introduce innovative and functional products. Additionally, the premiumization of popcorn with gourmet flavors such as caramel, cheese, and spicy varieties is attracting a broader consumer base, particularly in urban areas. The expansion of e-commerce and digital retail channels is also enabling greater accessibility and convenience for consumers, allowing brands to reach a wider audience and tap into new market segments.

LATAM POPCORN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.48% |

|

Segments Covered |

By Type, Flavour, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Latin America |

|

Key Companies Profiled |

ConAgra Brands, Inc., The Hershey Company (SkinnyPop), Weaver Popcorn Company, Inc., and Popcornopolis |

LATAM Popcorn Market Segmentation:

LATAM Popcorn Market Segmentation: By Type:

- Microwave

- Ready-to-Eat

The Ready-to-Eat (RTE) popcorn segment dominates the LATAM popcorn market, fueled by its convenience, diverse flavor options, and growing urbanization, which has led consumers to prefer on-the-go snacking solutions that require no preparation. The increasing availability of premium RTE popcorn with gourmet flavors, healthier ingredients, and innovative packaging has further strengthened its market position, making it a preferred choice among busy professionals and younger demographics.

The Microwave popcorn segment is the fastest-growing category in the LATAM popcorn market, driven by the rising adoption of home entertainment culture, affordable pricing, and the perception of it being a healthier alternative to traditional fried snacks. Consumers are increasingly shifting towards microwave popcorn due to its customizable seasoning options, easy preparation, and the availability of healthier variants, including organic, reduced-fat, and non-GMO options, further accelerating its market expansion.

LATAM Popcorn Market Segmentation: By Flavor:

- Butter

- Cheese

- Caramel

- Spicy

- Sweet

- Exotic Flavors

The Butter-flavored popcorn segment holds the dominant position in the LATAM popcorn market, fueled by its timeless appeal and strong consumer preference for classic, savory snacks. Butter popcorn has long been associated with cinema experiences, family movie nights, and casual snacking, making it a household staple across Latin America. The familiarity and rich, indulgent taste of butter-flavored popcorn continue to attract consumers across various age groups, reinforcing its market leadership. Moreover, this segment benefits from the wide availability of both microwaveable and ready-to-eat (RTE) formats, ensuring convenience for consumers who prefer quick and easy snack options. With established distribution channels, including supermarkets, convenience stores, and online retail platforms, butter popcorn remains a top-selling product, consistently driving high sales volume in the region.

The Exotic Flavors segment is emerging as the fastest-growing category in the LATAM popcorn market, fueled by increasing consumer demand for bold, innovative, and regionally inspired tastes. Shifting consumer preferences, particularly among younger demographics, have led to a surge in unique flavor experiments such as chili-lime, dulce de leche, chocolate-drizzled popcorn, and caramelized tropical fruit infusions. This trend is influenced by the rising influence of global snack innovation and the premiumization of the popcorn market, as consumers seek more sophisticated, gourmet flavors beyond traditional offerings. The growth of health-conscious, natural, and organic flavor variants is also accelerating the expansion of this segment, as brands introduce low-calorie, preservative-free, and artisanal popcorn products to cater to evolving dietary preferences.

LATAM Popcorn Market Segmentation: By End User:

- Household

- Commercial

The Household segment is the dominant end-user category in the LATAM popcorn market, as home consumption continues to drive the demand for both microwaveable and ready-to-eat (RTE) popcorn. Families and individuals across Latin America frequently purchase popcorn for home snacking, movie nights, and gatherings, making it a staple in household pantries. The affordability, convenience, and long shelf life of popcorn contribute to its strong presence in the household segment, with supermarkets and online retail platforms serving as primary distribution channels. Additionally, health-conscious consumers are increasingly opting for air-popped, low-fat, and organic popcorn variants, further strengthening the need within this segment.

The Commercial segment is experiencing rapid growth, driven by the expansion of cinemas, entertainment venues, amusement parks, and food service providers across Latin America. Popcorn remains an essential snack offering in movie theaters, sports stadiums, and casual dining establishments, where consumers seek indulgent and flavorful options. With the return of large-scale public events and the rising trend of gourmet popcorn in specialty stores and cafes, the commercial segment is witnessing a surge in demand. Businesses are increasingly offering premium, artisanal, and exotic-flavored popcorn options to attract consumers looking for unique snacking experiences. The segment's growth is further supported by the proliferation of vending machines, convenience stores near entertainment hubs, and partnerships between popcorn brands and foodservice providers.

LATAM Popcorn Market Segmentation: Regional Analysis:

The Latin American popcorn market is witnessing steady growth, driven by growing consumer demand for convenient, ready-to-eat snacks and the rising popularity of cinema culture and at-home entertainment. The region’s diverse consumer preferences, influenced by local flavors and snacking habits, are shaping the market dynamics. Countries such as Brazil, Mexico, and Argentina are leading contributors to the market, with significant consumption in both household and commercial sectors.

Brazil, being the largest economy in Latin America, dominates the regional popcorn market because of its high urban population, well-established retail infrastructure, and growing health-conscious consumer base. Mexico follows closely, driven by a strong cinema industry, increasing fast-food chains, and the influence of U.S. snacking trends. Argentina, Colombia, and Chile are also expanding their popcorn markets, fueled by rising disposable incomes and an increasing preference for premium and gourmet popcorn flavors. The rest of Latin America, including Peru and Ecuador, is witnessing gradual adoption, with local snack brands introducing new product innovations to cater to evolving consumer demands.

COVID-19 Impact Analysis on the LATAM Popcorn Market:

The COVID-19 pandemic had a mixed impact on the Latin American popcorn market, with initial disruptions in supply chains and retail closures affecting sales. However, the surge in at-home entertainment and streaming services significantly boosted demand for microwave and ready-to-eat popcorn, as consumers sought affordable and convenient snacking options. While the closure of cinemas and public entertainment venues initially led to a decline in commercial sales, the market rebounded as restrictions eased and theaters reopened. Additionally, the pandemic accelerated the shift toward online retail channels, with e-commerce platforms becoming a key distribution channel for popcorn brands across Latin America.

Latest Trends/ Developments:

The Latin American popcorn market is experiencing a surge in demand for healthier and innovative flavor options, driven by changing consumer preferences. Brands are increasingly offering low-fat, organic, and gluten-free popcorn to cater to health-conscious consumers. The trend of gourmet and artisanal popcorn varieties is also on the rise, with flavors like spicy chili, chocolate drizzle, and caramelized nuts gaining popularity. Additionally, the growth of ready-to-eat (RTE) popcorn is outpacing traditional microwave popcorn, as consumers seek convenient, on-the-go snacking options.

The expansion of online retail and direct-to-consumer (DTC) channels has transformed how popcorn is sold in Latin America. Many brands are now focusing on digital marketing strategies, subscription-based models, and influencer partnerships to reach a wider audience. E-commerce platforms and quick-commerce (Q-commerce) delivery services have further boosted sales, making premium and international popcorn brands more accessible. Moreover, sustainability trends are influencing packaging choices, with brands shifting toward biodegradable and eco-friendly materials to align with growing environmental awareness among consumers.

Key Players:

- ConAgra Brands, Inc.

- The Hershey Company (SkinnyPop)

- Weaver Popcorn Company, Inc.

- Popcornopolis

- Intersnack Group GmbH & Co. KG

- PepsiCo (Smartfood)

- Borges International Group

- Grupo Bimbo

- Act II

- Marilan Alimentos S.A.

Chapter 1. LATAM Popcorn Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. LATAM Popcorn Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. LATAM Popcorn Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Type Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. LATAM Popcorn Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. LATAM Popcorn Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. LATAM Popcorn Market – By Type

6.1 Introduction/Key Findings

6.2 Microwave

6.3 Ready-to-Eat

6.4 Y-O-Y Growth trend Analysis By Type :

6.5 Absolute $ Opportunity Analysis By Type :, 2025-2030

Chapter 7. LATAM Popcorn Market – By Flavor

7.1 Introduction/Key Findings

7.2 Butter

7.3 Cheese

7.4 Caramel

7.5 Spicy

7.6 Sweet

7.7 Exotic Flavors

7.8 Y-O-Y Growth trend Analysis By Flavor

7.9 Absolute $ Opportunity Analysis By Flavor , 2025-2030

Chapter 8. LATAM Popcorn Market – By End-User

8.1 Introduction/Key Findings

8.2 Household

8.3 Commercial

8.4 Y-O-Y Growth trend Analysis End-User

8.5 Absolute $ Opportunity Analysis End-User , 2025-2030

Chapter 9. LATAM Popcorn Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. South America

9.4.1. By Country

9.1.1.1. Brazil

9.1.1.2. Argentina

9.1.1.3. Colombia

9.1.1.4. Chile

9.1.1.5. Rest of South America

9.1.2. By End-User

9.1.3. By Flavor

9.1.4. By Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. LATAM Popcorn Market – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

10.1 ConAgra Brands, Inc.

10.2 The Hershey Company (SkinnyPop)

10.3 Weaver Popcorn Company, Inc.

10.4 Popcornopolis

10.5 Intersnack Group GmbH & Co. KG

10.6 PepsiCo (Smartfood)

10.7 Borges International Group

10.8 Grupo Bimbo

10.9 Act II

10.10 Marilan Alimentos S.A.

Download Sample

Choose License Type

2500

3400

3900

4600