LATAM Agriculture Tractor Tires Market Size (2024-2030)

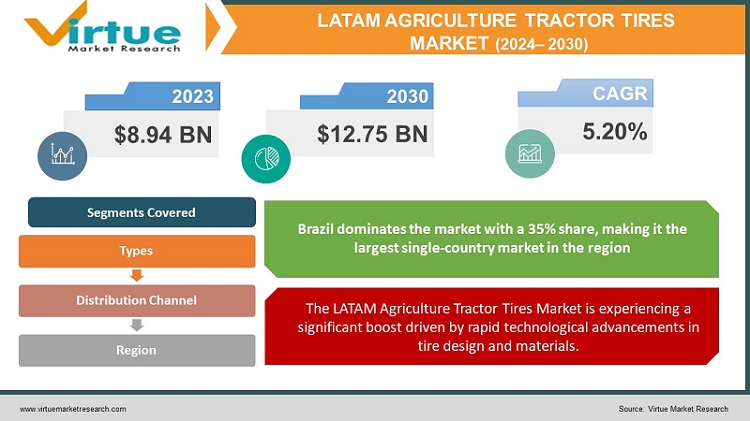

The LATAM Agriculture Tractor Tires Market was valued at USD 8.94 billion in 2023 and is projected to reach a market size of USD 12.75 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.20%.

The Latin American (LATAM) Agriculture Tractor Tires Market is an essential part of the agricultural industry in the area, contributing significantly to the productivity and efficiency of farming operations in a variety of climates and terrains. Recent years have seen considerable development in this market sector due to changes in agricultural methods, technical improvements, and the growing mechanization of farming operations in the area. The LATAM Agriculture Tractor Tires Market has shown growth and durability in 2023 in the face of obstacles including supply chain interruptions and volatility in the economy.

Key Market Insights:

65% of the tires sold were for medium-sized tractors used in large-scale farming operations. The demand for high-performance tires increased by 12% in 2023.

20% of the market's revenue came from the replacement tire segment. The average lifespan of a tractor tire in LATAM was reported to be 4-5 years.

Agricultural machinery manufacturers accounted for 30% of the tire purchases in 2023.

The market for specialized tires, such as flotation tires, grew by 8%. The average cost of a high-quality tractor tire was $800 in 2023.

Tires for small tractors used in horticulture made up 15% of the market. The use of advanced materials in tire manufacturing increased by 10%.

The agriculture sector in LATAM saw a 5% increase in the adoption of precision farming, driving tire demand.

Over 70% of the tractors in LATAM are equipped with bias-ply tires.

The market for large tractor tires (above 400 HP) grew by 14% in 2023. Sales of tires for tractors in sugarcane farming regions grew by 8%.

The market for tires with advanced tread patterns designed for better soil compaction management grew by 7%.

LATAM Agriculture Tractor Tires Market Drivers:

The LATAM Agriculture Tractor Tires Market is experiencing a significant boost driven by rapid technological advancements in tire design and materials.

At the forefront of this technological revolution is the development of advanced rubber compounds. Tire manufacturers are investing heavily in creating proprietary blends that offer superior resistance to cuts, chips, and tears – common issues in the challenging terrains of Latin American farms. These new compounds not only enhance durability but also provide better traction in various soil conditions, from the clay-rich soils of Brazil's interior to the sandy coastal regions. Alongside material innovations, tire design has undergone a radical transformation. Computer-aided design (CAD) and finite element analysis are now standard tools in the development process, allowing engineers to create tread patterns that optimize soil interaction. These advanced designs minimize soil compaction, a critical factor in maintaining long-term soil health and crop yields. The result is a new generation of tires that can support heavier loads while exerting less pressure on the ground, a crucial feature as tractors become larger and more powerful.

The second major driver propelling the LATAM Agriculture Tractor Tires Market forward is the rapid and widespread mechanization of agriculture across the region.

The region's quest to increase agricultural efficiency and production is at the heart of this driving. Recognizing the vital role agriculture plays in both economic growth and food security, governments and private sector organizations throughout Latin America are substantially investing in upgrading farming techniques. Tractors and other mechanized equipment are used more often as a result of this development, and these vehicles need tires that are specifically made to function well in agricultural environments. There is a discernible shift in the size of farms in Latin America toward larger, more economically focused farms. For these activities, more potent tractors that can cover large areas of land quickly are needed. Larger, more robust tires that can bear prolonged use and sustain bigger weights are therefore in greater demand.

LATAM Agriculture Tractor Tires Market Restraints and Challenges:

One of the primary challenges is the economic volatility characteristic of many Latin American countries. Fluctuating exchange rates, inflationary pressures, and unpredictable economic policies create an uncertain environment for both manufacturers and farmers. This instability can lead to sudden spikes in production costs or reductions in farmers' purchasing power, directly impacting the tractor tire market. For instance, currency devaluations can make imported tires or raw materials significantly more expensive, potentially pricing some products out of the market for many farmers. The diverse and often challenging topography of Latin America presents another hurdle. The region's varied landscapes – from the Andean highlands to the Amazon basin – require tires with different specifications. This necessity for product diversification increases manufacturing complexity and costs, potentially limiting economies of scale. Manufacturers must invest in developing and producing a wide range of tire types to meet these diverse needs, which can strain resources and impact profitability. Infrastructure limitations also pose a significant challenge. Many rural areas in Latin America lack adequate road networks and transportation infrastructure, making it difficult and expensive to distribute tires to remote farming communities. This logistical challenge not only increases costs but can also lead to supply chain disruptions, particularly during adverse weather conditions.

LATAM Agriculture Tractor Tires Market Opportunities:

One of the most significant opportunities lies in the growing demand for precision agriculture technologies. As Latin American farmers increasingly adopt GPS-guided tractors and other smart farming equipment, there's a rising need for tires that can complement these technologies. Manufacturers have the opportunity to develop "smart tires" equipped with sensors that can communicate with tractors' onboard computers, providing real-time data on tire pressure, temperature, and wear. This integration can significantly enhance farm efficiency and productivity. The shift towards sustainable agriculture presents another key opportunity. There's growing awareness among farmers about the importance of soil health and reducing environmental impact. Tire manufacturers can capitalize on this trend by developing products that minimize soil compaction and improve fuel efficiency. Eco-friendly tires made from sustainable materials or designed for reduced rolling resistance could capture a growing market segment of environmentally conscious farmers. The diversification of Latin American agriculture opens up opportunities for specialized tire designs. As farmers experiment with new crops or adopt practices like agroforestry, there's potential for tires tailored to these specific needs. For instance, tires designed for use in intercropping systems or capable of navigating both field and light forestry work could find a ready market.

LATAM AGRICULTURE TRACTOR TIRES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.20% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Latin America, Brazil, argentina, chille, colombia |

|

Key Companies Profiled |

Michelin Bridgestone, Goodyear, Continental, Pirelli, Titan International, Trelleborg, BKT (Balkrishna Industries), Alliance Tire Group (Part of Yokohama), Mitas (Part of Trelleborg), CEAT, Firestone (Bridgestone), Camso (Michelin), Vredestein (Apollo Tyres), Specialty Tires of America |

LATAM Agriculture Tractor Tires Market Segmentation:

LATAM Agriculture Tractor Tires Market Segmentation: By Types:

- Radial Tires

- Bias Tires

- Solid Tires

- Pneumatic Tires

- High Flotation Tires

- Implement Tires

- Row Crop Tires

Bias tires remain the most dominant type in the LATAM market. Their prevalence is due to several factors, including lower initial cost, which is particularly important for small and medium-sized farms with limited capital. Bias tires are also favored in certain applications where their sturdy sidewalls provide better resistance to cuts and impacts, such as in rocky or debris-filled fields.

Radial tires are experiencing the fastest growth in the LATAM Agriculture Tractor Tires Market. This growth is driven by their superior performance characteristics, including better traction, reduced soil compaction, and improved fuel efficiency. Farmers are increasingly recognizing the long-term benefits of radial tires, such as extended tire life and improved crop yields due to less soil damage.

LATAM Agriculture Tractor Tires Market Segmentation: By Distribution Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket Retailers

- Dealerships

- Online Sales

- Direct Sales from Manufacturers

- Agricultural Cooperatives

- Specialty Tire Shops

Dealerships remain the most dominant distribution channel in the market. Many farmers prefer the personalized service, expert advice, and ability to physically inspect tires before purchase that dealerships offer. Dealerships often have long-standing relationships with local farming communities, providing trust and reliability.

In the Latin American Agriculture Tractor Tires Market, the internet sales channel is expanding at the quickest rate. Growing internet penetration in rural regions, the ease of online buying, and the capacity to compare features and costs among companies are the main drivers of this rise.

LATAM Agriculture Tractor Tires Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

Brazil dominates the market with a 35% share, making it the largest single-country market in the region. This dominance is driven by Brazil's vast agricultural sector, particularly its large-scale soybean and corn production. The country's advanced agricultural practices and ongoing mechanization of farms contribute to a strong demand for high-performance tractor tires. The Cerrado region, with its expansive commercial farms, is a particular hotspot for premium tire sales.

The fastest-growing region in the LATAM Agriculture Tractor Tires Market is Colombia. This growth is driven by several factors, including government initiatives to modernize the agricultural sector, increasing foreign investment in Colombian agriculture, and the expansion of export-oriented crop production. The post-conflict rural development in some parts of the country is also contributing to increased mechanization and, consequently, tire demand.

COVID-19 Impact Analysis on the LATAM Agriculture Tractor Tires Market:

Initially, the pandemic caused severe disruptions to supply chains across the region. Border closures, transportation restrictions, and factory shutdowns in key manufacturing countries led to shortages of raw materials and finished products. This situation was particularly acute in the early months of 2020, causing delays in tire production and delivery, and in some cases, temporary halts in manufacturing operations. The agricultural sector, deemed essential in most Latin American countries, continued to operate throughout the pandemic. However, the implementation of safety protocols and social distancing measures on farms and in factories slowed down operations and reduced overall productivity. This had a ripple effect on the tractor tire market, as some farmers delayed purchases or maintenance of equipment. Financial uncertainty during the pandemic led many farmers to adopt a cautious approach to investment. Small and medium-sized farms, in particular, postponed non-essential purchases, including new tractor tires, opting instead for repairs or second-hand options where possible. This trend temporarily dampened demand in certain market segments. Conversely, the pandemic highlighted the critical importance of food security, leading some governments in the region to increase support for the agricultural sector. Countries like Brazil and Argentina implemented stimulus packages that included provisions for farm equipment upgrades.

Latest Trends/ Developments:

There's a growing trend towards the integration of smart technologies in tractor tires. These advanced tires are equipped with sensors that can monitor air pressure, temperature, and even soil conditions in real time. The data collected can be transmitted to the tractor's onboard computer or a farmer's mobile device, allowing for optimal tire performance and preventive maintenance. This trend aligns with the broader movement towards precision agriculture in the region. Environmental consciousness is driving the development of more sustainable tire options. Manufacturers are experimenting with bio-based materials and recycled content in tire production. There's also a focus on designing tires that minimize soil compaction and reduce fuel consumption, addressing both environmental concerns and farmers' operational costs. The market is seeing increased demand for tires tailored to specific crops, soil types, and farming practices. For instance, specialized tires for use in vineyards or orchards are gaining popularity. This trend toward customization is allowing manufacturers to target niche markets and command premium prices for specialized products.

Key Players:

- Michelin

- Bridgestone

- Goodyear

- Continental

- Pirelli

- Titan International

- Trelleborg

- BKT (Balkrishna Industries)

- Alliance Tire Group (Part of Yokohama)

- Mitas (Part of Trelleborg)

- CEAT

- Firestone (Bridgestone)

- Camso (Michelin)

- Vredestein (Apollo Tyres)

- Specialty Tires of America

Chapter 1. LATAM Agriculture Tractor Tires Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. LATAM Agriculture Tractor Tires Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. LATAM Agriculture Tractor Tires Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. LATAM Agriculture Tractor Tires Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. LATAM Agriculture Tractor Tires Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. LATAM Agriculture Tractor Tires Market– By Types

6.1. Introduction/Key Findings

6.2. Radial Tires

6.3. Bias Tires

6.4. Solid Tires

6.5. Pneumatic Tires

6.6. High Flotation Tires

6.7. Implement Tires

6.8. Row Crop Tires

6.9. Y-O-Y Growth trend Analysis By Types

6.10. Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. LATAM Agriculture Tractor Tires Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Original Equipment Manufacturers (OEMs)

7.3. Aftermarket Retailers

7.4. Dealerships

7.5. Online Sales

7.6. Direct Sales from Manufacturers

7.7. Agricultural Cooperatives

7.8. Specialty Tire Shops

7.9. Y-O-Y Growth trend Analysis By Distribution Channel

7.10. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. LATAM Agriculture Tractor Tires Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Latin America

8.1.1. By Country

8.1.1.1. Colombia

8.1.1.2. Brazil

8.1.1.3. Argentina

8.1.1.4. Chile

8.1.1.5. Rest of Latin America

8.1.2. By Types

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. LATAM Agriculture Tractor Tires Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Michelin

9.2. Bridgestone

9.3. Goodyear

9.4. Continental

9.5. Pirelli

9.6. Titan International

9.7. Trelleborg

9.8. BKT (Balkrishna Industries)

9.9. Alliance Tire Group (Part of Yokohama)

9.10. Mitas (Part of Trelleborg)

9.11. CEAT

9.12. Firestone (Bridgestone)

9.13. Camso (Michelin)

9.14. Vredestein (Apollo Tyres)

9.15. Specialty Tires of America

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Many LATAM countries are investing in agricultural development and modernization, encouraging farmers to adopt mechanized farming practices.

The region's economies can be volatile, impacting agricultural production and consequently, tire demand.

The LATAM Agriculture Tractor Tires Market is dominated by a mix of global tire giants and specialized agricultural tire manufacturers. Michelin, Bridgestone, and Goodyear lead the pack with their extensive product ranges and strong brand recognition. Continental and Pirelli, while traditionally known for automotive tires, have made significant inroads into the agricultural sector. Titan International and Trelleborg are recognized for their focus on off-highway and agricultural tires.

Brazil is the most dominant region in the market, accounting for approximately 35% of the total market share.

Columbia is the fastest-growing region in the market.