Laser Welding Machinery Market Size (2024 – 2030)

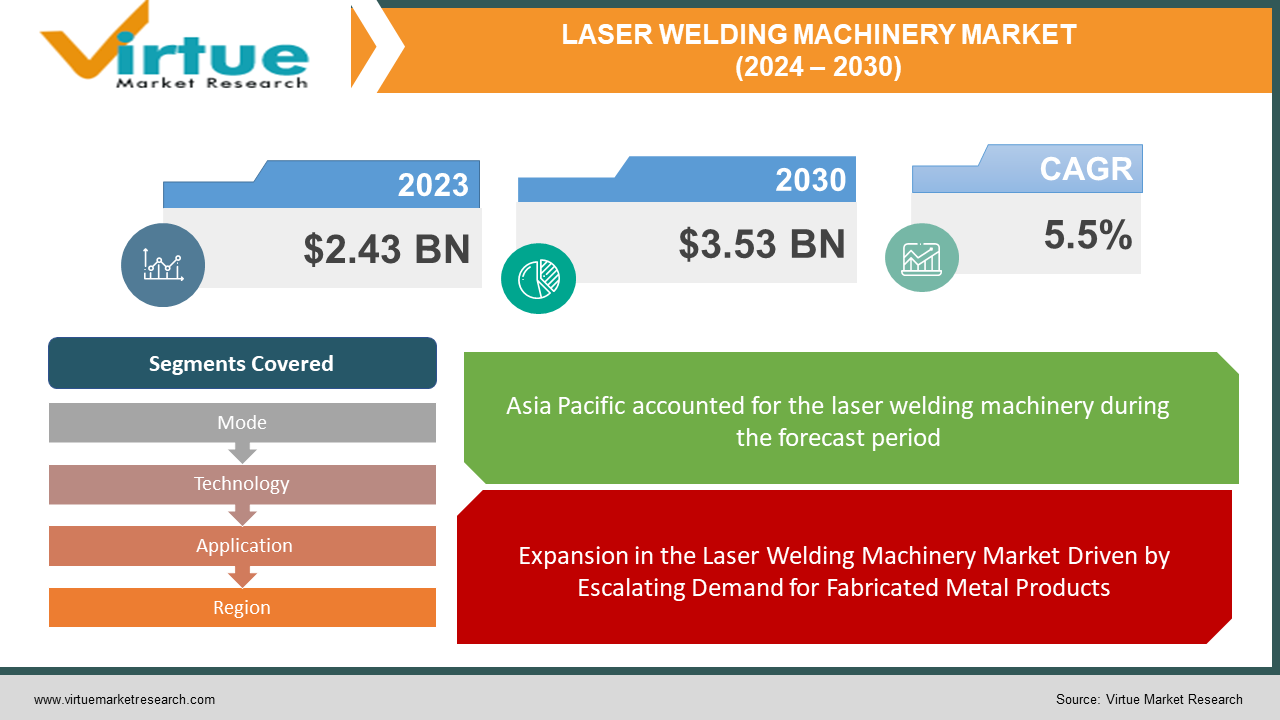

The Global Laser Welding Machinery Market size was exhibited at USD 2.43 billion in 2023 and is projected to hit around USD 3.53 billion by 2030, growing at a CAGR of 5.5% during the forecast period from 2024 to 2030.

A laser welding apparatus utilizes a laser beam as a concentrated heat source for joining various pieces of diverse materials. The technology of laser welding has progressed significantly, demonstrating a broad spectrum of applications. The capability of laser welding to facilitate the high-speed joining of materials or components with minimal thermal distortion is noteworthy. Industries in diverse sectors, such as entertainment electronics, photovoltaics, and medical device technology, are increasingly integrating laser welding machines into their processes.

The utilization of laser welding machines spans across various sectors, including automotive, medical, electronics, jewelry, and more. The adoption of chemical additives and adhesives in the welding process becomes obsolete with the use of this machinery. The anticipated surge in automation across industries is likely to drive the demand for laser welding machines. The automotive sector, in particular, exhibits a substantial inclination towards laser welding machines due to their cost-effective and highly productive capabilities in welding automobile components. The versatility of these machines, allowing the welding of different metal types with significant heat conductivity, further augments their utility.

Key Market Insights:

Manufacturers favor laser welding machines for their ability to provide high-speed welding with enhanced precision compared to traditional counterparts. The widespread use of these machines extends across diverse industries, encompassing automotive, medical, electronics, jewelry, and others. The elimination of chemical additives and glue from the welding process is a notable feature of laser welding machines. The increasing trend towards automation in various industrial domains is poised to drive the demand for these machines. The automotive industry, attracted by the cost-effectiveness and high productivity in welding, demonstrates a strong preference for laser welding machines. The capability of these machines to weld diverse metals with notable heat conductivity contributes to their broad applicability. The market growth is further propelled by the high thermal stability offered by laser welding machines. Anticipated growth in demand for fabricated metal parts and industrial equipment is a key factor driving market expansion. The transition of manufacturers from traditional welding methods to laser welding is expected to fuel market growth. Additionally, the rising demand for automated equipment, driven by a shortage of skilled workers in the industry, is likely to accelerate market growth.

Global Laser Welding Machinery Market Drivers:

Expansion in the Laser Welding Machinery Market Driven by Escalating Demand for Fabricated Metal Products

The anticipated growth in the laser welding machinery market is attributed to the increasing demand for fabricated metal products. Fabricated metal products encompass a diverse array of metal structures, parts, and components created through various fabrication processes such as cutting, bending, welding, and assembly. Laser welding machines play a crucial role in fabricating metal products, facilitating processes like the precise joining of thin metal sheets with minimal heat input and the welding of dissimilar metals. For example, Eurostat, the Luxembourg-based European statistical office, reported in April 2023 that the manufacturing of fabricated metal products and basic metals constituted 23% of Italy's sold production value. Bulgaria, Greece, Austria, Finland, and Slovenia followed closely, each capturing a significant share of the value of sold production for fabricated metal products and basic metals. Consequently, the rising demand for fabricated metal products is a key driver behind the growth of the market.

Growth in the Laser Welding Machinery Market Fueled by Increasing Manufacturing Activities

The projected expansion of the laser welding machine market is closely tied to the surge in manufacturing activities. Manufacturing involves the conversion of raw materials or components into finished products through the utilization of tools, human labor, equipment, and chemical processes. Laser welding machines contribute significantly to manufacturing activities, enabling precise and efficient material joining, thereby facilitating high-speed and accurate welding processes. The incorporation of laser welding machines in manufacturing enhances overall productivity by offering a versatile and automated solution across various industries. As an illustration, the Federal Reserve System, the US-based central bank, reported in September 2023 that US manufacturing output witnessed a 0.4% increase, signaling a growth in factory manufacturing. Consequently, the upswing in manufacturing activities serves as a driving force behind the market.

Global Laser Welding Machinery Market Restraints and Challenges:

Impediments to the Laser Welding Machinery Market Stemming from Elevated Initial and Maintenance Costs

Despite being a state-of-the-art technology offering precision and efficiency across various industries, laser welding machinery faces a notable challenge related to its high initial and maintenance costs. The intricate technology and precision components integral to laser welding machines contribute to a substantial upfront investment.

The initial capital outlay encompasses expenses for the laser source, optics, control systems, and other intricate components that bestow laser welding with high accuracy and reliability. Additionally, specialized personnel are often a requisite for the installation and setup of these machines, augmenting the overall financial burden. While the long-term advantages in terms of efficiency and quality are apparent, the significant financial hurdle may impede some businesses from readily adopting laser welding technology.

Maintenance costs present another facet adding to the overall expenditure. Regular maintenance is crucial for ensuring the optimal performance of laser welding machines. The complex nature of the components and the requirement for specialized knowledge during repairs contribute to the heightened maintenance expenses. Despite these cost challenges, continuous research and development endeavors aim to reduce costs, ultimately making laser welding more accessible for a broader spectrum of businesses in the foreseeable future.

Market Growth Hindered by a Shortage of Qualified and Knowledgeable Workers

A substantial impediment confronting the laser welding machinery market is the scarcity of qualified and knowledgeable workers. The operation and management of laser welding equipment demands specialized skills and expertise, given the precision and intricacy inherent in the process. However, there is a noticeable deficit of skilled workers possessing the requisite knowledge of laser welding technology.

The specific skill set required for operating laser welding machinery includes a deep understanding of laser parameters, and material characteristics, and the ability to troubleshoot technical issues arising during the welding process. As laser welding gains prominence across industries, the demand for skilled personnel continues to escalate. The shortage of qualified workers poses a challenge for businesses seeking to adopt laser welding technology, as finding individuals with the necessary expertise becomes a struggle.

Efforts are underway to tackle this challenge through training programs and educational initiatives designed to cultivate a workforce equipped with the essential skills for laser welding technology. Bridging the skills gap is pivotal for the widespread adoption of laser welding machinery, ensuring that industries can fully capitalize on the benefits of this advanced welding technology.

Global Laser Welding Machinery Market Opportunities:

Advancements in Plastic Welding Equipment Propel Market Potential

In recent years, the healthcare sector's increasing reliance on plastics has streamlined operations and ushered in innovative techniques and prosthetics. As a result, there is a compelling need for the medical device industry and its component manufacturers to enhance plastic joining and welding technologies, fostering the creation of novel healthcare products. Noteworthy advancements in this realm include the introduction of servo-driven ultrasonic welders and the recent integration of two-micron lasers. Laser welding technology, in particular, stands out for its ability to deliver heightened effectiveness and precision while also contributing to environmental sustainability by eliminating the necessity for hazardous adhesives and solvents.

The incorporation of two-micron lasers in plastic welding has proven especially advantageous for medical device manufacturers, streamlining the laser welding process for clear polymers. These lasers are distinguished for their enhanced absorption by clear polymers, facilitating a precisely controlled melting process throughout the thickness of optically transparent components. This technological integration represents a significant opportunity for further advancements in the global laser welding machinery market.

LASER WELDING MACHINERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Mode, Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ROFIN-SINAR Laser GmbH, The Emerson Electric Company, O.R. Lasertechnologie GmbH, TRUMPF GmbH + Co. KG, Panasonic Corporation, Colfax Corporation, CMF Groupe, Control Laser Corporation, Wuhan Farley Laserlab Cutting Welding System Engineering Co., Ltd., ALPHA LASER GmbH |

Global Laser Welding Machinery Market Segmentation: By Mode

-

Conduction Mode

-

Deep Penetration Mode

The global laser welding machinery market is categorized into two modes: conduction mode and deep penetration mode. The conduction mode, expected to dominate in the coming years, is characterized by its capability to deliver low laser energy to the metal, resulting in flat welds with minimal penetration. It is particularly suitable for joints that do not necessitate high strength, producing smooth and visually appealing welds that are wider than they are deep.

In contrast, the deep penetration mode is anticipated to witness significant growth during the forecast period. Also known as the keyhole penetration mode, it generates narrow and deep welds. Welds produced in this mode are typically deeper than the broader and stronger conduction mode welds. This laser beam welding (LBW) technique involves a high-power laser vaporizing the base metal, creating a narrow tunnel known as a "keyhole" down to the kerf. This keyhole serves as a conduit for the laser to penetrate deeply into the metal.

Global Laser Welding Machinery Market Segmentation: By Technology

-

Gas Laser (CO2)

-

Solid-state Laser

-

Fiber Laser

-

Diode/Semiconductor Laser

The market's technology segmentation includes gas laser (CO2), solid-state laser, fiber laser, and diode/semiconductor laser. The fiber laser segment is poised for exponential growth in the forecast period, characterized by its advanced features compared to other welders. It offers ease of operation and enables high-speed welding, making it increasingly in demand across various industries such as electronics, jewelry, aerospace, and automotive. Fiber laser welders utilize fiber optics to guide and amplify light, ensuring efficient and effective light delivery at the target location.

Additionally, the laser (CO2) segment is expected to exhibit substantial proliferation in the upcoming years. This type of laser produces light by passing an electric current through a gas, including examples such as carbon dioxide (CO2) lasers, argon lasers, helium-neon lasers, excimer lasers, and krypton lasers. Gas lasers find applications in barcode scanning, spectroscopy, holography, air pollution measurement, laser surgery, and material processing, with CO2 lasers being notably recognized for laser marking and cutting.

Moreover, the solid-state laser segment is predicted to experience significant growth due to its utilization of a laser medium rather than a gas. Solid-state lasers use minerals like yttrium, aluminum, garnet (YAG), and yttrium vanadate crystals (YVO4) as the laser medium. With high laser power, they are capable of operating in both pulsed and continuous modes, producing joints similar to spot welds but with increased depth.

Global Laser Welding Machinery Market Segmentation: By Application

-

Automotive

-

Aluminum Alloy Fuselage

-

Jewelry Industry

-

Medical

-

Electronics

-

Shipbuilding

-

Others (Oil & Gas)

The market is segmented based on application into automotive, aluminum alloy fuselage, jewelry industry, medical, electronics, shipbuilding, and others (oil & gas). Laser welding finds extensive use in the automotive sector due to its capability to precisely weld automotive components. This welding technique is applied to various automotive parts, including transmission components, welded engine parts, magnetic coils, and fuel filters. Its efficiency in mass production makes it increasingly sought after in the automotive industry. The ease of automation further contributes to the growing popularity of laser welders in this sector. Anticipated recovery in the automotive sector, driven by technological advancements, is expected to elevate demand. The quest for high-quality finished parts in the automotive segment is poised to propel market growth during the forecast period.

Considerable growth is expected in the aluminum alloy fuselage application, particularly in the aerospace industry. Laser welding is being explored as an alternative to mechanical mounting and joining in airframe and wing manufacturing applications. By simplifying the manufacturing process, potential benefits include improved quality, cost reduction, and weight reduction. One notable application involves adding weld reinforcements or stringers to reinforce skin panels.

Significant development is anticipated in the jewelry industry during the forecast period. Jewelry laser welders are revolutionizing processes in the industry, making them more manageable and efficient. The success of these machines is evident in applications such as resizing rings, re-tipping prongs, repairing bezel settings, reassembling broken jewelry, repairing miscellaneous jewelry, addressing porosity issues, and creating custom designs.

Global Laser Welding Machinery Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The market is regionally segmented into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. Asia Pacific holds a significant market share due to increasing industrialization and numerous manufacturing bases, driving regional market growth. The growing awareness and adoption of laser welding in various industrial sectors are expected to further accelerate market growth in the region. Additionally, the adoption of high-end technology contributes to expanding the market share of laser welding.

The North American market is poised for substantial growth, driven by increasing demand for fabricated metal parts in the heavy machinery industry. This demand is expected to positively influence market growth in the region. Rising automation is also anticipated to accelerate market growth, driven by the increasing demand for high productivity in welding operations in North America.

COVID-19 Impact on the Global Laser Welding Machinery Market:

The global laser welding machinery market experienced significant disruptions in 2020 due to the impact of the COVID-19 pandemic. The outbreak led to widespread disruptions in global supply chains, causing challenges in the production and availability of laser welding machines. Restrictions on manufacturing activities, international trade, and logistics created hurdles for suppliers and manufacturers, resulting in delays in the production and delivery of laser welding machines. Key industries such as automotive, aerospace, and construction faced temporary shutdowns or reduced operations due to lockdowns and restrictions implemented to curb the spread of the virus. This downturn in industrial activities directly influenced the demand for laser welding machines, given that these industries are prominent consumers of such equipment.

Recent Trends and Innovations in the Global Laser Welding Machinery Market:

In July 2022, Vitesco Technologies, a leading international manufacturer specializing in modern drive technologies and electrification solutions, utilized innovative laser systems from its longstanding production engineering partner TRUMPF. The introduction of new green laser equipment for copper welded joints positioned the company as a pioneer in the widespread adoption of this innovative solution. Green lasers, as opposed to the conventional infrared laser systems used in copper welding, have the potential to reduce energy consumption by up to 20%, depending on the application, and decrease the CO2 footprint per laser welded joint.

In February 2022, NLight, a prominent manufacturer of fiber lasers, acquired Plasmo Industrietechnik to enhance its manufacturing solutions portfolio by incorporating Plasmo's machine vision and analysis technologies. Plasmo, an Austrian-based provider of automated quality assurance and diagnostic solutions for the welding and additive manufacturing industry, is set to augment NLight's industrial laser product line.

In April 2022, Emerson Automation Solutions showcased the latest innovations in ASCO valves and Branson laser welding solutions for medical devices at MD&M West in Anaheim, California. This demonstration highlighted the continuous efforts to introduce cutting-edge solutions in the field of laser welding for medical applications.

Key Players:

-

ROFIN-SINAR Laser GmbH

-

The Emerson Electric Company

-

O.R. Lasertechnologie GmbH

-

TRUMPF GmbH + Co. KG

-

Panasonic Corporation

-

Colfax Corporation

-

CMF Groupe

-

Control Laser Corporation

-

Wuhan Farley Laserlab Cutting Welding System Engineering Co., Ltd.

-

ALPHA LASER GmbH

Chapter 1. Laser Welding Machinery Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Laser Welding Machinery Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Laser Welding Machinery Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Laser Welding Machinery Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Laser Welding Machinery Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Laser Welding Machinery Market – By Mode

6.1 Introduction/Key Findings

6.2 Conduction Mode

6.3 Deep Penetration Mode

6.4 Y-O-Y Growth trend Analysis By Mode

6.5 Absolute $ Opportunity Analysis By Mode, 2024-2030

Chapter 7. Laser Welding Machinery Market – By Technology

7.1 Introduction/Key Findings

7.2 Gas Laser (CO2)

7.3 Solid-state Laser

7.4 Fiber Laser

7.5 Diode/Semiconductor Laser

7.6 Y-O-Y Growth trend Analysis By Technology

7.7 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Laser Welding Machinery Market – By Application

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Aluminum Alloy Fuselage

8.4 Jewelry Industry

8.5 Medical

8.6 Electronics

8.7 Shipbuilding

8.8 Others (Oil & Gas)

8.9 Y-O-Y Growth trend Analysis By Application

8.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Laser Welding Machinery Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Mode

9.1.3 By Technology

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Mode

9.2.3 By Technology

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Mode

9.3.3 By Technology

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Mode

9.4.3 By Technology

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Mode

9.5.3 By Technology

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Laser Welding Machinery Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ROFIN-SINAR Laser GmbH

10.2 The Emerson Electric Company

10.3 O.R. Lasertechnologie GmbH

10.4 TRUMPF GmbH + Co. KG

10.5 Panasonic Corporation

10.6 Colfax Corporation

10.7 CMF Groupe

10.8 Control Laser Corporation

10.9 Wuhan Farley Laserlab Cutting Welding System Engineering Co., Ltd.

10.10 ALPHA LASER GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Laser Welding Machinery Market size is valued at USD 2.43 billion in 2023.

The worldwide Global Laser Welding Machinery Market growth is estimated to be 5.5% from 2024 to 2030.

The Global Laser Welding Machinery Market is segmented By Mode (Conduction Mode, Deep Penetration Mode), By Technology (Gas Laser (CO2), Solid-state Laser, Fiber Laser, Diode/Semiconductor Laser), By Application (Automotive, Aluminum Alloy Fuselage, Jewelry Industry, Medical, Electronics, Shipbuilding, Others (Oil & Gas)).

The Global Laser Welding Machinery Market is poised for growth with rising demand in the automotive, electronics, and healthcare industries. Advancements in laser technology, increased automation, and sustainability initiatives present promising opportunities, driving innovation and market expansion.

The COVID-19 pandemic initially disrupted the Global Laser Welding Machinery Market due to supply chain interruptions and reduced industrial activities. However, a rebound is observed with the increased adoption of automation and contactless manufacturing, fostering market recovery and resilience.