Laser Drilling Market Size (2024-2030)

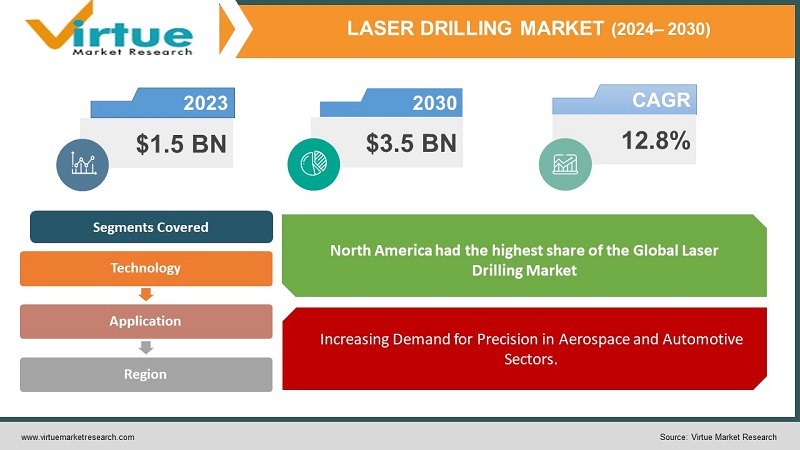

The Global Laser Drilling Market was valued at USD 1.5 billion in 2023 and is projected to reach a market size of USD 3.5 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 12.8% between 2024 and 2030.

The Global Laser Drilling Market is experiencing significant growth due to the increasing demand for precise and efficient drilling solutions across various industries. Laser drilling technology offers numerous advantages, including high accuracy, minimal material damage, and the ability to work with a wide range of materials, such as metals, composites, and ceramics. The aerospace, automotive, electronics, and medical device sectors are some of the key industries driving the adoption of laser drilling systems, as they require precision and reliability in their manufacturing processes. Additionally, the rising trend of miniaturization in electronics and advancements in material science further bolster the demand for laser drilling, as traditional drilling methods often struggle with delicate or complex designs. The market is also benefiting from continuous innovation, such as ultrafast lasers and automation integration, which improve drilling speed, accuracy, and efficiency. Furthermore, the increasing focus on sustainability and reducing waste in manufacturing processes is pushing industries to adopt laser drilling due to its ability to reduce material wastage compared to conventional techniques. As global industrialization and technological advancements continue, the laser drilling market is expected to grow, with manufacturers focusing on improving laser capabilities and expanding applications across diverse sectors.

Key Market Insights:

Over 40% of demand for laser drilling systems comes from the aerospace and automotive industries.

The market is expected to grow at a CAGR of 5.5% from 2024 to 2030.

Asia-Pacific accounts for over 35% of the global laser drilling market share, driven by industrial growth in China and India.

Ultrafast laser technology adoption has seen a 25% increase in the last three years.

The medical device industry contributes to approximately 15% of the global market demand for laser drilling applications.

Global Laser Drilling Market Drivers:

Increasing Demand for Precision in Aerospace and Automotive Sectors.

The aerospace and automotive industries are key drivers of the Global Laser Drilling Market due to their need for high-precision drilling solutions. Both sectors demand superior accuracy in drilling small, intricate holes in advanced materials, such as composites and metals, used in aircraft components and automotive parts. Laser drilling technology enables precise hole formation with minimal heat damage and material deformation, which is essential for maintaining the structural integrity and performance of critical components. As lightweight materials and composites gain popularity in aerospace and automotive manufacturing, laser drilling becomes increasingly vital due to its ability to handle complex geometries and hard-to-machine materials. Additionally, the push toward electric vehicles (EVs) and fuel-efficient aircraft is propelling the demand for advanced manufacturing processes, further driving the adoption of laser drilling systems. The market is expected to expand as manufacturers continue to innovate and optimize laser drilling technology to meet the evolving requirements of these sectors.

Growth of the Electronics Industry and Miniaturization Trends.

The rapid growth of the electronics industry and the increasing trend of miniaturization are significant drivers for the Global Laser Drilling Market. With the rising demand for smaller, more powerful electronic devices, manufacturers are facing challenges in producing high-density circuit boards with extremely small and precise holes. Traditional drilling methods often fall short in this regard, whereas laser drilling offers unparalleled accuracy and speed. Laser drilling is essential in creating microvias and tiny apertures required for next-generation printed circuit boards (PCBs) used in smartphones, tablets, and wearables. Furthermore, advancements in semiconductor technology and the demand for more compact designs in electronics drive the need for laser-based drilling systems. As 5G technology, IoT devices, and advanced consumer electronics continue to evolve, the need for miniaturized components and, by extension, laser drilling capabilities is expected to grow. This trend positions laser drilling as a critical technology in the electronics manufacturing landscape, further boosting market growth.

Global Laser Drilling Market Restraints and Challenges:

The Global Laser Drilling Market faces several restraints and challenges that may hinder its growth potential. One significant challenge is the high initial cost of laser drilling equipment, which can be prohibitive for small and medium-sized enterprises (SMEs) with limited budgets. While laser technology offers superior precision and efficiency compared to traditional methods, the upfront investment in purchasing and maintaining advanced laser drilling systems can deter widespread adoption. Another challenge is the complexity of integrating laser drilling into existing manufacturing processes. The need for skilled operators and technicians to handle sophisticated laser equipment adds to operational costs and may require specialized training. Additionally, laser drilling is not suitable for all materials, and certain substrates may be prone to thermal damage or micro-cracking when exposed to laser energy. This limitation affects its applicability in industries that work with heat-sensitive materials. Furthermore, the slow adoption of laser technology in some developing regions, due to a lack of technological infrastructure and awareness, also poses a restraint. Finally, competition from alternative drilling technologies, such as mechanical and waterjet drilling, presents a challenge, especially in industries where cost-efficiency takes precedence over precision. These factors collectively pose barriers to the growth of the laser drilling market.

Global Laser Drilling Market Opportunities:

The Global Laser Drilling Market presents several promising opportunities for growth, driven by advancements in technology and expanding applications across industries. One key opportunity lies in the increasing adoption of ultrafast lasers, which offer greater precision and speed compared to traditional laser systems. These lasers are particularly effective for micro-drilling in industries such as electronics, where miniaturization is a key trend. As demand for smaller, more powerful devices like smartphones, wearable tech, and IoT sensors continues to rise, manufacturers are increasingly turning to laser drilling to meet the need for high-density, precise circuit boards. Additionally, the growing focus on sustainability and reducing material waste in manufacturing processes presents an opportunity for laser drilling, as it produces minimal waste and offers high material utilization compared to conventional methods. The expansion of laser drilling applications in medical device manufacturing, where precision and sterility are paramount, also represents a significant opportunity. Moreover, the rise of additive manufacturing (3D printing) offers new avenues for laser drilling technology, as it can be used to refine and enhance components produced via 3D printing. With continuous innovation and growing demand for precision engineering across industries, the laser drilling market is poised for substantial expansion in the coming years.

LASER DRILLING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Technology, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Coherent, Inc., Trumpf GmbH + Co. KG, Han’s Laser Technology Industry Group Co., Ltd., Prima Power, Jenoptik AG, Lumentum Holdings Inc., IPG Photonics Corporation, Electro Scientific Industries, Inc. (ESI), 3D-Micromac AG, Wuhan Huagong Laser Engineering Co., Ltd. (HG Laser) |

Global Laser Drilling Market Segmentation:

Laser Drilling Market Segmentation By Technology:

- Percussion Laser Drilling

- Trepanning Laser Drilling

In 2023, based on market segmentation by Technology, Percussion Laser Drilling had the highest share of the Global Laser Drilling Market. Percussion laser drilling has gained widespread adoption in various industries due to its versatility, precision, efficiency, and cost-effectiveness. Its adaptability to a wide range of materials, including metals, ceramics, and composites, makes it suitable for industries such as aerospace, electronics, automotive, and healthcare. One of its key advantages is its ability to offer high-precision drilling, essential for sectors like electronics and aerospace, where accuracy is crucial for component functionality and safety. In addition, percussion laser drilling can achieve high drilling rates, significantly improving productivity and reducing lead times for manufacturers. While laser drilling systems are generally more expensive than traditional drilling methods, percussion laser drilling strikes a balance between cost and performance, making it an attractive option for industries seeking both precision and efficiency. This cost-effectiveness has further contributed to its market leadership in 2023. However, the laser drilling landscape continues to evolve, with emerging technologies like trepanning laser drilling showing promise for specific applications that require larger hole diameters and more complex geometries. As industries demand increasingly sophisticated solutions, the future may see trepanning and other advanced laser drilling techniques gaining traction alongside percussion laser drilling, driving further innovation and growth in the global laser drilling market.

Laser Drilling Market Segmentation By Application:

- Automotive

- Aerospace

- Electronics

- Ceramics

In 2023, based on market segmentation by Application, Automotive had the highest share of the Global Laser Drilling Market. Modern vehicles are becoming increasingly complex, incorporating intricate components and systems that require advanced manufacturing techniques. Laser drilling offers the precision and flexibility necessary to create the precise holes required for these components, making it indispensable in the automotive industry. Its ability to drill fine, accurate holes in advanced materials such as lightweight alloys and composites ensures that intricate parts like fuel injectors and sensor housings are manufactured with the necessary precision. Additionally, laser drilling significantly enhances the efficiency and performance of automotive components. For instance, it can be used to create cooling channels in engine blocks, improving heat dissipation and overall engine performance by maintaining optimal temperature levels. This not only boosts the vehicle's efficiency but also extends the lifespan of critical engine parts. Furthermore, laser drilling contributes to lightweighting efforts, an essential goal for automakers aiming to improve fuel efficiency and reduce emissions. By enabling the production of lighter, yet structurally sound components, laser drilling reduces vehicle weight without compromising strength or safety. This is particularly important as the automotive industry moves toward electric vehicles and more fuel-efficient designs. As a result, laser drilling plays a crucial role in meeting both performance and sustainability demands in modern automotive manufacturing.

Laser Drilling Market Segmentation By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

In 2023, based on market segmentation by Region, North America had the highest share of the Global Laser Drilling Market. North America boasts a strong manufacturing base, particularly in industries like automotive and aerospace, which are significant consumers of laser drilling technology. These industries require high-precision drilling for complex components, and the adoption of laser drilling has become essential to meet the demand for accuracy, efficiency, and quality in production processes. The region is also home to many leading laser technology companies, contributing to the development and widespread adoption of advanced laser drilling systems. These companies play a key role in innovating new techniques and improving the performance of laser drilling equipment, which benefits a wide range of industries. In addition, North America places a strong emphasis on research and development (R&D), particularly in the fields of manufacturing and technology. This commitment to R&D has led to continuous advancements in laser drilling technology, including the integration of ultrafast lasers, automation, and artificial intelligence (AI), which are transforming the capabilities and efficiency of laser drilling processes. As a result, North American industries are able to leverage cutting-edge laser technologies to enhance manufacturing precision, reduce production costs, and improve sustainability. This combination of a strong manufacturing base, leading technology companies, and a robust focus on innovation positions North America as a leader in the global laser drilling market.

COVID-19 Impact Analysis on the Global Laser Drilling Market.

The COVID-19 pandemic had a mixed impact on the Global Laser Drilling Market, with disruptions in supply chains and manufacturing activities affecting short-term growth, while also highlighting the long-term need for automation and precision in industrial processes. During the peak of the pandemic, industries such as aerospace, automotive, and electronics experienced significant slowdowns due to lockdowns, travel restrictions, and reduced demand. This led to delays in projects and a temporary dip in investments in advanced manufacturing technologies like laser drilling. However, the pandemic also accelerated the shift toward automation and digitalization, as companies sought to minimize human contact and increase operational efficiency. The increased demand for medical devices and electronic products during the pandemic provided some resilience to the laser drilling market, particularly in sectors like healthcare and consumer electronics, where precision and miniaturization are crucial. Additionally, as industries recover and adapt to post-pandemic realities, there is a growing emphasis on reducing material waste and improving manufacturing efficiency, which further drives the adoption of laser drilling technologies. In the long term, the pandemic has underscored the importance of resilient, automated manufacturing solutions, positioning the laser drilling market for steady growth as global industries bounce back.

Latest trends / Developments:

The Global Laser Drilling Market is witnessing several key trends and developments that are shaping its growth trajectory. One major trend is the increasing adoption of ultrafast lasers, which offer higher precision and reduced thermal damage compared to traditional laser systems. This development is particularly important in industries like electronics, aerospace, and healthcare, where precision is critical. Another trend is the integration of automation and artificial intelligence (AI) into laser drilling systems, enabling real-time monitoring, enhanced process control, and predictive maintenance. This shift is driven by the need for increased operational efficiency and reduced human intervention in manufacturing processes. Additionally, advancements in multi-axis laser drilling systems are expanding the range of complex geometries that can be drilled, allowing for greater versatility in applications across various industries. The rise of 5G technology and the growing demand for miniaturized components in electronics, such as microvias in printed circuit boards (PCBs), is further fueling the demand for laser drilling solutions. Moreover, the push for sustainable manufacturing processes has led to the development of energy-efficient laser systems that reduce material waste and environmental impact. These trends are positioning the laser drilling market for significant innovation and expansion in the coming years.

Key Players:

- Coherent, Inc.

- Trumpf GmbH + Co. KG

- Han’s Laser Technology Industry Group Co., Ltd.

- Prima Power

- Jenoptik AG

- Lumentum Holdings Inc.

- IPG Photonics Corporation

- Electro Scientific Industries, Inc. (ESI)

- 3D-Micromac AG

- Wuhan Huagong Laser Engineering Co., Ltd. (HG Laser)

Chapter 1. GLOBAL LASER DRILLING MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL LASER DRILLING MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL LASER DRILLING MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL LASER DRILLING MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL LASER DRILLING MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL LASER DRILLING MARKET – By Technology

6.1. Introduction/Key Findings

6.2. Percussion Laser Drilling

6.3. Trepanning Laser Drilling

6.4. Y-O-Y Growth trend Analysis By Technology

6.5. Absolute $ Opportunity Analysis By Technology , 2024-2030

Chapter 7. GLOBAL LASER DRILLING MARKET – By Application

7.1. Introduction/Key Findings

7.2 Automotive

7.3. Aerospace

7.4. Electronics

7.5. Ceramics

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. GLOBAL LASER DRILLING MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Technology

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Technology

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Technology

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Technology

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Technology

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL LASER DRILLING MARKET – Company Profiles – (Overview, Product Technology s Portfolio, Financials, Strategies & Development

9.1. Coherent, Inc.

9.2. Trumpf GmbH + Co. KG

9.3. Han’s Laser Technology Industry Group Co., Ltd.

9.4. Prima Power

9.5. Jenoptik AG

9.6. Lumentum Holdings Inc.

9.7. IPG Photonics Corporation

9.8. Electro Scientific Industries, Inc. (ESI)

9.9. 3D-Micromac AG

9.10. Wuhan Huagong Laser Engineering Co., Ltd. (HG Laser)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Laser Drilling market is expected to be valued at US$ 1.5 billion.

Through 2030, the Global Laser Drilling market is expected to grow at a CAGR of 12.8%.

By 2030, the Global Laser Drilling Market expected to grow to a value of US$ 3.5 billion.

North America is predicted to lead the Global Laser Drilling market.

The Global Laser Drilling Market has segments By Technology, Application, and Region.