Laser Alignment System Market Size (2024 – 2030)

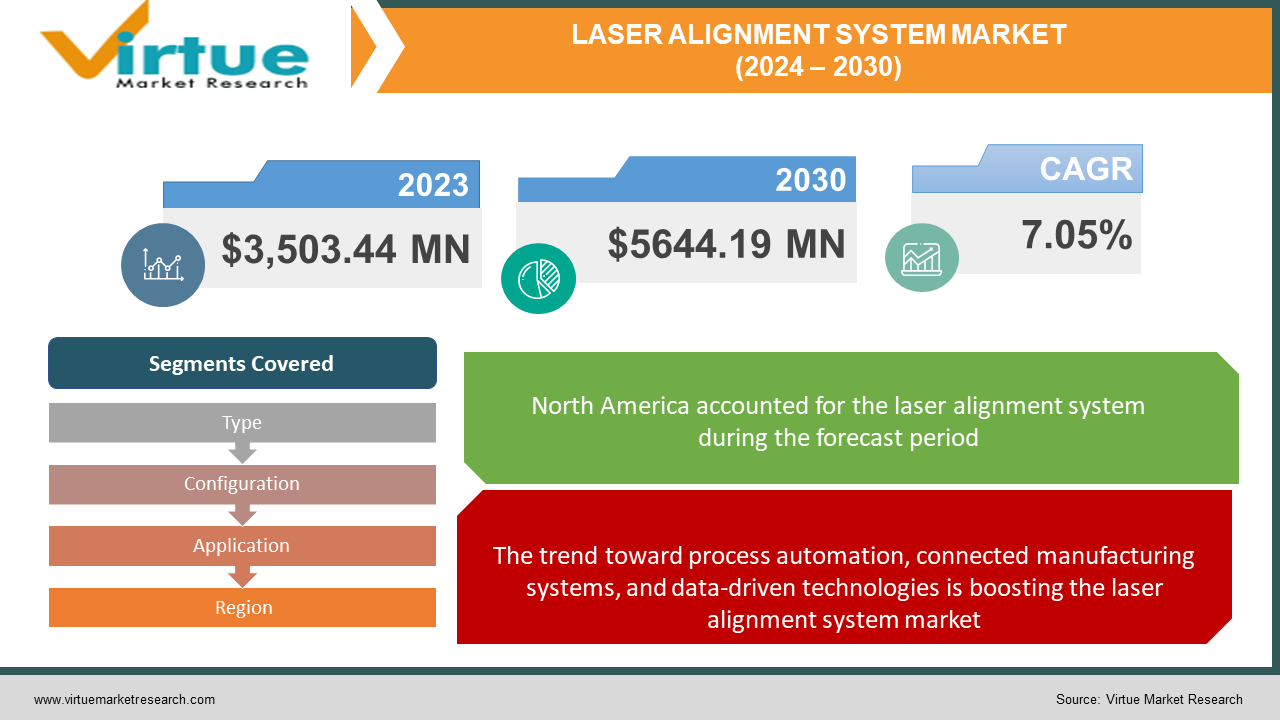

The global laser alignment system market was valued at USD 3,503.44 million in 2023 and is projected to reach a market size of USD 5644.19 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.05%.

Over the last several years, the requirement for increased accuracy and precision in industrial processes has propelled the growth of the global laser alignment system market. Laser alignment systems employ laser beams to precisely place apparatus and gauge attributes such as parallelism, levelness, straightness, and flatness. Compared to conventional alignment procedures, this shortens setup times and allows for the perfect alignment of machines. There are several obstacles facing the worldwide laser alignment system industry, such as significant initial investments and challenging learning curves. The goal of businesses like Spectra Precision, Hamar Laser Instruments Inc., and PRÜFTECHNIK Dieter Busch AG is to provide alignment systems that are easier to use and take less time to set up and adjust. To broaden the scope of applications and draw in new customers, advancements like machine learning capabilities, cloud connectivity, and data analytics integration are being implemented. Globally, alliances between OEMs and producers of alignment systems are becoming more and more popular.

Key Market Insights:

The rapid advancement of laser alignment systems for precise alignment and measurement applications is being driven by the automotive, aerospace, semiconductor, and renewable energy sectors' rapid industrialization and automation. Currently, the machine tool alignment segment commands a leading share of over 40% of the market. The installation of laser alignment systems for accurate positioning of machine components has expanded due to the growth of the machine tool industry in developing nations as a result of increased production activity. This lowers vibration, lowers maintenance expenses, and boosts output. North America leads the market for laser alignment systems geographically, followed by Europe and Asia-Pacific. North America, with its thriving industrial sector, is one of the first regions to adopt innovative automation technologies. Europe is also a significant regional market; many machine tool manufacturers and car giants are based in Germany. Up to 2025, the Asia-Pacific region is predicted to grow at the fastest rate—a CAGR of more than 8%. An important factor in the rising use of laser alignment systems in the region is the government's manufacturing expansion plans, such as those made in India.

Global Laser Alignment System Market Drivers:

The growing focus on lean manufacturing principles, waste reduction, quality improvement, and operational efficiency across industries is driving the adoption of laser alignment systems.

One of the main factors propelling the global discrete manufacturing sector's adoption of laser alignment systems is the demand for increased productivity and operational efficiency. Manufacturers are concentrating on improving their manufacturing processes to maximize output, decrease waste, lower maintenance costs, and improve overall efficiency due to fierce competition and growing labor expenses. Due to their substantial cost and productivity advantages, laser alignment systems are becoming more and more in demand. Industrial machinery and equipment misalignment can cause a variety of issues that reduce production, including increased noise and vibration, premature bearing wear, incorrect gear meshing, faults in finished goods, and more frequent failures. Spirit levels, dial indications, straight edges, and other manual alignment tools are time-consuming and have limited accuracy and speed. High-speed, non-contact alignment with micron-level precision is possible using laser alignment systems. It is possible to attach the laser emitter and detector to various machine parts, which makes it appropriate for aligning turbines, linked shafts, rollers, and other equipment. Quick and precise alignment minimizes noise and vibration, which lowers maintenance costs because there is less wear and tear. Additionally, it reduces waste, rework, and rejects. The total efficacy of the equipment is increased by laser systems, which allow accurate alignment of conveyors, sensors, motors, and drives (OEE). Consequently, this optimizes throughput and raises assembly line and production process productivity. Maintenance staff can carry out routine alignments more effectively due to features that track data and are easy to use.

The trend toward process automation, connected manufacturing systems, and data-driven technologies is boosting the laser alignment system market.

The growing global deployment of laser alignment systems is mostly driven by the continuous automation of production processes and the shift to smart factories, or Industry 4.0. Traditional factories are being transformed into highly linked, data-driven manufacturing facilities through the integration of sophisticated technologies such as IoT, AI, robotics, and 3D printing. Laser alignment is a key facilitator for this progress since it requires the exact alignment of sensors, devices, equipment, and components. Older factories used a lot of physical work and traditional machinery. Automated guided vehicles, cooperative robots, self-optimizing conveyor systems, and other networked equipment operating in tandem are used more frequently in Industry 4.0. In these kinds of environments, even a slight misalignment can cause collisions, damage, and disturbance. During installation, laser alignment enables quick, non-contact, and extremely precise positioning of automation components. IoT sensors are being used on modern manufacturing lines for analytics-based optimization and real-time monitoring. Proper alignment and calibration play a major role in sensor data accuracy. To continuously deliver useful alignment insights, IoT-enabled laser alignment devices can interact directly with automation and data-gathering systems. Machine tool laser alignment systems featuring Industry 4.0 features, such as cloud connectivity, digital twin integration, and data exchange with control systems, are provided by companies like PRÜFTECHNIK. These intelligent alignment systems are becoming increasingly popular as factories strive for remote diagnostics, predictive maintenance, and proactive interventions to reduce downtime.

Global Laser Alignment System Market Restraints and Challenges:

The biggest roadblock to the wider adoption of laser alignment systems, especially among small and medium enterprises, is the high costs involved. The upfront investment needed for hardware, software, installation, and training is still considerably high.

The high upfront costs involved in procuring and deploying laser alignment systems are one of the major barriers inhibiting wider adoption, especially among small and medium-sized enterprises (SMEs). While the technological capabilities and advantages of laser alignment are well recognized, the substantial capital investment required is often not feasible for companies with limited budgets. Complex installations in large factories may require purchasing multiple laser emitters and detectors, which multiplies the capital expenditure. The installation process itself necessitates skilled labor and production downtime, which is an added expense. Ongoing costs for periodic maintenance, component replacement, calibration, and servicing also mount up. For companies already saddled with other new technology implementation costs related to automation, IoT, data analytics, etc., investing in laser alignment could push budgets beyond limits. Many organizations have tight controls and caps on capital expenses, making it challenging to build an internal business case justifying laser alignment's benefits over extended periods. Startups and SMEs with limited access to large capital have an especially difficult time adopting newer technologies like laser alignment, even if the long-term merits are substantial. Unless the ROI is realized fairly quickly, within 12–18 months, securing funds for what is seen as a non-core investment becomes an obstacle. However, manufacturers must consider the cost implications of poor alignment: higher maintenance due to excess wear and tear, higher reject rates, opportunity costs from production downtimes, and the costs of manual rework. While the upfront investment is daunting, laser alignment pays back in productivity gains, quality improvement, and cost savings within a year or two for most users.

Global Laser Alignment System Market Opportunities:

To maintain efficiency and prevent outages, the renewable energy domain—which includes installations like wind turbines and solar panels—needs accurate alignment at several phases. For the precise placement of photovoltaic cells, parabolic troughs in solar thermal plants, wind turbine components, etc., laser alignment offers both speed and micron-level accuracy. When investments in renewable energy increase internationally, this generates significant demand potential. For the precise positioning of wings, landing gear, jet engines, radar antennas, and other components where even a small misalignment can have disastrous consequences, the aerospace industry mostly relies on laser alignment. The increasing use of laser alignment devices for assembly and quality control procedures will be fueled by the expanding global commercial aviation sector as well as new space initiatives by private companies such as SpaceX and Blue Origin. Throughout the upstream, middle, and downstream processes of the oil and gas sector, laser alignment can be quite helpful. It is utilized in cracker plant shaft alignment, pipe laying, turbine alignment, leveling rigs and platforms, and other applications. A consistent flow of demand is produced by the ongoing global investments in new infrastructure related to oil and gas. Two well-liked metal additive manufacturing techniques are directed energy deposition and powder bed fusion with lasers. To attain dimensional accuracy, each layer of deposition must be calibrated using laser alignment. There are financial prospects due to the 3D printing industry's expected exponential expansion, particularly in industrial production.

LASER ALIGNMENT SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.05% |

|

Segments Covered |

By Type, Configuration, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SKF, Prüftechnik Dieter Busch AG, Fluke Corporation, ACOEM, Schaeffler Group, Hamar Laser Instruments, Easy-Laser AB, Baltech GmbH, Ludeca, PCE Instruments |

Global Laser Alignment System Market Segmentation: By Type

-

Plumb Lasers

-

Line Lasers

-

Rotary Lasers

-

Laser Trackers

-

Laser Scanners

Line lasers have the largest market share and makeup around 30% of the global market. Line lasers project a beam spread across a horizontal line, usually 360 degrees. They are ideal for horizontal alignments like leveling floors, conveyors, turbine flanges, shafts, etc. Plumb lasers are the fastest-growing segment. They project a vertical beam and are used primarily for vertical alignment applications. They enable precise alignment of elevator tracks, building foundations, walls, aircraft fuselages, and other vertical structures. Plumb lasers account for an estimated 25% share of the total laser alignment system market.

Global Laser Alignment System Market Segmentation: By Configuration

-

Dual-Beam Laser Alignment System

-

Single-Beam Laser Alignment System

Single-beam laser alignment systems are the largest growing category. The majority of applications for single-beam laser alignment systems involve slower and smaller shifts in the laser beam locations. A single-beam laser alignment system can help with maintaining correct machine alignment, which may save wear and tear, control vibrations, and enable equipment to operate at peak efficiency. Dual-beam laser alignment systems are the fastest-growing category. Users may ensure exact placement by carefully aligning components or structures relative to one another by producing two parallel laser beams. This is especially helpful for applications like aligning rollers, conveyors, shafts, or tracks where preserving parallelism is essential.

Global Laser Alignment System Market Segmentation: By Application

-

Machine Tool Alignment

-

Power Machine Alignment

-

Pumps and Motors

-

Others

Machine tool alignment is the dominant laser application, fueled by rising automation in the automotive, aerospace, and other discrete manufacturing sectors. It is used to accurately position machine tools like CNC machining centers, lathes, presses, etc. It currently accounts for over 40% of the market share. However, pumps and motors are the fastest-growing. A technical service called pump laser alignment makes sure that the motor and pump shafts in industrial pumping systems are precisely aligned. Pumps that use laser alignment function by clamping a mirror onto one shaft and a laser on the other. After the two shafts are turned simultaneously, the built-in computer will inform the operators of any necessary changes to align the pump. Reduced vibration, more efficiency, and less wear and tear on the mechanical parts are the outcomes of a correctly positioned motor. Increased output, enhanced dependability, and less downtime are the outcomes.

Global Laser Alignment System Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America accounts for the largest share of around 35% of the global laser alignment system market presently. The extensive manufacturing sector and early adoption of advanced automation technologies make it a major market. North America is the dominant regional laser alignment system market globally due to high demand from automotive, aerospace, medical devices, and other industries. Europe is the second-largest regional market, representing about 25% of the market currently. Germany, France, Italy, and the UK are major contributors. Asia-Pacific is predicted to witness the fastest growth at over 8% CAGR during 2024–2030, owing to rapid industrial development in China, India, and Southeast Asian countries. Asia-Pacific accounts for 20% of the market share. Developing economies like China, India, South Korea, and Indonesia are driving growth in the region.

COVID-19 Impact Analysis on the Global Laser Alignment System Market:

Lockdowns and border closures disrupted the flow of essential components and raw materials. Manufacturing facilities faced delays, and some experienced temporary shutdowns, constraining the supply of laser alignment systems. Amidst economic uncertainty and safety concerns, many industrial projects were postponed or canceled. This led to a decline in demand for new laser alignment equipment as investments in machinery upgrades took a temporary backseat. Travel restrictions and social distancing measures made it difficult to deploy technicians for on-site installation and maintenance services. This slowed down service responses and hindered market growth. Industries recognized the elevated importance of preventive maintenance to reduce downtime risks in an unpredictable environment. Laser alignment became more crucial to ensure equipment reliability, even under reduced staffing levels during the pandemic. Manufacturers of laser alignment systems accelerated the development of remote diagnostics and support tools. This enabled some maintenance and troubleshooting to be conducted virtually, minimizing on-site visits and ensuring continued customer service.

Latest Trends/ Developments:

A major trend is laser alignment systems with integrated IoT connectivity to extract and transmit data to cloud/on-premises platforms. This allows for remote monitoring, predictive maintenance, and minimizing downtime through early failure prediction. Companies like PRÜFTECHNIK offer IIoT-enabled laser shafts and machine tool alignment systems. 3D laser scanners are gaining rapid adoption for the alignment of robots, AGV paths, aircraft assembly jigs, etc. Offering fast and highly accurate 3D data capture, laser scanners reduce inspection times significantly. Vendors are introducing long-range and high-speed laser scanners suitable for large production environments. Multi-laser projectors that can emit multiple laser dots, lines, or crosses simultaneously are being developed. This allows complex alignments in a single step, improving speed and precision significantly. Recently, Hamar Laser launched their Multi-Beam Spatial Analyzer using 6 laser sources in one unit. Laser alignment assisted by machine vision camera systems can overlay real-time images from cameras with laser data for improved contextual analysis. This combination guides operators to achieve precise alignment rapidly and avoid errors. Alexa Align from LMI Technologies combines lasers with machine vision. Laser management systems like EWS from Mirtec are being combined with alignment solutions to actively monitor laser usage for safety and compliance. They control laser power if any unintended human presence is detected in the work area during alignment.

Key Players:

-

SKF

-

Prüftechnik Dieter Busch AG

-

Fluke Corporation

-

ACOEM

-

Schaeffler Group

-

Hamar Laser Instruments

-

Easy-Laser AB

-

Baltech GmbH

-

Ludeca

-

PCE Instruments

Chapter 1. Laser Alignment System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Laser Alignment System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Laser Alignment System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Laser Alignment System Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Laser Alignment System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Laser Alignment System Market – By Type

6.1 Introduction/Key Findings

6.2 Plumb Lasers

6.3 Line Lasers

6.4 Rotary Lasers

6.5 Laser Trackers

6.6 Laser Scanners

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Laser Alignment System Market – By Configuration

7.1 Introduction/Key Findings

7.2 Dual-Beam Laser Alignment System

7.3 Single-Beam Laser Alignment System

7.4 Y-O-Y Growth trend Analysis By Configuration

7.5 Absolute $ Opportunity Analysis By Configuration, 2024-2030

Chapter 8. Laser Alignment System Market – By Application

8.1 Introduction/Key Findings

8.2 Machine Tool Alignment

8.3 Power Machine Alignment

8.4 Pumps and Motors

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Laser Alignment System Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Configuration

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Configuration

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Configuration

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Configuration

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Configuration

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Laser Alignment System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 SKF

10.2 Prüftechnik Dieter Busch AG

10.3 Fluke Corporation

10.4 ACOEM

10.5 Schaeffler Group

10.6 Hamar Laser Instruments

10.7 Easy-Laser AB

10.8 Baltech GmbH

10.9 Ludeca

10.10 PCE Instruments

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Industries are shifting from reactive to proactive maintenance strategies. Laser alignment systems play a vital role in identifying and correcting misalignment, which is a key cause of machine breakdowns, unplanned downtime, and lost productivity.

Advanced, multi-axis laser alignment systems with sophisticated software have a substantial price tag that is a barrier to the market.

B SKF, Prüftechnik Dieter Busch AG, Fluke Corporation, ACOEM, Schaeffler Group, Hamar Laser Instruments, and Easy-Laser AB are the key players.

North America currently holds the largest market share, estimated at around 35%.

Asia-Pacific exhibits the fastest growth, driven by its increasing population and expanding economy.