Lard oil Market Size (2023-2030)

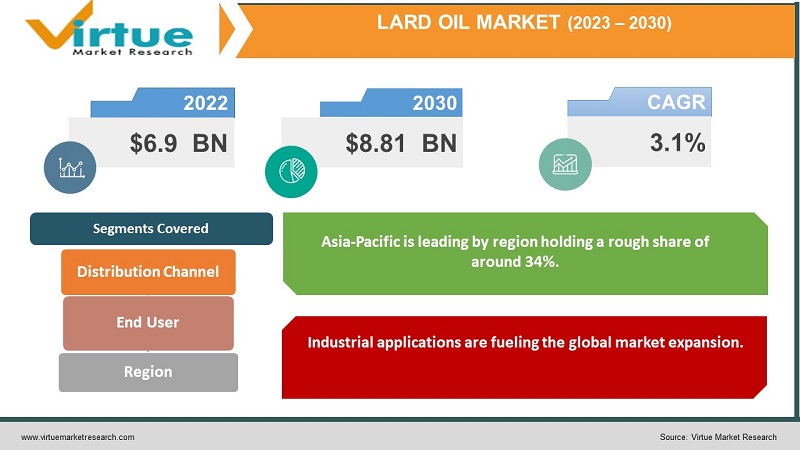

The global lard oil market was valued at USD 6.9 billion and is projected to reach a market size of USD 8.81 billion by the end of 2030. Over the forecast period of 2023–2030, the market is projected to grow at a CAGR of 3.1%.

The method used to make most lard is called rendering, and it involves gently cooking the fatty sections of the pig—such as the belly, shoulder, and tissue—until the fat melts. This results in the production of a semi-solid white-fat product known as lard. Dry heat, boiling, or steaming are the methods used to produce lard. Lard oil has been used for many years. In the past, it was used as a cooking oil in many culinary applications, like fried chicken. It was used for baking and deep-frying purposes as well. Presently, the applications of lard oil have been expanded. It is used in industrial applications for various cosmetics, soap, and other lubricants. Besides, its usage in the food and beverage industry has seen an expansion. In the future, with a growing focus on sustainability, healthier alternatives, and research and development, this market is expected to see good progress.

Key Market Insights:

The world's 3713th most traded product is lard. The top three countries exporting lard in 2021 were France, Belgium, and Germany.

In 2023, the Oils and fats market generated US$235.60 billion in revenue. The market is anticipated to expand by 6.80% a year (CAGR 2023-2028).

The value of lard and other pig and poultry fat imports into the United Kingdom (UK) in 2022 was estimated to be 32 million British pounds. Compared to 2020, this is an increase of over ten million British pounds.

In 2022, lard oil exports in South Korea reached $866.8 thousand.

It is generally advised by dietary guidelines from many health organizations that the consumption of saturated fat be kept to less than 10% of total daily calorie intake. About 40% of beef tallow and hog fat are usually saturated (myristic, palmitic, and stearic acids combined). To avoid unhealthy fat deposition, researchers and food committees are focusing on reducing unhealthy fats and finding alternatives.

Lard Oil Market Drivers:

The benefits of lard oil are helping the market grow rapidly.

There is no pig flavor in pure lard. It is associated with a neutral taste. Lard is a better alternative to hydrogenated fats because it doesn't contain trans fats. Secondly, butter has more cholesterol and saturated fat than lard. Lard has 20% less saturated fat and 1/3rd less cholesterol than butter. Thirdly, similar to olive oil, lard also includes beneficial monounsaturated fats. Blood levels of harmful cholesterol can be lowered by monounsaturated fats, thereby reducing the risk of heart disease and stroke. Besides, they also supply nutrients that support the growth and upkeep of our body's cells. Moreover, lard is a very adaptable fat since it doesn't smoke at high temperatures, making it ideal for frying or high-heat cooking. Additionally, it doesn't degrade or oxidize, which might release harmful free radicals. Furthermore, cooking with lard allows the use of more of the animal, which reduces waste and increases environmental consciousness.

Industrial applications are fueling the global market expansion.

According to research, lard oil is an inexpensive feedstock that can be used to produce biodiesel, and with the right process variable optimization, sustainable biodiesel production may be accomplished. There is a growing demand for the use of renewable energy sources and incorporating sustainable practices. Various measures are being taken to reduce the emissions of greenhouse gases. Additionally, dependency on fossil fuels is being minimized. Biofuels are being prioritized. Therefore, lard oil can be used as a suitable feedstock for the production of biofuel. Moreover, cutting oils, lubricating oils, drawing compounds, textile lubricants, sulfonating and sulfurized bases, copper rolling and drawing grease formulations, and lubricant additives are all applications for lard oil. It is also used as a lubricant when higher shear and thermal stability are preferred over petroleum lubricants. Furthermore, to give soap a creamy lather, conditioning qualities, and a hint of hardness, lard is utilized in the process.

An increasing number of eateries is aiding the progress augmenting market growth.

Globalization has led to the operations of food industries locally and internationally. Additionally, the growing population calls for more food production. The number of restaurants and hotels has increased over the past decade. Lard oil is being adopted in various bakeries and other food chains owing to its taste, authenticity, flavors, and texture. Moreover, experimentation is being carried out about culinary applications. Furthermore, youngsters are interested in trying new varieties. This diversity is enlarging the market.

Lard Oil Market Restraints and Challenges:

Lard oil faces heavy competition from vegetable oils like olive, soybean, and canola. They are perceived as healthier alternatives due to their nutritional profile. Therefore, consumers are leaning towards the use of other oils. Secondly, there is a growing popularity of veganism. This is the practice of incorporating plant-based foods. The animal industry is subjected to a lot of cruelty owing to their products. To avoid this, many environmentalists have started spreading awareness. Ethical aspects of animal fat production are questioned, causing losses for the market. Additionally, vegetarians do not prefer these oils. This has shifted consumer preferences. Thirdly, lard is associated with saturated fats. Due to ongoing health and wellness trends, people are looking for healthier options and other alternatives.

Lard Oil Market Opportunities:

Healthier lard options with lesser fat content are being researched. Alternatives and other plant-based options can provide the market with an ample number of possibilities. Secondly, sustainable and ethical sourcing methods are being given utmost prominence. Thirdly, product innovations are being carried out. This is done to improve the flavor and texture. Moreover, usage is increasing in meat products, cakes, sweets, and confectionery. Furthermore, the demand for lard oil is increasing due to the rising popularity of biofuels.

LARD OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.1% |

|

Segments Covered |

By End User, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lard Oil Company, Chevron, Texaco, ExxonMobil, Valero, Agrolane, Spectrum Chemical Mfg. Corp., Tannin Corp., Clarkson & Ford, The Seydel Companies |

Lard Oil Market Segmentation:

Lard Oil Market Segmentation: By End User:

- Food and Beverage

- Industrial

- Consumer

- Others

Based on end users, the food and beverage industry is the largest in the market holding the most dominant position in 2022. This is because of factors like traditionalism, authenticity, taste, varieties, consumer preference, availability, worldwide expansion, flavor, and nutritional profile. Moreover, an upsurge in the number of eateries is boosting growth. Baking products, roasted vegetables, and grilled meats are known to taste better when cooked in lard. The industrial segment is the fastest growing owing to an increased interest in biofuels, sustainability, and clean and renewable sources of energy. Besides, Governmental initiatives through investments in various research institutes, labs, and other universities are helping with the uprising.

Lard Oil Market Segmentation: By Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience stores

- Online Retail

The largest segment in this industry, based on distribution channels, are supermarkets and hypermarkets. This is due to availability, negotiation, in-person interactions, customer experience, convenience, traditionalism, and visual examination. Online retail, however, is considered to be expanding at the fastest rate. This is due to worldwide shipping, home delivery, savings, deals, simplicity, user-friendly features, the availability of a wider range of products, and customer satisfaction. The pandemic caused digitalization, thereby playing a huge role in adopting online retail. For this category, a notable growth rate is predicted throughout the projection period.

Lard Oil Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia-Pacific is leading by region holding a rough share of around 34%. Population growth, mass production, urbanization, the food industry's expansion, globalization, demand, manufacturing industries, Governmental support through initiatives and investments, and diet inclusion are the causes of this. Countries like China, Vietnam, and the Philippines are the leading. China produced more than four million barrels of oil per day in 2022, as per Statista. Due to recent population growth, emerging key players, partnerships, flavor diversification, rising demand, increasing funds, and global operations, Europe is one of the fastest-growing areas in the world. Countries like the Netherlands, Belgium, France, and Germany stand at the forefront. Europe holds a total share of approximately 25%. Additionally, these countries have shown a significant increase in import-export activities, contributing to the flourishment. With the UK excluded, the total oil output in the European Union in 2022 was around 16.7 million metric tonnes as per Statista. North America is showing moderate growth, especially in regions like the United States and Canada. This is owing to the rising adoption of oil and rapidly expanding companies.

COVID-19 Impact Analysis on the Global Lard Oil Market:

The outbreak of the virus hurt the market. Lockdowns, movement restrictions, and social isolation were the new norm. This caused disruptions in the supply chain, logistics, and transportation. This severely impacted import-export trade activities. Many companies and manufacturing units were shut down. Restaurants and hotels were closed, causing huge losses to the food and beverage industry. This caused an economic downfall. Besides, there was a rise in the number of people who started to incorporate plant-based foods. According to a recent poll conducted by Proagrica among over 1,000 people in the UK, over one in five (18%) had increased their intake of vegan and/or vegetarian cuisine since the pandemic's start in March 2020. Moreover, the pandemic highlighted the importance of staying healthy. People started to cut down on oil and fat content. Most of the funding was shifted towards vaccine development and other healthcare applications. This led to a decrease in R&D activities regarding biofuels. Furthermore, sustainability gained emphasis. All these factors took a toll on market growth. However, the market is rising steadily due to the upliftment of guidelines, the relaxation of lockdowns, the opening of food chains, and online retail.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heavily to improve existing formulations while maintaining competitive pricing.

Organizations are focusing on e-commerce growth. After the pandemic, digitalization has become very common. Online channels are being emphasized. This helps in reaching a broader consumer base. Online sales are helping the market boost its sales and augment its growth.

Key Players:

- Lard Oil Company

- Chevron

- Texaco

- ExxonMobil

- Valero

- Agrolane

- Spectrum Chemical Mfg. Corp.

- Tannin Corp.

- Clarkson & Ford

- The Seydel Companies

In April 2023, Lard Oil Company and Des-Case Corporation hosted an interactive 1-day symposium in a collaborative effort to further educate customers and industry leaders on best practices for lubrication, contamination control, oil analysis, and more.

Chapter 1. GLOBAL LARD OIL MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL LARD OIL MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL LARD OIL MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL LARD OIL MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL LARD OIL MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL LARD OIL MARKET – By Distribution Channel

6.1. Introduction/Key Findings

6.2. Supermarkets/Hypermarkets

6.3. Specialty Stores

6.4. Convenience stores

6.5. Online Retail

6.6. Y-O-Y Growth trend Analysis By Distribution Channel

6.7. Absolute $ Opportunity Analysis By Distribution Channel , 2023-2030

Chapter 7. GLOBAL LARD OIL MARKET – By End User

7.1. Introduction/Key Findings

7.2. Food and Beverage

7.3. Industrial

7.4. Consumer

7.5. Others

7.6. Y-O-Y Growth trend Analysis By End User

7.7 . Absolute $ Opportunity Analysis By End User , 2023-2030

Chapter 8. GLOBAL LARD OIL MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End User

8.1.3. By Distribution Channel

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By End User

8.2.3. By Distribution Channel

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By End User

8.3.3. By Distribution Channel

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By End User

8.4.3. By Distribution Channel

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By End User

8.5.3. By Distribution Channel

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL LARD OIL MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Lard Oil Company

9.2. Chevron

9.3. Texaco

9.4. ExxonMobil

9.5. Valero

9.6. Agrolane

9.7. Spectrum Chemical Mfg. Corp.

9.8. Tannin Corp.

9.9. Clarkson & Ford

9.10. The Seydel Companies

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

global lard oil market was valued at USD 6.9 billion and is projected to reach a market size of USD 8.81 billion by the end of 2030. Over the forecast period of 2023–2030, the market is projected to grow at a CAGR of 3.1%.

The benefits of lard oil, industrial applications, and an increasing number of eateries are the main drivers propelling the Global Lard Oil Market

Based on the Distribution Channel, the Global Lard Oil Market is segmented into Supermarkets/Hypermarkets, Specialty Stores, Convenience stores, and Online Retail

Asia-Pacific is the most dominant region for the Global Lard Oil Market

Lard Oil Company, Chevron, Texaco, ExxonMobil, and Valero are the key players operating in the Global Lard Oil Market.