Laminating Film Market Size (2024 – 2030)

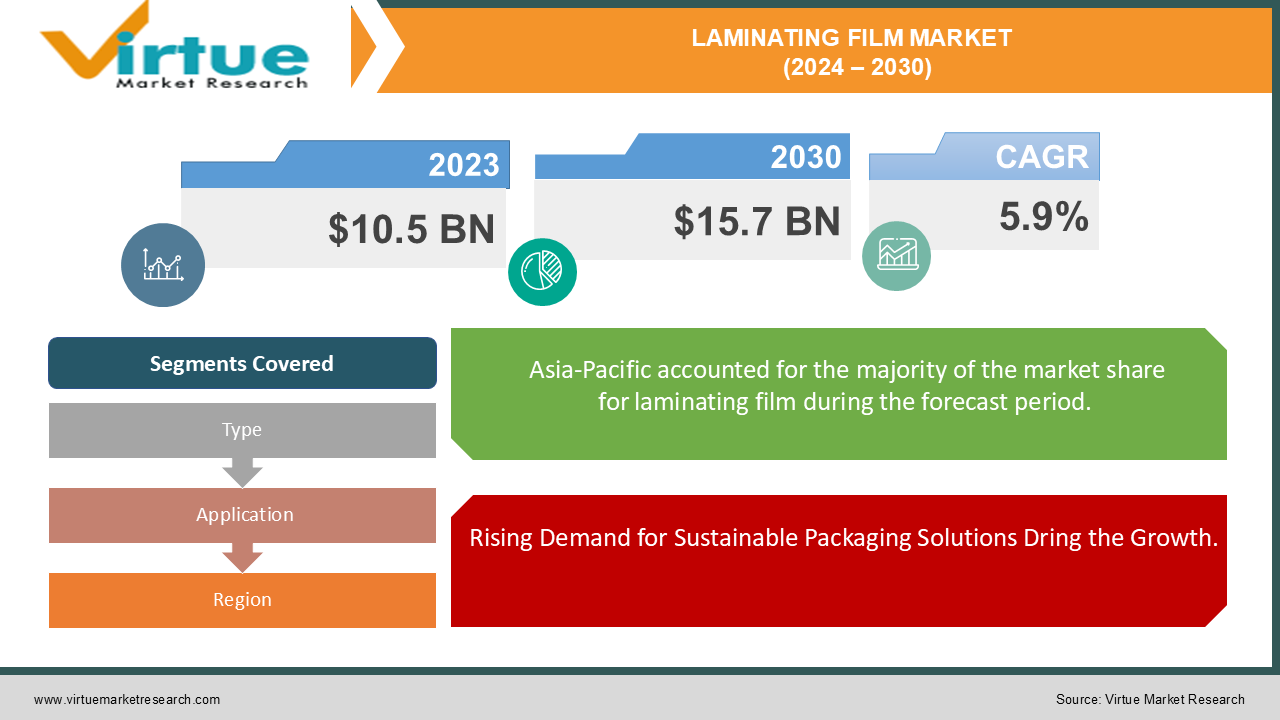

The Global Laminating Film Market was valued at USD 10.5 billion in 2023 and is projected to reach a market size of USD 15.7 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.9% between 2024 and 2030.

The Global Laminating Film Market is experiencing significant growth, driven by increasing demand across various sectors such as packaging, advertising, and consumer goods. Laminating films are essential for protecting printed materials, enhancing durability, and improving visual appeal. These films are used extensively in the food and beverage, pharmaceuticals, and educational sectors due to their ability to provide protection from moisture, dust, and wear. With the rise of digital printing and advancements in packaging technology, laminating films are becoming more versatile, offering features like UV protection, antimicrobial properties, and recyclability. The market is also witnessing a surge in demand for eco-friendly and biodegradable laminating films, fueled by growing environmental concerns and regulatory pressures. The global shift towards sustainable packaging solutions is pushing manufacturers to innovate and develop films that are not only functional but also environmentally responsible. Moreover, the rapid expansion of e-commerce and retail industries has further boosted the need for protective and aesthetically appealing packaging, contributing to the growth of the laminating film market. As businesses increasingly focus on product presentation and sustainability, the market is poised for continued expansion in the coming years.

Key Market Insights:

-

The packaging industry accounts for over 40% of the total demand for laminating films globally.

-

The demand for biodegradable laminating films is projected to grow by 12% annually due to increased environmental awareness.

-

The Asia-Pacific region holds more than 35% of the global laminating film market, driven by rapid industrialization and growing retail sectors.

-

Laminating films with UV protection features are expected to see a market growth of 8.2% annually, due to their rising usage in outdoor advertising and packaging.

-

Flexible packaging applications account for 30% of the total laminating film market share, largely due to its increasing use in the food and beverage industries.

Global Laminating Film Market Drivers:

Rising Demand for Sustainable Packaging Solutions Dring the Growth.

The growing emphasis on sustainability is a major driver for the global laminating film market. As environmental concerns mount and governments enforce stricter regulations on plastic use, industries are shifting towards eco-friendly packaging solutions. Laminating films play a crucial role in enhancing the durability and appeal of packaging, but traditional plastic films contribute to environmental waste. In response, manufacturers are increasingly developing biodegradable and recyclable laminating films, aligning with the global trend toward sustainability. Consumer preference for environmentally responsible products is also pushing companies to adopt greener packaging solutions, especially in sectors like food and beverages, personal care, and pharmaceuticals. The increasing demand for sustainable laminating films is expected to further fuel market growth, as brands focus on minimizing their environmental footprint without compromising on product protection and aesthetics.

Expanding E-commerce and Retail Sectors Propelling the Market Growth.

The rapid expansion of the e-commerce and retail industries is another key driver for the laminating film market. As online shopping continues to grow, the need for protective, attractive, and durable packaging has surged. Laminating films provide a layer of protection against moisture, dust, and physical damage, ensuring that products reach consumers in perfect condition. Additionally, laminating films enhance the visual appeal of packaging, helping brands stand out in a competitive marketplace. The rise in home deliveries, particularly for food, electronics, and consumer goods, has increased the demand for flexible, laminated packaging solutions. This trend is expected to continue as e-commerce and retail sectors expand globally, driving further growth in the laminating film market.

Global Laminating Film Market Restraints and Challenges:

The Global Laminating Film Market faces several restraints and challenges, primarily due to environmental concerns and fluctuating raw material prices. Traditional laminating films, often made from non-biodegradable plastics like PET and PVC, contribute significantly to environmental pollution, prompting governments to impose stringent regulations on plastic usage. This has led to a growing demand for sustainable alternatives, which, while beneficial for the environment, increases production costs for manufacturers. Developing eco-friendly laminating films that meet both functional and environmental standards requires significant investment in research and development, creating a financial burden for small and mid-sized manufacturers. Additionally, the volatility in raw material prices, especially for petroleum-based products, further challenges the market. The fluctuating costs can disrupt supply chains and make it difficult for manufacturers to maintain consistent pricing, affecting profitability. Moreover, while the demand for sustainable packaging is rising, the adoption of biodegradable laminating films is still slow in certain regions due to the higher costs associated with these materials. This, coupled with the limited availability of advanced recycling infrastructure, presents significant challenges for the widespread adoption of environmentally friendly laminating films. These factors are likely to hinder the market's growth unless sustainable innovations can be scaled cost-effectively across the industry.

Global Laminating Film Market Opportunities:

The Global Laminating Film Market presents significant opportunities, particularly in the development of eco-friendly and innovative laminating solutions. As sustainability becomes a key focus for consumers and industries alike, the demand for biodegradable, compostable, and recyclable laminating films is on the rise. This shift towards greener packaging solutions offers manufacturers the chance to capitalize on this growing trend by investing in advanced materials and technologies. Innovations such as water-based and solvent-free laminating films are gaining traction due to their reduced environmental impact. Additionally, the increasing popularity of digital printing and custom packaging opens new avenues for laminating films with specialized features, including UV protection, antimicrobial properties, and improved printability. These features are in high demand across industries such as food and beverage, healthcare, and electronics, where product protection and visual appeal are critical. Furthermore, emerging markets in Asia-Pacific, Latin America, and the Middle East present growth opportunities due to rising industrialization, urbanization, and expanding retail sectors. As businesses in these regions adopt more advanced packaging technologies, the demand for laminating films is expected to rise. By focusing on sustainability, innovation, and regional expansion, companies in the laminating film market can unlock new growth potential in the coming years.

LAMINATING FILM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cosmo Films Ltd., Avery Dennison Corporation, Toray Plastics (America), Inc., Uflex Ltd., D&K Group, Dunmore Corporation, FlexFilm Ltd., Derprosa Films, Mondi Group, Celplast Metallized Products Ltd., Transilwrap Company Inc. |

Global Laminating Film Market Segmentation: By Type

-

Polypropylene (PP)

-

Polyester (PET)

-

Nylon

In 2023, based on market segmentation by Type, Polypropylene (PP) had the highest share of the Global Laminating Film Market. Polypropylene (PP) is widely recognized for its cost-effectiveness and versatility, making it a preferred material for laminating applications. One of its key advantages is its affordability compared to other materials like polyester (PET) or nylon, offering manufacturers a budget-friendly option without sacrificing performance. PP also provides excellent barrier properties, effectively protecting products from moisture, oxygen, and grease, making it suitable for various packaging and industrial applications. This durability ensures that items remain secure and intact, particularly in food packaging and other sensitive industries. Additionally, PP has an ideal surface for printing, allowing for high-quality labels and printed materials, which is crucial in branding and product presentation. Its excellent printability ensures clear, vibrant graphics, enhancing the aesthetic appeal of packaging. The material's versatility further adds to its appeal, as it can be used across a wide range of applications, from food and beverage packaging to more industrial uses. While other materials may excel in specific niches, the balance of cost, performance, and adaptability makes PP a popular choice for laminating films, offering a reliable solution for industries seeking both quality and affordability.

Global Laminating Film Market Segmentation: By Application

-

Packaging

-

Graphics and Printing

-

Industrial Applications

-

Medical and Healthcare

In 2023, based on market segmentation by Application, Packaging had the highest share of the Global Laminating Film Market. Laminating films play a critical role in the packaging of various products, particularly in the food and beverage, consumer goods, and industrial sectors. In the food and beverage industry, these films are essential for maintaining freshness, preventing contamination, and enhancing the visual appeal of packaged products. Their protective barrier against moisture, oxygen, and external elements ensures that food remains safe and fresh for longer periods, while also boosting the product's shelf presence. Similarly, in the consumer goods sector, laminating films are widely used for packaging items such as cosmetics, pharmaceuticals, electronics, and household products. The films not only protect these items from damage and contamination but also improve their appearance, making them more attractive to consumers. In industrial applications, laminating films are crucial for safeguarding products like automotive parts, chemicals, and construction materials, offering a layer of protection during storage and transportation. The increasing demand for high-quality, diverse packaging solutions, combined with the rapid growth of the packaging industry, has significantly boosted the demand for laminating films across these segments. As industries seek more durable, flexible, and visually appealing packaging options, laminating films continue to be a go-to solution for both protective and aesthetic purposes.

Global Laminating Film Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, Asia-Pacific had the highest share of the Global Laminating Film Market. Asia-Pacific has emerged as a dominant region in the global laminating film market, driven by several key factors. Rapid industrialization in countries like China and India has significantly boosted the demand for packaging materials, including laminating films. As these nations experience industrial expansion, the need for efficient packaging solutions to protect and enhance the presentation of goods has grown. Additionally, the region's large and growing population has further fueled demand for consumer goods, ranging from food and beverages to electronics, all of which require laminating films for packaging. This surge in consumer demand has led to an increased need for high-quality packaging materials that ensure product safety, freshness, and appeal. Moreover, many Asian countries offer cost advantages due to lower manufacturing expenses, making the region an attractive hub for global laminating film producers. These cost efficiencies not only benefit local markets but also position Asia-Pacific as a key exporter of laminating films. As a result, the region holds a significant share of the global laminating film market and is expected to maintain its growth trajectory. The combination of industrial expansion, rising consumer demand, and cost advantages continues to drive the laminating film industry's growth in Asia-Pacific.

COVID-19 Impact Analysis on the Global Laminating Film Market.

The COVID-19 pandemic had a mixed impact on the Global Laminating Film Market. Initially, supply chain disruptions and lockdown measures led to a slowdown in manufacturing and distribution, negatively affecting market growth. The shortage of raw materials, particularly in key regions like Asia-Pacific, caused delays in production and increased costs. However, the demand for laminating films saw a notable rise in certain sectors, particularly in food packaging, healthcare, and e-commerce. The need for protective and hygienic packaging solutions surged as consumers turned to online shopping and contactless deliveries. Laminating films, with their protective properties, became essential in ensuring product safety and hygiene, especially in food, pharmaceuticals, and medical equipment packaging. Additionally, the increased focus on health and safety during the pandemic boosted the demand for films with antimicrobial properties. Post-pandemic, as economies reopened and industries resumed full-scale operations, the laminating film market began to recover. The e-commerce boom, accelerated by the pandemic, has had a lasting effect, with the need for durable and visually appealing packaging driving demand for laminating films. While the initial disruption posed challenges, the pandemic ultimately highlighted the importance of flexible, protective packaging, creating new growth opportunities for the laminating film market.

Latest trends / Developments:

The Global Laminating Film Market is witnessing several key trends and developments driven by advancements in technology, sustainability initiatives, and shifting consumer preferences. One of the most significant trends is the growing demand for eco-friendly and biodegradable laminating films, as industries across the board aim to reduce their environmental footprint. Manufacturers are increasingly focusing on developing films made from recyclable and compostable materials, aligning with global sustainability goals. Another major trend is the rise of antimicrobial laminating films, particularly in healthcare and food packaging, where hygiene and safety are paramount. The integration of UV-resistant films is also gaining traction, especially in outdoor advertising and packaging to protect products from sunlight damage. In addition, the surge in e-commerce and digital printing is boosting demand for custom, flexible packaging solutions that use laminating films for aesthetic enhancement and protection. Technological advancements are enabling the production of thinner, more durable, and cost-effective films, which help in reducing material waste and lowering production costs. Smart laminating films, with features like temperature sensitivity and tamper resistance, are also emerging in response to industry-specific needs. These innovations and trends are shaping the laminating film market, positioning it for continued growth in the coming years.

Key Players:

-

Cosmo Films Ltd.

-

Avery Dennison Corporation

-

Toray Plastics (America), Inc.

-

Uflex Ltd.

-

D&K Group

-

Dunmore Corporation

-

FlexFilm Ltd.

-

Derprosa Films

-

Mondi Group

-

Celplast Metallized Products Ltd.

-

Transilwrap Company Inc.

Chapter 1. Laminating Film Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Laminating Film Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Laminating Film Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Laminating Film Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Laminating Film Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Laminating Film Market – By Types

6.1 Introduction/Key Findings

6.2 Polypropylene (PP)

6.3 Polyester (PET)

6.4 Nylon

6.5 Y-O-Y Growth trend Analysis By Types

6.6 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Laminating Film Market – By Application

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Graphics and Printing

7.4 Industrial Applications

7.5 Medical and Healthcare

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Laminating Film Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Laminating Film Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cosmo Films Ltd.

9.2 Avery Dennison Corporation

9.3 Toray Plastics (America), Inc.

9.4 Uflex Ltd.

9.5 D&K Group

9.6 Dunmore Corporation

9.7 FlexFilm Ltd.

9.8 Derprosa Films

9.9 Mondi Group

9.10 Celplast Metallized Products Ltd.

9.11 Transilwrap Company Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

By 2023, the Global Laminating Film market is expected to be valued at US$ 10.5 billion.

Through 2030, the Global Laminating Film market is expected to grow at a CAGR of 5.9%.

By 2030, the Global Laminating Film Market is expected to grow to a value of US$ 15.7 billion.

Asia-Pacific is predicted to lead the Global Laminating Film market.

The Global Laminating Film Market has segments By Type, Application, and Region.