Laminated Glass Facade Market Size (2024-2030)

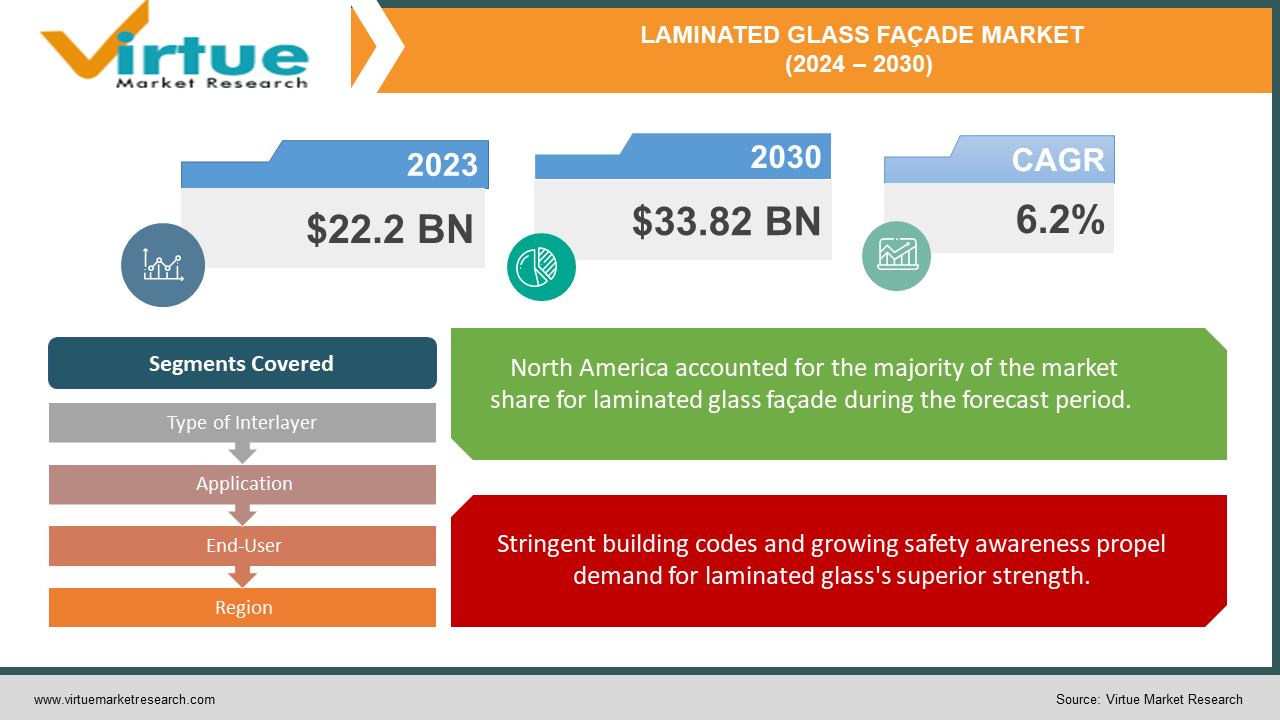

The Laminated Glass Facade Market was valued at USD 22.2 billion in 2023 and is projected to reach a market size of USD 33.82 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.2%.

The laminated glass facade market is on a steady rise. This growth is fueled by a focus on safety in construction projects. Building codes and growing awareness of safety benefits are pushing the industry towards laminated glass for its superior strength and ability to resist shattering upon impact. Additionally, laminated glass offers superior protection in hurricane-prone regions as the interlayer holds the glass together even if cracked, minimizing damage. Beyond safety, laminated glass facades offer design flexibility.

Key Market Insights:

Beyond safety, laminated glass facades offer a designer's dream. Architects can unleash their creativity with tinted, colored, or patterned glass options. This design flexibility caters to the growing trend of architecturally exposed structural steel (AESS) facades, which often incorporate laminated glass.

Furthermore, laminated glass goes beyond aesthetics. It can be a champion for sustainability when combined with energy-saving technologies like low-e coatings. This focus on energy efficiency aligns perfectly with the growing green building movement. With its combined benefits of safety, design appeal, and environmental responsibility, laminated glass facades are a promising trend that is expected to dominate the construction landscape, particularly in the booming Asia Pacific region.

The Laminated Glass Facade Market Drivers:

Stringent building codes and growing safety awareness propel demand for laminated glass's superior strength.

Building codes are becoming increasingly stringent as safety takes center stage in construction projects. This, coupled with a growing public awareness of the importance of safety in buildings, is pushing architects and builders towards laminated glass. Unlike regular glass, laminated glass boasts superior strength and exceptional resistance to shattering upon impact. This is particularly crucial in areas like schools, hospitals, and commercial buildings where broken glass could cause injuries.

Laminated glass emerges as a hurricane protection powerhouse due to its unique interlayer holding it together even when cracked.

In hurricane-prone regions, laminated glass facades become a true powerhouse for protection. The secret lies within the interlayer – a special layer sandwiched between the glass panes. This interlayer holds the laminated glass together even if it cracks from windborne debris flung by hurricanes. This translates to significantly minimized damage to buildings, offering superior protection compared to regular glass facades. In areas constantly threatened by these extreme weather events, laminated glass facades are becoming an increasingly attractive option.

Architects unleash their creativity with laminated glass's design versatility in tinting, coloring, and patterns.

Beyond its safety benefits, laminated glass offers a world of design possibilities for architects. Unlike the limitations of regular glass, laminated glass comes in a wide range of options, including tinted, colored, and patterned varieties. This design versatility allows architects to unleash their creativity and create unique and visually striking building facades. This design flexibility aligns perfectly with the growing trend of architecturally exposed structural steel (AESS) facades, which often incorporate laminated glass for a distinctive aesthetic appeal.

Laminated glass champions sustainability by creating an energy-efficient building envelope when combined with low-e coatings.

Laminated glass goes beyond just aesthetics; it can also be a champion for sustainability. When combined with energy-saving technologies like low-e coatings, laminated glass can create a highly efficient building envelope. These low-e coatings help regulate the flow of heat through the glass, reducing energy consumption for heating and cooling the building. This focus on energy efficiency perfectly aligns with the growing green building movement, making laminated glass facades an attractive option for eco-conscious construction projects.

The Laminated Glass Facade Market Restraints and Challenges:

Despite the positive outlook for laminated glass facades, there are hurdles to overcome for even wider adoption. The main challenge is cost. Laminated glass is significantly more expensive than regular annealed glass due to the specialized equipment and materials required during manufacturing. This price difference can be a major obstacle, particularly in developing markets where budget constraints are a significant factor. Consequently, laminated glass facades are often limited to high-end commercial buildings, while budget-conscious construction projects might shy away from this option.

Another hurdle is installation complexity. Laminated glass is heavier than regular glass and the presence of the interlayer necessitates specialized handling techniques. This translates to a more complex and time-consuming installation process compared to regular glass. The need for specialized labor and potentially longer project timelines can add to the overall cost and deter some builders from choosing laminated glass facades.

Finally, there's the issue of limited awareness. While knowledge of laminated glass is on the rise, there might still be a gap in understanding in some regions. Specifiers, architects, and even some building owners may not be fully aware of the safety, design flexibility, and energy-saving benefits that laminated glass offers. This lack of comprehensive knowledge can be a barrier to wider adoption, as decision-makers might not fully appreciate the value proposition of laminated glass facades compared to traditional options.

The Laminated Glass Facade Market Opportunities:

The future of laminated glass facades is brimming with exciting opportunities. Advancements in manufacturing technology hold the key to bringing down production costs, making laminated glass a more accessible option for budget-conscious construction projects, particularly in developing markets. Furthermore, research into self-healing interlayers or improved sound insulation could further enhance the value proposition of laminated glass facades. The growing focus on sustainability presents another significant opportunity. Laminated glass, when combined with energy-saving technologies, can contribute to energy-efficient buildings, perfectly aligning with the green building movement and government regulations. As sustainability becomes a top priority, laminated glass facades are poised for wider acceptance.

Developing economies with booming construction industries offer a vast potential market. As these economies progress and safety awareness increases, the demand for laminated glass is expected to surge. Manufacturers can tap into this market by establishing local production facilities or developing cost-effective laminated glass solutions. Finally, the design versatility of laminated glass, with its ability to be tinted, coloured, and patterned, opens doors for innovative and visually striking building facades. This caters to the growing demand for architecturally unique structures and can be a major selling point for developers and architects seeking to create iconic landmarks. As architects push the boundaries of design, laminated glass facades are expected to play a key role in shaping the future of architecture.

LAMINATED GLASS FACADE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type of Interlayer, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AGC, Asahi India Glass Limited, Saint-Gobain, Nippon Sheet Glass, Central Glass, Sisecam, Guardian Industries, Xinyi Glass Holdings, CGS Holdings, Fuyao Glass Industry |

Laminated Glass Facade Market Segmentation: By Type of Interlayer

-

Polyvinyl Butyral (PVB)

-

SentryGlas Plus (SGP)

-

Ethylene-Vinyl Acetate (EVA)

-

Others

The most dominant segment by type of interlayer in the laminated glass facade market is Polyvinyl Butyral (PVB) due to its cost-effectiveness, offering a good balance between adhesion, transparency, and impact resistance. However, SentryGlas Plus (SGP) is expected to be the fastest-growing segment. Its exceptional clarity and strength make it ideal for demanding applications, particularly in hurricane zones.

Laminated Glass Facade Market Segmentation: By Application

-

Commercial Buildings

-

Residential Buildings

-

Institutional Buildings

-

Other Applications

The dominant segment of the laminated glass facade market by application is Curtain Walls. These large, non-structural walls extensively use laminated glass for both aesthetics and safety reasons, making them the leading choice in various building types. On the other hand, Canopies are expected to be the fastest-growing segment. Their use of laminated glass for light transmission and weather protection aligns with the increasing demand for sustainable buildings with natural light integration.

Laminated Glass Facade Market Segmentation: By End-User

-

Building and Construction

-

Automotive

-

Electronics

The dominant segment of the laminated glass facade market by End-User Industry is likely the Building and Construction sector, encompassing various building types like offices, schools, and high-rises. This segment benefits from the safety, design flexibility, and energy efficiency advantages of laminated glass. The fastest-growing segment is expected to be Developing Economies (within Building and Construction) driven by rapid urbanization and increasing safety awareness in these regions.

Laminated Glass Facade Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America’s well-established market is characterized by a focus on high-performance and energy-efficient buildings. Stringent building codes and a mature construction industry contribute to steady demand for laminated glass facades. However, growth might be tempered by the already high penetration of laminated glass in this region.

Asia Pacific region reigns supreme as the dominant market, fueled by rapid urbanization and a booming construction sector, particularly in China and India. The increasing demand for modern and aesthetically pleasing buildings, coupled with rising safety awareness, creates a vast opportunity for laminated glass facades. With significant infrastructure development projects underway, the Asia Pacific region is expected to maintain its leading position in the coming years.

COVID-19 Impact Analysis on the Laminated Glass Facade Market:

The COVID-19 pandemic's impact on the laminated glass facade market was a double-edged sword. In the short term, the market faced challenges. Lockdowns and travel restrictions disrupted the global supply chain for raw materials and glass, leading to temporary shortages and price hikes. This impacted project timelines and potentially increased costs. Additionally, the pandemic caused a slowdown in construction due to labor shortages, project delays, and economic uncertainty, leading to a decline in demand for laminated glass facades. With a focus on public health measures, some construction projects, particularly those related to hospitality or retail, were put on hold, further impacting demand.

However, the long-term outlook appears more positive. The pandemic has heightened the focus on hygiene and safety in buildings. Laminated glass's ease of cleaning and shatter resistance can be seen as an advantage, potentially leading to increased adoption in healthcare facilities, offices, and public spaces. Furthermore, the rise of remote work trends could lead to a demand for laminated glass facades in residential buildings as homeowners seek well-lit and visually appealing workspaces, where laminated glass with its design flexibility can be a favorable option. Finally, the growing concerns about climate change are driving a focus on sustainable construction practices. Laminated glass, when combined with energy-saving technologies, can contribute to energy-efficient buildings, aligning with the green building movement and potentially boosting demand in the long run. Overall, while the COVID-19 pandemic presented initial challenges, the laminated glass facade market is expected to recover and resume its growth trajectory, driven by these emerging trends.

Latest Trends/ Developments:

The laminated glass facade market is brimming with cutting-edge advancements that push the boundaries of design, functionality, and sustainability. Researchers are on the cusp of unlocking self-healing interlayer technology for laminated glass. Imagine facades that can automatically repair minor cracks or scratches, significantly enhancing their durability and reducing maintenance costs. Furthermore, the integration of smart glass technologies is gaining momentum. By incorporating these innovative materials, laminated glass facades can transform into dynamic architectural elements. Imagine buildings with electronically controlled transparency for privacy or optimized sunlight penetration, or even projection surfaces that come alive with vibrant displays. Architects are also embracing biomimicry, drawing inspiration from nature to create stunning and functional facades. Laminated glass with unique textures, patterns, or even self-cleaning properties inspired by nature like lotus leaves can become key elements in achieving this biomimetic aesthetic.

Key Players:

-

AGC

-

Asahi India Glass Limited

-

Saint-Gobain

-

Nippon Sheet Glass

-

Central Glass

-

Sisecam

-

Guardian Industries

-

Xinyi Glass Holdings

-

CGS Holdings

-

Fuyao Glass Industry

Chapter 1. Laminated Glass Facade Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Deployment Models

1.5 Secondary Deployment Models

Chapter 2. Laminated Glass Facade Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Laminated Glass Facade Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Laminated Glass Facade MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Laminated Glass Facade Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Laminated Glass Facade Market– By Type of Interlayer

6.1 Introduction/Key Findings

6.2 Polyvinyl Butyral (PVB)

6.3 SentryGlas Plus (SGP)

6.4 Ethylene-Vinyl Acetate (EVA)

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type of Interlayer

6.7 Absolute $ Opportunity Analysis By Type of Interlayer, 2024-2030

Chapter 7. Laminated Glass Facade Market– By Application

7.1 Introduction/Key Findings

7.2 Commercial Buildings

7.3 Residential Buildings

7.4 Institutional Buildings

7.5 Other Applications

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Laminated Glass Facade Market– By End-User

8.1 Introduction/Key Findings

8.2 Building and Construction

8.3 Automotive

8.4 Electronics

8.5 Y-O-Y Growth trend Analysis By End-User

8.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Laminated Glass Facade Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type of Interlayer

9.1.3 By Application

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type of Interlayer

9.2.3 By Application

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type of Interlayer

9.3.3 By Application

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type of Interlayer

9.4.3 By Application

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type of Interlayer

9.5.3 By Application

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Laminated Glass Facade Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 AGC

10.2 Asahi India Glass Limited

10.3 Saint-Gobain

10.4 Nippon Sheet Glass

10.5 Central Glass

10.6 Sisecam

10.7 Guardian Industries

10.8 Xinyi Glass Holdings

10.9 CGS Holdings

10.10 Fuyao Glass Industry

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Laminated Glass Facade Market was valued at USD 22.2 billion in 2023 and is projected to reach a market size of USD 33.82 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.2%.

Enhanced Safety Regulations and Growing Public Awareness, Hurricane Protection Powerhouse, Design Flexibility Unleashing Architectural Creativity, Sustainable Synergy with Energy-Saving Technologies.

Commercial Buildings, Residential Buildings, Institutional Buildings, Other Applications.

The most dominant region for the Laminated Glass Facade Market is the Asia Pacific, driven by rapid urbanization and a booming construction sector, particularly in China and India.

AGC, Asahi India Glass Limited, Saint-Gobain, Nippon Sheet Glass, Central Glass, Sisecam, Guardian Industries, Xinyi Glass Holdings, CGS Holdings, Fuyao Glass Industry.