Global Lactose Free Market size (2024-2030)

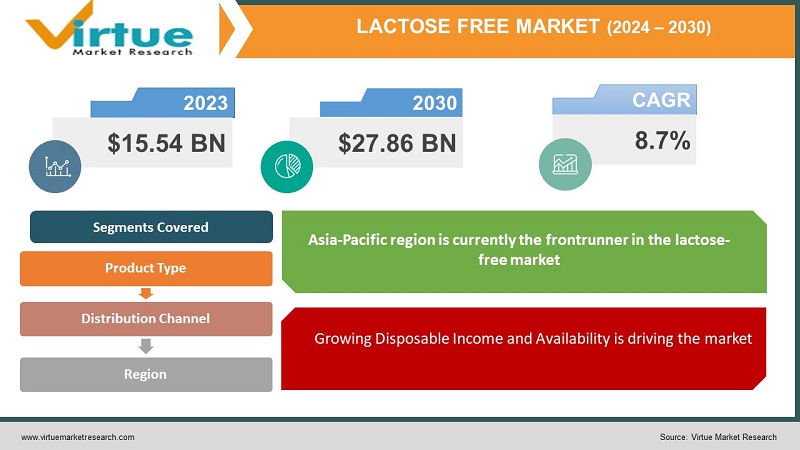

The Global Lactose Free Market was valued at USD 15.54 billion in 2023 and will grow at a CAGR of 8.7% from 2024 to 2030. The market is expected to reach USD 27.86 billion by 2030.

Key Market Insights:

The lactose-free market is experiencing explosive growth, driven by a confluence of factors. Lactose intolerance, affecting a significant portion of the global population, is a key driver. Rising awareness of this condition and its easy diagnosis through readily available tests fuels the market. Additionally, a growing vegan and plant-based movement seeks dairy alternatives, including lactose-free options. This expands the market beyond just the lactose intolerant. Lactose-free doesn't have to skimp on taste or nutrition either, with manufacturers offering a vast array of delicious and fortified dairy alternatives like milk, cheese, yogurt, and even ice cream. This caters to health-conscious consumers seeking digestive comfort without sacrificing on dietary needs. As disposable incomes increase and lactose-free options become more readily available, the market is poised for continued expansion, offering exciting possibilities for lactose-free product innovation.

Global Lactose Free Market Drivers:

Growing Disposable Income and Availability is driving the market

Rising disposable incomes globally are fueling a purchasing power shift. Consumers are no longer limited to just necessities and can explore specialty options like lactose-free products. This sweetens the deal for the lactose-free market. But it's not just about money; growing awareness of lactose intolerance and the resulting demand are pushing retailers to stock lactose-free options. From supermarkets to online stores, these products are becoming increasingly accessible. This perfect storm of affordability and availability is making it easier than ever for lactose-intolerant consumers to find the products they need and enjoy the delicious world of dairy, discomfort-free.

Health-conscious consumers are driving the market

The health-conscious consumer is king, and the lactose-free market is catering with a crown jewel approach. Gone are the days of simply avoiding discomfort; lactose-free products are now stepping up to be functional health allies. Manufacturers are fortifying these options with essential nutrients like calcium and vitamin D, mirroring the natural benefits found in dairy. This is a game-changer for those seeking digestive comfort without throwing their dietary needs out the window. Imagine enjoying a lactose-free yogurt packed with gut-friendly probiotics and bone-building calcium, or swapping to lactose-free milk fortified with vitamin D for strong muscles and a sunshine boost. This focus on well-rounded nutrition, alongside digestive ease, is a major reason why lactose-free products are finding favor with health-conscious consumers who refuse to compromise on either taste or well-being.

Rising Prevalence of Lactose Intolerance is driving the market

Lactose intolerance, the inability to digest milk sugar (lactose), affects a surprisingly large chunk of the global population. Thankfully, growing awareness and readily available tests are helping people identify this condition. This newfound knowledge isn't just a buzzword; it's driving a surge in the lactose-free market. Imagine experiencing bloating, cramps, and discomfort every time you enjoy dairy. No wonder people diagnosed with lactose intolerance actively seek alternatives. This creates a perfect storm for lactose-free products, propelling them from a niche option to a mainstream necessity.

Global Lactose Free Market challenges and restraints:

Competition from Plant-Based Alternatives is restricting the market growth

The rise of plant-based alternatives presents a major roadblock for the lactose-free dairy market. These products, encompassing milk, cheese, yogurt, and even ice cream, offer a complete dairy-free solution, capturing not just lactose-intolerant consumers but also vegans seeking ethical or environmentally-conscious choices. Plant-based options often boast wider availability and a lower price point compared to lactose-free dairy products, making them an attractive alternative for cost-conscious shoppers. This fierce competition forces lactose-free dairy producers to innovate and emphasize the unique benefits their products offer, such as containing the same essential nutrients as traditional dairy while remaining easily digestible.

Limited Consumer Awareness is restricting the market growth

A knowledge gap persists in the lactose-free market. Though awareness of lactose intolerance is on the rise, a significant portion of the population remains undiagnosed or unequipped with information about the advantages of lactose-free options. This can be due to factors like limited access to healthcare or a lack of clear understanding of the symptoms of lactose intolerance. This creates a challenge for the lactose-free market, as potential consumers who might benefit from these products are not actively seeking them out. Educational campaigns and increased collaboration with healthcare professionals can bridge this knowledge gap and unlock new market segments.

Market Opportunities:

The lactose-free market brims with exciting opportunities for innovation and expansion. A key area lies in price reduction. By optimizing production processes and potentially utilizing government subsidies in certain regions, lactose-free products can become more accessible to budget-conscious consumers. Secondly, lactose-free manufacturers can leverage the booming plant-based trend by offering combination products. Imagine lactose-free yogurt with an almond milk base or cheese alternatives with a cashew nut blend. This would cater to consumers with both lactose intolerance and a desire for plant-based ingredients. Furthermore, upping the flavor game is crucial. From innovative savory cheese varieties to decadent lactose-free ice cream flavors, a wider range caters to adventurous palates. Additionally, lactose-free manufacturers can tap into the growing demand for functional foods. This could involve lactose-free yogurts with prebiotics for gut health or lactose-free cheeses fortified with additional protein for active individuals. Finally, educational campaigns can address misconceptions and raise awareness about lactose intolerance and the benefits of high-quality lactose-free products. By addressing these opportunities, the lactose-free market can solidify its position as a mainstream grocery staple, offering delicious, functional, and accessible options for everyone.

LACTOSE FREE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.7% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Danone SA, FrieslandCampina, Saputo Inc., Lactalis Group, Dean Foods Company, Fonterra Co-operative Group, Valio Ltd, Campbell Soup Company, Solae, Oatly |

Lactose Free Market Segmentation by Product Type

- Lactose-Free Milk

- Lactose-Free Cheese

- Lactose-Free Yogurt

While lactose-free yogurt and cheese offer exciting options for health-conscious consumers and cheese lovers respectively, lactose-free milk currently reigns supreme in the market. This dominance stems from two key factors. Firstly, milk is a widely consumed beverage enjoyed by all age groups, making lactose-free milk a relevant choice for a large portion of the population. Secondly, lactose-free milk comes in two forms: familiar cow's milk without the lactose discomfort, and plant-based alternatives like soy, almond, and oat milk. This variety caters to those seeking a lactose-free solution that either mirrors the taste of regular milk or explores new plant-based options, solidifying lactose-free milk's position as the most dominant product in the market.

Lactose Free Market Segmentation By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online Retailers

Supermarkets and hypermarkets hold the crown as the dominant channel for lactose-free products. These one-stop shops offer the most comprehensive selection, catering to a wide range of lactose-free needs. From budget-friendly private-label options to national brands and even lactose-free milk alternatives, they provide competitive prices for various consumers. This convenience, coupled with the ability to browse and compare different lactose-free products in person, makes supermarkets and hypermarkets the go-to destination for most lactose-free shoppers.

Lactose Free Market Segmentation Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The Asia-Pacific region is currently the frontrunner in the lactose-free market, boasting the dominant market share. This leadership is fueled by factors like a booming population and a rapidly growing middle class with more disposable income. However, the fastest-growing region for lactose-free products is also located within Asia-Pacific. This explosive growth is driven by the same factors mentioned previously, alongside an increasing interest in international flavors and a willingness to experiment with new lactose-free options.

COVID-19 Impact Analysis on the Global Lactose-Free Market

The COVID-19 pandemic delivered a mixed bag of impacts for the global lactose-free market. Initial lockdowns triggered panic buying, leading to a short-term surge in demand for shelf-stable lactose-free dairy products like milk and cheese. This benefited established brands as consumers stocked their pantries with familiar options. However, as the pandemic progressed, consumer behavior shifted. Increased focus on health and immunity fueled a rise in demand for plant-based alternatives, which often cater to both lactose intolerance and vegan dietary needs. This presented a challenge for lactose-free dairy. Supply chain disruptions caused temporary product shortages and price fluctuations, impacting both lactose-free and traditional dairy products. However, it also opened doors for local and regional lactose-free producers who faced less disruption. The rise of e-commerce platforms provided a lifeline, allowing consumers safe and convenient access to lactose-free options. Overall, the long-term impact of COVID-19 is still unfolding. While the initial surge subsided, the focus on health and online grocery shopping continues to influence consumer behavior. Lactose-free dairy manufacturers who can adapt to this new landscape by emphasizing immune-supporting ingredients and leveraging e-commerce channels are well-positioned to thrive in the post-pandemic market.

Latest trends/Developments

The lactose-free market is experiencing exciting innovation as it strives to cater to a wider audience and compete with plant-based alternatives. Inclusion is a key trend, with lactose-free cheesemakers offering varieties specifically designed for melting and pizza-making, previously a challenge for lactose-free consumers. Customization is another area of focus, with lactose-free yogurt producers introducing options with mix-ins and toppings for a more personalized snacking experience. Fermentation is gaining traction, with lactose-free kefir and kombucha touted for their gut health benefits. Sustainability is also a growing concern, with lactose-free dairy manufacturers exploring eco-friendly packaging solutions and sourcing lactose-free milk from cows raised on pasture. However, the biggest trend might be the lactose-free dairy industry embracing plant-based ingredients. This hybrid approach combines the creaminess and familiarity of dairy with the allergen-free and sometimes lower environmental impact of plant-based options. Lactose-free creamers with oat milk or lactose-free ice cream with pea protein are just a few examples. By addressing the challenges of taste, texture, and price while embracing innovation and inclusivity, the lactose-free market is poised to expand its reach and cater to the evolving needs of health-conscious consumers.

Key Players:

- Danone SA

- FrieslandCampina

- Saputo Inc.

- Lactalis Group

- Dean Foods Company

- Fonterra Co-operative Group

- Valio Ltd

- Campbell Soup Company

- Solae

- Oatly

Chapter 1. GLOBAL LACTOSE FREE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL LACTOSE FREE MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL LACTOSE FREE MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL LACTOSE FREE MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL LACTOSE FREE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL LACTOSE FREE MARKET – By Product Type

6.1. Introduction/Key Findings

6.2. Lactose-Free Milk

6.3. Lactose-Free Cheese

6.4. Lactose-Free Yogurt

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. GLOBAL LACTOSE FREE MARKET – By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets & Hypermarkets

7.3. Specialty Stores

7.4. Online Retailers

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. GLOBAL LACTOSE FREE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Distribution Channel

8.2.3. By Product Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Distribution Channel

8.3.3. By Product Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Distribution Channel

8.4.3. By Product Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Distribution Channel

8.5.3. By Product Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL LACTOSE FREE MARKET – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Development

9.1. Danone SA

9.2. FrieslandCampina

9.3. Saputo Inc.

9.4. Lactalis Group

9.5. Dean Foods Company

9.6. Fonterra Co-operative Group

9.7. Valio Ltd

9.8. Campbell Soup Company

9.9. Solae

9.10. Oatly

.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Lactose Free Market was valued at USD 15.54 billion in 2023 and will grow at a CAGR of 8.7% from 2024 to 2030. The market is expected to reach USD 27.86 billion by 2030.

Rising health consciousness is driving the market, Health-conscious consumers, Growing Disposable Income, and Availability are the reasons that are driving the market.

Based on product type it is divided into three segments – Lactose-Free Milk, Lactose-Free Cheese, Lactose-Free Yogurt

Asia-Pacific is the most dominant region for the Lactose Free Market.

Valio Ltd, Campbell Soup Company, Solae, Oatly